# BItcoin

6.62M

BasheerAlgundubi

#Bitwise , the issuer of (#ETFs ) exchange-traded funds, confirmed that a meeting was held with a central bank to discuss the purchase of Bitcoin (#BTC ).

Matt Hogan, CEO of Bitwise, announced his meeting with a central bank to discuss Bitcoin, highlighting the growing institutional interest in digital assets. This announcement comes as Bitwise continues to expand in the digital asset ETF market, including recent approvals and the upcoming launch of #XRP ETFs.

This event reflects broader trends among major financial institutions toward investing in digital assets, following steps taken by l

View OriginalMatt Hogan, CEO of Bitwise, announced his meeting with a central bank to discuss Bitcoin, highlighting the growing institutional interest in digital assets. This announcement comes as Bitwise continues to expand in the digital asset ETF market, including recent approvals and the upcoming launch of #XRP ETFs.

This event reflects broader trends among major financial institutions toward investing in digital assets, following steps taken by l

- Reward

- 1

- Comment

- Repost

- Share

Old Bitcoin selling 👀 is declining. This chart is important.

It tracks the spending of #Bitcoin by holders of old coins — coins that have been dormant for more than 5 years.

At the beginning of this cycle, old coin holders were very active. The selling pressure from long-term holders exceeded that of the previous cycle, which makes sense. Institutions and governments entered strongly, and liquidity was available. That was the most suitable period to sell large quantities.

But look at what is happening now.

The selling of old coins at its local highs has started to decline.

The last

View OriginalIt tracks the spending of #Bitcoin by holders of old coins — coins that have been dormant for more than 5 years.

At the beginning of this cycle, old coin holders were very active. The selling pressure from long-term holders exceeded that of the previous cycle, which makes sense. Institutions and governments entered strongly, and liquidity was available. That was the most suitable period to sell large quantities.

But look at what is happening now.

The selling of old coins at its local highs has started to decline.

The last

- Reward

- 1

- Comment

- Repost

- Share

Why On-Chain Data Can Reveal the Next Big Move

Many traders rely solely on charts and news, but the real edge often comes from on-chain data. Tracking wallet flows, exchange balances, and smart contract activity can show where liquidity is moving before prices react. When large holders accumulate quietly, or exchanges see unusual inflows or outflows, it’s often a signal that a major move is brewing.

For example, when Bitcoin leaves exchanges in significant amounts, it usually indicates long-term holding intentions, reducing short-term selling pressure. Conversely, sudden inflows can signal pot

Many traders rely solely on charts and news, but the real edge often comes from on-chain data. Tracking wallet flows, exchange balances, and smart contract activity can show where liquidity is moving before prices react. When large holders accumulate quietly, or exchanges see unusual inflows or outflows, it’s often a signal that a major move is brewing.

For example, when Bitcoin leaves exchanges in significant amounts, it usually indicates long-term holding intentions, reducing short-term selling pressure. Conversely, sudden inflows can signal pot

- Reward

- 2

- 1

- Repost

- Share

TheAboveOne :

:

please pin down your thoughts. and if you like to get more of this and other helpful topics, just follow and share.Freed Thiel says that #Bitcoin and #Ethereum are not identical.

#BTC was designed to be the optimal decentralized store of value — digital gold with a maximum of 21 million units, without any central authority controlling its decisions, and a protocol that has been stable and tested since 2009.

Absolute scarcity + maximum decentralization.

On the other hand, #ETH was built to be a programmable world computer — enabling smart contracts, decentralized finance, non-fungible tokens, stablecoins, layer-two scalability, and continuous innovation.

#الإيثيريوم sacrifices some decentralization for

View Original#BTC was designed to be the optimal decentralized store of value — digital gold with a maximum of 21 million units, without any central authority controlling its decisions, and a protocol that has been stable and tested since 2009.

Absolute scarcity + maximum decentralization.

On the other hand, #ETH was built to be a programmable world computer — enabling smart contracts, decentralized finance, non-fungible tokens, stablecoins, layer-two scalability, and continuous innovation.

#الإيثيريوم sacrifices some decentralization for

- Reward

- 2

- Comment

- Repost

- Share

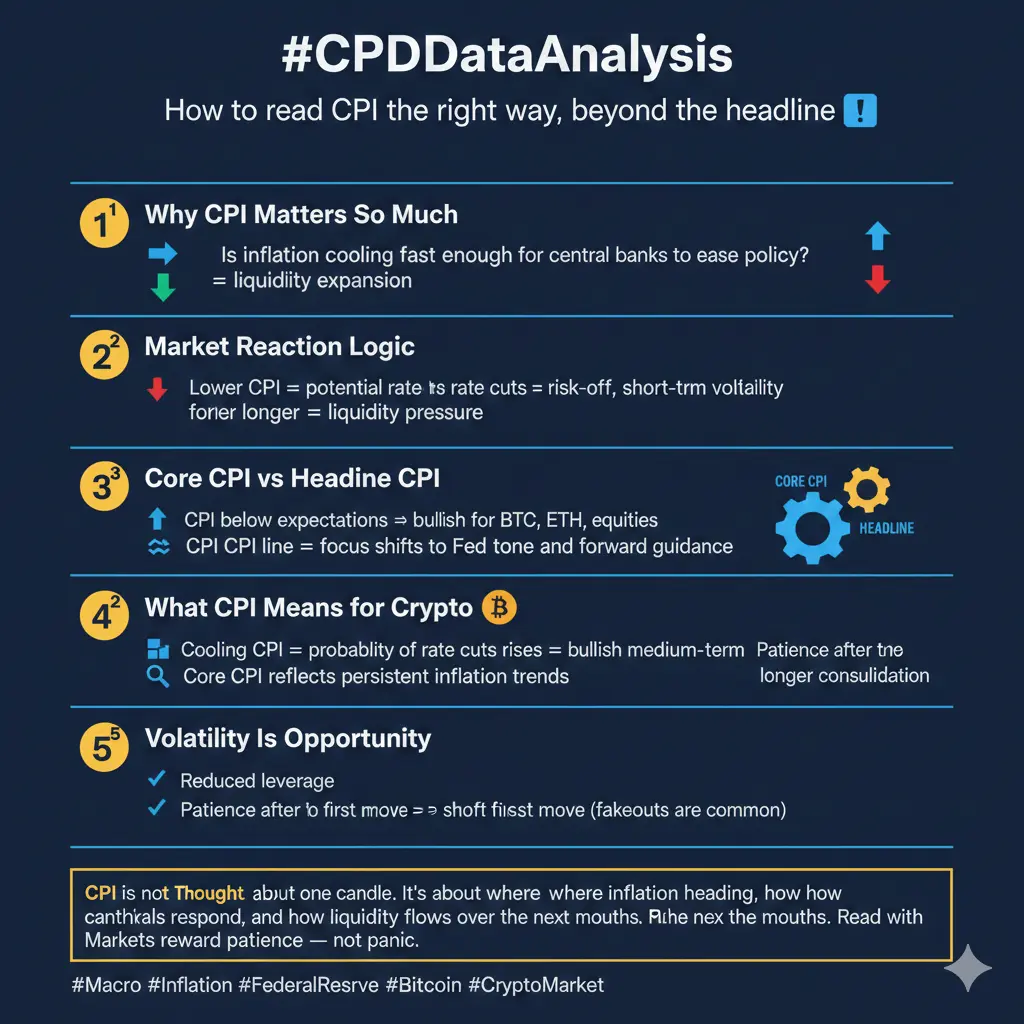

#CPIDataAnalysis

The Consumer Price Index (CPI) goes beyond being an economic indicator; it serves as a significant market trigger. Each CPI release can alter expectations regarding inflation, interest rates, liquidity, and ultimately affect risk assets such as cryptocurrencies and stocks.

Here's a guide to interpreting CPI beyond its headline figures 👇

1️⃣ Importance of CPI

CPI measures the pace at which prices rise for everyday goods and services, crucially addressing:

➡️ Is inflation slowing down sufficiently for central banks to ease policies?

A lower CPI may signal potential rate cuts a

The Consumer Price Index (CPI) goes beyond being an economic indicator; it serves as a significant market trigger. Each CPI release can alter expectations regarding inflation, interest rates, liquidity, and ultimately affect risk assets such as cryptocurrencies and stocks.

Here's a guide to interpreting CPI beyond its headline figures 👇

1️⃣ Importance of CPI

CPI measures the pace at which prices rise for everyday goods and services, crucially addressing:

➡️ Is inflation slowing down sufficiently for central banks to ease policies?

A lower CPI may signal potential rate cuts a

- Reward

- 4

- 2

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

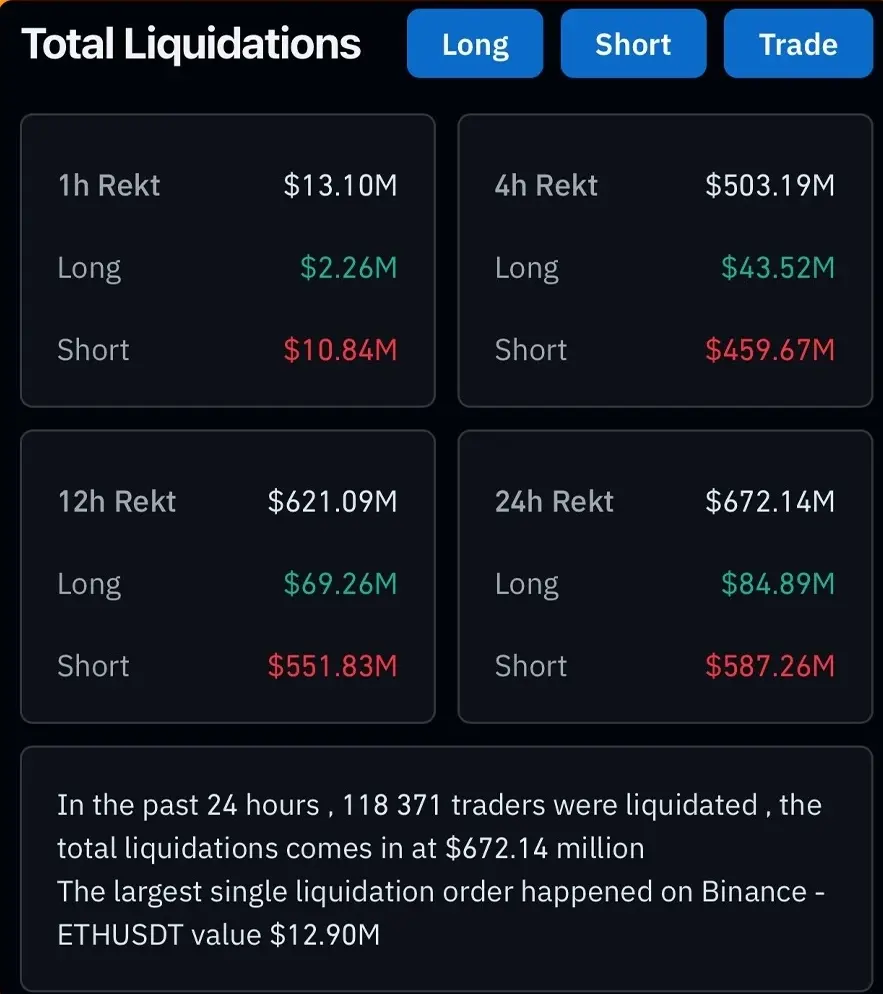

Short-term liquidation operations once again dominate the scene in the cryptocurrency market 📊

Over the past 24 hours, the market recorded liquidations worth $672.1 million, involving 118,371 traders. The imbalance was clear, with liquidations from short positions totaling approximately $587.3 million, compared to $84.9 million from long positions. The largest single liquidation was recorded on the Binance platform, for the #ETHUSDT pair, valued at $12.9 million ⚠

The total market capitalization increased to $3.25 trillion, up 5.04% over 24 hours. #BTCUSDT is trading near $95,400, up 4.6%,

View OriginalOver the past 24 hours, the market recorded liquidations worth $672.1 million, involving 118,371 traders. The imbalance was clear, with liquidations from short positions totaling approximately $587.3 million, compared to $84.9 million from long positions. The largest single liquidation was recorded on the Binance platform, for the #ETHUSDT pair, valued at $12.9 million ⚠

The total market capitalization increased to $3.25 trillion, up 5.04% over 24 hours. #BTCUSDT is trading near $95,400, up 4.6%,

- Reward

- 1

- Comment

- Repost

- Share

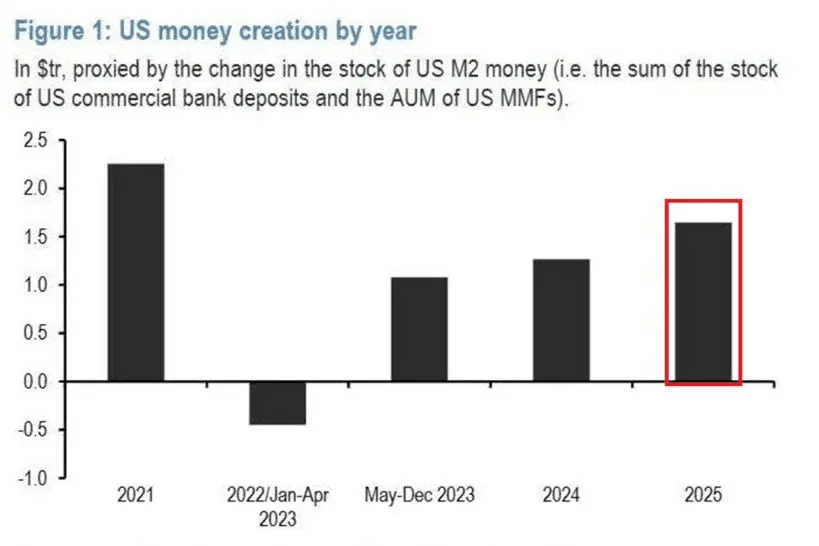

This is a big macro signal that shouldn’t be ignored.

US M2 money supply expanded by more than $1.65 trillion in 2025, pushing total liquidity to a record $26.7 trillion. That’s the largest yearly increase since 2021, a period everyone remembers for what followed in risk assets.

Money supply growth doesn’t hit markets instantly. It works with a lag. But historically, when liquidity expands this fast, it eventually finds its way into assets that hedge dilution.

That’s why this matters for #Bitcoin and #crypto.

Price can stay quiet short term.

But liquidity trends always win long term.

You don’t

US M2 money supply expanded by more than $1.65 trillion in 2025, pushing total liquidity to a record $26.7 trillion. That’s the largest yearly increase since 2021, a period everyone remembers for what followed in risk assets.

Money supply growth doesn’t hit markets instantly. It works with a lag. But historically, when liquidity expands this fast, it eventually finds its way into assets that hedge dilution.

That’s why this matters for #Bitcoin and #crypto.

Price can stay quiet short term.

But liquidity trends always win long term.

You don’t

BTC-1,2%

- Reward

- 2

- Comment

- Repost

- Share

BTC Analysis: Current Calm... Buying Opportunity or Sell Trap?

After the recent surge, Bitcoin has entered a calm phase. Don't be fooled by this stillness; decisive movements often originate here.

All eyes are focused on one area that will determine everything:

🔑 The decisive zone (POC): $90,000 - $93,000

Simply put, the scenario depends on this zone:

🟢 Bull Scenario (Bulls): If we see clear consolidation above $93,000, this is a healthy correction signal before continuing the upward trend.

🔴 Bear Scenario (Bears): If we break and close below $90,000, this confirms that the recent rise was

After the recent surge, Bitcoin has entered a calm phase. Don't be fooled by this stillness; decisive movements often originate here.

All eyes are focused on one area that will determine everything:

🔑 The decisive zone (POC): $90,000 - $93,000

Simply put, the scenario depends on this zone:

🟢 Bull Scenario (Bulls): If we see clear consolidation above $93,000, this is a healthy correction signal before continuing the upward trend.

🔴 Bear Scenario (Bears): If we break and close below $90,000, this confirms that the recent rise was

BTC-1,2%

- Reward

- like

- Comment

- Repost

- Share

“Capital is flowing where conviction lives.

Record Bitcoin ETF inflows, rising prices, and clearer regulation all signal the same truth:

Bitcoin is not a trade — it’s a monetary network.

When institutions allocate, governments clarify rules, and markets respond, the message is clear:

Digital property is becoming the foundation of the modern financial system.

Short-term volatility fades.

Long-term conviction compounds.”

— Michael Saylor

#Bitcoin #Crypto #DigitalAssets #ETF

Record Bitcoin ETF inflows, rising prices, and clearer regulation all signal the same truth:

Bitcoin is not a trade — it’s a monetary network.

When institutions allocate, governments clarify rules, and markets respond, the message is clear:

Digital property is becoming the foundation of the modern financial system.

Short-term volatility fades.

Long-term conviction compounds.”

— Michael Saylor

#Bitcoin #Crypto #DigitalAssets #ETF

BTC-1,2%

- Reward

- like

- Comment

- Repost

- Share

#BTCMarketAnalysis Wait.....Wait.....wait..... Guy's Leave everything and must read this.....You can't believe.....$BTC has added $130 billion, and the total crypto market has added $190 billion this week.....

I’ve analyzed #Bitcoin in detail $BTC has already shown this behavior before strong impulse up, deep correction into demand, and then continuation to new highs.

Right now, Bitcoin is holding above the major demand zone around $80,000 and has already started bouncing.

As long as this zone holds, the structure favors another impulsive leg upward toward the upper liquidity zone.

This is cla

I’ve analyzed #Bitcoin in detail $BTC has already shown this behavior before strong impulse up, deep correction into demand, and then continuation to new highs.

Right now, Bitcoin is holding above the major demand zone around $80,000 and has already started bouncing.

As long as this zone holds, the structure favors another impulsive leg upward toward the upper liquidity zone.

This is cla

BTC-1,2%

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

21.66K Popularity

32.74K Popularity

17.69K Popularity

1.49K Popularity

623 Popularity

444 Popularity

138.09K Popularity

773 Popularity

101.92K Popularity

40 Popularity

2.8K Popularity

1M Popularity

5.94K Popularity

3.5K Popularity

156.38K Popularity

News

View MoreThe "Life K-Line" virtue donation and daily fortune features have been successfully deployed.

3 m

Ondo Finance's third round of ONDO token unlock is imminent, with a total circulation surge of $737 million.

3 m

Founder of Life K-line Project: The whitelist tokens have been confirmed to be 6, and buyback and burn are planned for the next website update.

8 m

Data: 1,365,400 TON transferred out from Kiln, and after transit, flowed into TON

17 m

Vanguard's first purchase of Strategy stocks in the US Mid-Cap Stock Index Fund

25 m

Pin