Web3ProductManager

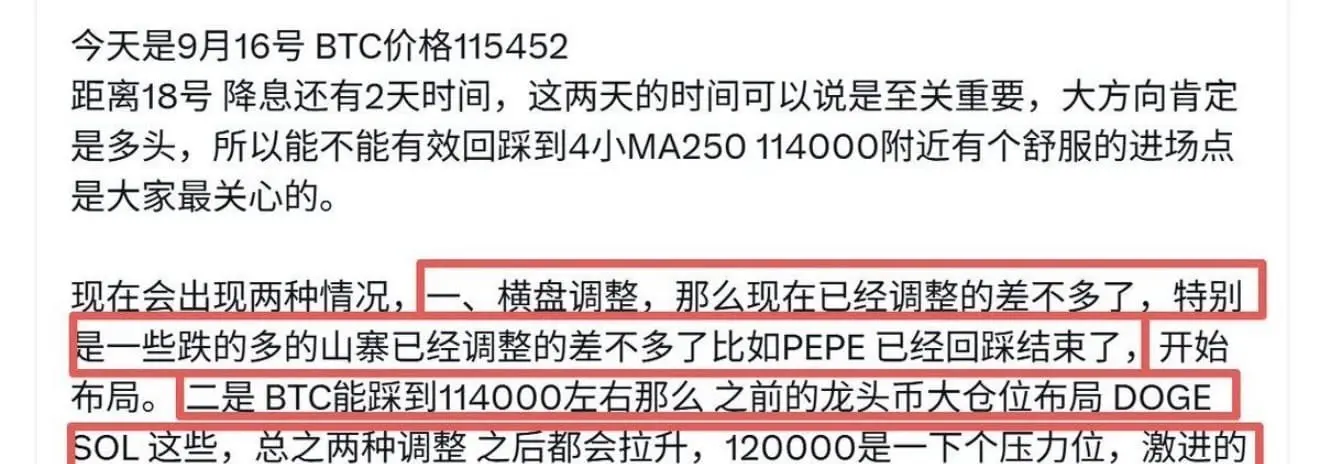

For the upcoming Fed interest rate decision, market observers generally predict a high likelihood of a 25 basis point rate cut. Although there is also a certain probability of a 50 basis point cut, most analysts believe that such a magnitude may be too aggressive. A moderate 25 basis point cut is seen as a more ideal choice, as it can convey a signal of policy adjustment without causing excessive concern about an economic recession.

However, the interest rate decision itself is not everything. Market participants are more focused on Fed Chair Powell's remarks after the decision. His statem

View OriginalHowever, the interest rate decision itself is not everything. Market participants are more focused on Fed Chair Powell's remarks after the decision. His statem