How Blockchain Technology Enables Decentralization

Here we’ll look under the hood at how blockchain makes decentralization possible. You’ll see how nodes, consensus, and smart contracts keep systems fair without relying on a single authority.

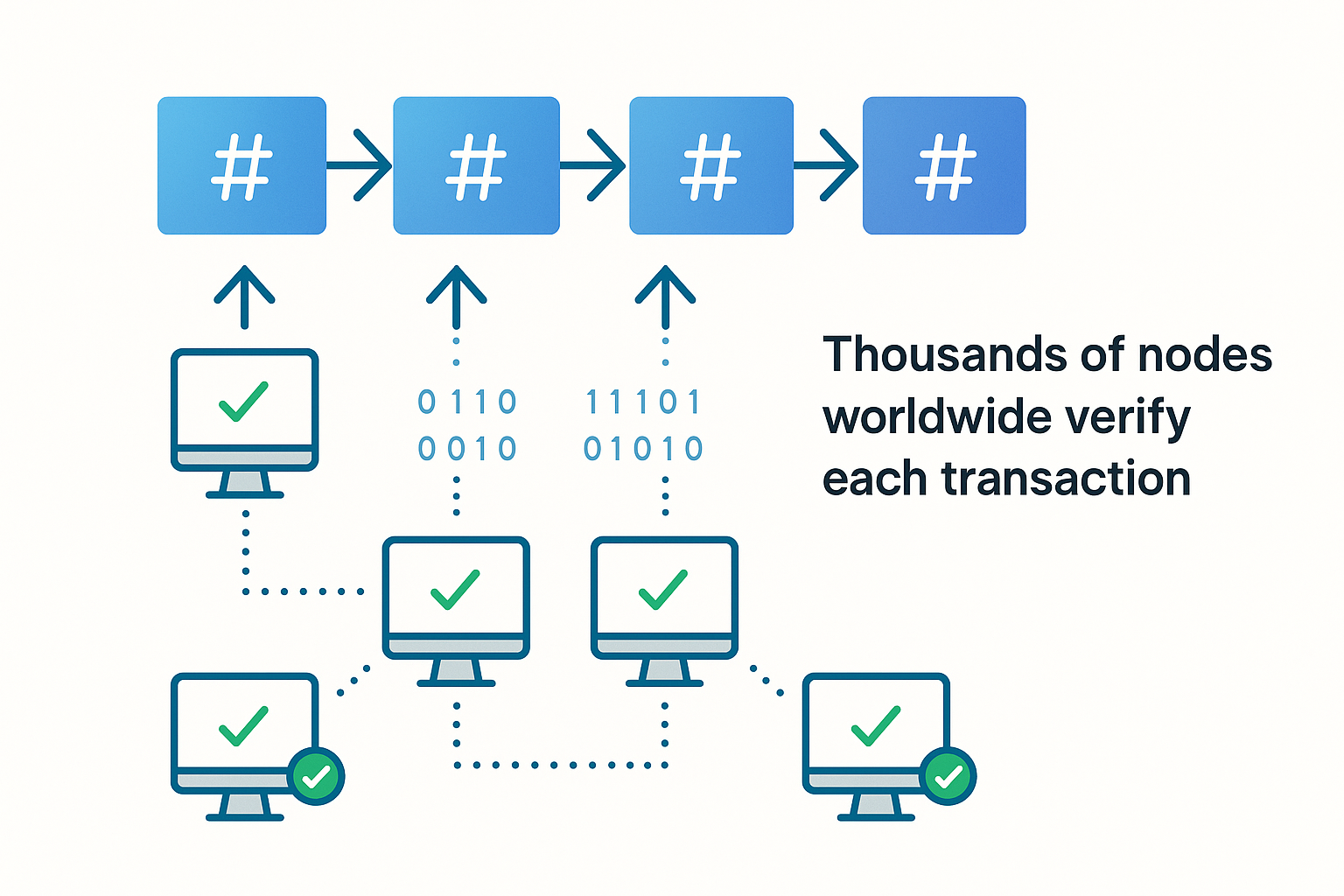

Decentralization in cryptocurrencies is made possible by the underlying technology: blockchain. A blockchain is essentially a distributed digital ledger shared across a network of computers. Instead of one central database that a single authority manages, many participants each keep a copy of the ledger and update it together by consensus.

For example, every Bitcoin full node stores the entire history of all Bitcoin transactions (which amounts to around 500 GB of data as of 2025) and cross-checks new transactions against this history. Because every transaction record is redundantly held by thousands of nodes, the system doesn’t depend on any single server or data center. If one node goes offline, the network keeps running. To add new data (a batch of recent transactions, known as a block) to the blockchain, participants use consensus mechanisms (such as Bitcoin’s Proof of Work algorithm, or Proof of Stake in other networks like Ethereum) to agree on which block is valid and should be appended next. This process ensures that no single participant can forge or alter transactions at will – if a malicious actor tries to cheat (for instance, by creating a fake transaction or changing history), the rest of the honest nodes will simply reject that invalid data. In this way, the rules of the system are enforced collectively by the network, rather than by trusting a central gatekeeper.

Blockchain technology thus creates a “trustless” system – not meaning that no trust exists, but that you do not have to trust any one middleman or authority. You only need to trust the system’s code and consensus rules, which are transparently known and are enforced by everyone. This is how cryptocurrency networks can function without banks or governments in charge: users anywhere in the world can transact directly with each other, and the network’s built-in rules (executed by all those nodes) ensure the transactions are valid and secure. The result is a peer-to-peer system of money (and other digital assets) that is censorship-resistant and highly resilient. There is no central “off switch.” As long as some nodes in the world are still running, the blockchain remains alive and transactions can be processed.

Many cryptocurrencies have expanded on Bitcoin’s model of decentralization in various ways. Ethereum, for instance, is a decentralized, open-source blockchain platform that supports smart contracts and decentralized applications (dApps). Ethereum showed that decentralization isn’t only for digital money – it can also serve as a decentralized global computing platform.

On Ethereum, programs called smart contracts run on thousands of computers globally rather than on a single company’s server. This means a lending app or game built as a smart contract on Ethereum is not controlled by any single entity; once the code (rules) is deployed to the blockchain, it runs autonomously and can be used by anyone. Ether (ETH) is the native cryptocurrency that powers this network, and like Bitcoin, Ethereum is maintained by a community of nodes and validators (formerly miners) instead of a central administrator. In 2022, Ethereum even strengthened its decentralized infrastructure by transitioning from a Proof of Work mining system to a Proof of Stake validation system – an upgrade known as “The Merge.” This shift (executed on September 15, 2022) completed Ethereum’s move to a more energy-efficient consensus mechanism, further securing the network through a distributed set of validators who stake ETH, rather than a small group of miners. The bottom line is that blockchains combine cryptography, consensus algorithms, and distributed networks to achieve decentralization. They remove the need to trust any single actor by making the entire network collectively responsible for verifying and recording what happens.