Post content & earn content mining yield

placeholder

DianeDeCrypt

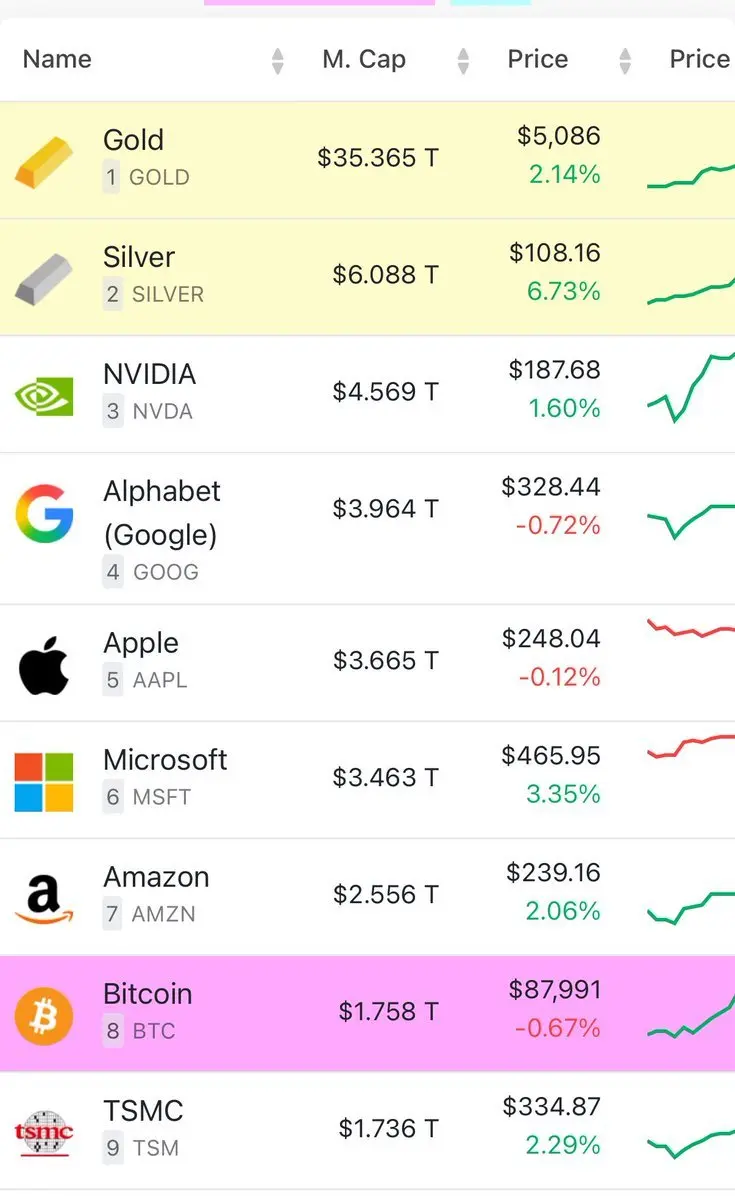

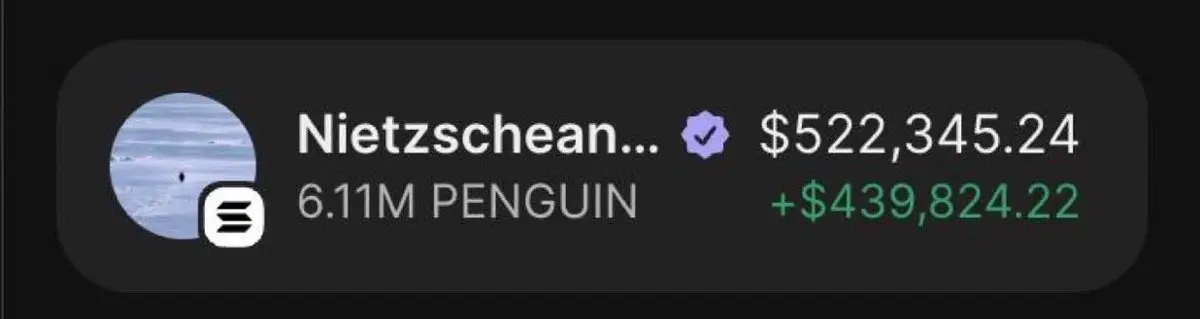

I bought my first bitcoins at $3000 and i made a lot of money from itI also bought XRP at $0.2 in april 2017 before the bullrunI hit many 50-1000x trades with ADA, SOL, PNUT, FRED etcThis year alone, $whitewhale, $shoebill, $penguin, $ralph , $mountainI buy low, wait, and sell highThis game is so easyYou’ll regret not following me.

- Reward

- like

- 1

- Repost

- Share

GateUser-36d01c9d :

:

https://www.gate.com/competition/f1rb/s5?ref=VQNBVVWJVA&ref_type=165&utm_cmp=AXHKa1jS#ContentMiningRevampPublicBeta 🚀

The digital asset market moves faster than price charts. Real edge comes from understanding narratives, sentiment shifts, and attention flows before the market reacts—and that’s exactly where Gate’s Content Mining Revamp (Public Beta) steps in.

🔍 Why It Matters

Traditional tools track prices. This tracks market psychology.

With advanced content mining, you can identify early signals hidden in conversations—before they turn into trends.

🧠 What’s New

• Sentiment + Volume Analysis – Not just what is being said, but how loud it is

• Cross-Platform Trend Detectio

The digital asset market moves faster than price charts. Real edge comes from understanding narratives, sentiment shifts, and attention flows before the market reacts—and that’s exactly where Gate’s Content Mining Revamp (Public Beta) steps in.

🔍 Why It Matters

Traditional tools track prices. This tracks market psychology.

With advanced content mining, you can identify early signals hidden in conversations—before they turn into trends.

🧠 What’s New

• Sentiment + Volume Analysis – Not just what is being said, but how loud it is

• Cross-Platform Trend Detectio

BTC-0.97%

- Reward

- 2

- 1

- Repost

- Share

楚老魔 :

:

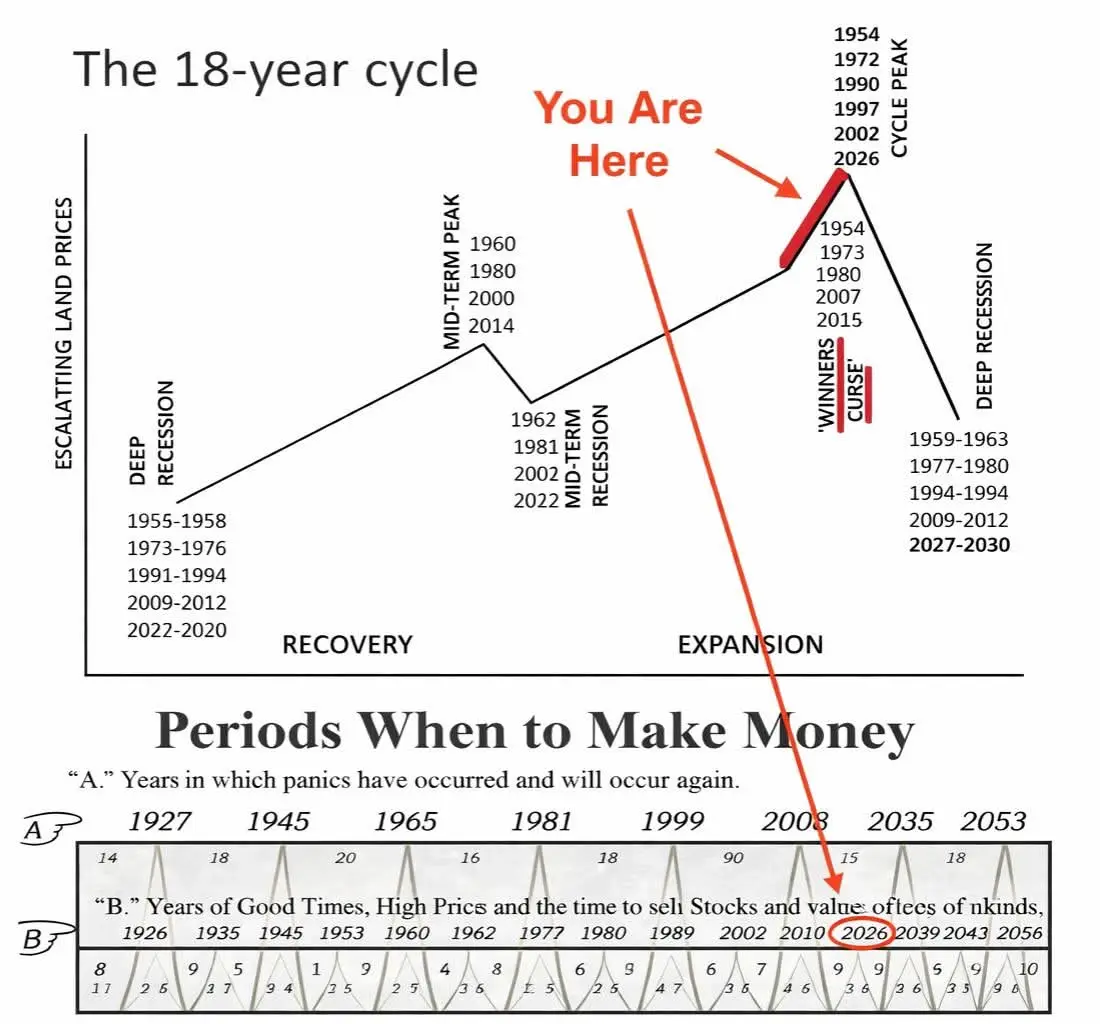

2026 Go Go Go 👊- Reward

- 2

- 4

- Repost

- Share

XiangdongAtAGlance :

:

My good comrade, please don't fall before dawn. Don't act rashly without a signal.View More

CNMB

草尼马币

Created By@Aaaaaaaaaaaaaaaaaaaaaaaa

Subscription Progress

0.00%

MC:

$0

Create My Token

- Reward

- 2

- Comment

- Repost

- Share

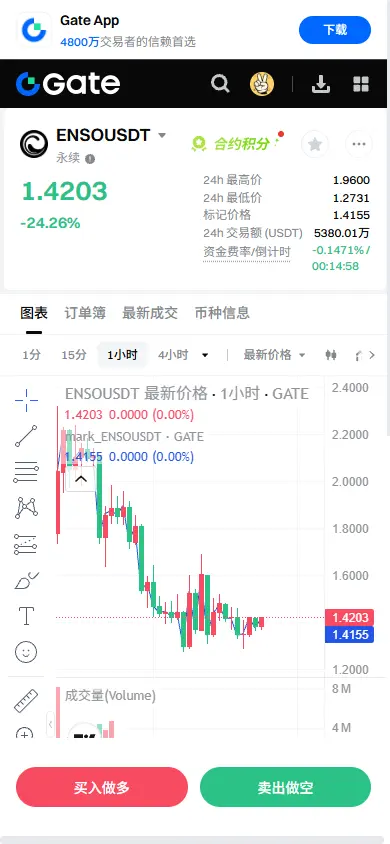

【$ENSO Signal】Short | Weak consolidation after volume breakout

$ENSO After experiencing a -24.75% volume-driven plunge, it is now undergoing weak consolidation. The price action indicates a downward continuation rather than a valid rebound. High trading volume accompanied by falling prices suggests caution for main force distribution or long liquidation pressure in the open interest data.

🎯 Direction: Short (Short)

🎯 Entry: 1.35 - 1.37

🛑 Stop Loss: 1.42 (Rigid Stop Loss)

🚀 Target 1: 1.20

🚀 Target 2: 1.05

The decline of $ENSO is driven, not a healthy correction. Prices are consolidating

$ENSO After experiencing a -24.75% volume-driven plunge, it is now undergoing weak consolidation. The price action indicates a downward continuation rather than a valid rebound. High trading volume accompanied by falling prices suggests caution for main force distribution or long liquidation pressure in the open interest data.

🎯 Direction: Short (Short)

🎯 Entry: 1.35 - 1.37

🛑 Stop Loss: 1.42 (Rigid Stop Loss)

🚀 Target 1: 1.20

🚀 Target 2: 1.05

The decline of $ENSO is driven, not a healthy correction. Prices are consolidating

ENSO-20.66%

- Reward

- 1

- Comment

- Repost

- Share

ZEC hourly chart shows that after the price retraced to around 354, it dipped again. The Kunkou trend is not over yet. On the technical indicators, the KDJ indicator is turning downward and forming a death cross, and the MA monthly line has crossed below the weekly line. The downward trend is still ongoing.

Personal suggestion, for reference only (strictly set stop-loss)

ZEC can range around 348-355, with a target of 330-300

Personal suggestion, for reference only (strictly set stop-loss)

ZEC can range around 348-355, with a target of 330-300

ZEC-3%

- Reward

- like

- Comment

- Repost

- Share

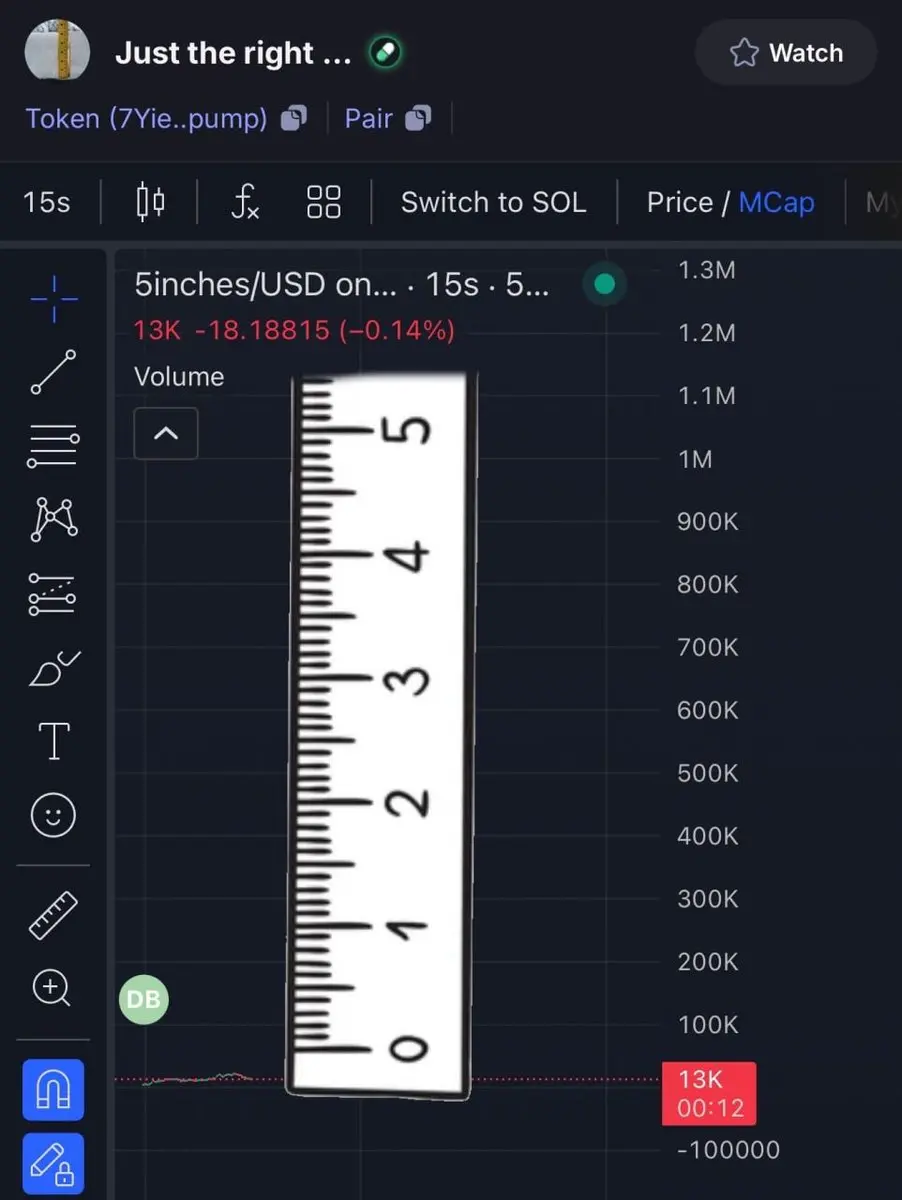

Anything more than 5 inches of snow would be unpleasant.right?

- Reward

- like

- Comment

- Repost

- Share

The cost of eliminating inflation is an economic recession. When the recession comes, what should you buy? Not copper, not oil, but 20-year U.S. Treasury bonds!📉➡️📈

View Original- Reward

- like

- Comment

- Repost

- Share

#ContentMiningRevampPublicBeta #ContentMiningRevampPublicBeta

The digital asset space is evolving at lightning speed, and staying on top of trends is more than just watching prices—it’s about understanding what the market is saying, where attention is shifting, and which narratives are gaining momentum. Gate’s Content Mining Revamp Public Beta is designed precisely for this.

Why this matters:

Traditional tracking often misses subtle shifts in sentiment and discussion volume. Now, with advanced content mining tools, you can spot early signals before markets react.

The revamped system analyzes s

The digital asset space is evolving at lightning speed, and staying on top of trends is more than just watching prices—it’s about understanding what the market is saying, where attention is shifting, and which narratives are gaining momentum. Gate’s Content Mining Revamp Public Beta is designed precisely for this.

Why this matters:

Traditional tracking often misses subtle shifts in sentiment and discussion volume. Now, with advanced content mining tools, you can spot early signals before markets react.

The revamped system analyzes s

BTC-0.97%

- Reward

- 4

- 5

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

- Reward

- 1

- Comment

- Repost

- Share

#ContentMiningRevampPublicBeta 🎊Upgrading Gate Web3 to Gate DEX isn't just a name change; it’s a strategic move to solve the "UX debt" that has kept mainstream users away from on-chain trading for years.

Here is a breakdown of the key takeaways from this evolution:

🔑 The Core Evolution

The transition focuses on three main pillars that have historically been "pain points" for DeFi users:

User Experience (UX): Replacing clunky wallet setups with familiar login flows.

Performance: Aiming for CEX-like speed (fast confirmations) on a trustless architecture.

Cost: Minimizing gas fees to make the p

Here is a breakdown of the key takeaways from this evolution:

🔑 The Core Evolution

The transition focuses on three main pillars that have historically been "pain points" for DeFi users:

User Experience (UX): Replacing clunky wallet setups with familiar login flows.

Performance: Aiming for CEX-like speed (fast confirmations) on a trustless architecture.

Cost: Minimizing gas fees to make the p

- Reward

- 1

- Comment

- Repost

- Share

【$SOL Signal】Long - Healthy Reset After Liquidation Cleanup

$SOL Price decline accompanied by high open interest presents a typical bullish liquidation washout, rather than a main force distribution. This is a healthy reset in an upward trend.

🎯 Direction: Long

🎯 Entry: 120.50 - 122.50

🛑 Stop Loss: 118.00 ( Rigid Stop Loss )

🚀 Target 1: 128.00

🚀 Target 2: 135.00

$SOL The appearance of high trading volume and high open interest above a key support zone indicates standard liquidity cleansing. Price action shows rapid absorption of selling pressure without sustained selling. The lower tim

$SOL Price decline accompanied by high open interest presents a typical bullish liquidation washout, rather than a main force distribution. This is a healthy reset in an upward trend.

🎯 Direction: Long

🎯 Entry: 120.50 - 122.50

🛑 Stop Loss: 118.00 ( Rigid Stop Loss )

🚀 Target 1: 128.00

🚀 Target 2: 135.00

$SOL The appearance of high trading volume and high open interest above a key support zone indicates standard liquidity cleansing. Price action shows rapid absorption of selling pressure without sustained selling. The lower tim

SOL-3.43%

- Reward

- like

- Comment

- Repost

- Share

河流

河流

Created By@XingluoBlockchain

Listing Progress

0.00%

MC:

$3.4K

Create My Token

$SUI downtrend momentum is slowing right at prior demand.

If buyers step in SUI can snap back toward the consolidation highs with a clean R:R setup.

#Tradingview

If buyers step in SUI can snap back toward the consolidation highs with a clean R:R setup.

#Tradingview

SUI-2.72%

- Reward

- 1

- Comment

- Repost

- Share

🚨 GLOBAL MACRO WARNING: WHY 2026 IS A CRITICAL YEAR FOR MARKETS

A Major Macro Shift Is Quietly Building Beneath The Surface Of Global Markets.

This Is Not About Short-Term Volatility Or Headlines.

This Is About Structural Pressure In The Global Financial System.

Below Is A Clear, Professional, And Policy-Safe Breakdown Of Why 2026 Matters.

➤ BOND MARKETS ARE FLASHING EARLY SIGNALS

Sovereign Bond Volatility Is Rising Across Major Economies.

The MOVE Index Is Trending Higher — A Sign That Funding Conditions Are Tightening.

Bond Markets React To Liquidity Stress, Not Sentiment.

When Bo

A Major Macro Shift Is Quietly Building Beneath The Surface Of Global Markets.

This Is Not About Short-Term Volatility Or Headlines.

This Is About Structural Pressure In The Global Financial System.

Below Is A Clear, Professional, And Policy-Safe Breakdown Of Why 2026 Matters.

➤ BOND MARKETS ARE FLASHING EARLY SIGNALS

Sovereign Bond Volatility Is Rising Across Major Economies.

The MOVE Index Is Trending Higher — A Sign That Funding Conditions Are Tightening.

Bond Markets React To Liquidity Stress, Not Sentiment.

When Bo

- Reward

- like

- Comment

- Repost

- Share

🧱 Market stress doesn’t create new problems it exposes existing ones.

During bull runs, inefficiencies hide behind momentum. Users accept slippage, overlook latency, and forgive poor execution because upside dominates attention.

But when markets compress or turn volatile, every imperfection becomes visible.

In those conditions, execution shifts from convenience to risk management. Failed swaps, delayed confirmations, or unclear pricing translate directly into losses, not frustration.

That’s where execution-first DEXs start to matter. On $TON , STONfi prioritizes predictable settle

During bull runs, inefficiencies hide behind momentum. Users accept slippage, overlook latency, and forgive poor execution because upside dominates attention.

But when markets compress or turn volatile, every imperfection becomes visible.

In those conditions, execution shifts from convenience to risk management. Failed swaps, delayed confirmations, or unclear pricing translate directly into losses, not frustration.

That’s where execution-first DEXs start to matter. On $TON , STONfi prioritizes predictable settle

TON-1.17%

- Reward

- 3

- 2

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

$BTC are finally waking up — and the macro setup explains why.

The Russell 2000 peaked back in Q4 2021.

It stayed quiet while large caps stole the spotlight.

Even when the S&P 500 kept printing new highs from Q1 2024 onward, small caps lagged. Patience was tested. Conviction was questioned.

Then Q4 2025 happened.

Russell 2000 broke into a fresh all-time high.

Now comes the important part — it has started to outperform the S&P 500.

That’s the shift.

Capital always rotates. First into safety. Then into size. Then into risk.

Small caps don’t lead at the start — they explode after structure is b

The Russell 2000 peaked back in Q4 2021.

It stayed quiet while large caps stole the spotlight.

Even when the S&P 500 kept printing new highs from Q1 2024 onward, small caps lagged. Patience was tested. Conviction was questioned.

Then Q4 2025 happened.

Russell 2000 broke into a fresh all-time high.

Now comes the important part — it has started to outperform the S&P 500.

That’s the shift.

Capital always rotates. First into safety. Then into size. Then into risk.

Small caps don’t lead at the start — they explode after structure is b

BTC-0.97%

- Reward

- 1

- Comment

- Repost

- Share

#ContentMiningRevampPublicBeta 🚀 Gate Square Content Mining Revamp Public Beta — A New Era of Creator Earnings

Gate Square has officially launched the Content Mining Revamp Public Beta, marking a major transformation in how crypto content creators are rewarded. This upgrade is not just a system update — it represents a complete shift toward a results-driven creator economy where content is directly connected to real trading activity and long-term income potential.

With this new revamp, content is no longer valued only by views or impressions. Instead, the true focus is on impact. Creators are

Gate Square has officially launched the Content Mining Revamp Public Beta, marking a major transformation in how crypto content creators are rewarded. This upgrade is not just a system update — it represents a complete shift toward a results-driven creator economy where content is directly connected to real trading activity and long-term income potential.

With this new revamp, content is no longer valued only by views or impressions. Instead, the true focus is on impact. Creators are

- Reward

- 3

- 3

- Repost

- Share

楚老魔 :

:

2026 Go Go Go 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More7.25K Popularity

89K Popularity

61.77K Popularity

16.34K Popularity

35.99K Popularity

News

View MoreGate CandyDrop Precious Metals and Index Zone Benefits Now Open, Share 20 XAUT (622g Gold)

3 m

The 10-year French government bond yield fell by 5 basis points intraday, likely marking the largest decline since October last year.

11 m

The EU launches an investigation into X's AI chatbot Grok

30 m

Overview of mainstream Perp DEXs: Hyperliquid's open interest is nearly the sum of other platforms, and its trading volume continues to lead this month.

33 m

Gate Instant Swap launches the third phase of the Instant Swap Lucky Draw, sharing 60,000 USDT

35 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889