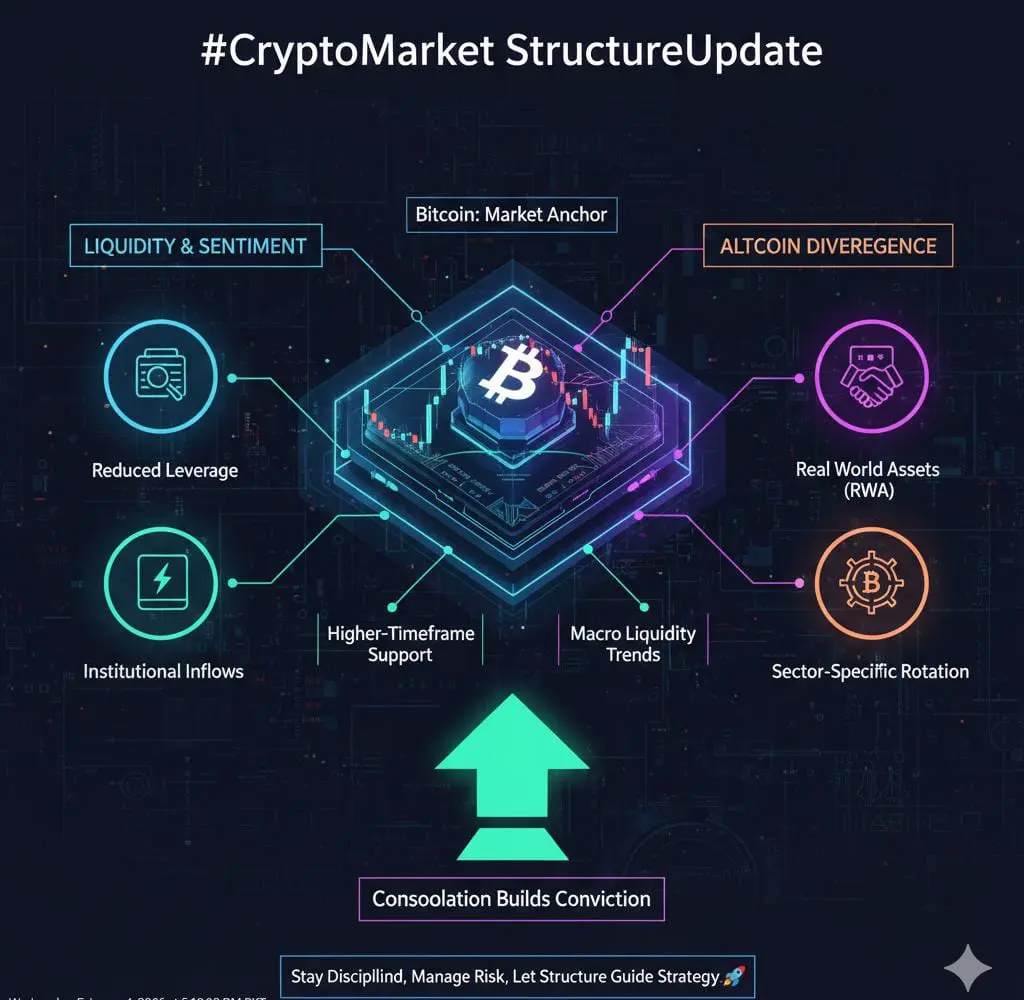

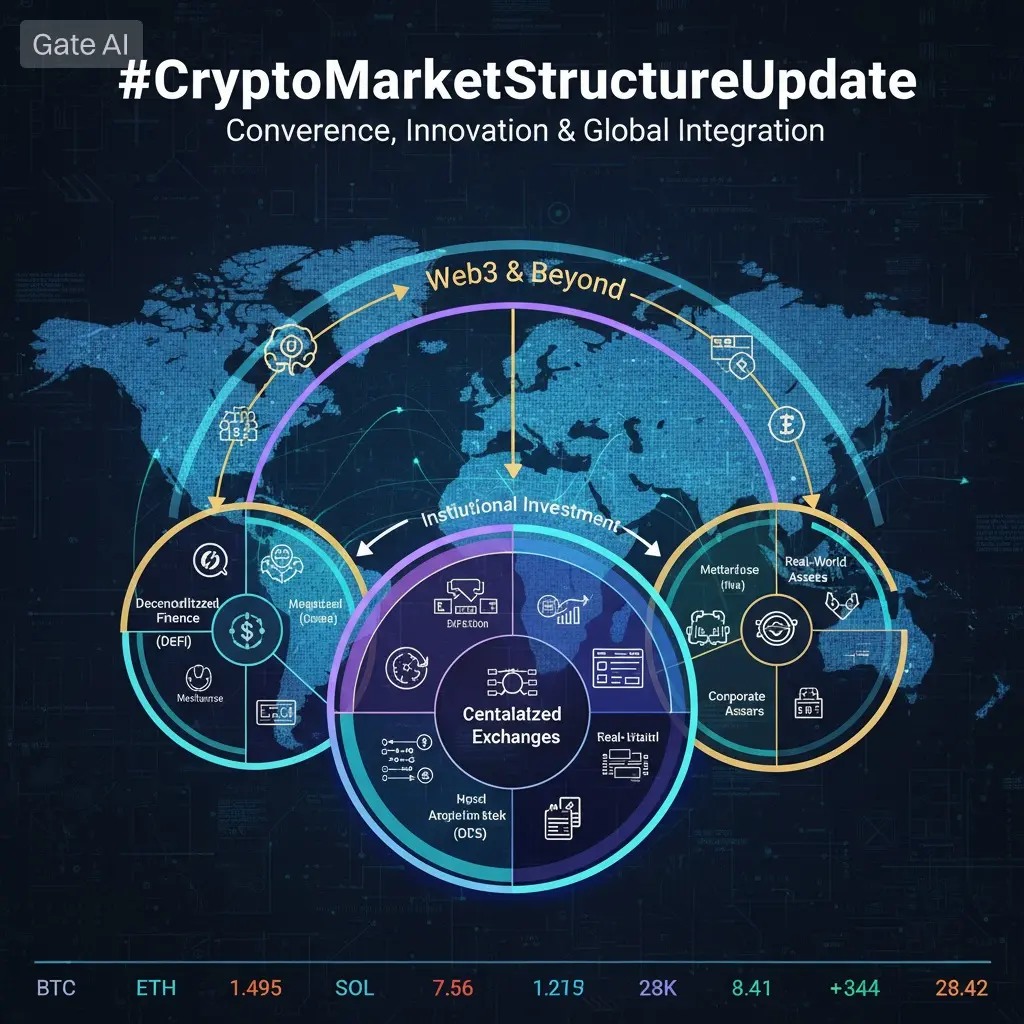

#CryptoMarketStructureUpdate In-Depth Market Structure & Liquidity Analysis

The crypto market is currently moving through a critical transition phase, where price behavior is being driven less by headlines and more by liquidity flows, institutional positioning, and structural dynamics. This environment favors disciplined traders who understand market mechanics over emotional participants reacting to short-term noise.

🔹 1) Bitcoin (BTC): High Time Frame Structure

On higher time frames, Bitcoin remains locked in a broad range and potential distribution zone. Price continues to approach similar highs and face repeated rejection, a pattern that often reflects liquidity hunting and gradual position unwinding by larger participants. This behavior suggests that strong bullish conviction has not yet returned.

📌 Key Insight:

Without a decisive breakout and sustained close outside this range, long-term bullish confirmation remains limited. Until then, rallies should be treated with caution.

🔹 2) Lower Time Frame (LTF) Price Behavior

On lower time frames, BTC is forming a sequence of lower highs combined with weak higher lows, alongside declining volatility. This compression phase typically precedes major expansion moves. However, direction remains uncertain.

⚠️ During these periods, retail traders often overtrade minor fluctuations and become trapped in false breakouts and breakdowns.

🔹 3) Altcoin Market Structure & Capital Rotation

Altcoins are showing selective strength rather than broad-based momentum. Sectors such as artificial intelligence, real-world asset tokenization, and infrastructure continue attracting capital, while meme coins and low-utility projects remain under pressure.

BTC dominance remains elevated, indicating that investors are still prioritizing capital preservation over aggressive risk-taking. This reflects a capital rotation phase rather than a true altseason.

🔹 4) Volume, Open Interest & Liquidity Signals

Spot market volume remains relatively weak, signaling limited organic demand. In contrast, derivatives markets show elevated open interest with funding rates near neutral or slightly positive.

📌 This imbalance suggests growing leverage in the system, increasing the likelihood of forced liquidation events that can trigger sharp directional moves.

🔹 5) Smart Money Positioning

Institutional and experienced traders are avoiding aggressive entries near range highs. Instead, they are gradually accumulating during pullbacks and periods of fear. This behavior aligns with the long-standing principle of buying during pessimism and reducing exposure during euphoria.

🔹 6) Probable Market Scenarios

Two primary scenarios currently dominate market expectations:

Scenario A — Liquidity Sweep & Reversal

✔ Downside liquidity is taken

✔ Weak hands are flushed out

✔ Strong demand enters

✔ Sustainable recovery begins

Scenario B — Fake Breakout & Rejection

❌ Price breaks range highs temporarily

❌ Retail FOMO enters

❌ Smart money distributes

❌ Sharp reversal follows

Both scenarios remain viable until structure confirms direction.

🧠 Optimal Trading Approach

In this environment, survival and discipline matter more than aggression:

• Avoid emotional entries and FOMO

• Reduce position size without confirmation

• Prioritize capital protection

• Respect invalidation levels

• Treat cash as a strategic position

Risk management remains the primary edge.

🔚 Summary

The current crypto market is defined by structure, liquidity, and patience rather than hype. It is a technically driven environment where smart positioning matters more than frequent trading. Traders who respect market mechanics, wait for confirmation, and manage risk effectively will be best prepared for the next major expansion phase.

📌 In this market, patience is a strategy — not a weakness.

The crypto market is currently moving through a critical transition phase, where price behavior is being driven less by headlines and more by liquidity flows, institutional positioning, and structural dynamics. This environment favors disciplined traders who understand market mechanics over emotional participants reacting to short-term noise.

🔹 1) Bitcoin (BTC): High Time Frame Structure

On higher time frames, Bitcoin remains locked in a broad range and potential distribution zone. Price continues to approach similar highs and face repeated rejection, a pattern that often reflects liquidity hunting and gradual position unwinding by larger participants. This behavior suggests that strong bullish conviction has not yet returned.

📌 Key Insight:

Without a decisive breakout and sustained close outside this range, long-term bullish confirmation remains limited. Until then, rallies should be treated with caution.

🔹 2) Lower Time Frame (LTF) Price Behavior

On lower time frames, BTC is forming a sequence of lower highs combined with weak higher lows, alongside declining volatility. This compression phase typically precedes major expansion moves. However, direction remains uncertain.

⚠️ During these periods, retail traders often overtrade minor fluctuations and become trapped in false breakouts and breakdowns.

🔹 3) Altcoin Market Structure & Capital Rotation

Altcoins are showing selective strength rather than broad-based momentum. Sectors such as artificial intelligence, real-world asset tokenization, and infrastructure continue attracting capital, while meme coins and low-utility projects remain under pressure.

BTC dominance remains elevated, indicating that investors are still prioritizing capital preservation over aggressive risk-taking. This reflects a capital rotation phase rather than a true altseason.

🔹 4) Volume, Open Interest & Liquidity Signals

Spot market volume remains relatively weak, signaling limited organic demand. In contrast, derivatives markets show elevated open interest with funding rates near neutral or slightly positive.

📌 This imbalance suggests growing leverage in the system, increasing the likelihood of forced liquidation events that can trigger sharp directional moves.

🔹 5) Smart Money Positioning

Institutional and experienced traders are avoiding aggressive entries near range highs. Instead, they are gradually accumulating during pullbacks and periods of fear. This behavior aligns with the long-standing principle of buying during pessimism and reducing exposure during euphoria.

🔹 6) Probable Market Scenarios

Two primary scenarios currently dominate market expectations:

Scenario A — Liquidity Sweep & Reversal

✔ Downside liquidity is taken

✔ Weak hands are flushed out

✔ Strong demand enters

✔ Sustainable recovery begins

Scenario B — Fake Breakout & Rejection

❌ Price breaks range highs temporarily

❌ Retail FOMO enters

❌ Smart money distributes

❌ Sharp reversal follows

Both scenarios remain viable until structure confirms direction.

🧠 Optimal Trading Approach

In this environment, survival and discipline matter more than aggression:

• Avoid emotional entries and FOMO

• Reduce position size without confirmation

• Prioritize capital protection

• Respect invalidation levels

• Treat cash as a strategic position

Risk management remains the primary edge.

🔚 Summary

The current crypto market is defined by structure, liquidity, and patience rather than hype. It is a technically driven environment where smart positioning matters more than frequent trading. Traders who respect market mechanics, wait for confirmation, and manage risk effectively will be best prepared for the next major expansion phase.

📌 In this market, patience is a strategy — not a weakness.