MarketMaestro

No content yet

MarketMaestro

$RDW

I was expecting this pullback, but I wasn’t expecting it to get this deep. When the market mood shifted from growth stocks to value stocks, the selloff intensified. Why? Because in this kind of environment, if the market doesn’t believe in the story for these cash burning names, it shows no mercy. This is a moonshot stock. It requires time, patience, and conviction

I was expecting this pullback, but I wasn’t expecting it to get this deep. When the market mood shifted from growth stocks to value stocks, the selloff intensified. Why? Because in this kind of environment, if the market doesn’t believe in the story for these cash burning names, it shows no mercy. This is a moonshot stock. It requires time, patience, and conviction

- Reward

- like

- Comment

- Repost

- Share

$MOVE

The anxiety isn’t in the $VIX. It’s in the MOVE. The bond vigilantes seem like they don’t want the Fed to cut rates. But if rates aren’t cut on time, the economy could slip into deflation. While the bond vigilantes are trying to keep the Fed’s hand cold, they’re ignoring the risk of pushing the economy into a deflation pit. And deflation is not a good thing at all. The vigilantes’ hawkish stance right now contradicts the fundamentals of the economy. Ignoring the disinflation process isn’t cooling the engine, it’s breaking it. If any vigilantes are reading this message, I’d love to give t

The anxiety isn’t in the $VIX. It’s in the MOVE. The bond vigilantes seem like they don’t want the Fed to cut rates. But if rates aren’t cut on time, the economy could slip into deflation. While the bond vigilantes are trying to keep the Fed’s hand cold, they’re ignoring the risk of pushing the economy into a deflation pit. And deflation is not a good thing at all. The vigilantes’ hawkish stance right now contradicts the fundamentals of the economy. Ignoring the disinflation process isn’t cooling the engine, it’s breaking it. If any vigilantes are reading this message, I’d love to give t

- Reward

- like

- Comment

- Repost

- Share

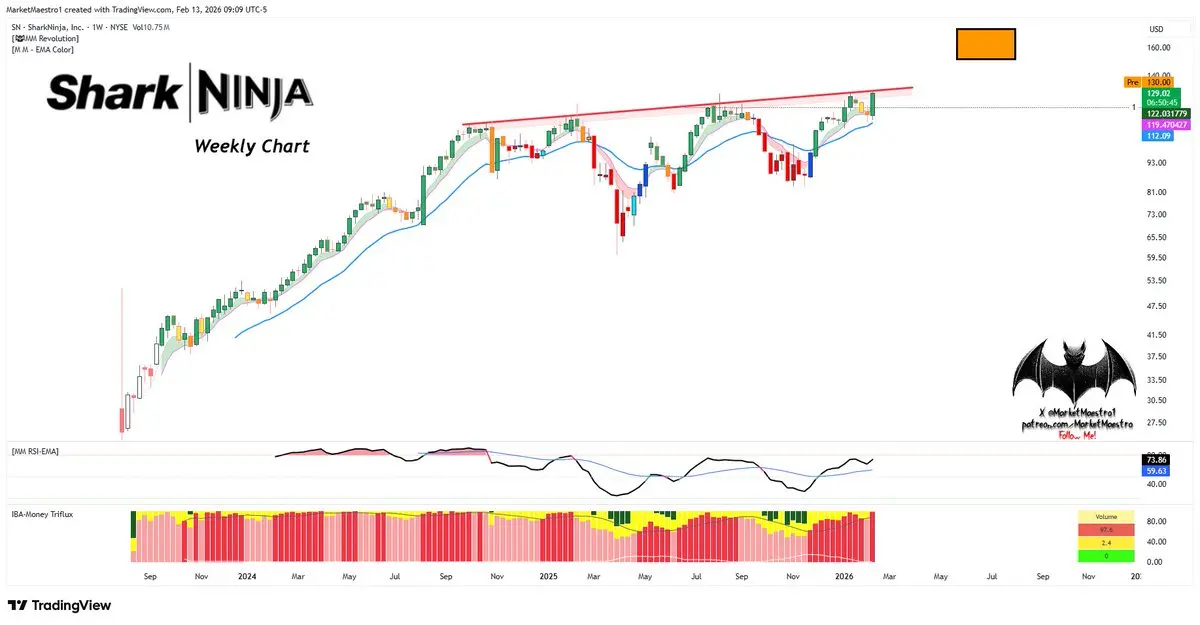

$SN

Such a hard to find setup in an environment like this!

Its financial growth is very strong. Based on the financials, this should still be ripping higher

Such a hard to find setup in an environment like this!

Its financial growth is very strong. Based on the financials, this should still be ripping higher

- Reward

- 1

- Comment

- Repost

- Share

There is no inflation in America! I’ve been trying to explain since I started writing here that the U.S. has entered a disinflation process. The market didn’t really take it positively, but…

- Reward

- like

- Comment

- Repost

- Share

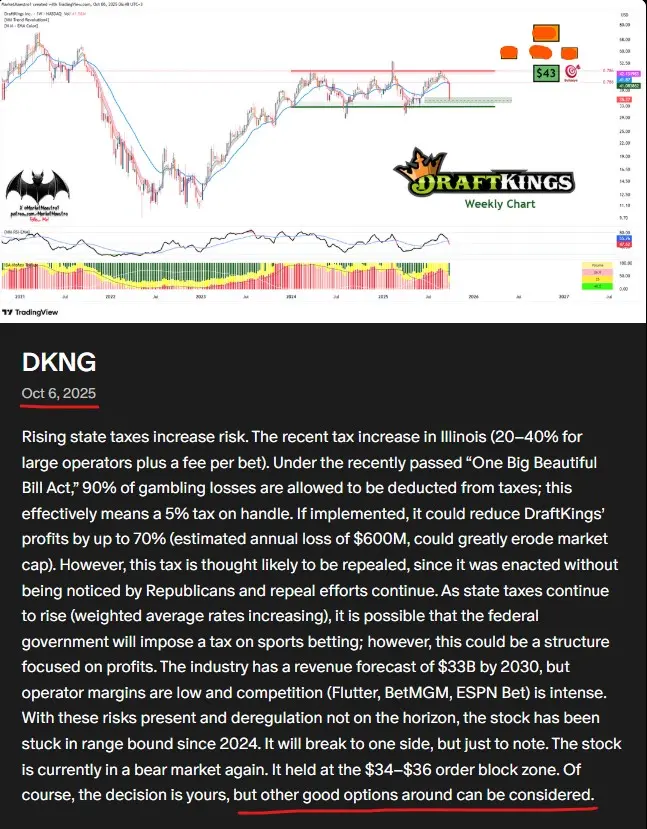

$DKNG 👇❗️

View Original

- Reward

- like

- Comment

- Repost

- Share

$BGC

it did a neckline retest, then it also broke the red diagonal resistance and got stuck at the $9.60 fibo61 resistance. The monthly setup looks good

it did a neckline retest, then it also broke the red diagonal resistance and got stuck at the $9.60 fibo61 resistance. The monthly setup looks good

- Reward

- like

- Comment

- Repost

- Share

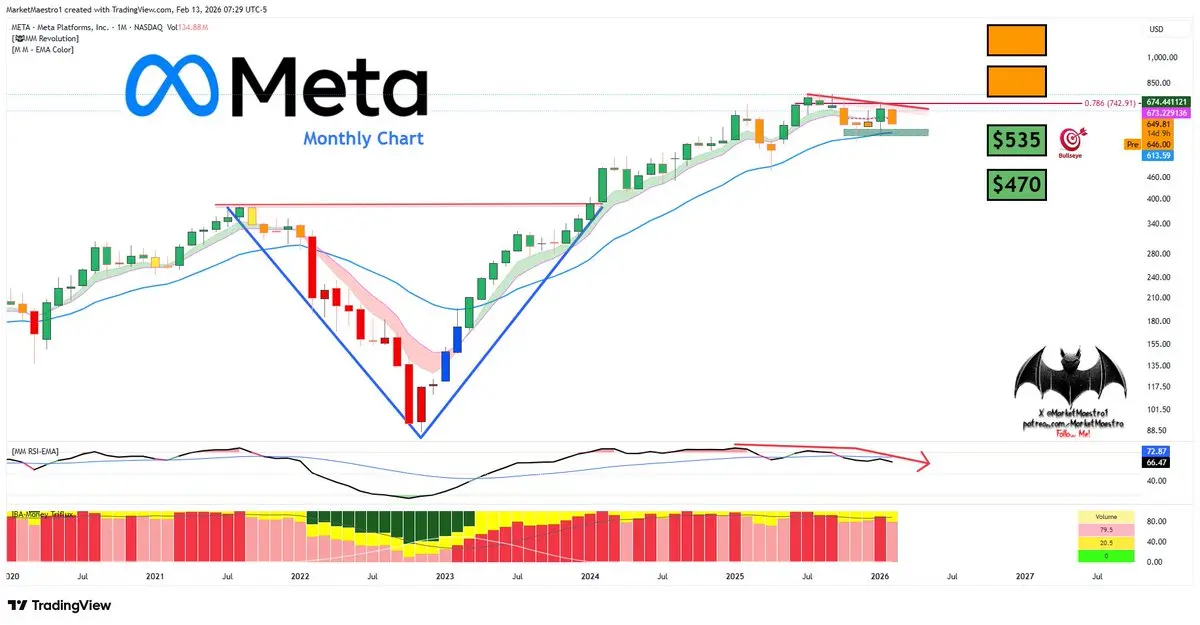

$META

It couldn’t clear $742-fibo78. That created a possible distribution setup risk. In 2021 the issue was fear of excessive CapEx spending. This time there isn’t the same fear because ad revenue is increasing; in 2021 it was seen as burying money in the grave.

At first, I think it will form a triangle like consolidation. But after the fibo78 rejection, I also can’t ignore the double top distribution pattern that’s showing up

It couldn’t clear $742-fibo78. That created a possible distribution setup risk. In 2021 the issue was fear of excessive CapEx spending. This time there isn’t the same fear because ad revenue is increasing; in 2021 it was seen as burying money in the grave.

At first, I think it will form a triangle like consolidation. But after the fibo78 rejection, I also can’t ignore the double top distribution pattern that’s showing up

- Reward

- like

- Comment

- Repost

- Share

$ANET

ANET Q4 2025 Financial Results and 2026 Outlook

Big picture: strong finish, more aggressive 2026 Arista Networks closed 2025 with a strong beat and shifted its 2026 message to a higher pace. In Q4 2025, the company reported $2.49B in revenue (+29% YoY) and $0.82 in Non-GAAP EPS. Combined with full-year 2025 growth of 28.6% and record revenue of $9B, this wasn’t just a strong quarter, it signals Arista is riding an expanding demand cycle.

2026 outlook: higher growth target, bar set at $11.25B Management translated confidence into numbers by raising its 2026 revenue growth target to 25% an

ANET Q4 2025 Financial Results and 2026 Outlook

Big picture: strong finish, more aggressive 2026 Arista Networks closed 2025 with a strong beat and shifted its 2026 message to a higher pace. In Q4 2025, the company reported $2.49B in revenue (+29% YoY) and $0.82 in Non-GAAP EPS. Combined with full-year 2025 growth of 28.6% and record revenue of $9B, this wasn’t just a strong quarter, it signals Arista is riding an expanding demand cycle.

2026 outlook: higher growth target, bar set at $11.25B Management translated confidence into numbers by raising its 2026 revenue growth target to 25% an

- Reward

- like

- Comment

- Repost

- Share

$ALAB

VWAP, EMA50, and BoS all broke key supports. The index is also below EMA21. Today’s CPI print is very important. Because if it can’t recover, the target becomes green zone. ALAB is like this: sharp corrections and sharp rallies

VWAP, EMA50, and BoS all broke key supports. The index is also below EMA21. Today’s CPI print is very important. Because if it can’t recover, the target becomes green zone. ALAB is like this: sharp corrections and sharp rallies

- Reward

- like

- Comment

- Repost

- Share

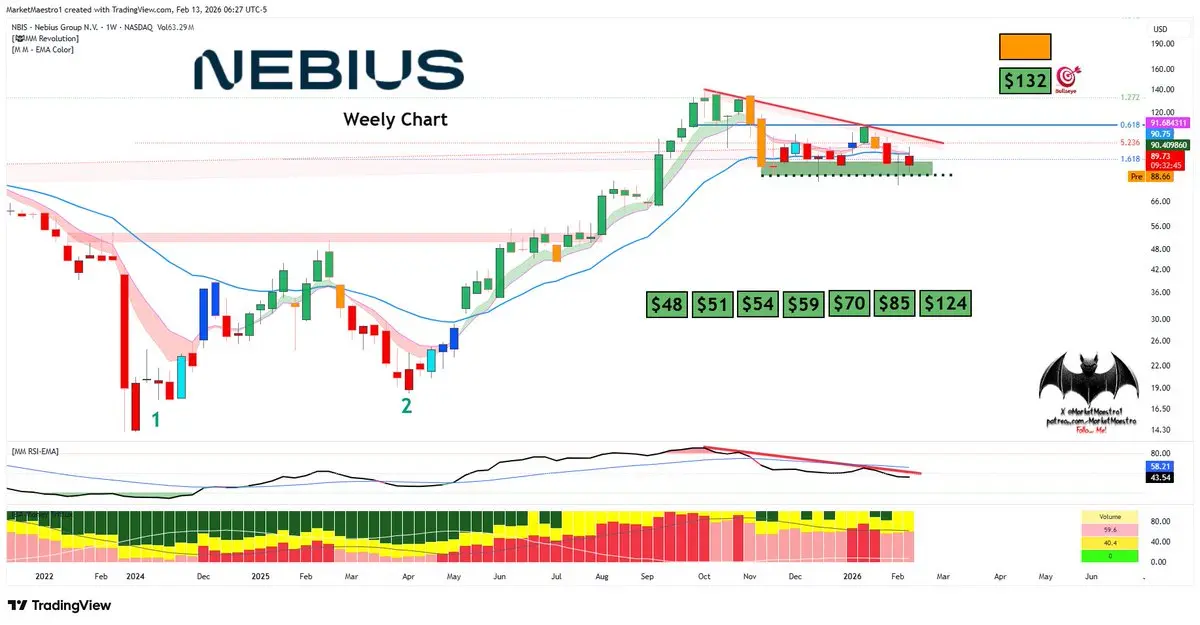

$NBIS

Nebius Group generated $227.7M in revenue in the final quarter of 2025, up 547% year over year, but it came in below the market expectation of $242.79M and the shares fell 3%. The company’s net loss widened versus the same quarter last year to $173M; however, Annual Recurring Revenue (ARR) came in at $1.25B, above the company’s own guidance. Management is maintaining its aggressive growth stance by targeting $7–$9B ARR and $3–$3.4B in revenue by the end of 2026. The company emphasized that its current GPU capacity is fully sold out for 2H 2025 and Q1 2026, with no slowdown in demand. It

Nebius Group generated $227.7M in revenue in the final quarter of 2025, up 547% year over year, but it came in below the market expectation of $242.79M and the shares fell 3%. The company’s net loss widened versus the same quarter last year to $173M; however, Annual Recurring Revenue (ARR) came in at $1.25B, above the company’s own guidance. Management is maintaining its aggressive growth stance by targeting $7–$9B ARR and $3–$3.4B in revenue by the end of 2026. The company emphasized that its current GPU capacity is fully sold out for 2H 2025 and Q1 2026, with no slowdown in demand. It

- Reward

- like

- Comment

- Repost

- Share

$SPY

OI-based Net Gamma Exposure: negative

Volume-based Net Gamma Exposure: clearly negative

Directionalized Volume: negative

This combination means a negative gamma regime. In a negative gamma regime, Market Makers are forced to trade in the direction of the price move. If the market falls, dealers SELL to hedge and accelerate the drop. If the market rises, dealers BUY to hedge, creating a squeeze.

There is a massive pile-up at the 680 strike level. We are currently at 681.06, meaning we are right on top of this big wall. The heavy open interest at this level acts like a magnet that pulls pri

OI-based Net Gamma Exposure: negative

Volume-based Net Gamma Exposure: clearly negative

Directionalized Volume: negative

This combination means a negative gamma regime. In a negative gamma regime, Market Makers are forced to trade in the direction of the price move. If the market falls, dealers SELL to hedge and accelerate the drop. If the market rises, dealers BUY to hedge, creating a squeeze.

There is a massive pile-up at the 680 strike level. We are currently at 681.06, meaning we are right on top of this big wall. The heavy open interest at this level acts like a magnet that pulls pri

- Reward

- like

- Comment

- Repost

- Share

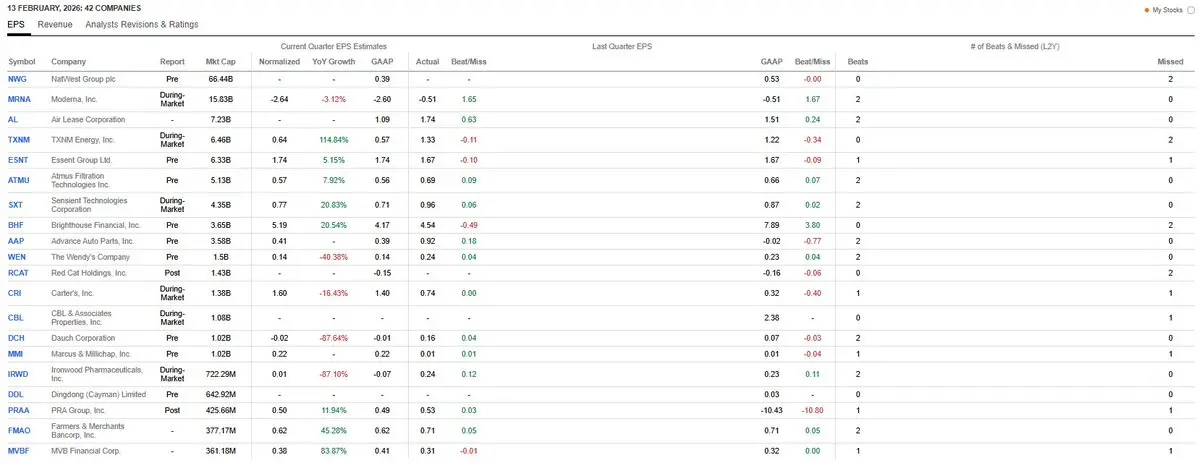

Today's ERs

$RCAT

$RCAT

- Reward

- like

- Comment

- Repost

- Share

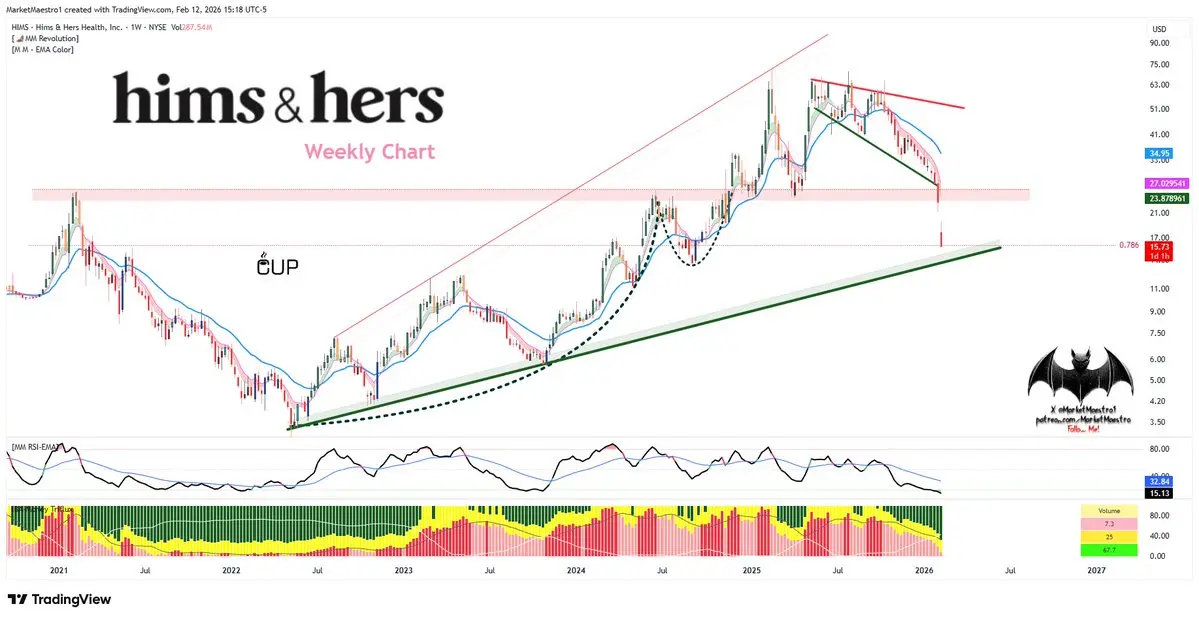

$HIMS

The wind has turned against HIMS. Compounded GLP-1 products, which sit at the center of the company’s growth story, are no longer just a gray-area debate, they are now facing a concrete regulatory barrier. Especially with the FDA hardening its tone and bringing the Department of Justice (DoJ) into the process, the risk parameters have completely changed.

Novo Nordisk’s legal moves, and especially the fact that oral formulations are being treated as a red line, have increased the pressure on the company. The fact that HIMS had to stop oral GLP-1 sales is also operational proof of this pre

The wind has turned against HIMS. Compounded GLP-1 products, which sit at the center of the company’s growth story, are no longer just a gray-area debate, they are now facing a concrete regulatory barrier. Especially with the FDA hardening its tone and bringing the Department of Justice (DoJ) into the process, the risk parameters have completely changed.

Novo Nordisk’s legal moves, and especially the fact that oral formulations are being treated as a red line, have increased the pressure on the company. The fact that HIMS had to stop oral GLP-1 sales is also operational proof of this pre

- Reward

- like

- Comment

- Repost

- Share

$VNQ

It broke the red diagonal resistance 💥 It got stuck at fibo88. It looks extremely bullish.

It broke the red diagonal resistance 💥 It got stuck at fibo88. It looks extremely bullish.

- Reward

- like

- Comment

- Repost

- Share

$VZ

BULL's EYE! 🎯

It broke the neckline very strongly. got stuck at fibo127

VZ beat expectations on both revenue and EPS in Q4. The new CEO’s cost-saving measures and growth strategies worked; the company posted its biggest mobile and broadband subscriber gains in the past six years. Management announced a massive $25B share buyback program that pleased investors. For 2026, the company guides for 4%–5% EPS growth and 7% free cash flow growth. While the Frontier acquisition increases total debt, Verizon continues to have the lowest leverage ratio in the industry

BULL's EYE! 🎯

It broke the neckline very strongly. got stuck at fibo127

VZ beat expectations on both revenue and EPS in Q4. The new CEO’s cost-saving measures and growth strategies worked; the company posted its biggest mobile and broadband subscriber gains in the past six years. Management announced a massive $25B share buyback program that pleased investors. For 2026, the company guides for 4%–5% EPS growth and 7% free cash flow growth. While the Frontier acquisition increases total debt, Verizon continues to have the lowest leverage ratio in the industry

- Reward

- like

- Comment

- Repost

- Share

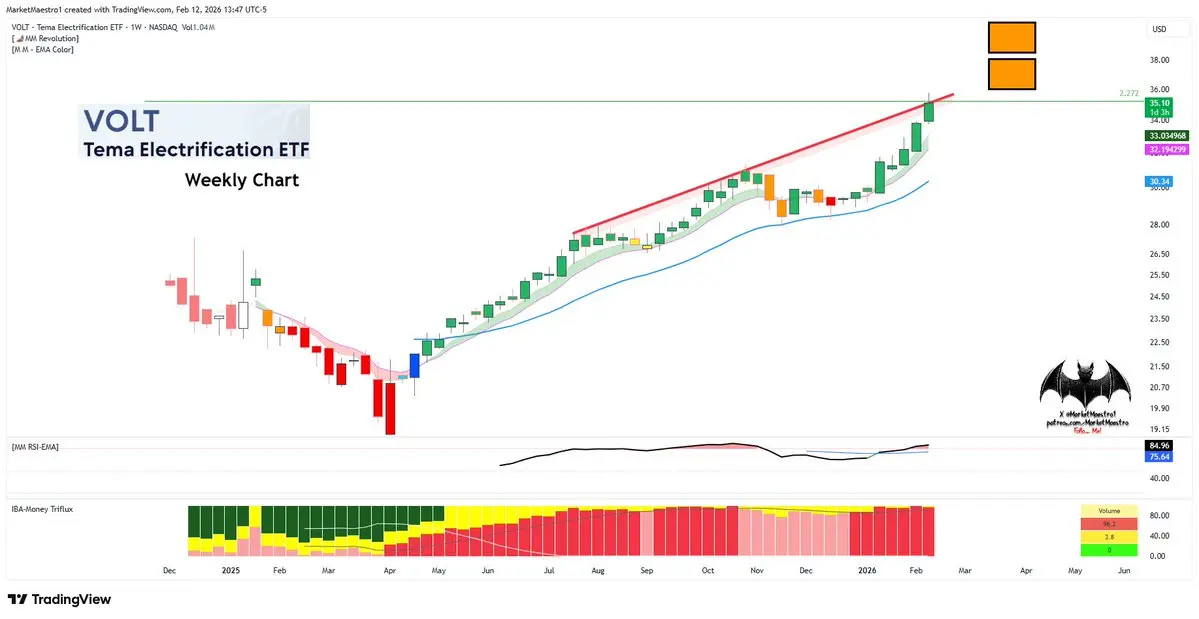

$VOLT

The ETF’s holdings align with Trump policies. From a technical perspective, the chart is also signaling a steep uptrend is possible

Industrials – 35%–40% Weight

These companies generally focus on electric infrastructure, power management, and grid construction.

$POWL: Produces equipment for electricity distribution and control.

$PWR: Provides infrastructure and construction engineering services for electric grids. HUBB: Manufactures electrical and electronic products/components.

$GEV: A spin-off from General Electric, a giant focused on energy generation (turbines, wind) and electrif

The ETF’s holdings align with Trump policies. From a technical perspective, the chart is also signaling a steep uptrend is possible

Industrials – 35%–40% Weight

These companies generally focus on electric infrastructure, power management, and grid construction.

$POWL: Produces equipment for electricity distribution and control.

$PWR: Provides infrastructure and construction engineering services for electric grids. HUBB: Manufactures electrical and electronic products/components.

$GEV: A spin-off from General Electric, a giant focused on energy generation (turbines, wind) and electrif

VOLT7,16%

- Reward

- like

- 4

- Repost

- Share

GateUser-c886be29 :

:

Ape In 🚀View More

$XLU might change its long standing bad luck dating back to 1999 this year. The ETF’s biggest weight is $NEE, and is extremely bullish

- Reward

- like

- Comment

- Repost

- Share

$AMZN ’s setup has now become risky ❗️ On the 3 month, monthly, and weekly timeframes, the charts have all broken down. This technical setup is a rising wedge. If it breaks down, the picture can deteriorate further

- Reward

- like

- Comment

- Repost

- Share

$TE

For now, the first target looks like support band. If it drops into that area, it still has room to correct further, so the index situation is very critical. If we can see a reversal in the index, the first zone could be enough, but if selling continues in the index, second band comes into play

For now, the first target looks like support band. If it drops into that area, it still has room to correct further, so the index situation is very critical. If we can see a reversal in the index, the first zone could be enough, but if selling continues in the index, second band comes into play

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More53.82K Popularity

74.82K Popularity

18.86K Popularity

44.83K Popularity

254.62K Popularity

Pin