TraderLinXiao

No content yet

TraderLinXiao

November 20th Thursday morning trading strategy

The price of Bitcoin is now stuck around 91600. Over the past couple of days, it dropped to 88500 on the 4H chart and then bounced back. It looks a bit like it's "stabilizing after a drop", but don't rush to jump in.

Long opportunity: Wait for a pullback to buy low in the 90500-91000 range, add positions after stabilizing at 90600 (MA5), set the stop loss at 88500 (if this support is broken, it's basically hopeless), initially target 93400 (resistance level), and if it can break through, look at 95300.

Shorting opportunity: If it do

The price of Bitcoin is now stuck around 91600. Over the past couple of days, it dropped to 88500 on the 4H chart and then bounced back. It looks a bit like it's "stabilizing after a drop", but don't rush to jump in.

Long opportunity: Wait for a pullback to buy low in the 90500-91000 range, add positions after stabilizing at 90600 (MA5), set the stop loss at 88500 (if this support is broken, it's basically hopeless), initially target 93400 (resistance level), and if it can break through, look at 95300.

Shorting opportunity: If it do

BTC-7.35%

- Reward

- like

- Comment

- Repost

- Share

trading strategy for the evening of Monday, November 17

Long entry conditions

Entry: Breakout with volume above 95584 and hold above 95720

Stop Loss: 95720

Target: Resistance level above (follow the market trends)

short selling condition point

Entry 1: Break below the 93778 support level + MACD death cross confirmation

Stop loss 1: 94500

Target 1: 93500→91300

Entry 2: Rebound to the 96500-97180 resistance zone

Stop loss 2: 98500-99500

Target 2: 93500→91300#美联储会议纪要将公布 $BTC

Long entry conditions

Entry: Breakout with volume above 95584 and hold above 95720

Stop Loss: 95720

Target: Resistance level above (follow the market trends)

short selling condition point

Entry 1: Break below the 93778 support level + MACD death cross confirmation

Stop loss 1: 94500

Target 1: 93500→91300

Entry 2: Rebound to the 96500-97180 resistance zone

Stop loss 2: 98500-99500

Target 2: 93500→91300#美联储会议纪要将公布 $BTC

BTC-7.35%

- Reward

- like

- Comment

- Repost

- Share

November 4th Friday evening trading strategy

The crypto market has plummeted again! Bitcoin has dropped nearly 6% in 24 hours, now reported at 97107. Bottom feeders are eager to jump in, while bears are looking to capitalize on the momentum—should we get in or wait and see? Key points: the overall trend is still bearish, but short-term oversold signals are piling up, so a small position could be taken to bet on a rebound, just don't be a "bag holder"!

First, let's talk about why there is a short-term rebound opportunity. The technical indicators are almost "crying for help": on the 4

The crypto market has plummeted again! Bitcoin has dropped nearly 6% in 24 hours, now reported at 97107. Bottom feeders are eager to jump in, while bears are looking to capitalize on the momentum—should we get in or wait and see? Key points: the overall trend is still bearish, but short-term oversold signals are piling up, so a small position could be taken to bet on a rebound, just don't be a "bag holder"!

First, let's talk about why there is a short-term rebound opportunity. The technical indicators are almost "crying for help": on the 4

BTC-7.35%

- Reward

- like

- Comment

- Repost

- Share

Trading strategy for the evening of November 13

The morning market continued to trade at low levels, with prices fluctuating narrowly between 1025 and 1035, failing to break through the MA20 resistance. The trading volume during the rebound remained weak, completely not keeping up with the price rhythm, which is a typical signal of weak rebound. Technically, the bears still dominate: moving averages are in a bearish arrangement, prices are below the MA20, and the MACD death cross has not changed, only showing shrinking green bars. The KDJ has a golden cross but did not drive a trend reversal,

The morning market continued to trade at low levels, with prices fluctuating narrowly between 1025 and 1035, failing to break through the MA20 resistance. The trading volume during the rebound remained weak, completely not keeping up with the price rhythm, which is a typical signal of weak rebound. Technically, the bears still dominate: moving averages are in a bearish arrangement, prices are below the MA20, and the MACD death cross has not changed, only showing shrinking green bars. The KDJ has a golden cross but did not drive a trend reversal,

BTC-7.35%

- Reward

- like

- Comment

- Repost

- Share

Trading strategy for midday on Thursday, November 13

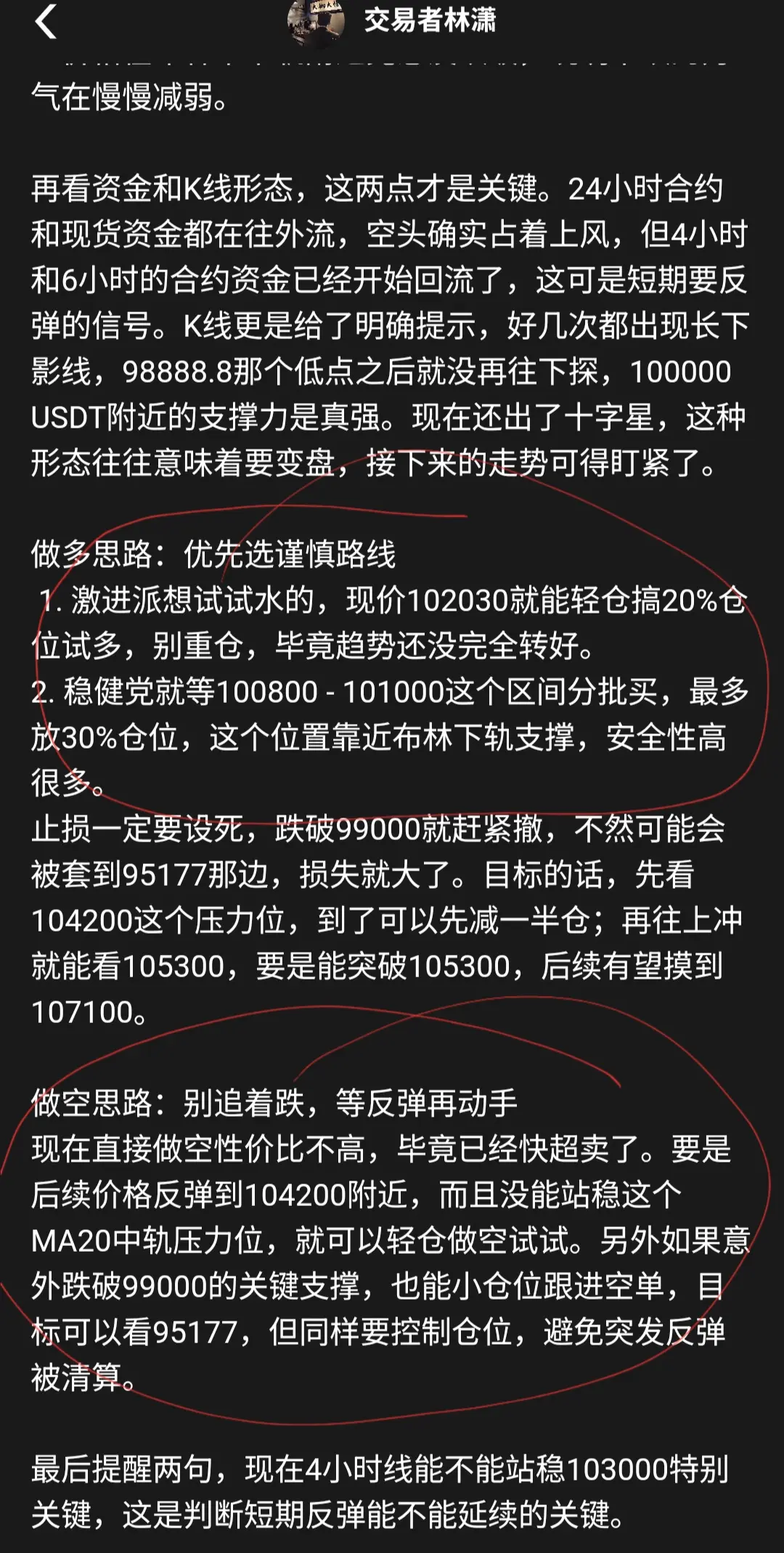

Today, the price of Bitcoin is stuck at 102030, having dropped 1.252% in the last 24 hours, indicating a general downward trend. Let's look at the technical aspects; the indicators right now are quite straightforward. The moving average system is clearly in a bearish arrangement, and the current price is lower than the MA5, MA10, and other moving averages. MA5 has crossed below MA10, forming a death cross, making it difficult to rebound in the short term. The MACD is also in a death cross state, showing strong bearish momentum. However,

Today, the price of Bitcoin is stuck at 102030, having dropped 1.252% in the last 24 hours, indicating a general downward trend. Let's look at the technical aspects; the indicators right now are quite straightforward. The moving average system is clearly in a bearish arrangement, and the current price is lower than the MA5, MA10, and other moving averages. MA5 has crossed below MA10, forming a death cross, making it difficult to rebound in the short term. The MACD is also in a death cross state, showing strong bearish momentum. However,

BTC-7.35%

- Reward

- like

- Comment

- Repost

- Share

November 12th, Wednesday Morning Trading Strategy

Bitcoin 4H Chart: After a sharp drop last night followed by a weak rebound, is this the right time to act this morning?

Last night, Bitcoin experienced a heart-stopping moment, dropping directly from around 105,000 to just above 100,000. It only slowly recovered to about 103,000 in the early morning. Over 24 hours, it fell nearly 3%, and the bears' selling pressure was relentless.

This morning's movement shows a pause after the decline, with the price fluctuating between 102,000 and 103,000. It didn't break last night's support but also lacks t

Bitcoin 4H Chart: After a sharp drop last night followed by a weak rebound, is this the right time to act this morning?

Last night, Bitcoin experienced a heart-stopping moment, dropping directly from around 105,000 to just above 100,000. It only slowly recovered to about 103,000 in the early morning. Over 24 hours, it fell nearly 3%, and the bears' selling pressure was relentless.

This morning's movement shows a pause after the decline, with the price fluctuating between 102,000 and 103,000. It didn't break last night's support but also lacks t

BTC-7.35%

- Reward

- like

- Comment

- Repost

- Share

November 1st, Wednesday evening trading ideas

Currently, Bitcoin is around the middle band of the Bollinger Bands at approximately 105023. The bands are widening, indicating increased volatility.

The KDJ indicator shows K49/D65/J17, with the J line nearly flat, suggesting a clear downward pressure in the short term; MACD has also formed a death cross, with the line below DEA heading downward, indicating stronger bearish sentiment. The Alligator indicator looks like it's consolidating, and a large sell order of 3.2 billion USDT has just appeared, adding significant selling pressure.

Trading Ide

Currently, Bitcoin is around the middle band of the Bollinger Bands at approximately 105023. The bands are widening, indicating increased volatility.

The KDJ indicator shows K49/D65/J17, with the J line nearly flat, suggesting a clear downward pressure in the short term; MACD has also formed a death cross, with the line below DEA heading downward, indicating stronger bearish sentiment. The Alligator indicator looks like it's consolidating, and a large sell order of 3.2 billion USDT has just appeared, adding significant selling pressure.

Trading Ide

BTC-7.35%

- Reward

- 1

- Comment

- Repost

- Share

November 11th Tuesday midday trading ideas

After breaking through 105,000, the market oscillated and retested without breaking key support. The highs and lows are rising, indicating overall oscillation leaning bullish. This is a correction in the downtrend.

Long entry points

- Rebound and stabilize at 104,800-105,400 to go long, stop loss at 104,200

- Break and hold above 106,765 to add long positions, stop loss at 106,300

- Conservative approach: wait for 102,300, stop loss at 101,400

Short entry points

- Break below 105,831 with no rebound to go short, stop loss at 106,200

- Fake breakout ab

After breaking through 105,000, the market oscillated and retested without breaking key support. The highs and lows are rising, indicating overall oscillation leaning bullish. This is a correction in the downtrend.

Long entry points

- Rebound and stabilize at 104,800-105,400 to go long, stop loss at 104,200

- Break and hold above 106,765 to add long positions, stop loss at 106,300

- Conservative approach: wait for 102,300, stop loss at 101,400

Short entry points

- Break below 105,831 with no rebound to go short, stop loss at 106,200

- Fake breakout ab

BTC-7.35%

- Reward

- 1

- Comment

- 1

- Share

October 10th Monday Evening Trading Strategy

Waking up in the morning and immediately collecting profits feels great. I was busy today and didn't post! Short-term Bitcoin update! The 10.6K key level sees bulls and bears battling; precise levels to follow for quick trades.

The 4-hour chart has surged past 10.6K, with a 24-hour increase of over 4.5%. However, overbought signals are flashing, so short-term traders should avoid blindly rushing in. Use clear entry points and risk controls, and follow the plan.

Let's look at the core short-term signals: Moving averages are in a bullish alignment sup

Waking up in the morning and immediately collecting profits feels great. I was busy today and didn't post! Short-term Bitcoin update! The 10.6K key level sees bulls and bears battling; precise levels to follow for quick trades.

The 4-hour chart has surged past 10.6K, with a 24-hour increase of over 4.5%. However, overbought signals are flashing, so short-term traders should avoid blindly rushing in. Use clear entry points and risk controls, and follow the plan.

Let's look at the core short-term signals: Moving averages are in a bullish alignment sup

BTC-7.35%

- Reward

- 1

- Comment

- Repost

- Share

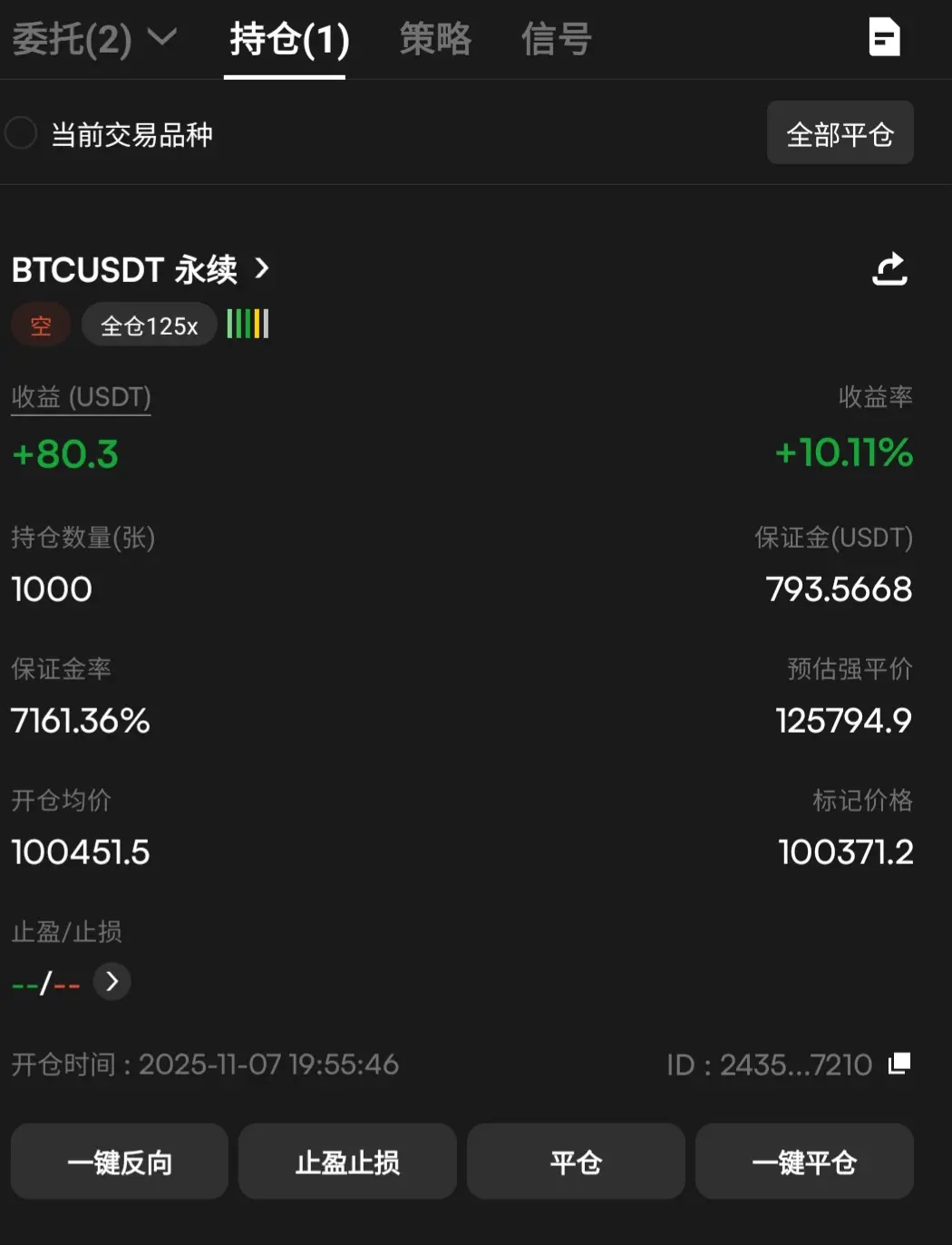

Yesterday's short position was topped up to average cost. Unfortunately, the entry point was not ideal. Decided to close the position and exit. Waiting patiently for a better entry point to go short again.

BTC-7.35%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Fight the bears to the end! A rebound is a buy-in, I won't stop until breaking through 102,000!

Don't talk to me about rebound recovery. The current market is dominated by bears!

I was hesitant whether to wait for a deep drop before shorting, but now I get it — as long as it doesn't break the 102,000 life-and-death line, every rebound is a chance to add to my position!

No matter how the whales manipulate to lure more shorts, following the trend is the smartest move!

To take profits with my brothers, I must be bold and aggressive. Short all the way down to 94,000 — just do it!

Don't talk to me about rebound recovery. The current market is dominated by bears!

I was hesitant whether to wait for a deep drop before shorting, but now I get it — as long as it doesn't break the 102,000 life-and-death line, every rebound is a chance to add to my position!

No matter how the whales manipulate to lure more shorts, following the trend is the smartest move!

To take profits with my brothers, I must be bold and aggressive. Short all the way down to 94,000 — just do it!

BTC-7.35%

- Reward

- like

- Comment

- Repost

- Share

To be honest, I used to be obsessed with catching rebounds, not because I lacked faith, but because reality kept hitting me in the face. Each time I bottomed out, I only managed a small profit, and after waiting so long, I was still anxious and fearful. In contrast, shorting with the trend yields quick and decisive profits.

The bears are so strong that there's nothing to say—continuous downward declines, ongoing capital outflows, and key support levels breaking one after another. At this point, holding long positions is going against the market. Our core goal is to make money, not to gamble on

The bears are so strong that there's nothing to say—continuous downward declines, ongoing capital outflows, and key support levels breaking one after another. At this point, holding long positions is going against the market. Our core goal is to make money, not to gamble on

BTC-7.35%

- Reward

- like

- Comment

- Repost

- Share

October 7th, Friday evening trading ideas

Should you bottom fish or short now? Here are the key points!

First, look at the current market: After several days of continuous decline, a long lower shadow has finally appeared, testing support. This indicates that funds are indeed holding at the 100,000 level, but overall the trend remains sideways with a bearish bias. All moving averages are in a bearish alignment, with prices staying below all MAs. The MACD shows a dead cross that has eased but not reversed, RSI is oversold but not at extreme levels. Additionally, both futures and spot funds are

Should you bottom fish or short now? Here are the key points!

First, look at the current market: After several days of continuous decline, a long lower shadow has finally appeared, testing support. This indicates that funds are indeed holding at the 100,000 level, but overall the trend remains sideways with a bearish bias. All moving averages are in a bearish alignment, with prices staying below all MAs. The MACD shows a dead cross that has eased but not reversed, RSI is oversold but not at extreme levels. Additionally, both futures and spot funds are

BTC-7.35%

- Reward

- like

- 1

- Repost

- Share

PrincessQingyue :

:

November 7th, Friday midday trading thoughts

Bitcoin 4-hour chart breakdown: Oversold rebound signals are already showing, so follow the key levels for quick trades!

After continuous sideways decline overnight, the market has moved down as expected, with the lowest point reaching 100,238. Then, buying at the lows perfectly validated the strategy. Currently, there’s a profit of over 1,000 points, and our internal followers are all on the same page. Yesterday evening’s post explained everything clearly and transparently!

Let’s look at the core signals on the chart:

- The moving averages are in

Bitcoin 4-hour chart breakdown: Oversold rebound signals are already showing, so follow the key levels for quick trades!

After continuous sideways decline overnight, the market has moved down as expected, with the lowest point reaching 100,238. Then, buying at the lows perfectly validated the strategy. Currently, there’s a profit of over 1,000 points, and our internal followers are all on the same page. Yesterday evening’s post explained everything clearly and transparently!

Let’s look at the core signals on the chart:

- The moving averages are in

BTC-7.35%

- Reward

- like

- Comment

- Repost

- Share

Decisive and precise! When it's time to take profits, there's no hesitation—just go for it. The signals are clear, and brothers who followed along are now well-fed and satisfied! A few days ago, I missed the big picture, but this time I’ve learned my lesson—just do it!

BTC-7.35%

- Reward

- like

- Comment

- Repost

- Share

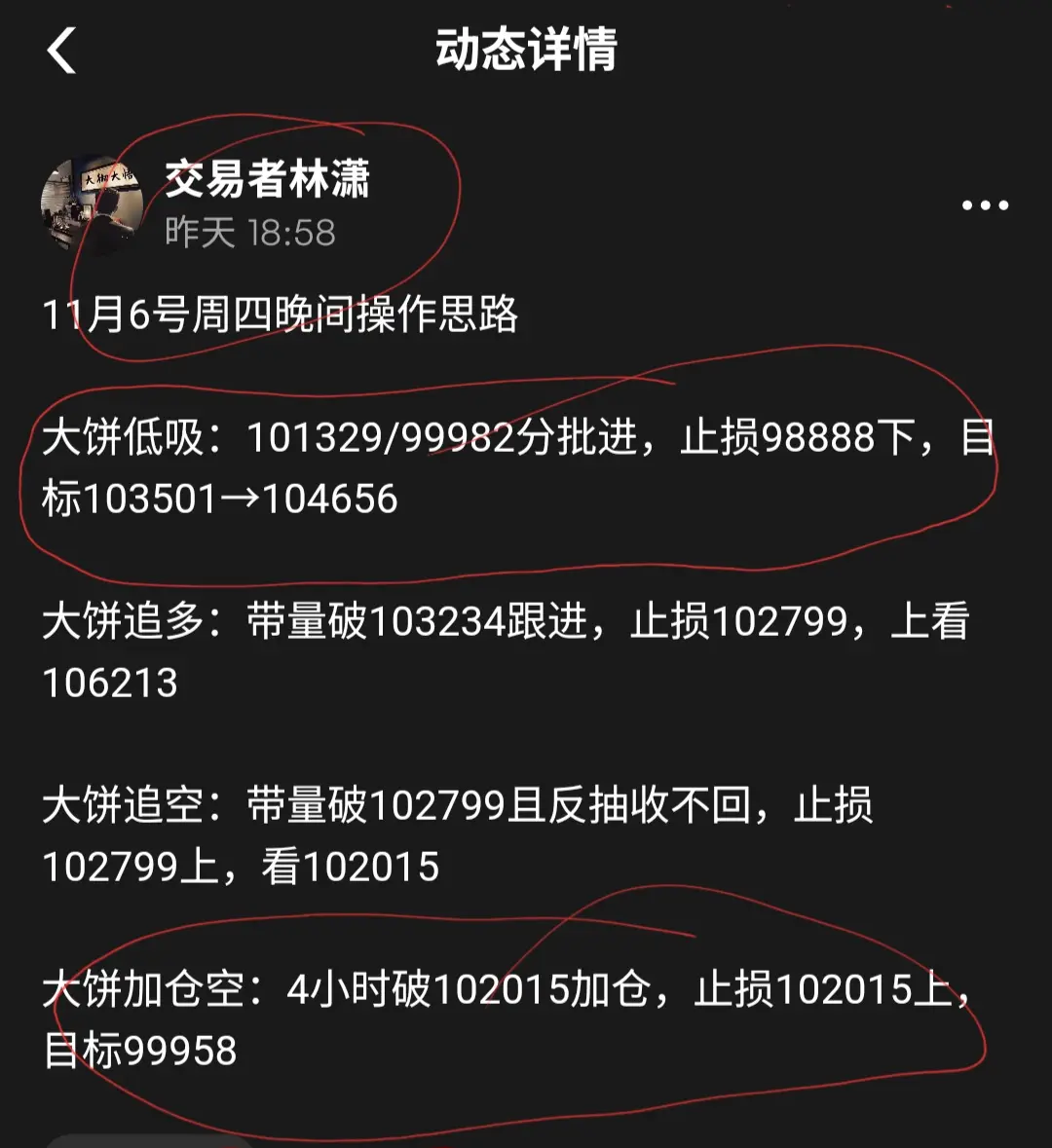

Operational Strategy for Thursday Night, November 6th

Bitcoin (Big Cake) Low-Buy: Enter in batches at 101,329 / 99,982, with a stop loss below 98,888. Targets are 103,501 → 104,656.

Bitcoin Long Chase: Follow up with increased volume upon breaking 103,234; stop loss at 102,799. Expect to rise to 106,213.

Bitcoin Short Chase: When volume breaks below 102,799 and fails to recover on a rebound, set stop loss at 102,799. Target is 102,015.

Bitcoin Add to Short Position: If the 4-hour chart breaks below 102,015, add to the short position with a stop loss above 102,015. Target is 99,958.

Bitcoin (Big Cake) Low-Buy: Enter in batches at 101,329 / 99,982, with a stop loss below 98,888. Targets are 103,501 → 104,656.

Bitcoin Long Chase: Follow up with increased volume upon breaking 103,234; stop loss at 102,799. Expect to rise to 106,213.

Bitcoin Short Chase: When volume breaks below 102,799 and fails to recover on a rebound, set stop loss at 102,799. Target is 102,015.

Bitcoin Add to Short Position: If the 4-hour chart breaks below 102,015, add to the short position with a stop loss above 102,015. Target is 99,958.

BTC-7.35%

- Reward

- like

- Comment

- Repost

- Share