What Does Decentralization Mean and Why It Matters

In this module, we’ll define decentralization and show why it’s at the heart of crypto. You’ll learn how Bitcoin was created to remove central control and how its community, not corporations, decides its future.

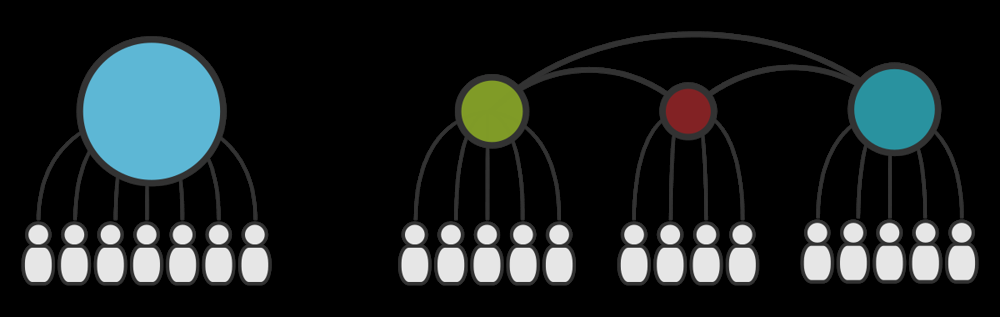

Centralized vs. decentralized networks.

The image on the left illustrates a centralized network with one main hub (large blue node) connected to all users – similar to a single company controlling a platform. The image on the right depicts a decentralized network with multiple smaller hubs (green, red, blue nodes) connecting users; no single point has complete authority or control. In a decentralized system, even if one node fails or leaves, the rest of the network can still operate. This peer-to-peer design makes the system more resilient, removing any single point of failure and reducing reliance on a central intermediary.

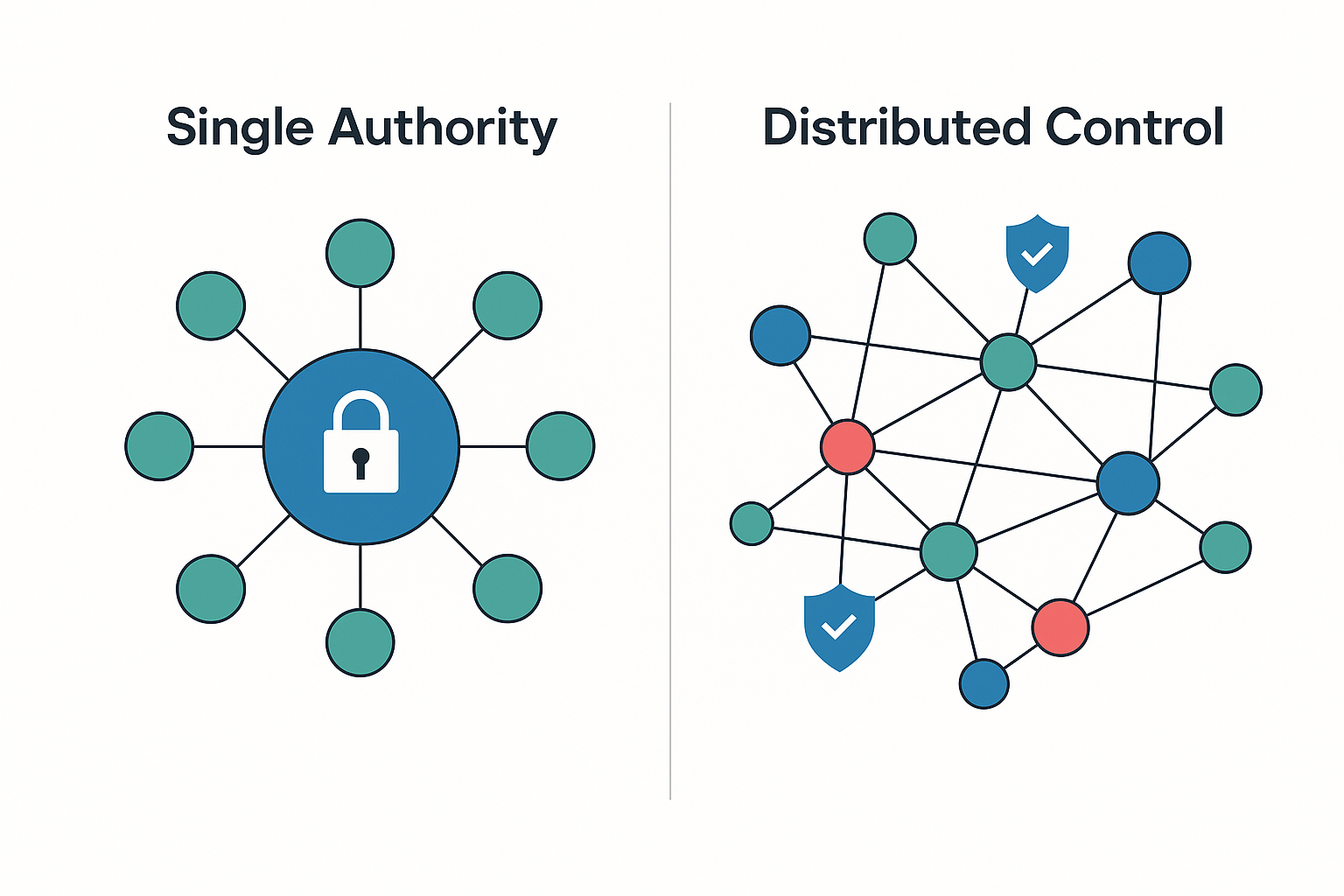

In simple terms, decentralization means no single person or authority is in charge; instead, power and decision-making are distributed among many participants. This concept is a core principle of the crypto industry – it’s the very reason Bitcoin was created, and why so many crypto projects strive to be decentralized. In traditional systems like banks or social networks, a central entity has control: they set the rules, can censor or reverse transactions, and could even shut down the service. Cryptocurrency was born as a response to these limitations and central points of control. Bitcoin, the first cryptocurrency, was introduced in 2009 by the pseudonymous Satoshi Nakamoto specifically to enable peer-to-peer digital money without any central bank or government involvement. As Satoshi famously wrote: “The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

In other words, Bitcoin’s goal was to remove the need to trust a central authority by creating a system where the system itself – through code and consensus – ensures fairness*. This is why decentralization is so valued: it puts the rules in the hands of the community and software, rather than requiring blind trust in a single institution.*

By design, a decentralized cryptocurrency like Bitcoin has no single company, government, or individual that controls the network. Instead, thousands of independent computers around the world (called nodes) run the Bitcoin software and collectively keep the network running. For example, as of August 2025 there were over 23,000 active Bitcoin nodes spread across 181 countries. Each of these nodes verifies transactions and enforces the rules of the Bitcoin protocol. This global distribution of participants means the system doesn’t rely on any single server or authority. In fact, entrusting the network to a vast number of independent node operators “prevent[s] any single entity from taking over the system.”

No central authority can arbitrarily change Bitcoin’s rules, censor transactions, or issue new bitcoins beyond the fixed supply coded into the protocol. Any changes to the network (for instance, software upgrades) only happen if a majority of the community agrees – a process known as decentralized consensus.

The power of decentralization in Bitcoin was demonstrated during a famous chapter of its history. In 2017, some large companies and mining groups pushed for a change to Bitcoin’s code to allow bigger blocks (increasing the block size, which they argued would improve transaction speed). However, many independent node operators and users disagreed and refused to adopt the change, ultimately defeating the proposal. This episode, often called the “Block Size War” , showed that Bitcoin’s community (the many node operators), not a few corporate leaders, has the final say on protocol changes. It cemented the fact that power in Bitcoin is truly decentralized, as even well-funded groups could not force a change that the broader node community rejected. In short, Bitcoin’s design puts the collective consensus of its users above any one entity’s desires. This resiliency and community governance highlight why decentralization matters so much in crypto: it keeps control in the hands of the many, rather than the few.