# SEConTokenizedSecurities

20.38K

The SEC confirmed tokenization doesn’t change securities regulation. Does this signal a more institution-friendly phase for RWA, and which sectors stand to benefit first?

QueenOfTheDay

#SEConTokenizedSecurities 📢 SEC Clarifies Tokenization & Securities Regulation

The U.S. SEC has confirmed that tokenizing assets does not change securities regulations. While digital representations of real-world assets (RWA) can increase accessibility and efficiency, they remain subject to existing compliance frameworks.

💡 Key Implications:

Regulatory Certainty:

Tokenization alone does not exempt an asset from securities laws.

This clarity helps institutions navigate digital asset adoption with confidence.

Institution-Friendly Environment:

While compliance obligations persist, clearer guide

The U.S. SEC has confirmed that tokenizing assets does not change securities regulations. While digital representations of real-world assets (RWA) can increase accessibility and efficiency, they remain subject to existing compliance frameworks.

💡 Key Implications:

Regulatory Certainty:

Tokenization alone does not exempt an asset from securities laws.

This clarity helps institutions navigate digital asset adoption with confidence.

Institution-Friendly Environment:

While compliance obligations persist, clearer guide

- Reward

- 2

- 1

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊#SEConTokenizedSecurities The Future of Finance: Tokenized Securities

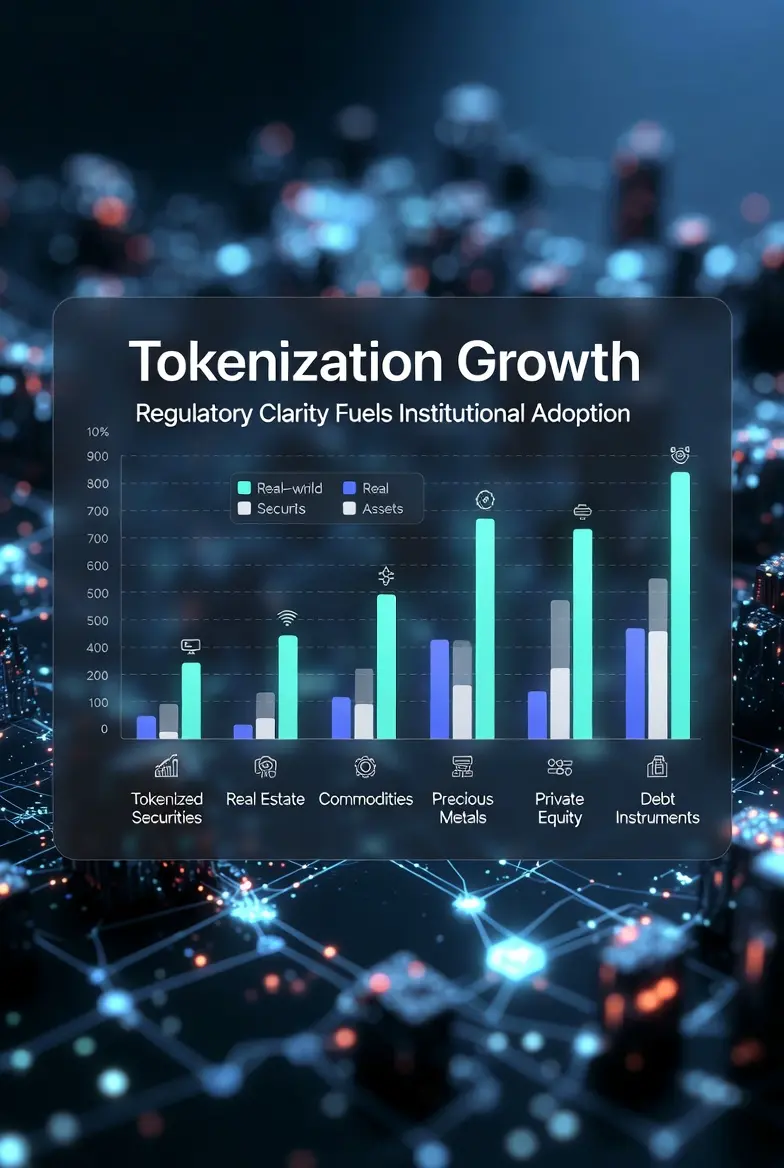

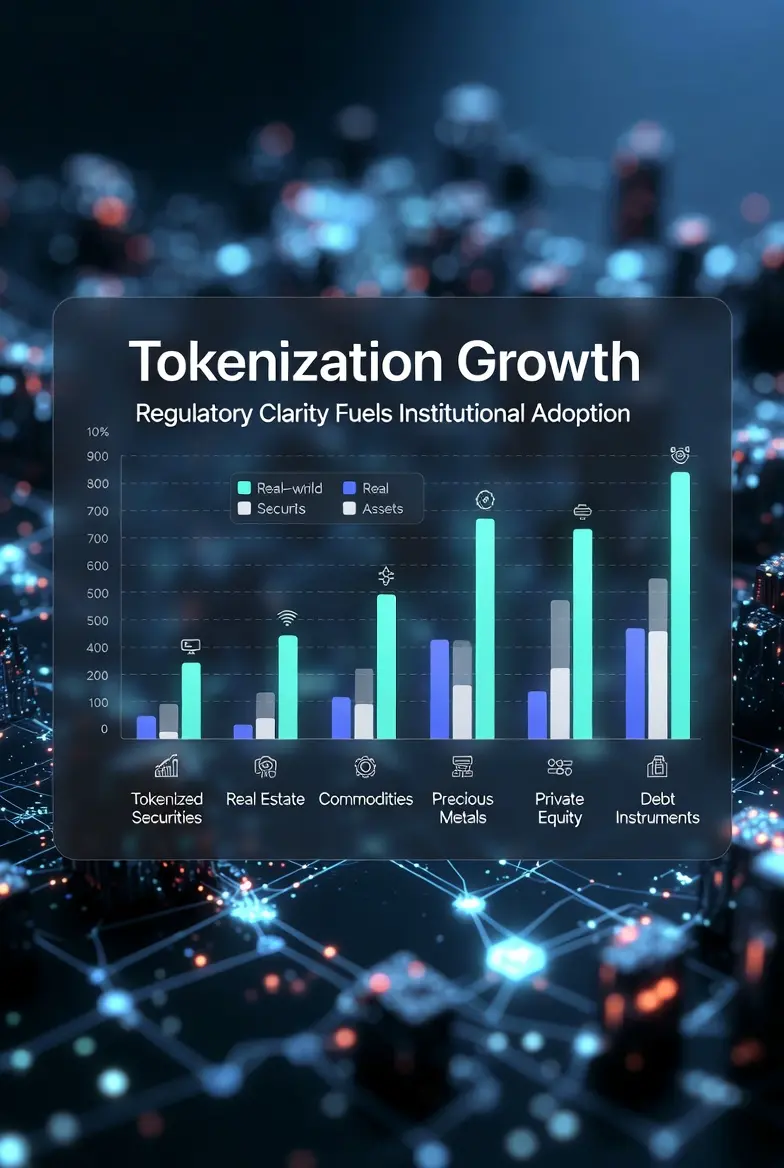

The global financial system is entering a transformative phase where traditional assets converge with blockchain infrastructure. This evolution has given rise to Tokenized Securities—regulated, transparent, and accessible digital representations of real-world assets (RWAs). Unlike speculative tokens or meme coins, tokenized securities represent legal ownership or economic rights in underlying assets, are backed by issuers, and comply with existing securities regulations. They provide holders with rights such as dividends, vo

The global financial system is entering a transformative phase where traditional assets converge with blockchain infrastructure. This evolution has given rise to Tokenized Securities—regulated, transparent, and accessible digital representations of real-world assets (RWAs). Unlike speculative tokens or meme coins, tokenized securities represent legal ownership or economic rights in underlying assets, are backed by issuers, and comply with existing securities regulations. They provide holders with rights such as dividends, vo

- Reward

- 3

- 1

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊#SEConTokenizedSecurities

The recent clarification from the SEC that tokenization does not exempt digital assets from existing securities regulations is a pivotal moment for the crypto and RWA (Real-World Assets) ecosystem. While some initially hoped tokenization might create a regulatory loophole, the SEC’s stance makes it clear: whether an asset is on-chain or off-chain, compliance obligations remain unchanged. Far from being a setback, this confirmation can actually signal a more institution-friendly phase for tokenized securities and RWAs, because institutional investors prioritize clarity

The recent clarification from the SEC that tokenization does not exempt digital assets from existing securities regulations is a pivotal moment for the crypto and RWA (Real-World Assets) ecosystem. While some initially hoped tokenization might create a regulatory loophole, the SEC’s stance makes it clear: whether an asset is on-chain or off-chain, compliance obligations remain unchanged. Far from being a setback, this confirmation can actually signal a more institution-friendly phase for tokenized securities and RWAs, because institutional investors prioritize clarity

- Reward

- 1

- Comment

- Repost

- Share

#SEConTokenizedSecurities

The U.S. Securities and Exchange Commission’s (SEC) focus on tokenized securities marks an important moment for the convergence of traditional finance and blockchain technology. Below is a clear breakdown of its significance:

1️⃣ Clear Regulatory Attention on Tokenization

The SEC’s involvement shows that tokenized securities are no longer a niche concept. Regulators are actively examining how digital representations of stocks, bonds, and funds fit within existing securities laws.

2️⃣ Tokenized Securities Are Treated as Real Securities

From a regulatory perspective, t

The U.S. Securities and Exchange Commission’s (SEC) focus on tokenized securities marks an important moment for the convergence of traditional finance and blockchain technology. Below is a clear breakdown of its significance:

1️⃣ Clear Regulatory Attention on Tokenization

The SEC’s involvement shows that tokenized securities are no longer a niche concept. Regulators are actively examining how digital representations of stocks, bonds, and funds fit within existing securities laws.

2️⃣ Tokenized Securities Are Treated as Real Securities

From a regulatory perspective, t

- Reward

- 6

- 6

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#SEConTokenizedSecurities The Future of Finance: Tokenized Securities

The global financial system is entering a transformative phase where traditional assets converge with blockchain infrastructure. This evolution has given rise to Tokenized Securities, a regulated, transparent, and accessible way to own and trade real-world assets (RWAs) on-chain. Unlike speculative tokens or meme coins, tokenized securities represent legal ownership or economic rights in underlying assets, are backed by issuers, and comply with existing securities regulations. They provide holders with rights such as dividen

The global financial system is entering a transformative phase where traditional assets converge with blockchain infrastructure. This evolution has given rise to Tokenized Securities, a regulated, transparent, and accessible way to own and trade real-world assets (RWAs) on-chain. Unlike speculative tokens or meme coins, tokenized securities represent legal ownership or economic rights in underlying assets, are backed by issuers, and comply with existing securities regulations. They provide holders with rights such as dividen

- Reward

- 7

- 6

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#SEConTokenizedSecurities

The recent clarification from the SEC that tokenization does not exempt digital assets from existing securities regulations is a pivotal moment for the crypto and RWA (Real-World Assets) ecosystem. While some initially hoped tokenization might create a regulatory loophole, the SEC’s stance makes it clear: whether an asset is on-chain or off-chain, compliance obligations remain unchanged. Far from being a setback, this confirmation can actually signal a more institution-friendly phase for tokenized securities and RWAs, because institutional investors prioritize clarity

The recent clarification from the SEC that tokenization does not exempt digital assets from existing securities regulations is a pivotal moment for the crypto and RWA (Real-World Assets) ecosystem. While some initially hoped tokenization might create a regulatory loophole, the SEC’s stance makes it clear: whether an asset is on-chain or off-chain, compliance obligations remain unchanged. Far from being a setback, this confirmation can actually signal a more institution-friendly phase for tokenized securities and RWAs, because institutional investors prioritize clarity

- Reward

- 10

- 11

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#SEConTokenizedSecurities | The Future of Finance: Tokenized Securities 🌐

The global financial system is entering a new phase—where traditional assets meet blockchain infrastructure. This evolution is giving rise to Tokenized Securities, a regulated, transparent, and more accessible way to own and trade real-world assets on-chain.

🔍 What Are Tokenized Securities?

Tokenized securities are blockchain-based digital representations of real-world assets (RWAs) such as equities, real estate, commodities, or funds. Unlike utility tokens or speculative meme coins, these tokens:

Represent legal owner

The global financial system is entering a new phase—where traditional assets meet blockchain infrastructure. This evolution is giving rise to Tokenized Securities, a regulated, transparent, and more accessible way to own and trade real-world assets on-chain.

🔍 What Are Tokenized Securities?

Tokenized securities are blockchain-based digital representations of real-world assets (RWAs) such as equities, real estate, commodities, or funds. Unlike utility tokens or speculative meme coins, these tokens:

Represent legal owner

- Reward

- 8

- 14

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#SEConTokenizedSecurities

📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional financial instruments like stocks, bonds, or funds—are treated under existing securities laws, regardless of whether they exist natively on-chain or as digital representations. The SEC has made it clear that all legal obligations, including registration, disclosures, investor protections, and anti-fraud

📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The landscape of tokenized securities is evolving rapidly, with the U.S. SEC playing a central role in shaping both regulation and market behavior. Tokenized securities—digital representations of traditional financial instruments like stocks, bonds, or funds—are treated under existing securities laws, regardless of whether they exist natively on-chain or as digital representations. The SEC has made it clear that all legal obligations, including registration, disclosures, investor protections, and anti-fraud

- Reward

- 27

- 18

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

🏦 #SEConTokenizedSecurities – The Future of Finance is Here! 💎✨

The SEC is stepping into the world of tokenized securities, opening new doors for regulated digital assets. 🚀

✨ What This Means:

Greater transparency and security for investors 🔒

Easier access to digital assets under regulatory oversight 🌐

Potential for mainstream adoption of tokenized investments 📈

💡 Gate.io Insight:

Stay informed and trade confidently with compliant tokenized securities on Gate.io. Leverage our tools and resources to navigate the evolving crypto landscape. ⚡

🔗 Discover & Trade Smart: [Gate.io App]

#Gate

The SEC is stepping into the world of tokenized securities, opening new doors for regulated digital assets. 🚀

✨ What This Means:

Greater transparency and security for investors 🔒

Easier access to digital assets under regulatory oversight 🌐

Potential for mainstream adoption of tokenized investments 📈

💡 Gate.io Insight:

Stay informed and trade confidently with compliant tokenized securities on Gate.io. Leverage our tools and resources to navigate the evolving crypto landscape. ⚡

🔗 Discover & Trade Smart: [Gate.io App]

#Gate

- Reward

- 3

- Comment

- Repost

- Share

#SEConTokenizedSecurities #SEConTokenizedSecurities

Tokenized securities are no longer a future concept—they’re here, and the SEC just made it clear: ignorance will cost you.

🔹 Why it’s a game-changer: The SEC is cracking down on tokenized securities—this isn’t a minor warning. Platforms, projects, and even investors who treat these assets like ordinary crypto are playing with fire. The line between decentralized ambition and regulatory compliance just became razor-thin.

🔹 Market reality check: Expect turbulence. Non-compliant projects will face fines, delistings, or worse. Investors chasing

Tokenized securities are no longer a future concept—they’re here, and the SEC just made it clear: ignorance will cost you.

🔹 Why it’s a game-changer: The SEC is cracking down on tokenized securities—this isn’t a minor warning. Platforms, projects, and even investors who treat these assets like ordinary crypto are playing with fire. The line between decentralized ambition and regulatory compliance just became razor-thin.

🔹 Market reality check: Expect turbulence. Non-compliant projects will face fines, delistings, or worse. Investors chasing

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

378.72K Popularity

7.37K Popularity

7.28K Popularity

4.28K Popularity

2.83K Popularity

4.81K Popularity

2.8K Popularity

3.24K Popularity

2.17K Popularity

23 Popularity

54.45K Popularity

72.75K Popularity

20.38K Popularity

26.61K Popularity

219.71K Popularity

News

View MoreKorean regulatory agency expands AI system to track cryptocurrency manipulation activities

18 m

Bloomberg: SpaceX is in advanced talks to merge with xAI, and the merger announcement could be made as early as this week.

21 m

Opinion: The crypto bear market cycle is expected to reverse by 2026, with Bitcoin potentially bottoming out around $60,000.

31 m

Michael Saylor: Strategy has accumulated a total of 713,502 BTC, with an average purchase price of approximately $76,052.

33 m

Spot gold prices briefly surged past $4,800 per ounce, breaking through the short-term resistance level.

45 m

Pin