Bugsbunnygg

No content yet

Bugsbunnygg

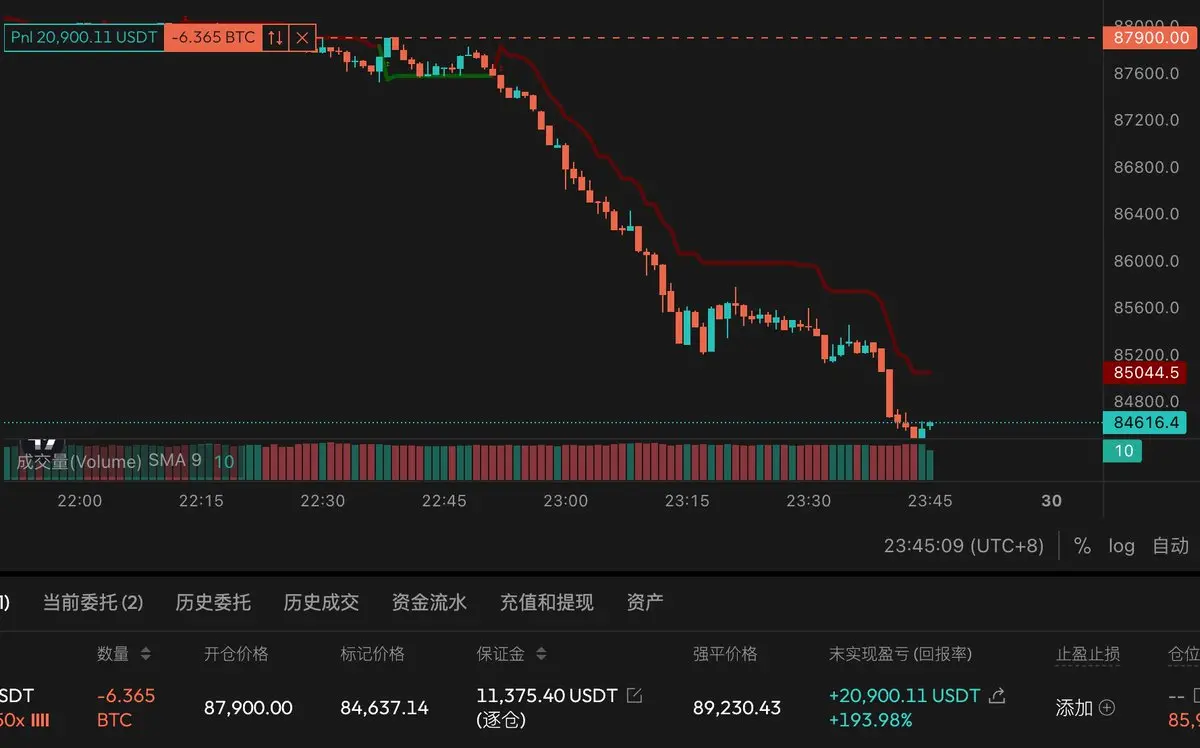

Very important reminder: Leveraged positions to buy the dip before a major crash are extremely risky. The liquidation of scam contracts often ends with blowing up almost all opposing orders.

View Original- Reward

- like

- Comment

- Repost

- Share

Prevention methods: 1. Do not open contracts to buy the dip 2. Turn off full position mode 3. Spot buy the dip

View Original- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Entering a bullish liquidation phase means that all large holders' positions in the market will become targets, similar to what was seen with Luna before. Institutional investors often watch these situations closely. Be cautious of risks associated with leveraged lending projects.

LUNA-11,74%

- Reward

- like

- Comment

- Repost

- Share

I'm wondering if some idiot sovereign funds/pension funds are leveraging to chase higher gold and silver 😂 and dropping so much.

View Original- Reward

- like

- Comment

- Repost

- Share

When the market knows where your risk points are, that is the most dangerous moment. It reveals your position and can lead to significant losses. Therefore, understanding and managing your risk exposure is crucial to avoid being caught off guard when others are aware of your vulnerabilities.

View Original- Reward

- like

- Comment

- Repost

- Share

After the market opens, VIX remains high, the fundamentals of gold stay unchanged, silver faces liquidation risk, and Bitcoin maintains a primarily defensive stance.

BTC-9,75%

- Reward

- like

- Comment

- Repost

- Share

The competition deadline has passed, and my short position is starting to make huge profits XD I'm so anxious @Aster_DEX @Ccweb3hub

View Original

- Reward

- like

- Comment

- Repost

- Share

In the current market environment, the accumulation of existing assets will be the main focus.

Just like the broader strategy of RMB internationalization, the premise remains the internal circulation of existing stock.

Just like the broader strategy of RMB internationalization, the premise remains the internal circulation of existing stock.

BNB-10,68%

- Reward

- like

- Comment

- Repost

- Share

Major Event — Nordic Pension Funds Sell Off U.S. Treasuries

They are trillion-dollar funds

This will have a significant impact on U.S. Treasuries.

Gold will have a new growth point again

View OriginalThey are trillion-dollar funds

This will have a significant impact on U.S. Treasuries.

Gold will have a new growth point again

- Reward

- like

- Comment

- Repost

- Share

Talking about gold with institutional friends at the beginning of the month

He said gold will reach 5000 in 26 years

Now it's at 4800

View OriginalHe said gold will reach 5000 in 26 years

Now it's at 4800

- Reward

- like

- Comment

- Repost

- Share

Wow, gold has reached 4750.

View Original- Reward

- like

- Comment

- Repost

- Share

Since Trump took office, insider trading has really increased.

View Original- Reward

- like

- Comment

- Repost

- Share

The sensitivity of crypto assets will be directly reflected in the upward movement of VIX.

View Original- Reward

- like

- Comment

- Repost

- Share

Huo Yun Evil God has also left

We are saying goodbye to childhood one by one

View OriginalWe are saying goodbye to childhood one by one

- Reward

- like

- Comment

- Repost

- Share

In 2026, I saw the Marala train again.

View Original

- Reward

- like

- Comment

- Repost

- Share

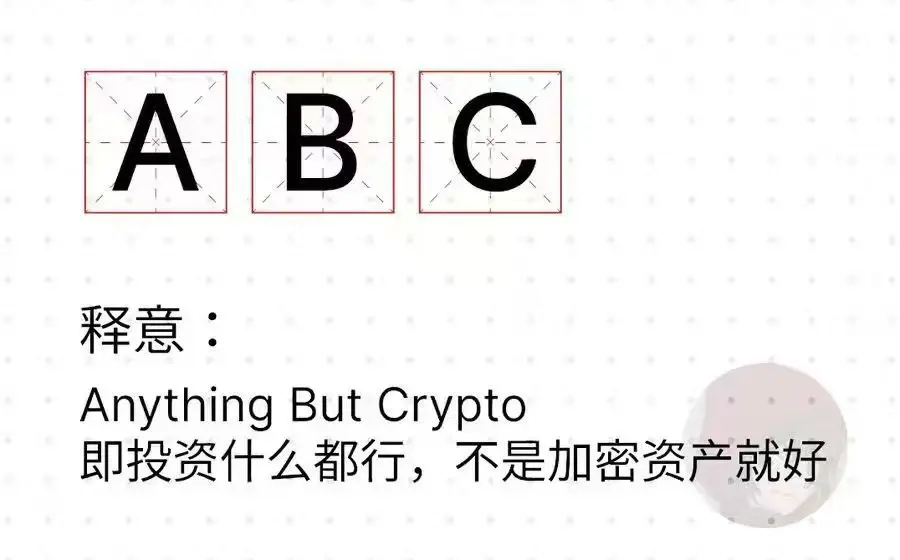

ABC

Meaning:

AnythingButCrypto

Invest in anything you like, as long as it's not a crypto asset

XD

View OriginalMeaning:

AnythingButCrypto

Invest in anything you like, as long as it's not a crypto asset

XD

- Reward

- like

- Comment

- Repost

- Share

VIX clearly surged after the opening; pay attention to the specific situation of the 11 o'clock tariff ruling.

View Original

- Reward

- like

- Comment

- Repost

- Share