Decentralization in Organizations – Decentralized Autonomous Organizations (DAOs)

We’ll explore how decentralization goes beyond money into human governance. DAOs use blockchain and smart contracts to let communities make decisions together, without CEOs or boards.

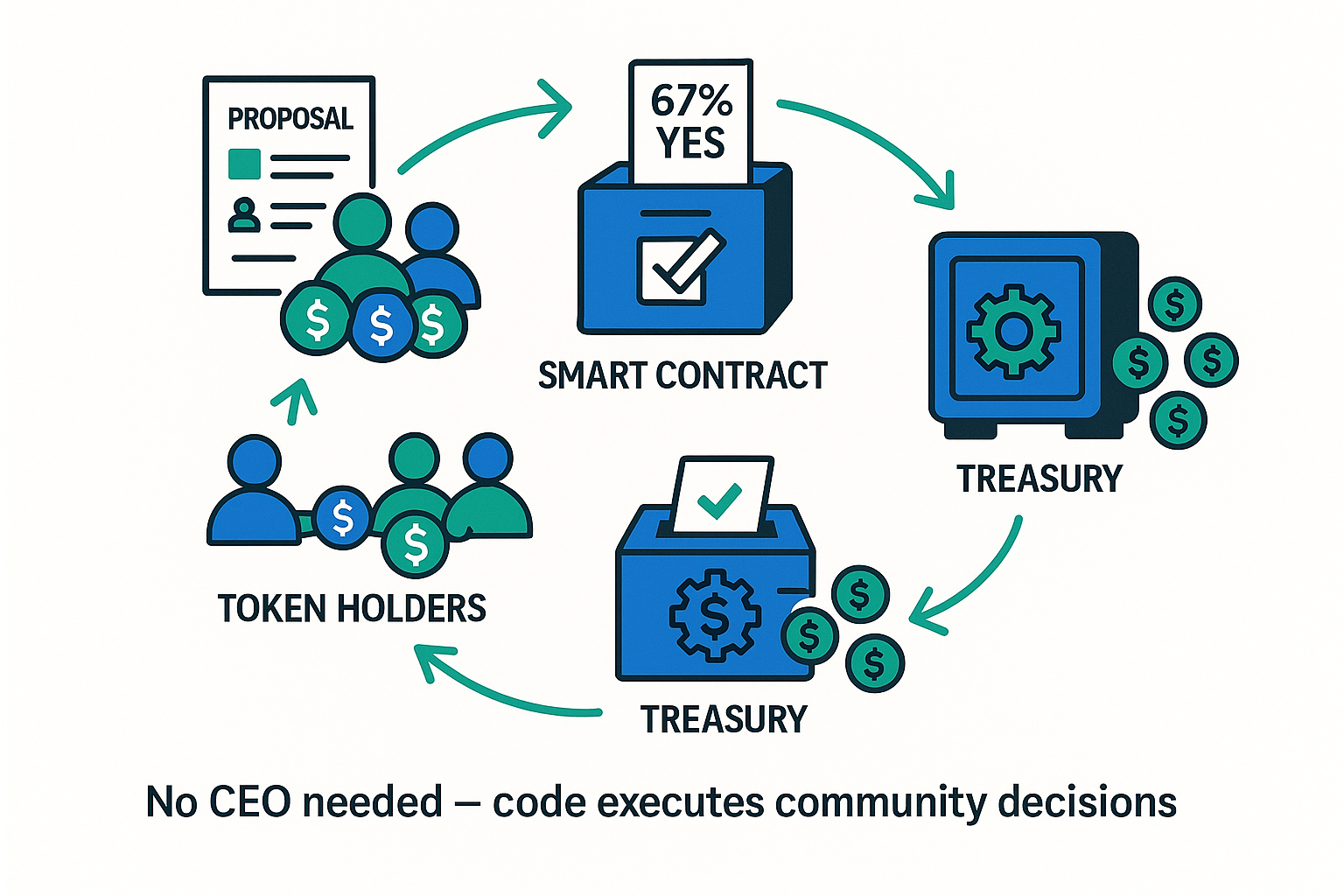

Another groundbreaking application of the decentralization ethos is in how people organize and govern collective projects. Enter Decentralized Autonomous Organizations, or DAOs. A DAO is essentially an organization or community that is governed by its members via blockchain-based rules (smart contracts), rather than by a single centralized leader or board of directors. You can think of a DAO as an Internet-native organization with a shared treasury and a transparent voting system, where all decisions are made from the bottom up by the stakeholders. In a succinct definition, “A decentralized autonomous organization (DAO) is an organizational structure with no central governing body… They are completely transparent and make decisions using a bottom-up management approach.” In a DAO, anyone who holds the DAO’s token (or otherwise earns voting rights in the community) can propose and vote on decisions such as how to use funds, which projects to pursue, or changes to the group’s rules. All votes and treasury movements are recorded on the blockchain, making the organization’s actions auditable by everyone. This model ensures that every stakeholder has a say and no single person holds all the power – governance is truly distributed among the participants. As one article put it: imagine a company where every decision is transparent, every stakeholder has a voice, and no CEO can unilaterally dictate the outcome – that’s the world of DAOs. Proponents believe this can lead to more democratic, resilient organizations that better align with the community’s interests.

DAOs began to gain attention around 2016 with early experiments (the most famous simply called “The DAO”), and they surged in popularity from 2020 onward. Today, there are DAOs for all sorts of purposes: managing investment funds, governing decentralized protocols (like DeFi projects), pooling donations for charities, purchasing and holding valuable collectibles, even social clubs and gaming guilds. This is no longer a niche concept; by 2025, over 13,000 DAOs have been established globally, collectively managing about $24.5 billion in treasuries and involving roughly 11 million governance token holders in total. In other words, a significant number of people worldwide are now participating in decentralized governance of various projects. For example, MakerDAO (which we mentioned in the DeFi section) is a DAO that manages the DAI stablecoin system – holders of MKR tokens regularly vote on risk parameters and upgrades to keep the system stable. Aave is another protocol governed by a DAO; AAVE token holders can vote on new asset listings, protocol upgrades, and other settings for the lending platform. Interestingly, participation rates in some well-established DAOs are fairly healthy. In fact, leading DAOs like Aave and MakerDAO see over 22% of token holders voting on major proposals, which is comparable to or even higher than the shareholder voting turnout in many traditional public companies. This suggests that when designed well, DAOs can actively engage a broad base of members in collective decision-making.

DAOs take decentralization beyond just technology – they apply it to human governance and coordination. They operate on the principle of “code is law.” The rules and processes that bind the group (like how proposals are made, what percentage of votes is needed to pass a decision, and what actions are executed when a vote passes) are all encoded in smart contracts. These smart contracts automatically enforce the outcomes of votes without the need for a manual authority. For example, if a funding proposal in a DAO is approved by the voters, the smart contract controlling the treasury can automatically release the specified funds to the project, without any single person having to intervene. This automation ensures that the rules cannot be selectively applied or ignored – whatever the membership decides per the encoded rules will happen. A memorable illustration of the power of DAOs was ConstitutionDAO in 2021, where thousands of people on the internet quickly self-organized into a DAO and pooled over $40 million worth of crypto in an attempt to bid on a rare original copy of the U.S. Constitution at a public auction. Though ConstitutionDAO ultimately didn’t win (they were outbid by a billionaire), it showcased how strangers from around the world could use crypto and smart contracts to coordinate and pursue a common goal with no formal company structure – all in a matter of weeks. Since then, many other DAOs have emerged for a wide range of aims: some functions like venture capital funds (investing in startups or other assets), some are focused on social or environmental causes, some manage shared virtual worlds or NFT collections, and so on. The common thread is decentralized control: members collectively own and manage the organization’s resources and direction.

Of course, DAOs are still evolving and come with their own challenges. Making decisions by committee – especially a global, and often pseudonymous, online committee can be slow or inefficient at times. There’s no CEO to make a quick executive call; proposals need to be discussed and voted on, which can take days or weeks. Additionally, while DAOs aim for decentralization, in practice, some can see power imbalances. If a small group of members hold a very large share of the governance tokens, they can wield outsized influence on votes (since typically voting power is proportional to token holdings). In fact, studies have found that in many DAOs, a tiny fraction of holders (so-called crypto “whales”) often control a majority of the voting power. For example, one analysis showed that in ten major DAOs, less than 0.1% of all holders possessed about 90% of the voting power. This concentration is something the DAO community is actively trying to address. Proposed solutions include mechanisms like quadratic voting (which reduces the effective voting weight of large token holders to give smaller holders more relative influence) and other novel governance models to curb the dominance of whales. Despite these hurdles, DAOs continue to grow in number and in the richness of their experiments because they align with the spirit of crypto – they are open, borderless, and user-governed organizations that anyone can potentially join and contribute to. Every year, new best practices and innovations in DAO governance are emerging, which are gradually making these organizations more effective and equitable. It’s an ongoing evolution, but one that carries the promise of fundamentally changing how groups coordinate resources and authority.