# GrayscaleEyesAVESpotETFConversion

5.42K

User_any

#GrayscaleEyesAVESpotETFConversion

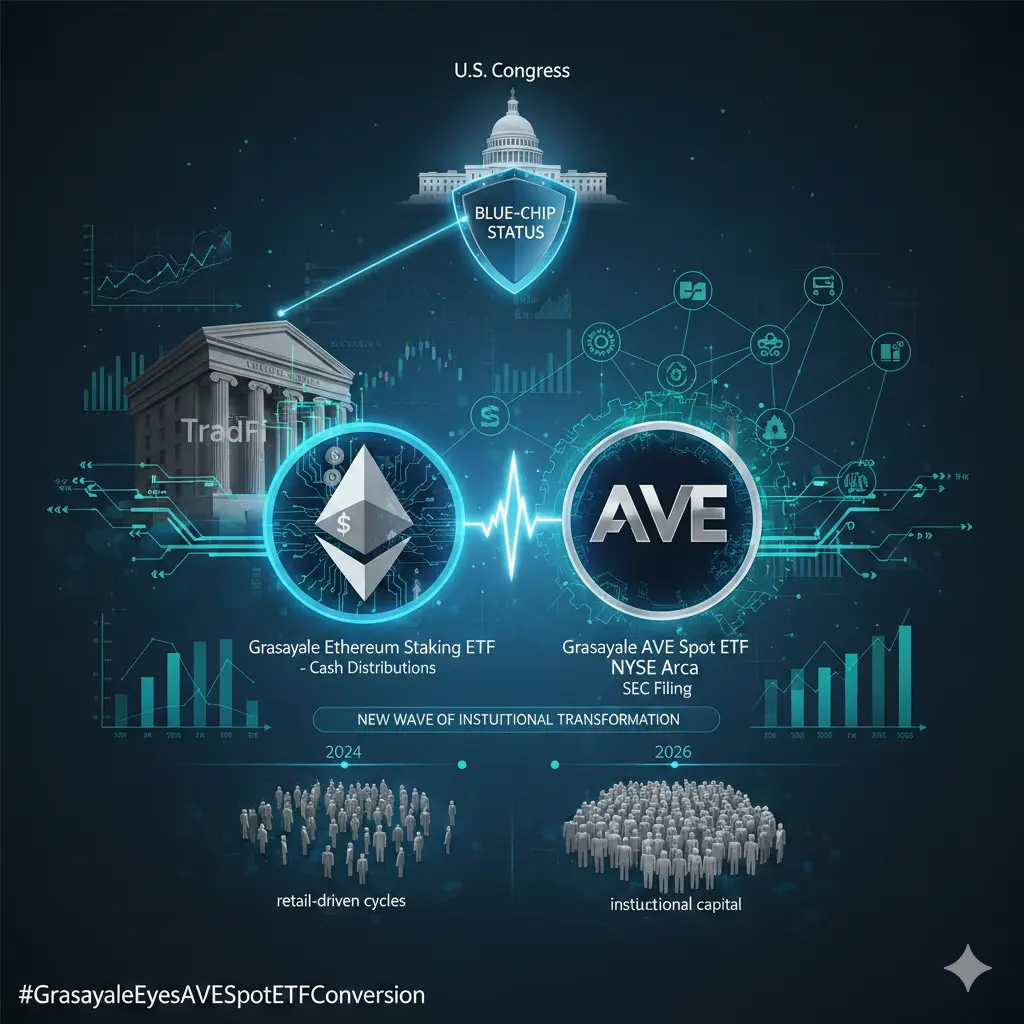

Grayscale, one of the world's largest crypto asset managers, has taken action to create a spot ETF based on its Aave ($AAVE) token! The company has filed an S-1 registration statement with the US Securities and Exchange Commission (SEC) to convert its existing Grayscale Aave Trust (currently a closed-end fund traded on OTC markets) into a spot exchange-traded fund (ETF). The application was filed on February 13, 2026. If approved:

The ETF will be listed on the NYSE Arca exchange.

Coinbase will act as both the custodian and the main underwriter.

The sponsorsh

Grayscale, one of the world's largest crypto asset managers, has taken action to create a spot ETF based on its Aave ($AAVE) token! The company has filed an S-1 registration statement with the US Securities and Exchange Commission (SEC) to convert its existing Grayscale Aave Trust (currently a closed-end fund traded on OTC markets) into a spot exchange-traded fund (ETF). The application was filed on February 13, 2026. If approved:

The ETF will be listed on the NYSE Arca exchange.

Coinbase will act as both the custodian and the main underwriter.

The sponsorsh

AAVE8,05%

- Reward

- 13

- 4

- Repost

- Share

PandaX :

:

2026 GOGOGO 👊View More

#GrayscaleEyesAVESpotETFConversion A New Phase for DeFi in Traditional Markets 📈

Reports that Grayscale Investments is exploring a potential AAVE Spot ETF conversion have sparked serious discussion across crypto and traditional finance. This is not just another headline — it reflects a possible shift in how decentralized finance assets are viewed by institutional investors.

If this move materializes, it could become one of the first major steps toward bringing leading DeFi tokens like Aave into regulated investment structures.

🌍 Why This Matters for the Market

A potential AAVE Spot ETF woul

Reports that Grayscale Investments is exploring a potential AAVE Spot ETF conversion have sparked serious discussion across crypto and traditional finance. This is not just another headline — it reflects a possible shift in how decentralized finance assets are viewed by institutional investors.

If this move materializes, it could become one of the first major steps toward bringing leading DeFi tokens like Aave into regulated investment structures.

🌍 Why This Matters for the Market

A potential AAVE Spot ETF woul

- Reward

- like

- Comment

- Repost

- Share

#GrayscaleEyesAVESpotETFConversion \nGrayscale is reportedly exploring a potential AAVE Spot ETF conversion — and that’s more than just another filing headline.\n\nIf realized, this move could signal a deeper shift:\n\n• Institutional access expanding beyond BTC and ETH\n• DeFi assets entering regulated investment channels\n• Increased legitimacy for AAVE as a macro asset\n• Potential liquidity inflows from traditional markets\n\nBut ETF narratives are rarely linear.\n\nApproval speculation can drive price momentum.\nDelays or rejections can trigger sharp reversals.\n\nThe real questions are:\

- Reward

- 6

- 4

- Repost

- Share

ProfitQueen :

:

Ape In 🚀View More

#GrayscaleEyesAVESpotETFConversion

The digital asset market is closely watching a major institutional development as Grayscale explores a potential spot ETF conversion for AAVE, signaling another step toward deeper integration between decentralized finance (DeFi) and traditional financial markets. This move reflects a broader trend where institutional players are increasingly seeking regulated investment vehicles that provide direct exposure to crypto assets beyond Bitcoin and Ethereum. If approved, a spot AAVE ETF could mark a significant milestone for DeFi adoption, institutional participat

The digital asset market is closely watching a major institutional development as Grayscale explores a potential spot ETF conversion for AAVE, signaling another step toward deeper integration between decentralized finance (DeFi) and traditional financial markets. This move reflects a broader trend where institutional players are increasingly seeking regulated investment vehicles that provide direct exposure to crypto assets beyond Bitcoin and Ethereum. If approved, a spot AAVE ETF could mark a significant milestone for DeFi adoption, institutional participat

- Reward

- 3

- 1

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Innovate and reform, follow the natural order and respond to the people's needs#GrayscaleEyesAVESpotETFConversion

A New Phase for DeFi in Traditional Markets

Reports that Grayscale Investments is exploring a potential AAVE Spot ETF conversion have sparked serious discussion across crypto and traditional finance. This is not just another headline—it reflects a possible shift in how decentralized finance assets are viewed by institutional investors.

If this move materializes, it could mark one of the first major steps toward bringing DeFi tokens into regulated investment structures.

Why This Matters for the Market

A potential AAVE Spot ETF would represent more than just

A New Phase for DeFi in Traditional Markets

Reports that Grayscale Investments is exploring a potential AAVE Spot ETF conversion have sparked serious discussion across crypto and traditional finance. This is not just another headline—it reflects a possible shift in how decentralized finance assets are viewed by institutional investors.

If this move materializes, it could mark one of the first major steps toward bringing DeFi tokens into regulated investment structures.

Why This Matters for the Market

A potential AAVE Spot ETF would represent more than just

- Reward

- 1

- 2

- Repost

- Share

Lock_433 :

:

LFG 🔥View More

#GrayscaleEyesAVESpotETFConversion

Grayscale Investments, a leading digital asset management firm, is once again making waves in the cryptocurrency space. The firm has officially filed for the conversion of its flagship Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin Exchange-Traded Fund (ETF), a move that could reshape institutional access to digital assets and influence market dynamics significantly.

For years, GBTC has provided investors with a vehicle to gain exposure to Bitcoin without directly purchasing or managing the underlying asset. However, it has often traded at a discount or

Grayscale Investments, a leading digital asset management firm, is once again making waves in the cryptocurrency space. The firm has officially filed for the conversion of its flagship Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin Exchange-Traded Fund (ETF), a move that could reshape institutional access to digital assets and influence market dynamics significantly.

For years, GBTC has provided investors with a vehicle to gain exposure to Bitcoin without directly purchasing or managing the underlying asset. However, it has often traded at a discount or

BTC1,38%

- Reward

- 10

- 16

- Repost

- Share

CryptoDaisy :

:

2026 GOGOGO 👊View More

#GrayscaleEyesAVESpotETFConversion 🚀

The crypto market may soon witness another pivotal development as Grayscale signals interest in converting its AAVE-related product into a Spot ETF. This move, if realized, could represent a major step forward not only for AAVE but also for the broader DeFi ecosystem.

For years, institutional investors have been looking for safer, regulated entry points into crypto assets. Spot ETFs provide exactly that — offering direct exposure without the complexities of self-custody, private keys, or on-chain management. With Grayscale exploring the possibility of an A

The crypto market may soon witness another pivotal development as Grayscale signals interest in converting its AAVE-related product into a Spot ETF. This move, if realized, could represent a major step forward not only for AAVE but also for the broader DeFi ecosystem.

For years, institutional investors have been looking for safer, regulated entry points into crypto assets. Spot ETFs provide exactly that — offering direct exposure without the complexities of self-custody, private keys, or on-chain management. With Grayscale exploring the possibility of an A

- Reward

- 9

- 13

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊View More

#GrayscaleEyesAVESpotETFConversion

Grayscale Investments, one of the largest digital asset management firms, is reportedly considering the conversion of its AVE (Aave) holdings into a spot ETF, signaling a potentially significant shift in the way institutional and retail investors gain exposure to decentralized finance (DeFi) tokens. This move comes at a pivotal time in the cryptocurrency market, as regulators, institutional participants, and market infrastructure increasingly converge around the concept of regulated, transparent, and easily accessible crypto investment products. A spot ETF w

Grayscale Investments, one of the largest digital asset management firms, is reportedly considering the conversion of its AVE (Aave) holdings into a spot ETF, signaling a potentially significant shift in the way institutional and retail investors gain exposure to decentralized finance (DeFi) tokens. This move comes at a pivotal time in the cryptocurrency market, as regulators, institutional participants, and market infrastructure increasingly converge around the concept of regulated, transparent, and easily accessible crypto investment products. A spot ETF w

- Reward

- 2

- Comment

- Repost

- Share

#GrayscaleEyesAVESpotETFConversion

As of February 14, 2026, the discussion around #GrayscaleEyesAVESpotETFConversion highlights a significant development in the digital asset investment space. Grayscale Investments has submitted a filing with the U.S. Securities and Exchange Commission (SEC) to convert its existing AAVE Trust into a spot exchange-traded fund (ETF). This proposed conversion would allow investors to gain direct exposure to Aave (AVE) through a regulated ETF structure, rather than through trust shares, offering greater transparency, liquidity, and accessibility.

Spot ETFs differ

As of February 14, 2026, the discussion around #GrayscaleEyesAVESpotETFConversion highlights a significant development in the digital asset investment space. Grayscale Investments has submitted a filing with the U.S. Securities and Exchange Commission (SEC) to convert its existing AAVE Trust into a spot exchange-traded fund (ETF). This proposed conversion would allow investors to gain direct exposure to Aave (AVE) through a regulated ETF structure, rather than through trust shares, offering greater transparency, liquidity, and accessibility.

Spot ETFs differ

- Reward

- 9

- 11

- Repost

- Share

CryptoChampion :

:

To The Moon 🌕View More

#GrayscaleEyesAVESpotETFConversion

Grayscale’s Strategic Pivot: The Evolution of Ethereum and AAVE Spot ETFs

The landscape of crypto asset management is undergoing a profound transformation as Grayscale’s strategy to modernize its financial products reaches a new dimension. Specifically, the steps taken toward the Ethereum and Decentralized Finance (DeFi) ecosystems are fundamentally reshaping how institutional investors perceive digital assets.

Here are the most current reflections of this transition and its impact on the institutional market:

A New Wave of Institutional Transformation

Follo

Grayscale’s Strategic Pivot: The Evolution of Ethereum and AAVE Spot ETFs

The landscape of crypto asset management is undergoing a profound transformation as Grayscale’s strategy to modernize its financial products reaches a new dimension. Specifically, the steps taken toward the Ethereum and Decentralized Finance (DeFi) ecosystems are fundamentally reshaping how institutional investors perceive digital assets.

Here are the most current reflections of this transition and its impact on the institutional market:

A New Wave of Institutional Transformation

Follo

- Reward

- 29

- 24

- Repost

- Share

Sand谋3S :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

88.49K Popularity

7.72K Popularity

7.99K Popularity

54.96K Popularity

4.42K Popularity

261.71K Popularity

256.62K Popularity

17.12K Popularity

5.42K Popularity

3.91K Popularity

3.82K Popularity

4.03K Popularity

3.95K Popularity

32.65K Popularity

News

View MoreSPACE increased by 100.85% after launching Alpha, current price is 0.013050662431344185 USDT

27 m

Data: 149.19 BTC transferred from an anonymous address, then routed through a relay and sent to another anonymous address

1 h

Data: If ETH drops below $1,977, the total long liquidation strength on major CEXs will reach $700 million.

5 h

The probability that the Federal Reserve will keep interest rates unchanged in March is currently reported at 90.8%.

7 h

In the past 24 hours, the entire network's contract liquidations reached $144 million, mainly from short positions.

8 h

Pin