# FranklinAdvancesTokenizedMMFs

1.77K

MissCrypto

#FranklinAdvancesTokenizedMMFs

Institutional Finance Meets Blockchain Infrastructure

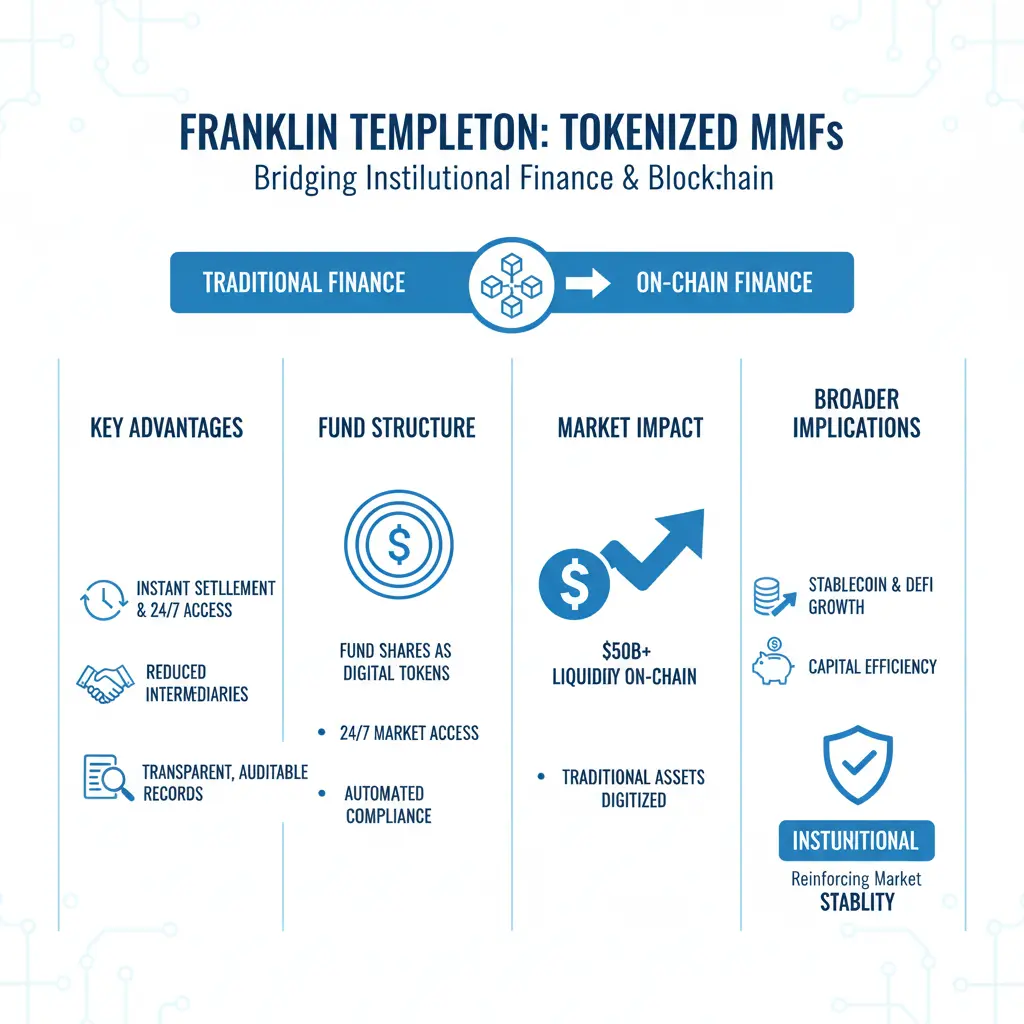

Franklin Templeton’s expansion of tokenized Money Market Funds (MMFs) marks a defining step in the convergence of traditional finance and blockchain technology. This development is not a digital experiment—it represents structural modernization of capital markets, where regulated, high-liquidity financial instruments are being integrated directly into on-chain ecosystems.

1️⃣ Blockchain-Based MMF Expansion

By deploying MMFs on distributed ledger infrastructure, Franklin Templeton is transforming traditional se

Institutional Finance Meets Blockchain Infrastructure

Franklin Templeton’s expansion of tokenized Money Market Funds (MMFs) marks a defining step in the convergence of traditional finance and blockchain technology. This development is not a digital experiment—it represents structural modernization of capital markets, where regulated, high-liquidity financial instruments are being integrated directly into on-chain ecosystems.

1️⃣ Blockchain-Based MMF Expansion

By deploying MMFs on distributed ledger infrastructure, Franklin Templeton is transforming traditional se

- Reward

- 1

- Comment

- Repost

- Share

#FranklinAdvancesTokenizedMMFs

The news that Franklin Templeton is advancing tokenized money market funds (MMFs) is a strong signal that traditional finance is actively exploring the next phase of digital asset innovation. This is not just about experimentation; it’s about bridging institutional-grade finance with blockchain efficiency, and it carries important implications for both retail and professional participants.

Why this development matters:

Institutional adoption of blockchain-native products: Money market funds have traditionally been conservative instruments

safe, liquid, and stab

The news that Franklin Templeton is advancing tokenized money market funds (MMFs) is a strong signal that traditional finance is actively exploring the next phase of digital asset innovation. This is not just about experimentation; it’s about bridging institutional-grade finance with blockchain efficiency, and it carries important implications for both retail and professional participants.

Why this development matters:

Institutional adoption of blockchain-native products: Money market funds have traditionally been conservative instruments

safe, liquid, and stab

DEFI0,81%

- Reward

- 5

- 8

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#FranklinAdvancesTokenizedMMFs

Today’s markets are evolving in ways that feel like history in the making and the news that Franklin is advancing tokenized money market funds (MMFs) is one of those developments that could quietly reshape the industry. Traditionally, money market funds have been a cornerstone of conservative capital management: stable, liquid, and trusted by institutions and retail investors alike. But when a well‑established financial firm starts exploring tokenized versions of these instruments, it signals something deeper a bridge between mainstream finance and digital ass

Today’s markets are evolving in ways that feel like history in the making and the news that Franklin is advancing tokenized money market funds (MMFs) is one of those developments that could quietly reshape the industry. Traditionally, money market funds have been a cornerstone of conservative capital management: stable, liquid, and trusted by institutions and retail investors alike. But when a well‑established financial firm starts exploring tokenized versions of these instruments, it signals something deeper a bridge between mainstream finance and digital ass

- Reward

- 5

- 7

- Repost

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

Money market fund tokens—robust assets also want "speed and passion"

Money market funds have long been regarded as "wealth management tools," but their drawbacks are slow settlement and limited use cases. After tokenization, fund shares can circulate on the chain like stablecoins, which means traditional cash management tools gain Web3 liquidity wings.

Franklin's move may be aimed at institutional-level application scenarios. Imagine: corporate fund management, cross-border settlements, on-chain collateralization—all can directly access the income assets of the money market fund, instead of le

View OriginalMoney market funds have long been regarded as "wealth management tools," but their drawbacks are slow settlement and limited use cases. After tokenization, fund shares can circulate on the chain like stablecoins, which means traditional cash management tools gain Web3 liquidity wings.

Franklin's move may be aimed at institutional-level application scenarios. Imagine: corporate fund management, cross-border settlements, on-chain collateralization—all can directly access the income assets of the money market fund, instead of le

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- 2

- Repost

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

When money market funds meet blockchain, what game is Franklin playing next?

Franklin is promoting the tokenization of money funds, which is not simply about "bringing funds onto the chain," but about reconstructing the way traditional assets circulate. Money market funds are inherently low-risk, highly liquid cash management tools, making them a natural fit with blockchain's efficient clearing. Once tokenized, fund shares can achieve near real-time settlement, 24/7 trading, and even be used for on-chain collateral and payment scenarios.

This reveals a trend: traditional financial institutions

View OriginalFranklin is promoting the tokenization of money funds, which is not simply about "bringing funds onto the chain," but about reconstructing the way traditional assets circulate. Money market funds are inherently low-risk, highly liquid cash management tools, making them a natural fit with blockchain's efficient clearing. Once tokenized, fund shares can achieve near real-time settlement, 24/7 trading, and even be used for on-chain collateral and payment scenarios.

This reveals a trend: traditional financial institutions

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 1

- Repost

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴Why did Franklin choose money market funds amid the rising RWA track?

Tokenization of Real World Assets (RWA) is becoming increasingly popular, and money market funds are an excellent entry point. The reasons are very practical: simple asset structure, low risk, stable prices, and very suitable for on-chain mapping. Compared to complex assets like real estate and private equity, money market funds are more like "standardized commodities."

Franklin promotes this direction to test blockchain technology while avoiding excessive risk, making it a smart incremental strategy. Starting with low-volat

Tokenization of Real World Assets (RWA) is becoming increasingly popular, and money market funds are an excellent entry point. The reasons are very practical: simple asset structure, low risk, stable prices, and very suitable for on-chain mapping. Compared to complex assets like real estate and private equity, money market funds are more like "standardized commodities."

Franklin promotes this direction to test blockchain technology while avoiding excessive risk, making it a smart incremental strategy. Starting with low-volat

RWA2,07%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 3

- Repost

- Share

Ryakpanda :

:

Happy New Year 🧨View More

Is the wave of tokenization something ordinary investors should get excited about?

When hearing about "fund tokenization," many people think of new opportunities, but from a rational perspective, it's more like an upgrade to industry infrastructure rather than a short-term profit window. It enhances efficiency, transparency, and composability, rather than returns themselves.

For ordinary investors, the real significance lies in the potential change in future financial management methods: funds can be flexibly called on-chain, and yield assets can participate in more financial scenarios. But th

View OriginalWhen hearing about "fund tokenization," many people think of new opportunities, but from a rational perspective, it's more like an upgrade to industry infrastructure rather than a short-term profit window. It enhances efficiency, transparency, and composability, rather than returns themselves.

For ordinary investors, the real significance lies in the potential change in future financial management methods: funds can be flexibly called on-chain, and yield assets can participate in more financial scenarios. But th

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 4

- 4

- Repost

- Share

Ryakpanda :

:

Good luck and prosperity 🧧View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

11.18K Popularity

5.06K Popularity

2.09K Popularity

33.67K Popularity

248.03K Popularity

140.82K Popularity

2.01K Popularity

2.63K Popularity

1.18K Popularity

1.77K Popularity

120.25K Popularity

24.97K Popularity

21.4K Popularity

14.58K Popularity

1.58K Popularity

News

View MoreWorld Gold Council: In January, China's gold ETF inflows reached 44 billion RMB, setting a new record for the start of the year

8 m

ETH Breaks Through 2000 USDT

12 m

The Hong Kong Monetary Authority lists tokenization as a key focus area for 2026, supporting the sustainable and responsible development of digital assets.

20 m

Bitcoin mining company Cango completes $10.5 million equity financing and receives an additional $65 million investment commitment

32 m

Data: 238.44 BTC transferred from an anonymous address, then routed through a relay and sent to another anonymous address

40 m

Pin