SEEDALTAR

No content yet

SEEDALTAR

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

People don't want to understand you they want to label you. You speak up and suddenly you're “too emotional." You stay quiet and now you've “changed." You set boundaries and somehow, you become the villain. People rarely listen to hear you they listen to judge you. And no matter how carefully you try to explain yourself, they'll still twist your words to fit the version of you they've already created in their heads. So stop breaking yourself just to be understood. Let them misunderstand you.

Let them talk. Your peace doesn't need their permission.$BTC $GT

Let them talk. Your peace doesn't need their permission.$BTC $GT

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Bitcoin's desertion of its maker is a clean spiritual maneuver: the message must stand or fall by itself.

5) The moral architecture — what Bitcoin asks of humanity

If Bitcoin is a spirit-teaching, its curriculum includes:

Discipline — you must follow rules to keep the system healthy.

Self-responsibility — custody of keys = custody of destiny.

Community stewardship — power is in groups, not kings.

Non-attachment — the greatest gift is not profit but the ability to let go of ownership.

Resistance to corruption — systems are only sacred if their caretakers are moral.

This is the altar lesson: own

5) The moral architecture — what Bitcoin asks of humanity

If Bitcoin is a spirit-teaching, its curriculum includes:

Discipline — you must follow rules to keep the system healthy.

Self-responsibility — custody of keys = custody of destiny.

Community stewardship — power is in groups, not kings.

Non-attachment — the greatest gift is not profit but the ability to let go of ownership.

Resistance to corruption — systems are only sacred if their caretakers are moral.

This is the altar lesson: own

BTC-0,61%

- Reward

- like

- Comment

- Repost

- Share

The core vision — what Bitcoin is as spirit

Think of Bitcoin not as software only, but as an idea made into a living thing. It carries a character:

Impartial law — rules that do not bend for kings or thieves.

Scarcity as sacredness — the 21 million cap is like a commandment: limits create value and discipline.

Autonomy — it does not bow to one man, one god, or one state.

Impersonality — it refuses owners; it is instead a commons, a field anyone can work in.$BTC #CryptoMarketPullback

Think of Bitcoin not as software only, but as an idea made into a living thing. It carries a character:

Impartial law — rules that do not bend for kings or thieves.

Scarcity as sacredness — the 21 million cap is like a commandment: limits create value and discipline.

Autonomy — it does not bow to one man, one god, or one state.

Impersonality — it refuses owners; it is instead a commons, a field anyone can work in.$BTC #CryptoMarketPullback

BTC-0,61%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin is a “tool for freedom,

a tool that breaks government control,

a tool that gives power back to the ordinary person,

a tool that challenges corrupted financial systems.

That is why it feels spiritual.

So nobody owns it.

This is the key point.

If Satoshi was a human:

He would have:

spent the money

shown himself

sold his part

controlled the community

taken praise

But Satoshi designed a system where:

no one can change Bitcoin

no one can delete it

no one can destroy it

no one can own it

no one can corrupt it

This behavior is like:

A creator who wants the creation to belong to EVERYON

a tool that breaks government control,

a tool that gives power back to the ordinary person,

a tool that challenges corrupted financial systems.

That is why it feels spiritual.

So nobody owns it.

This is the key point.

If Satoshi was a human:

He would have:

spent the money

shown himself

sold his part

controlled the community

taken praise

But Satoshi designed a system where:

no one can change Bitcoin

no one can delete it

no one can destroy it

no one can own it

no one can corrupt it

This behavior is like:

A creator who wants the creation to belong to EVERYON

BTC-0,61%

- Reward

- like

- Comment

- Repost

- Share

Decoding the latest crypto headlines. Beyond the daily noise, what fundamental shifts are really happening? Interesting times ahead.

MC:$3.58KHolders:1

0.00%

- Reward

- like

- Comment

- Repost

- Share

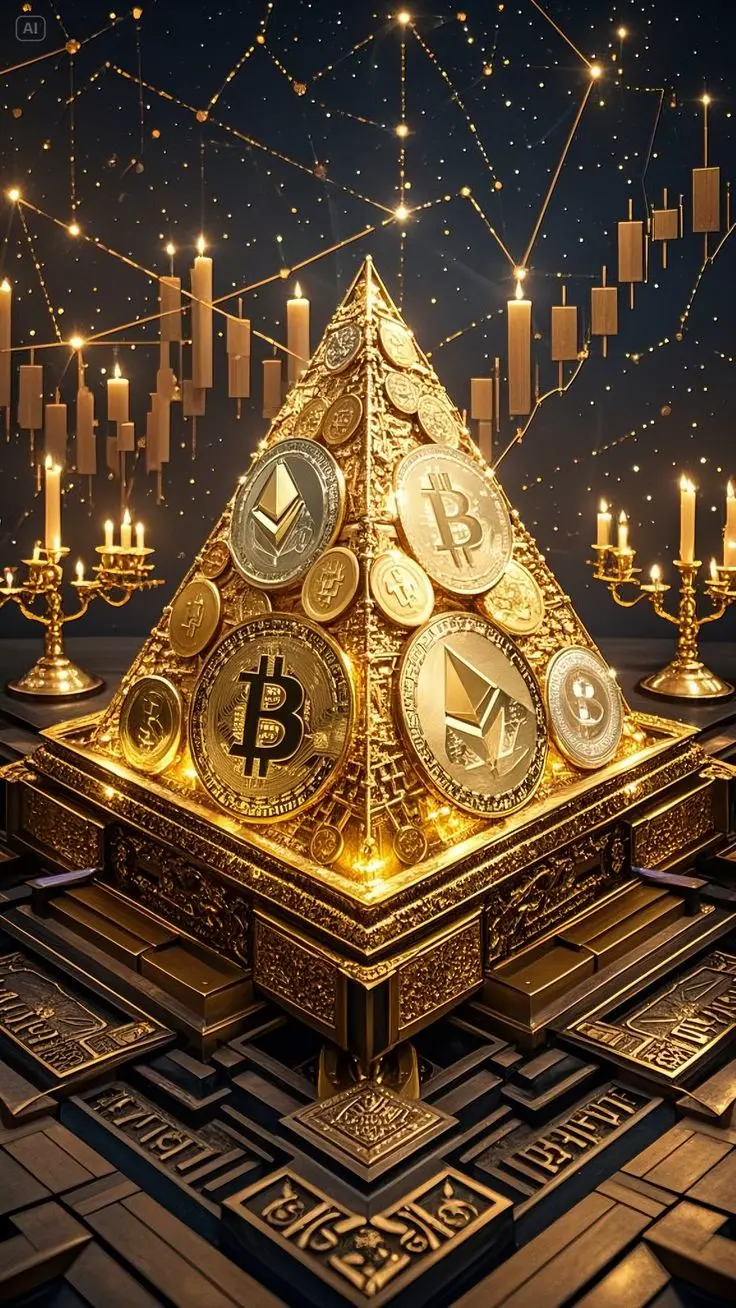

The cryptocurrency market is currently in a consolidation phase, with major assets trading sideways as participants wait for a clear directional signal. Bitcoin remains the market anchor, holding key levels while liquidity stays moderate and volatility remains contained.

Ethereum continues to show strong network activity, driven by Layer-2 usage and ongoing ecosystem development, even as price action remains range-bound. Meanwhile, select altcoins and meme tokens are seeing short-term rotations, reflecting speculative interest rather than broad market momentum.

Market sentiment: Cautious but

Ethereum continues to show strong network activity, driven by Layer-2 usage and ongoing ecosystem development, even as price action remains range-bound. Meanwhile, select altcoins and meme tokens are seeing short-term rotations, reflecting speculative interest rather than broad market momentum.

Market sentiment: Cautious but

MC:$3.58KHolders:1

0.00%

- Reward

- 1

- Comment

- Repost

- Share

Cryptocurrency is all the rage at the moment as people keep minting lots and lots of cash just by sitting in front of their computers and making a number of clicks and strokes. Bitcoins is the most common cryptocurrency but you should know that there are a number of other cryptocurrencies out there that are similar but differentiated in a few ways. It is more like the android operating system when compared to windows operating system. They are different but have some similar properties but both do a great job.

As we speak, cryptocurrency has come of age as it is now not just being used to purc

As we speak, cryptocurrency has come of age as it is now not just being used to purc

- Reward

- 1

- 2

- Repost

- Share

SEEDALTAR :

:

2026 GOGOGO 👊View More

meaning that it is not approved by any government as a legal tender.

The big question is how sure can we be that this is something that is going to hold and not just another scheme that has been designed to rob people off their hard earned cash. Another question about digital currency is how sure can we be that this is not going to fail as we saw some time back with egold. However, it is important to note that egold failed as the real owner of egold could not be verified but Bitcoin took care of this problem.

$BTC $ETH $SOL

The big question is how sure can we be that this is something that is going to hold and not just another scheme that has been designed to rob people off their hard earned cash. Another question about digital currency is how sure can we be that this is not going to fail as we saw some time back with egold. However, it is important to note that egold failed as the real owner of egold could not be verified but Bitcoin took care of this problem.

$BTC $ETH $SOL

- Reward

- 1

- Comment

- Repost

- Share

The Big Question

If you are still toddling in the internet, you are probably wondering what the rave surrounding digital currency is. In the first place you may not even know what this is or how it works. So to start with we are going to look at a few definitions.

Digital currency - this is a medium of exchange that is purely electronically based.

Cryptocurrency this is basically digital currency with a twist. It has a security feature that uses cryptography to protect it from being counterfeited.

There is one major difference between virtual money and paper money that you should be aware of;

If you are still toddling in the internet, you are probably wondering what the rave surrounding digital currency is. In the first place you may not even know what this is or how it works. So to start with we are going to look at a few definitions.

Digital currency - this is a medium of exchange that is purely electronically based.

Cryptocurrency this is basically digital currency with a twist. It has a security feature that uses cryptography to protect it from being counterfeited.

There is one major difference between virtual money and paper money that you should be aware of;

- Reward

- 1

- Comment

- Repost

- Share

The Bitcoin Power Law is a model by Giovanni Santostasi that aims to show the price of Bitcoin over time based on its historical growth pattern. The core of the Bitcoin Power Law is expressed algebraically as:

Estimated Price = A * (days from GB)^n

Where:

"GB" stands for the Genesis Block of Bitcoin, mined on January 3, 2009

"A" is a constant (10^-16.493)

"n" is 5.68

There is no guarantee that the pattern will continue, invest at your own risk.#2025GateYearEndSummary $BTC

Estimated Price = A * (days from GB)^n

Where:

"GB" stands for the Genesis Block of Bitcoin, mined on January 3, 2009

"A" is a constant (10^-16.493)

"n" is 5.68

There is no guarantee that the pattern will continue, invest at your own risk.#2025GateYearEndSummary $BTC

BTC-0,61%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

The model has historically tracked closely with actual price movements and suggests potential long-term targets. For example, it predicted Bitcoin would approach $100,000 before January 2025 and forecasts a potential cycle peak of around $210,000 in January 2026.$BTC $GT $ETH

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

The Power Law Explained

The Bitcoin Power Law model uses logarithmic regression on historical price data to establish a long-term trend line, along with upper and lower price bands (resistance and support lines).

Formula: The model is often represented by the formula: Price = A × (days from Genesis Block)^5.8, where 5.8 is the specific growth exponent.

Mechanism: It operates on the principle of network effects, such as Metcalfe's Law (value increases with the square of users), and the feedback loop between higher prices and increased mining security.$BTC #2025GateYearEndSummary #CryptoMarke

The Bitcoin Power Law model uses logarithmic regression on historical price data to establish a long-term trend line, along with upper and lower price bands (resistance and support lines).

Formula: The model is often represented by the formula: Price = A × (days from Genesis Block)^5.8, where 5.8 is the specific growth exponent.

Mechanism: It operates on the principle of network effects, such as Metcalfe's Law (value increases with the square of users), and the feedback loop between higher prices and increased mining security.$BTC #2025GateYearEndSummary #CryptoMarke

BTC-0,61%

- Reward

- 2

- Comment

- Repost

- Share

Bitcoin's current price is approximately $88,204.42 USD. The "power law" for BTC is a mathematical model that suggests its price follows a predictable, long-term growth pattern, treating it more like a natural phenomenon than a traditional financial asset. $BTC #2025GateYearEndSummary

#CryptoMarketMildlyRebounds

#GateChristmasVibes

#CryptoMarketMildlyRebounds

#GateChristmasVibes

BTC-0,61%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

#btc Market sentiment remains cautious — the fear index is elevated, and technical patterns suggest a potential breakout toward ~$94,000 if BTC flips key resistance.

A recent flash dip to $24,000 on one exchange’s pair was a localized glitch, not the actual market price — BTC quickly returned to its ~$87K range across major platforms. #CryptoMarketMildlyRebounds

$BTC 🤔

A recent flash dip to $24,000 on one exchange’s pair was a localized glitch, not the actual market price — BTC quickly returned to its ~$87K range across major platforms. #CryptoMarketMildlyRebounds

$BTC 🤔

BTC-0,61%

- Reward

- 1

- Comment

- Repost

- Share

$BTC Bitcoin is trading around ~$87,000–$88,000 USD, slightly down in the last 24 hrs as markets stay quiet late in the year.

BTC continues to trade below the key $90,000 resistance level with range-bound movement typical of end-of-year liquidity.

#2025GateYearEndSummary

#CryptoMarketMildlyRebounds

#GateChristmasVibes

BTC continues to trade below the key $90,000 resistance level with range-bound movement typical of end-of-year liquidity.

#2025GateYearEndSummary

#CryptoMarketMildlyRebounds

#GateChristmasVibes

BTC-0,61%

- Reward

- 1

- Comment

- Repost

- Share

Technical Outlook:

BTC is in a critical zone where bulls and bears are battling for control near the late-year pivot point. A strong breakout above resistance could kickstart renewed momentum.

TradingView is holding its ground near ~$89K–$90K, with range-bound trading and cautious sentiment as markets digest macro catalysts and holiday liquidity dynamics.#2025GateYearEndSummary

BTC is in a critical zone where bulls and bears are battling for control near the late-year pivot point. A strong breakout above resistance could kickstart renewed momentum.

TradingView is holding its ground near ~$89K–$90K, with range-bound trading and cautious sentiment as markets digest macro catalysts and holiday liquidity dynamics.#2025GateYearEndSummary

BTC-0,61%

- Reward

- 2

- 1

- Repost

- Share

muhengi :

:

HODL Tight 💪Trending Topics

View More18.6K Popularity

7.81K Popularity

3.38K Popularity

35.36K Popularity

250.09K Popularity

Pin