# InterestRates

10.08K

NovaCryptoGirl

📌 #MacroWatchFedChairPick | A Turning Point for Global Markets & Crypto

Markets are on edge as the world looks ahead to May 2026, when Jerome Powell’s term as Fed Chair comes to an end. The choice of the next Federal Reserve leader could shape the direction of interest rates, liquidity, and risk assets for years to come — especially crypto.

President Trump has made his stance clear: he wants a Fed Chair who supports aggressive interest rate cuts to fuel growth and unlock liquidity. That message has already captured the attention of investors worldwide.

Two names are standing out:

🔹 Kevin Has

Markets are on edge as the world looks ahead to May 2026, when Jerome Powell’s term as Fed Chair comes to an end. The choice of the next Federal Reserve leader could shape the direction of interest rates, liquidity, and risk assets for years to come — especially crypto.

President Trump has made his stance clear: he wants a Fed Chair who supports aggressive interest rate cuts to fuel growth and unlock liquidity. That message has already captured the attention of investors worldwide.

Two names are standing out:

🔹 Kevin Has

- Reward

- 5

- 3

- Repost

- Share

AngryBird :

:

Christmas Bull Run! 🐂View More

#BOJRateHikesBackontheTable

#BOJRateHikesBackontheTable – Japan Signals Interest Rate Shift

The Bank of Japan (#BOJRateHikesBackontheTable) is signaling a major shift in its decades-long ultra-low interest rate policy. After maintaining near-zero or negative rates for most of the past 30 years to fight deflation and stimulate growth, the BOJ raised its key short-term rate by 25 basis points to 0.75% on December 19, 2025 — the highest since 1995. This move comes amid persistent inflation above the BOJ’s 2% target, rising wages, and ongoing pressure from global monetary tightening. Policymakers

#BOJRateHikesBackontheTable – Japan Signals Interest Rate Shift

The Bank of Japan (#BOJRateHikesBackontheTable) is signaling a major shift in its decades-long ultra-low interest rate policy. After maintaining near-zero or negative rates for most of the past 30 years to fight deflation and stimulate growth, the BOJ raised its key short-term rate by 25 basis points to 0.75% on December 19, 2025 — the highest since 1995. This move comes amid persistent inflation above the BOJ’s 2% target, rising wages, and ongoing pressure from global monetary tightening. Policymakers

- Reward

- 22

- 12

- Repost

- Share

BabaJi :

:

Merry Christmas ⛄View More

The US Federal Reserve cuts interest rates by 25 basis points to 3.75% - in line with market expectations

The US Federal Reserve has lowered its key interest rate (upper limit) to 3.75%, marking a decrease of 25 basis points from the previous rate of 4.00%. This move aligns with market expectations, indicating the Fed's continued shift towards a more accommodative monetary policy as inflation pressures ease and growth stabilizes.

💬 Investors are now awaiting Jerome Powell's statements for clues about future interest rate movements.

#USFed #InterestRates #JeromePowell #Markets

$BTC

$SOL

View OriginalThe US Federal Reserve has lowered its key interest rate (upper limit) to 3.75%, marking a decrease of 25 basis points from the previous rate of 4.00%. This move aligns with market expectations, indicating the Fed's continued shift towards a more accommodative monetary policy as inflation pressures ease and growth stabilizes.

💬 Investors are now awaiting Jerome Powell's statements for clues about future interest rate movements.

#USFed #InterestRates #JeromePowell #Markets

$BTC

$SOL

- Reward

- 1

- Comment

- Repost

- Share

Federal Reserve Meeting: Jerome Powell's December Speech!

The U.S. Federal Reserve Board will hold its annual Federal Open Market Committee (FOMC) meeting for two days to determine the next step in interest rates.

In the last meeting in October, the Federal Reserve cut interest rates by 25 basis points, to a range of 3.75%–4.00%.

Global markets are now awaiting what Jerome Powell and his team will announce.

🗓 Meeting Schedule

The Federal Open Market Committee (FOMC) will meet on December 9 and 10, 2025 (US Time).

⏰ Monetary Policy Announcement

• 2:00 PM Eastern US Time

• 12:30 AM Indi

View OriginalThe U.S. Federal Reserve Board will hold its annual Federal Open Market Committee (FOMC) meeting for two days to determine the next step in interest rates.

In the last meeting in October, the Federal Reserve cut interest rates by 25 basis points, to a range of 3.75%–4.00%.

Global markets are now awaiting what Jerome Powell and his team will announce.

🗓 Meeting Schedule

The Federal Open Market Committee (FOMC) will meet on December 9 and 10, 2025 (US Time).

⏰ Monetary Policy Announcement

• 2:00 PM Eastern US Time

• 12:30 AM Indi

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

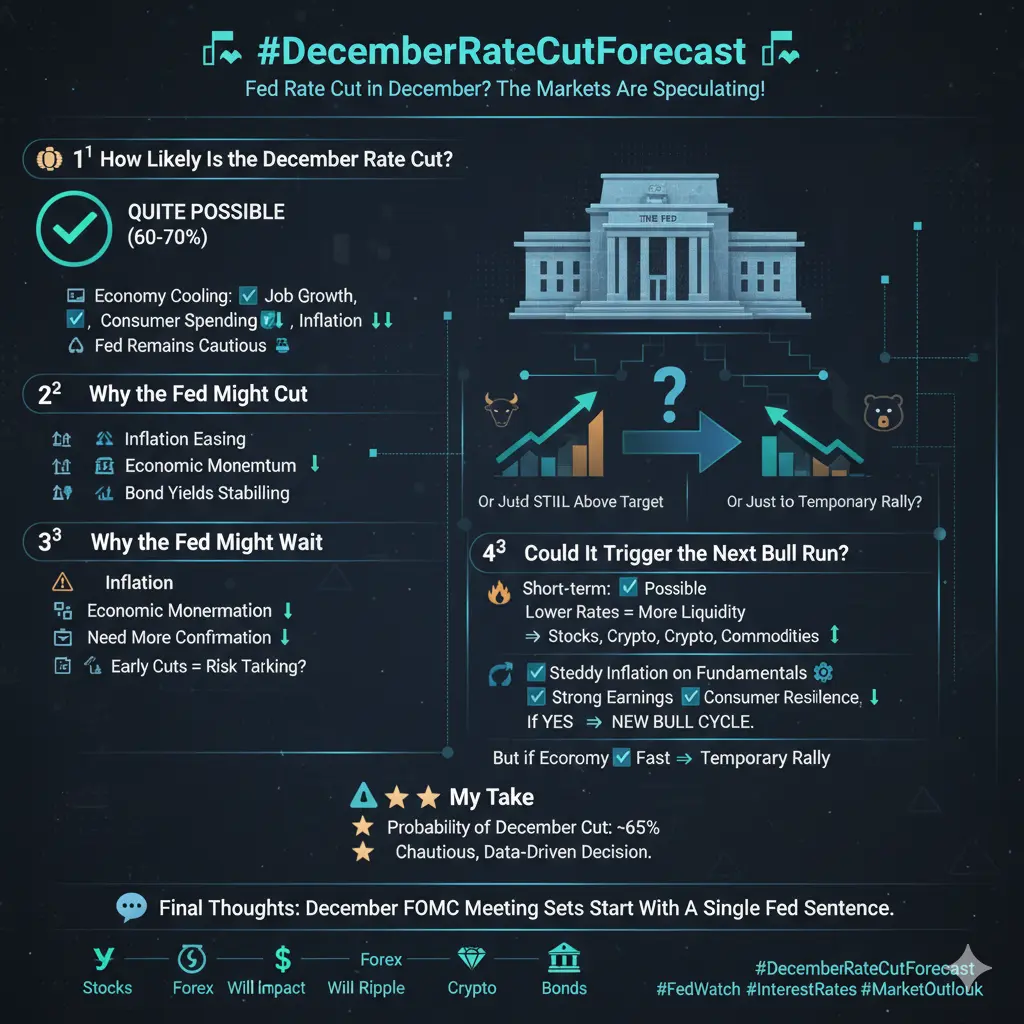

US Federal Reserve Meeting: Jerome Powell's Speech in December!📉 #DecemberRateCutForecast 📉

The Fed may cut rates again this December, and the markets are heating up with speculation.

But the real question is 👇

💭 How likely is the rate cut?

💭 Could it ignite the next bull run?

Let’s break it down 🔍

💰 1️⃣ How Likely Is the December Rate Cut?

✅ Quite possible — but not guaranteed.

The economy is cooling down — job growth is slowing, consumer spending is softening, and inflation is gradually coming under control. These are exactly the conditions that could push the Fed to ease rates to prevent a sharper slowdown.

However… the Fed remains cautious ⚖️

O

The Fed may cut rates again this December, and the markets are heating up with speculation.

But the real question is 👇

💭 How likely is the rate cut?

💭 Could it ignite the next bull run?

Let’s break it down 🔍

💰 1️⃣ How Likely Is the December Rate Cut?

✅ Quite possible — but not guaranteed.

The economy is cooling down — job growth is slowing, consumer spending is softening, and inflation is gradually coming under control. These are exactly the conditions that could push the Fed to ease rates to prevent a sharper slowdown.

However… the Fed remains cautious ⚖️

O

- Reward

- 4

- 2

- Repost

- Share

TheRealKing :

:

niceView More

Current expectations indicate that the Federal Reserve #FederalReserve is close to cutting interest rates #InterestRates by 25 basis points, with a probability of 86.2% according to the #CME #FedWatch tool.

The market is awaiting the official announcement and press conference to outline the features of the upcoming monetary policy #MonetaryPolicy for the next period.

$LTC

$ADA

$SUI

View OriginalThe market is awaiting the official announcement and press conference to outline the features of the upcoming monetary policy #MonetaryPolicy for the next period.

$LTC

$ADA

$SUI

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

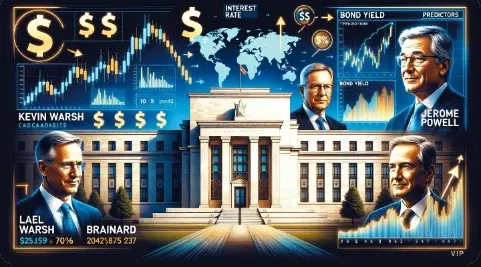

Wait and see cautiously 🔍#NextFedChairPredictions

The race for the next Federal Reserve Chair is heating up! Global investors and VIP traders are closely watching potential candidates as the Fed’s next moves could reshape interest rates, markets, and macro strategies.

🔹 Top Contenders & Predictions:

1️⃣ Kevin Warsh – Market-friendly, potential for gradual rate adjustments, favored by financial institutions.

2️⃣ Lael Brainard – Focused on financial stability and inflation control, may maintain cautious approach.

3️⃣ Jerome Powell (Reappointment) – Continuity in policy, likely steady but reactive to inflation and empl

The race for the next Federal Reserve Chair is heating up! Global investors and VIP traders are closely watching potential candidates as the Fed’s next moves could reshape interest rates, markets, and macro strategies.

🔹 Top Contenders & Predictions:

1️⃣ Kevin Warsh – Market-friendly, potential for gradual rate adjustments, favored by financial institutions.

2️⃣ Lael Brainard – Focused on financial stability and inflation control, may maintain cautious approach.

3️⃣ Jerome Powell (Reappointment) – Continuity in policy, likely steady but reactive to inflation and empl

BTC0,99%

- Reward

- 7

- 5

- Repost

- Share

DragonFlyOfficial :

:

Happy New Year! 🤑View More

🏦 #FedRateCutComing | Macro Market Alert 📉✨

Markets are anticipating a potential Federal Reserve rate cut, a move that could impact global liquidity, risk sentiment, and crypto market momentum. Traders are watching closely to adjust strategies and manage risk. 🌍💹

🔍 Key Points to Monitor:

Potential boost to risk assets, including crypto 🚀

Impact on USD strength and global trading sentiment 💱

Volatility around macroeconomic announcements ⚠️

Stay informed and trade smart with Gate.io’s real-time market insights and advanced tools. ⚡💼

#Gateio #FedWatch #InterestRates #CryptoMarket 🚀✨

Markets are anticipating a potential Federal Reserve rate cut, a move that could impact global liquidity, risk sentiment, and crypto market momentum. Traders are watching closely to adjust strategies and manage risk. 🌍💹

🔍 Key Points to Monitor:

Potential boost to risk assets, including crypto 🚀

Impact on USD strength and global trading sentiment 💱

Volatility around macroeconomic announcements ⚠️

Stay informed and trade smart with Gate.io’s real-time market insights and advanced tools. ⚡💼

#Gateio #FedWatch #InterestRates #CryptoMarket 🚀✨

- Reward

- 3

- Comment

- Repost

- Share

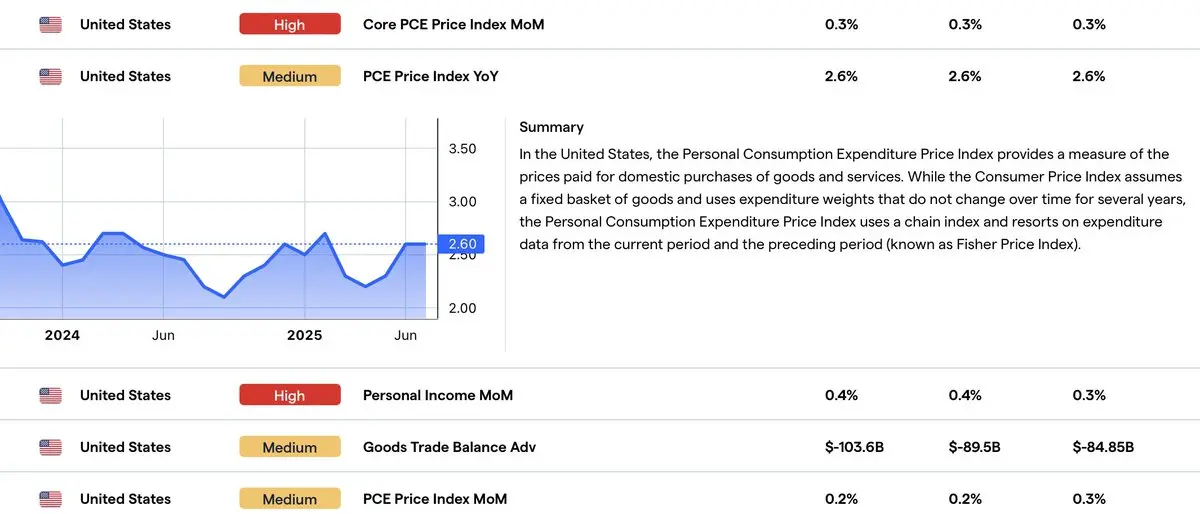

#PCE data released yesterday, remained stubbornly high, indicating that #Inflation is STILL an issue. THIS IS THE HINDERANCE to reducing #InterestRates in the US.

The #FOMC committee has a MANDATE which includes controlling price inflation.

@Trump is trying to ignore the mandate and remove FED independence, which cannot be a good thing as it will ultimately erode confidence in the US and will actually IRONICALLY drive interest rates higher - the opposite of Trumps intention - HENCE THE MARKET SELL OFF for #BTC & Altcoins yesterday

The #FOMC committee has a MANDATE which includes controlling price inflation.

@Trump is trying to ignore the mandate and remove FED independence, which cannot be a good thing as it will ultimately erode confidence in the US and will actually IRONICALLY drive interest rates higher - the opposite of Trumps intention - HENCE THE MARKET SELL OFF for #BTC & Altcoins yesterday

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING 🚨

🇺🇸 The Federal Reserve has cut interest rates by 25 bps.

Markets will be watching closely to see how this move impacts stocks, bonds, and crypto sentiment. 📊

💭 Do you think this is the start of a longer easing cycle?

#FED #InterestRates #Macro #Finance #Crypto

🇺🇸 The Federal Reserve has cut interest rates by 25 bps.

Markets will be watching closely to see how this move impacts stocks, bonds, and crypto sentiment. 📊

💭 Do you think this is the start of a longer easing cycle?

#FED #InterestRates #Macro #Finance #Crypto

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

2.78K Popularity

66.09K Popularity

24.43K Popularity

8.69K Popularity

7.98K Popularity

7.62K Popularity

6.62K Popularity

6.34K Popularity

72.91K Popularity

19.32K Popularity

81.37K Popularity

22.94K Popularity

48.78K Popularity

43.25K Popularity

195.77K Popularity

News

View MoreEthereum mainnet launches AI agent economy standard, ERC-8004 ushers in a new paradigm of decentralized artificial intelligence

17 m

Data: 54.2 BTC transferred out from Cumberland DRW, worth approximately $2.76 million

22 m

Bitcoin remains steady above $89,000, as the market waits with bated breath for the Federal Reserve's statement and Mag 7 earnings report.

29 m

"Heavy Long Position on Precious Metals" Whale once again goes long on silver, bullish on the future market, with monthly profits exceeding $1.2 million, doubling the principal.

29 m

Arthur Hayes Analysis: How Trump's Tariffs and Exchange Rate Policies Affect Bitcoin Trends

44 m

Pin