# BItcoin

6.65M

AngryBird

🚨 BREAKING: Strong Institutional Demand for Bitcoin

The latest data shows a powerful wave of capital entering the Bitcoin market through Spot BTC ETFs. Yesterday alone, total net inflows reached $458,000,000, signaling continued institutional confidence in the long-term outlook of Bitcoin and the broader digital asset ecosystem.

Among the major contributors:

• BlackRock: +$263M

• Fidelity: +$95M

These numbers highlight a clear trend. Large financial institutions are steadily increasing their exposure to Bitcoin through regulated investment vehicles. Spot ETFs are becoming one of the most impo

The latest data shows a powerful wave of capital entering the Bitcoin market through Spot BTC ETFs. Yesterday alone, total net inflows reached $458,000,000, signaling continued institutional confidence in the long-term outlook of Bitcoin and the broader digital asset ecosystem.

Among the major contributors:

• BlackRock: +$263M

• Fidelity: +$95M

These numbers highlight a clear trend. Large financial institutions are steadily increasing their exposure to Bitcoin through regulated investment vehicles. Spot ETFs are becoming one of the most impo

BTC-1,96%

- Reward

- 3

- 1

- Repost

- Share

AngryBird :

:

To The Moon 🌕🚨 Market Shakeout Alert 🚨

In the last 4 hours, total crypto liquidations have exceeded $55 MILLION 💥

$ETH alone accounted for nearly $15 MILLION in liquidations 😳

Leverage getting wiped. Volatility back on the table.

When liquidations spike, it usually means:

• Overleveraged positions flushed

• Short-term panic or euphoria

• Potential setup for the next big move

Stay sharp. Manage risk. The market rewards discipline, not emotions.

#Crypto #Bitcoin #BTC #Ethereum #ETH

$BTC $XLM

In the last 4 hours, total crypto liquidations have exceeded $55 MILLION 💥

$ETH alone accounted for nearly $15 MILLION in liquidations 😳

Leverage getting wiped. Volatility back on the table.

When liquidations spike, it usually means:

• Overleveraged positions flushed

• Short-term panic or euphoria

• Potential setup for the next big move

Stay sharp. Manage risk. The market rewards discipline, not emotions.

#Crypto #Bitcoin #BTC #Ethereum #ETH

$BTC $XLM

- Reward

- like

- Comment

- Repost

- Share

#DeepCreationCamp

2026 Crypto Report: Macro Turmoil, Institutional Positions, and Pricing "Tomorrow"

As of March 2026, the cryptocurrency market is not merely in a "bull or bear" phase; it has entered a historic era of "maturation," placing itself at the very center of the global financial system. Today, the prices we see on our screens are not just numbers; they are reflections of geopolitical tensions, liquidity wars, and technological revolutions. Let’s analyze this complex puzzle with the precision of a chess grandmaster.

1. Bitcoin (BTC): The Liquidity War Below $66,000 and ETF Dynamics

2026 Crypto Report: Macro Turmoil, Institutional Positions, and Pricing "Tomorrow"

As of March 2026, the cryptocurrency market is not merely in a "bull or bear" phase; it has entered a historic era of "maturation," placing itself at the very center of the global financial system. Today, the prices we see on our screens are not just numbers; they are reflections of geopolitical tensions, liquidity wars, and technological revolutions. Let’s analyze this complex puzzle with the precision of a chess grandmaster.

1. Bitcoin (BTC): The Liquidity War Below $66,000 and ETF Dynamics

- Reward

- 1

- Comment

- Repost

- Share

🌍⚠️ #USIranTensionsImpactMarkets ⚠️🌍

Global markets are once again on edge as rising tensions between the U.S. and Iran create uncertainty across the financial world. 📉🔥

Whenever geopolitical risks increase, markets react fast — sometimes emotionally. We are seeing volatility not only in traditional markets like stocks and oil, but also in crypto.

🛢 Oil prices tend to spike on Middle East tensions due to supply concerns.

📊 Stock markets often turn cautious as investors reduce risk exposure.

🪙 Gold may attract safe-haven demand.

₿ Bitcoin’s role becomes a key discussion — is it acting li

Global markets are once again on edge as rising tensions between the U.S. and Iran create uncertainty across the financial world. 📉🔥

Whenever geopolitical risks increase, markets react fast — sometimes emotionally. We are seeing volatility not only in traditional markets like stocks and oil, but also in crypto.

🛢 Oil prices tend to spike on Middle East tensions due to supply concerns.

📊 Stock markets often turn cautious as investors reduce risk exposure.

🪙 Gold may attract safe-haven demand.

₿ Bitcoin’s role becomes a key discussion — is it acting li

BTC-1,96%

- Reward

- 1

- Comment

- Repost

- Share

🚀 #CryptoMarketBouncesBack – The Comeback Is Real! 📈

The crypto market is showing strong signs of recovery as major coins regain momentum and investor confidence returns. After weeks of volatility and uncertainty, digital assets are bouncing back with renewed strength.

💰 ** (BTC)** has climbed steadily, reclaiming key resistance levels and signaling bullish sentiment in the market.

🔥 ** (ETH)** is also gaining traction, supported by growing network activity and institutional interest.

Altcoins are following the trend, with several projects posting impressive double-digit gains. Increased t

The crypto market is showing strong signs of recovery as major coins regain momentum and investor confidence returns. After weeks of volatility and uncertainty, digital assets are bouncing back with renewed strength.

💰 ** (BTC)** has climbed steadily, reclaiming key resistance levels and signaling bullish sentiment in the market.

🔥 ** (ETH)** is also gaining traction, supported by growing network activity and institutional interest.

Altcoins are following the trend, with several projects posting impressive double-digit gains. Increased t

- Reward

- like

- Comment

- Repost

- Share

美伊局势影响 🌍⚡

The U.S. announces an upcoming “large-scale attack” on Iran — and global markets react instantly.

Volatility spikes across risk assets.

Oil jumps.

Gold strengthens.

And surprisingly… Bitcoin rebounds.

We are no longer trading just charts.

We are trading geopolitics.

🔥 What’s Happening in Markets?

As tensions escalate:

• 🛢 Crude Oil rises on supply disruption fears

• 🥇 Gold strengthens as a traditional safe haven

• ₿ Bitcoin shows resilience as a “neutral” global asset

This is a structural shift — capital is rotating into scarcity and mobility.

💬 This Week’s Key Debate:

1️⃣ Bitco

The U.S. announces an upcoming “large-scale attack” on Iran — and global markets react instantly.

Volatility spikes across risk assets.

Oil jumps.

Gold strengthens.

And surprisingly… Bitcoin rebounds.

We are no longer trading just charts.

We are trading geopolitics.

🔥 What’s Happening in Markets?

As tensions escalate:

• 🛢 Crude Oil rises on supply disruption fears

• 🥇 Gold strengthens as a traditional safe haven

• ₿ Bitcoin shows resilience as a “neutral” global asset

This is a structural shift — capital is rotating into scarcity and mobility.

💬 This Week’s Key Debate:

1️⃣ Bitco

BTC-1,96%

- Reward

- 5

- 9

- Repost

- Share

Crypto_Buzz_with_Alex :

:

LFG 🔥View More

#DeepCreationCamp 🚀💥💥

2026 Crypto Report: Macro Turmoil, Institutional Positions, and Pricing "Tomorrow"

As of March 2026, the cryptocurrency market is not merely in a "bull or bear" phase; it has entered a historic era of "maturation," placing itself at the very center of the global financial system. Today, the prices we see on our screens are not just numbers; they are reflections of geopolitical tensions, liquidity wars, and technological revolutions. Let’s analyze this complex puzzle with the precision of a chess grandmaster.

1. Bitcoin (BTC): The Liquidity War Below $66,000 and ETF Dy

2026 Crypto Report: Macro Turmoil, Institutional Positions, and Pricing "Tomorrow"

As of March 2026, the cryptocurrency market is not merely in a "bull or bear" phase; it has entered a historic era of "maturation," placing itself at the very center of the global financial system. Today, the prices we see on our screens are not just numbers; they are reflections of geopolitical tensions, liquidity wars, and technological revolutions. Let’s analyze this complex puzzle with the precision of a chess grandmaster.

1. Bitcoin (BTC): The Liquidity War Below $66,000 and ETF Dy

- Reward

- 1

- Comment

- Repost

- Share

#DeepCreationCamp 🚀💥💥

2026 Crypto Report: Macro Turmoil, Institutional Positions, and Pricing "Tomorrow"

As of March 2026, the cryptocurrency market is not merely in a "bull or bear" phase; it has entered a historic era of "maturation," placing itself at the very center of the global financial system. Today, the prices we see on our screens are not just numbers; they are reflections of geopolitical tensions, liquidity wars, and technological revolutions. Let’s analyze this complex puzzle with the precision of a chess grandmaster.

1. Bitcoin (BTC): The Liquidity War Below $66,000 and ETF Dy

2026 Crypto Report: Macro Turmoil, Institutional Positions, and Pricing "Tomorrow"

As of March 2026, the cryptocurrency market is not merely in a "bull or bear" phase; it has entered a historic era of "maturation," placing itself at the very center of the global financial system. Today, the prices we see on our screens are not just numbers; they are reflections of geopolitical tensions, liquidity wars, and technological revolutions. Let’s analyze this complex puzzle with the precision of a chess grandmaster.

1. Bitcoin (BTC): The Liquidity War Below $66,000 and ETF Dy

- Reward

- 2

- 3

- Repost

- Share

Yusfirah :

:

LFG 🔥View More

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

good information 👍🔥 BULLISH!

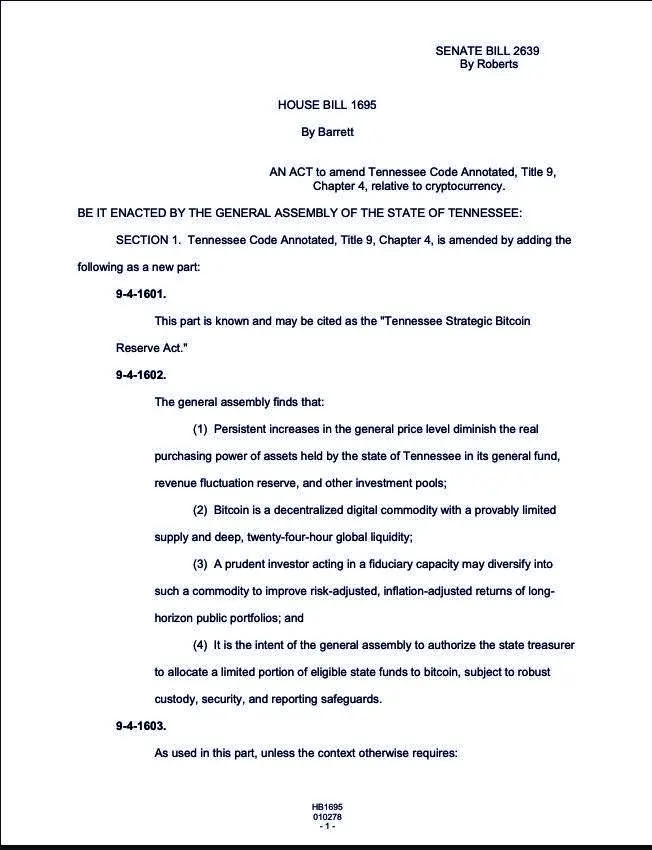

Tennessee just took a big step toward a Strategic Bitcoin Reserve!

The bill has been recommended for approval and sent to the Finance Committee for final review.

If it passes, the state can put up to 10% of its public money into Bitcoin! 🚀

What a move for $BTC ! #Bitcoin #Tennessee #CryptoMarketBouncesBack #BuyTheDipOrWaitNow? #news

Tennessee just took a big step toward a Strategic Bitcoin Reserve!

The bill has been recommended for approval and sent to the Finance Committee for final review.

If it passes, the state can put up to 10% of its public money into Bitcoin! 🚀

What a move for $BTC ! #Bitcoin #Tennessee #CryptoMarketBouncesBack #BuyTheDipOrWaitNow? #news

BTC-1,96%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

814.06K Popularity

306.77K Popularity

142.23K Popularity

403.6K Popularity

32.03K Popularity

181.82K Popularity

231.16K Popularity

194.38K Popularity

271.63K Popularity

1.98K Popularity

6.07M Popularity

54.95K Popularity

5.37M Popularity

390.52K Popularity

53.06K Popularity

News

View MoreData: In the past 24 hours, the entire network has been liquidated for $399 million, mainly long positions.

3 m

Data: 33,000 AAVE transferred from an anonymous address, worth approximately $3.6 million

4 m

Data: 43,533,900 ENA transferred from an anonymous address, valued at approximately $4.71 million

5 m

Schmidt: The cost of losing inflation credibility is high

10 m

U.S. Government Transfers 0.0378 BTC Worth $2,520

13 m

Pin