# FedLeadershipImpact

9.95K

Macro expectations are back in focus. How much do they influence your crypto decisions at this stage?

AylaShinex

#FedLeadershipImpact #FedLeadershipImpact 🏦⚡

When Fed leadership shifts, markets don’t just react — they reprice the future.

2026 is proving that monetary tone matters more than ever. A hawkish stance strengthens the dollar, pressures risk assets, and tightens liquidity. A dovish pivot injects confidence, fuels equities, and often reignites crypto momentum.

Bitcoin and Ethereum are no longer isolated from macro. They move with yields, inflation expectations, and policy guidance.

Here’s what traders should watch:

🔹 Forward guidance on rate cuts or pauses

🔹 Treasury yield movement (10Y is key

When Fed leadership shifts, markets don’t just react — they reprice the future.

2026 is proving that monetary tone matters more than ever. A hawkish stance strengthens the dollar, pressures risk assets, and tightens liquidity. A dovish pivot injects confidence, fuels equities, and often reignites crypto momentum.

Bitcoin and Ethereum are no longer isolated from macro. They move with yields, inflation expectations, and policy guidance.

Here’s what traders should watch:

🔹 Forward guidance on rate cuts or pauses

🔹 Treasury yield movement (10Y is key

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Why Federal Reserve Leadership Changes Matter for Crypto & Risk Assets

Markets are not just reacting to data anymore —

they are reacting to who controls the narrative and decision-making at the Federal Reserve.

Fed leadership shifts don’t change policy overnight,

but they reshape expectations, and expectations move markets first.

🏦 1) Why Fed Leadership Is a Big Deal

The Federal Reserve is not only a rate-setting body — it is the anchor of global liquidity.

A change in leadership signals: • Potential shift in policy philosophy

• Different tolerance for inflation vs growth

• New communication

Markets are not just reacting to data anymore —

they are reacting to who controls the narrative and decision-making at the Federal Reserve.

Fed leadership shifts don’t change policy overnight,

but they reshape expectations, and expectations move markets first.

🏦 1) Why Fed Leadership Is a Big Deal

The Federal Reserve is not only a rate-setting body — it is the anchor of global liquidity.

A change in leadership signals: • Potential shift in policy philosophy

• Different tolerance for inflation vs growth

• New communication

- Reward

- 2

- 3

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

#FedLeadershipImpact

Fed Leadership Impact: Macro Expectations and How They Are Shaping Crypto Markets in February

Macro expectations are once again dominating market sentiment, and the focus is firmly on Federal Reserve leadership, policy decisions, and forward guidance. For crypto markets, which remain highly sensitive to global liquidity conditions, interest rate shifts, and investor risk appetite, Fed signals can have an outsized influence. After January’s volatility and broad deleveraging, market participants are acutely aware that macro factors are no longer abstract they directly affec

Fed Leadership Impact: Macro Expectations and How They Are Shaping Crypto Markets in February

Macro expectations are once again dominating market sentiment, and the focus is firmly on Federal Reserve leadership, policy decisions, and forward guidance. For crypto markets, which remain highly sensitive to global liquidity conditions, interest rate shifts, and investor risk appetite, Fed signals can have an outsized influence. After January’s volatility and broad deleveraging, market participants are acutely aware that macro factors are no longer abstract they directly affec

- Reward

- 5

- 9

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

#FedLeadershipImpact The leadership of the US Federal Reserve continues to act as a central gravitational force for global financial markets, influencing capital flows, risk sentiment, and long-term investment behavior. As markets move deeper into a data-driven and expectation-sensitive environment, Fed leadership is no longer judged solely by interest rate decisions, but by credibility, consistency, and strategic foresight. In the current cycle, even subtle shifts in tone can reshape narratives across equities, bonds, commodities, and digital assets.

At the foundation of this influence lies t

At the foundation of this influence lies t

BTC1,58%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#FedLeadershipImpact The leadership of the US Federal Reserve continues to act as a central gravitational force for global financial markets, influencing capital flows, risk sentiment, and long-term investment behavior. As markets move deeper into a data-driven and expectation-sensitive environment, Fed leadership is no longer judged solely by interest rate decisions, but by credibility, consistency, and strategic foresight. In the current cycle, even subtle shifts in tone can reshape narratives across equities, bonds, commodities, and digital assets.

At the foundation of this influence lies t

At the foundation of this influence lies t

BTC1,58%

- Reward

- 6

- 3

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More

#FedLeadershipImpact The leadership of the US Federal Reserve continues to act as a central gravitational force for global financial markets, influencing capital flows, risk sentiment, and long-term investment behavior. As markets move deeper into a data-driven and expectation-sensitive environment, Fed leadership is no longer judged solely by interest rate decisions, but by credibility, consistency, and strategic foresight. In the current cycle, even subtle shifts in tone can reshape narratives across equities, bonds, commodities, and digital assets.

At the foundation of this influence lies t

At the foundation of this influence lies t

BTC1,58%

- Reward

- 8

- 11

- Repost

- Share

AylaShinex :

:

Buy To Earn 💎View More

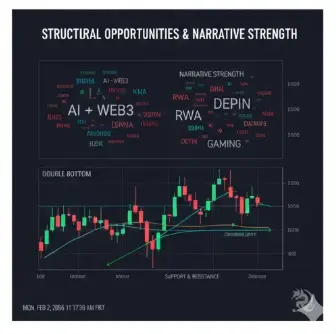

#FedLeadershipImpact 🪶 AYATTAC Rising star top1 ranking Take: Macro Expectations Back in Focus 📊

🔹 The Human Insight

The "crypto-only" bubble has burst—not in terms of price, but in terms of narrative. Macro signals are aggressively re-entering the spotlight, dictating the pace of the current cycle. We are no longer just watching candles; we are watching liquidity flows, interest rates, and the pulse of global risk-on sentiment.

📊 Main Market Analysis

1. On-Chain & Price Structure

BTC: Maintaining a strong foothold near the $29.5K–$30K support zone.

ETH: Demonstrating resilient accumulatio

🔹 The Human Insight

The "crypto-only" bubble has burst—not in terms of price, but in terms of narrative. Macro signals are aggressively re-entering the spotlight, dictating the pace of the current cycle. We are no longer just watching candles; we are watching liquidity flows, interest rates, and the pulse of global risk-on sentiment.

📊 Main Market Analysis

1. On-Chain & Price Structure

BTC: Maintaining a strong foothold near the $29.5K–$30K support zone.

ETH: Demonstrating resilient accumulatio

- Reward

- 12

- 18

- Repost

- Share

AylaShinex :

:

Buy To Earn 💎View More

#FedLeadershipImpact Fed Leadership Impact on Global Markets and Crypto Outlook

The leadership of the Federal Reserve plays a critical role in shaping global financial markets. Changes in tone, policy direction, or leadership expectations at the Fed often trigger immediate reactions across equities, bonds, commodities, and the crypto market. As investors closely watch signals from the central bank, Fed leadership impact has become one of the most important macro themes influencing market behavior.

At the core of this impact is monetary policy control. The Federal Reserve sets interest rates an

The leadership of the Federal Reserve plays a critical role in shaping global financial markets. Changes in tone, policy direction, or leadership expectations at the Fed often trigger immediate reactions across equities, bonds, commodities, and the crypto market. As investors closely watch signals from the central bank, Fed leadership impact has become one of the most important macro themes influencing market behavior.

At the core of this impact is monetary policy control. The Federal Reserve sets interest rates an

BTC1,58%

- Reward

- 6

- 10

- Repost

- Share

Luna_Star :

:

Buy To Earn 💎View More

#FedLeadershipImpact The recent wave of volatility across global markets has been driven less by price action itself and more by a sudden shift in expectations around monetary leadership. The nomination of Kevin Warsh as the next Federal Reserve Chair has introduced a powerful uncertainty premium, forcing investors to reassess not just interest rate trajectories, but the philosophy that may guide monetary policy in the coming years. Markets are rarely afraid of tightening alone; they are afraid of not knowing how far and how fast that tightening may go.

The concept of a “Warsh Effect” is now b

The concept of a “Warsh Effect” is now b

BTC1,58%

- Reward

- 3

- 1

- Repost

- Share

LittleQueen :

:

Buy To Earn 💎#FedLeadershipImpact 📊 Macro Meets Crypto: February Check-In

After months of crypto-focused narratives, macro trends are back in the spotlight. Interest rates, inflation data, and global liquidity are once again influencing market sentiment — not just traditional markets, but digital assets too.

🔥 Why it matters for crypto:

Bitcoin & Ethereum correlations: BTC often reacts to macro shifts like rate hikes or liquidity tightening.

DeFi and Lending: Borrowing costs, stablecoin yields, and liquidity incentives are increasingly affected by global financial conditions.

Investor behavior: Risk appe

After months of crypto-focused narratives, macro trends are back in the spotlight. Interest rates, inflation data, and global liquidity are once again influencing market sentiment — not just traditional markets, but digital assets too.

🔥 Why it matters for crypto:

Bitcoin & Ethereum correlations: BTC often reacts to macro shifts like rate hikes or liquidity tightening.

DeFi and Lending: Borrowing costs, stablecoin yields, and liquidity incentives are increasingly affected by global financial conditions.

Investor behavior: Risk appe

- Reward

- 7

- 4

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

381.11K Popularity

10.23K Popularity

9.95K Popularity

5.66K Popularity

4.02K Popularity

6.41K Popularity

3.83K Popularity

4.43K Popularity

2.23K Popularity

43 Popularity

55.09K Popularity

69.55K Popularity

20.7K Popularity

27.02K Popularity

201.91K Popularity

News

View MoreCircle has increased the issuance of 750 million USDC on the Solana network.

34 m

Circle Transfers 750 Million USDC

39 m

Argentine cryptocurrency scam suspect arrested in Venezuela after allegedly fleeing with $56 million worth of Bitcoin

47 m

Data: The only group currently continuing to buy is the mega whales holding over 1,000 BTC. Retail investors holding less than 10 BTC have been continuously selling for a month.

1 h

Sky Protocol used a total of 8.5 million USDS to repurchase 130 million SKY in January.

1 h

Pin