Decentralization in Action – Decentralized Finance (DeFi)

This module shows how decentralization has created a new kind of financial system. From exchanges to lending, you’ll discover how DeFi lets people access financial services without banks or brokers.

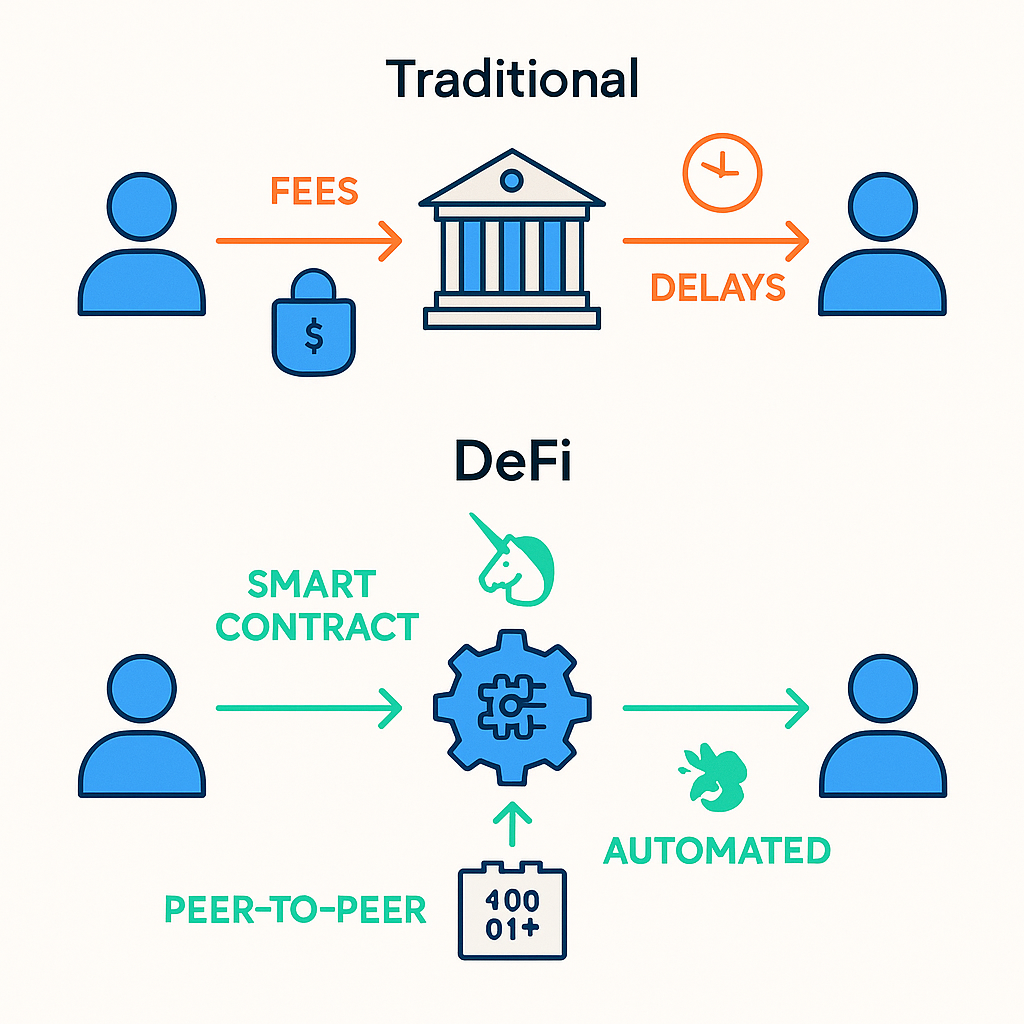

Decentralization might sound abstract, but it’s already impacting real products and services. Nearly every major innovation in the crypto space builds on the idea of removing middlemen and empowering users directly. One of the most vibrant areas is Decentralized Finance, or DeFi. DeFi refers to financial applications built on blockchain networks that operate without traditional banks or brokers. These include things like decentralized exchanges (DEXes), lending platforms, savings and yield services, insurance protocols, and more – all run by code (smart contracts) that anyone can inspect and use. In DeFi, you typically hold your assets in your own crypto wallet and interact with financial protocols directly on the blockchain; there’s no need to deposit funds into a bank or brokerage account first. This peer-to-peer model can offer greater access and often lower fees, since it cuts out the intermediaries that normally take a cut or impose gatekeeping.

What started around 2018–2019 as a handful of experimental projects has, by 2025, grown into a robust alternative financial system. To give a sense of the scale: by mid-2025, the total value of cryptocurrency locked in DeFi protocols reached $123.6 billion (a 41% increase from the year before). Over 14.2 million unique wallets interacted with DeFi applications by that time, indicating that millions of people globally are now borrowing, lending, trading, and earning yield on crypto assets through decentralized platforms. Ethereum remains the dominant blockchain for DeFi – it hosts roughly 63% of all DeFi protocols and volume as of 2025 – but newer networks like Arbitrum and Optimism (Layer-2 solutions for Ethereum) have risen in popularity by offering lower fees and faster transactions for DeFi users. In short, DeFi has become a global, user-driven financial ecosystem, accessible to anyone with an Internet connection and a crypto wallet.

One of the flagship examples of DeFi is decentralized exchanges (DEXs). These are cryptocurrency exchanges that run on smart contracts, allowing users to trade tokens directly with each other without a central exchange holding custody of funds. The largest DEX is Uniswap, which operates on Ethereum. Uniswap (UNI) is both a decentralized exchange protocol and the name of its governance token. Launched in 2020, Uniswap pioneered an Automated Market Maker (AMM) model: instead of using the traditional order books managed by a company, Uniswap aggregates liquidity supplied by users into pools, and a formula automatically determines the token prices based on supply and demand in the pool. Anyone can swap ERC-20 tokens on Uniswap straight from their wallet, or earn fees by contributing their tokens to these liquidity pools. Uniswap’s growth has been tremendous – it evolved from a small developer project into a platform that, by 2025, had facilitated over $3 trillion in cumulative trading volume (becoming the first DEX to reach such a milestone). Its success also propelled the value of the UNI token, which is used for community governance of the protocol. In mid-2025, Uniswap’s UNI was the largest DeFi-related token with a market capitalization around $12.3 billion. (For reference, you can trade UNI on Gate.com as well – it’s listed on the exchange in the UNI/USDT market.) Other major DeFi protocols include Aave (AAVE), a decentralized money market for lending and borrowing (AAVE’s market cap was about $7.5 billion); Lido (LDO), a decentralized staking service (around $9.1 billion market cap); and MakerDAO’s MKR token, which governs the Maker protocol that issues the DAI stablecoin (MKR’s market cap was roughly $4.6 billion). These projects demonstrate that complex financial services – exchanges, loans, interest-bearing accounts, asset management, and more – can be operated in a decentralized way on blockchain networks.

Despite removing centralized intermediaries, DeFi protocols are designed to be secure and transparent. All transactions and the smart contract code are recorded on the public blockchain, so anyone can audit how these protocols work and track funds. This openness ensures that users can verify claims (for example, checking that a lending pool is fully collateralized, or seeing the total fees a platform has generated). However, using DeFi also means users take on more responsibility. There is no regulated bank watching over your shoulder – you control your own keys and funds, and if you make a mistake (like losing your private key or sending assets to the wrong address) there’s no customer support hotline to undo it. Additionally, smart contract bugs or hacks have occurred on some DeFi platforms, so the community places a big emphasis on third-party audits, security testing, and even decentralized insurance mechanisms to protect users. Over the years, many DeFi protocols have been battle-tested and improved to enhance their safety. The rapid growth of DeFi, from essentially zero to over $100 billion locked in just a few years, signals a strong demand for the financial freedom and innovation that decentralization enables. People are clearly intrigued by the idea of financial services that run 24/7 worldwide, open to all, and governed by users rather than by banks.