DanielRomero

No content yet

DanielRomero

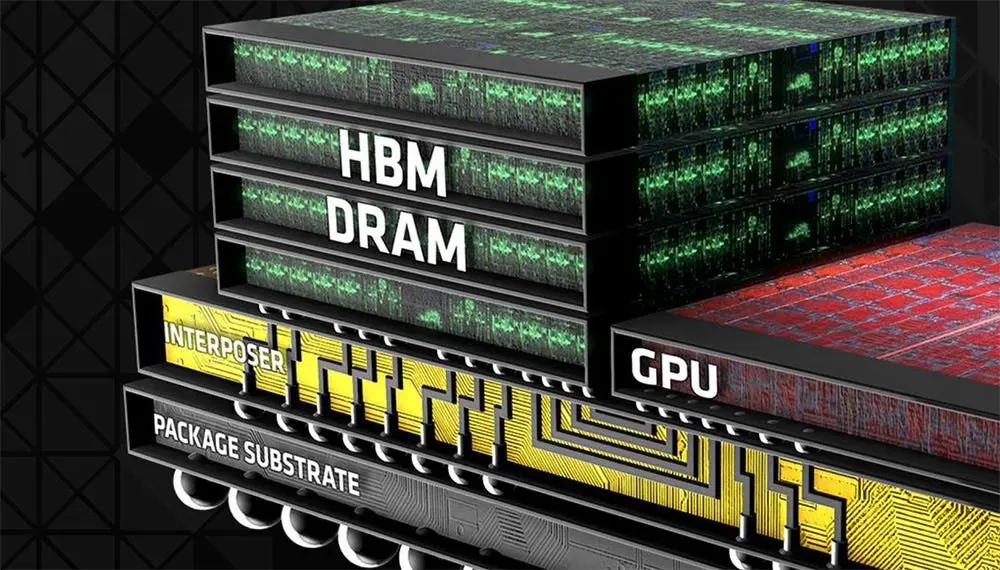

DRAM & NAND Shortages Will Extend Beyond 2030, Warns Phison CEO

$MU $000660 $005930

Sellers are currently demanding a 3-year prepaid payment for capacity

Internal estimates from foundries suggest shortages will persist until 2030, or even potentially for a decade, with no end in sight

$MU $000660 $005930

Sellers are currently demanding a 3-year prepaid payment for capacity

Internal estimates from foundries suggest shortages will persist until 2030, or even potentially for a decade, with no end in sight

- Reward

- like

- Comment

- Repost

- Share

It’s the year 2040

DDR9 RAM costs $50,000 for a 64GB kit

$MU trades at a $10,000 share price after a 100-to-1 split

AI has taken all jobs. The only way to make money is wagering on what price $NVDA shares will be in 5 minutes

$TSLA Unsupervised FSD is only 6 months away

Life is good

DDR9 RAM costs $50,000 for a 64GB kit

$MU trades at a $10,000 share price after a 100-to-1 split

AI has taken all jobs. The only way to make money is wagering on what price $NVDA shares will be in 5 minutes

$TSLA Unsupervised FSD is only 6 months away

Life is good

- Reward

- 1

- Comment

- Repost

- Share

If your thesis requires a complicated and uncertain business model shift for the stock to be attractive, it’s not a buy

- Reward

- like

- Comment

- Repost

- Share

MI355X has a lower cost per million tokens than the B200 at high throughput

Considering it’s an apples-to-apples comparison(8-GPU node) it’s quite reassuring for $AMD

Considering it’s an apples-to-apples comparison(8-GPU node) it’s quite reassuring for $AMD

- Reward

- like

- Comment

- Repost

- Share

Bullish note on $NBIS by SemiAnalysis:

When server prices rise this sharply, Neoclouds’ project economics change considerably. Proposed GPU deployments that once cleared IRR hurdle rates become unattractive, leading Neoclouds to walk away from deals and starving the market of compute.

Uncertainty around final system costs makes forward planning difficult. Lead times also continue to lengthen, not only for servers but for networking equipment as well, as strong demand drives component tightness.

Procuring compute was already difficult given strong demand to rent GPUs, and the AI Server Pricing

When server prices rise this sharply, Neoclouds’ project economics change considerably. Proposed GPU deployments that once cleared IRR hurdle rates become unattractive, leading Neoclouds to walk away from deals and starving the market of compute.

Uncertainty around final system costs makes forward planning difficult. Lead times also continue to lengthen, not only for servers but for networking equipment as well, as strong demand drives component tightness.

Procuring compute was already difficult given strong demand to rent GPUs, and the AI Server Pricing

- Reward

- like

- Comment

- Repost

- Share

The White House just released America’s Maritime Action Plan

The plan says the U.S. now builds less than 1% of new commercial ships globally

Recommended policies:

• Establish a new grant program to fund projects that increase the capacity and efficiency of U.S. shipyards

• Establish a universal fee on foreign built vessels from any nation entering U.S. ports

• Allow shipyards to establish tax deferred accounts to reinvest earnings into infrastructure improvements, new equipment, or debt repayment

• Provide shipyards with access to long term financing for large scale capital projects

• Require

The plan says the U.S. now builds less than 1% of new commercial ships globally

Recommended policies:

• Establish a new grant program to fund projects that increase the capacity and efficiency of U.S. shipyards

• Establish a universal fee on foreign built vessels from any nation entering U.S. ports

• Allow shipyards to establish tax deferred accounts to reinvest earnings into infrastructure improvements, new equipment, or debt repayment

• Provide shipyards with access to long term financing for large scale capital projects

• Require

- Reward

- 1

- Comment

- Repost

- Share

$AMD to deploy 200MW of its Helios rack-scale AI architecture in India

Tata Consultancy Services, through its subsidiary HyperVault AI Data Center, and $AMD will co-develop a rack-scale design based on the Helios platform to support India’s national AI initiatives

Tata Consultancy Services, through its subsidiary HyperVault AI Data Center, and $AMD will co-develop a rack-scale design based on the Helios platform to support India’s national AI initiatives

- Reward

- like

- Comment

- Repost

- Share

$NBIS is now up only 318% since my deep dive

I need to step up my game

I need to step up my game

- Reward

- like

- Comment

- Repost

- Share

Elon Musk is calling for 100 GW of domestic solar manufacturing

$MWH is one of the largest solar constructors in the US and just went public, now trading at a $6.5B market cap

Snapshot from 2025

- Revenue growth: up 21% YoY

- Net profit: $100M, up 60% YoY

- Cash: $243M

- Debt: $30M

$MWH is one of the largest solar constructors in the US and just went public, now trading at a $6.5B market cap

Snapshot from 2025

- Revenue growth: up 21% YoY

- Net profit: $100M, up 60% YoY

- Cash: $243M

- Debt: $30M

- Reward

- like

- Comment

- Repost

- Share

Copper could enter a supercycle

The time from discovery to production has increased from 12 years to 18 years over the past 20 years

All while demand is skyrocketing due to AI

The time from discovery to production has increased from 12 years to 18 years over the past 20 years

All while demand is skyrocketing due to AI

- Reward

- like

- Comment

- Repost

- Share

$ARR owns the largest rare earth deposit in the US, with a non-binding letter of interest from EXIM for a $456M loan, at a $170M market cap

- Reward

- 1

- Comment

- Repost

- Share

$AMD hits record CPU market share, according to Mercury Research

- Desktop unit share: 36.4%

- Server unit share: 28.8%

- Mobile unit share: 26.0%

- Desktop revenue share: 42.6%

- Server revenue share: 41.3%

Q4 was the strongest quarter in the company’s history for CPUs

- Desktop unit share: 36.4%

- Server unit share: 28.8%

- Mobile unit share: 26.0%

- Desktop revenue share: 42.6%

- Server revenue share: 41.3%

Q4 was the strongest quarter in the company’s history for CPUs

- Reward

- 2

- Comment

- Repost

- Share

$ANET says $AMD is taking market share from $NVDA

“A year ago, deployments were almost entirely $NVDA, around 99%. Today, about 20% to 25% of our deployments use $AMD.”

“A year ago, deployments were almost entirely $NVDA, around 99%. Today, about 20% to 25% of our deployments use $AMD.”

- Reward

- like

- Comment

- Repost

- Share

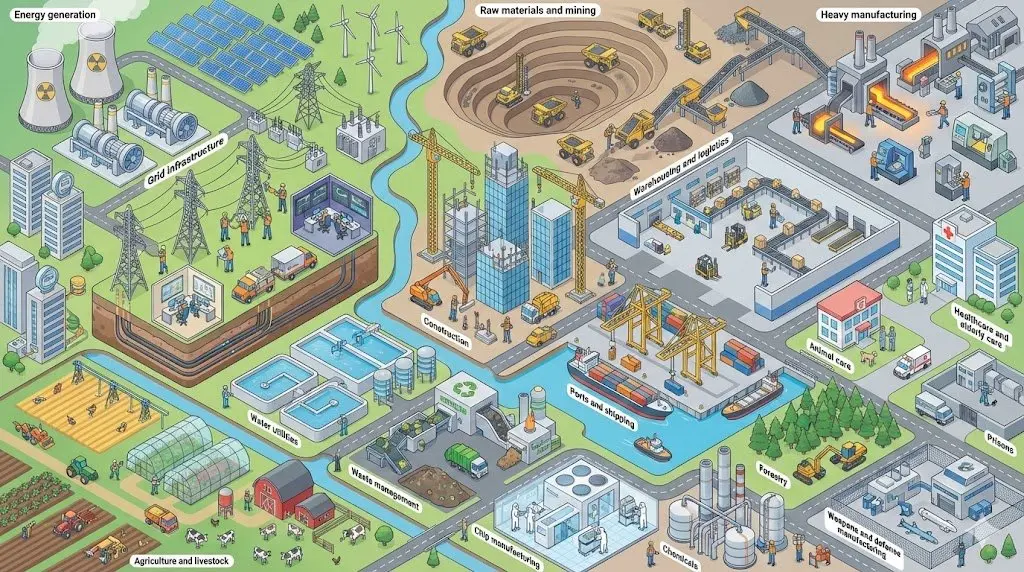

Atoms > Bits

- Reward

- like

- Comment

- Repost

- Share

Industries AI won’t replace:

• Energy generation

• Grid infrastructure

• Raw materials

• Heavy manufacturing

• Construction

• Warehousing

• Ports and shipping

• Agriculture

• Water utilities

• Waste management

• Chip manufacturing

• Weapons manufacturing

• Chemicals

• Forestry

• Livestock farming

• Prisons

• Animal care

• Elderly care

• Healthcare

• Energy generation

• Grid infrastructure

• Raw materials

• Heavy manufacturing

• Construction

• Warehousing

• Ports and shipping

• Agriculture

• Water utilities

• Waste management

• Chip manufacturing

• Weapons manufacturing

• Chemicals

• Forestry

• Livestock farming

• Prisons

• Animal care

• Elderly care

• Healthcare

- Reward

- like

- Comment

- Repost

- Share

FinX is in shambles

- Reward

- like

- Comment

- Repost

- Share