# CryptoVolatility

2.11K

BeautifulDay

📊 #FUDEmotionalDisturbance | Crypto Market Sentiment Alert ⚠️

Fear, Uncertainty, and Doubt (FUD) is creating emotional turbulence among traders, impacting decision-making in Bitcoin, Ethereum, and broader crypto markets. Sudden news, rumors, or regulatory chatter can amplify volatility even without major fundamental changes.

🔍 Key Insights:

• Market psychology matters: Emotional reactions often trigger exaggerated price swings

• Short-term volatility: Traders should distinguish between genuine risks and FUD-driven noise

• Long-term perspective: Institutional flows and on-chain data often rev

Fear, Uncertainty, and Doubt (FUD) is creating emotional turbulence among traders, impacting decision-making in Bitcoin, Ethereum, and broader crypto markets. Sudden news, rumors, or regulatory chatter can amplify volatility even without major fundamental changes.

🔍 Key Insights:

• Market psychology matters: Emotional reactions often trigger exaggerated price swings

• Short-term volatility: Traders should distinguish between genuine risks and FUD-driven noise

• Long-term perspective: Institutional flows and on-chain data often rev

- Reward

- 4

- 4

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

📊 #BTC/ETHVolatilityIntensifies | Crypto Market Update ⚡

Bitcoin (BTC) and Ethereum (ETH) are experiencing heightened volatility as markets react to macro events, ETF flows, and profit-taking rotations. Price swings have intensified, testing both support and resistance levels across key trading zones.

🔍 Market Highlights:

• BTC: Consolidating near critical support zones; short-term swings driven by ETF inflows and macro sentiment

• ETH: Showing increased correlation with BTC, but with sharper intraday moves due to DeFi and staking news

• Volatility indicators: Rising, signaling potential opp

Bitcoin (BTC) and Ethereum (ETH) are experiencing heightened volatility as markets react to macro events, ETF flows, and profit-taking rotations. Price swings have intensified, testing both support and resistance levels across key trading zones.

🔍 Market Highlights:

• BTC: Consolidating near critical support zones; short-term swings driven by ETF inflows and macro sentiment

• ETH: Showing increased correlation with BTC, but with sharper intraday moves due to DeFi and staking news

• Volatility indicators: Rising, signaling potential opp

ETH0,77%

MC:$3.43KHolders:1

0.00%

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

The recent price action of FHE Token highlights a period of extreme volatility, reminding traders and investors how quickly sentiment can shift in fast-moving markets. Sharp fluctuations often reflect low liquidity, rapid speculation, or heightened reaction to news and market momentum.

During such phases, disciplined risk management becomes essential. Avoid emotional decisions, stay aware of market conditions, and prioritize strategy over hype. Volatility can create opportunities — but only for those who approach it with caution and clarity.

Staying informed and maintaining a long-term perspec

During such phases, disciplined risk management becomes essential. Avoid emotional decisions, stay aware of market conditions, and prioritize strategy over hype. Volatility can create opportunities — but only for those who approach it with caution and clarity.

Staying informed and maintaining a long-term perspec

FHE-41,58%

- Reward

- 15

- 8

- Repost

- Share

NovaCryptoGirl :

:

HODL Tight 💪View More

#WeekendMarketAnalysis Bitcoin has pulled back once again, losing the key $95,000 support level. This breakdown has triggered short-term uncertainty and increased volatility, especially across lower timeframes.

From a structural perspective, this move appears more like a liquidity-driven reset rather than a definitive trend reversal. Support breaks often trigger stop-loss cascades and leverage liquidations, temporarily exaggerating downside pressure.

If BTC can reclaim the $95k–$96k zone with volume, this dip may be remembered as a classic shakeout. Failure to do so could lead to extended cons

From a structural perspective, this move appears more like a liquidity-driven reset rather than a definitive trend reversal. Support breaks often trigger stop-loss cascades and leverage liquidations, temporarily exaggerating downside pressure.

If BTC can reclaim the $95k–$96k zone with volume, this dip may be remembered as a classic shakeout. Failure to do so could lead to extended cons

BTC-0,01%

- Reward

- 11

- 11

- Repost

- Share

MissCrypto :

:

Buy To Earn 💎View More

#FHETokenExtremeVolatility 🚨

Extreme volatility is not just noise — it’s information.

$FHE is currently experiencing sharp price swings, and while many see chaos, smart traders see opportunity backed by data and fundamentals.

📊 What’s driving the volatility?

• Sudden spikes in trading volume

• Rapid sentiment shifts across the market

• Liquidity movement from short-term traders

• Speculation around future development and adoption

⚡ Why FHE is worth watching closely:

FHE operates in a space where innovation meets scalability, and historically, assets with strong narratives often show high vol

Extreme volatility is not just noise — it’s information.

$FHE is currently experiencing sharp price swings, and while many see chaos, smart traders see opportunity backed by data and fundamentals.

📊 What’s driving the volatility?

• Sudden spikes in trading volume

• Rapid sentiment shifts across the market

• Liquidity movement from short-term traders

• Speculation around future development and adoption

⚡ Why FHE is worth watching closely:

FHE operates in a space where innovation meets scalability, and historically, assets with strong narratives often show high vol

FHE-41,58%

- Reward

- 8

- 7

- Repost

- Share

chartking :

:

goodView More

🚨 Powell Under Investigation? Markets on Alert

#FedWatch #MacroRisk #CryptoVolatility

Recent reports have sparked headlines around U.S. Fed Chair Jerome Powell and an alleged investigation tied to Fed HQ renovation spending.

⚠️ No verdict, no confirmation yet — but markets don’t wait for outcomes, they react to uncertainty.

📉 Why Markets Care The Federal Reserve runs on credibility and trust.

Even perceived governance risk can: • Shake investor confidence

• Increase volatility

• Delay risk-taking across markets

📊 Immediate Market Reaction 🔹 Stocks & Crypto: Sensitive to policy clarity → ch

#FedWatch #MacroRisk #CryptoVolatility

Recent reports have sparked headlines around U.S. Fed Chair Jerome Powell and an alleged investigation tied to Fed HQ renovation spending.

⚠️ No verdict, no confirmation yet — but markets don’t wait for outcomes, they react to uncertainty.

📉 Why Markets Care The Federal Reserve runs on credibility and trust.

Even perceived governance risk can: • Shake investor confidence

• Increase volatility

• Delay risk-taking across markets

📊 Immediate Market Reaction 🔹 Stocks & Crypto: Sensitive to policy clarity → ch

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

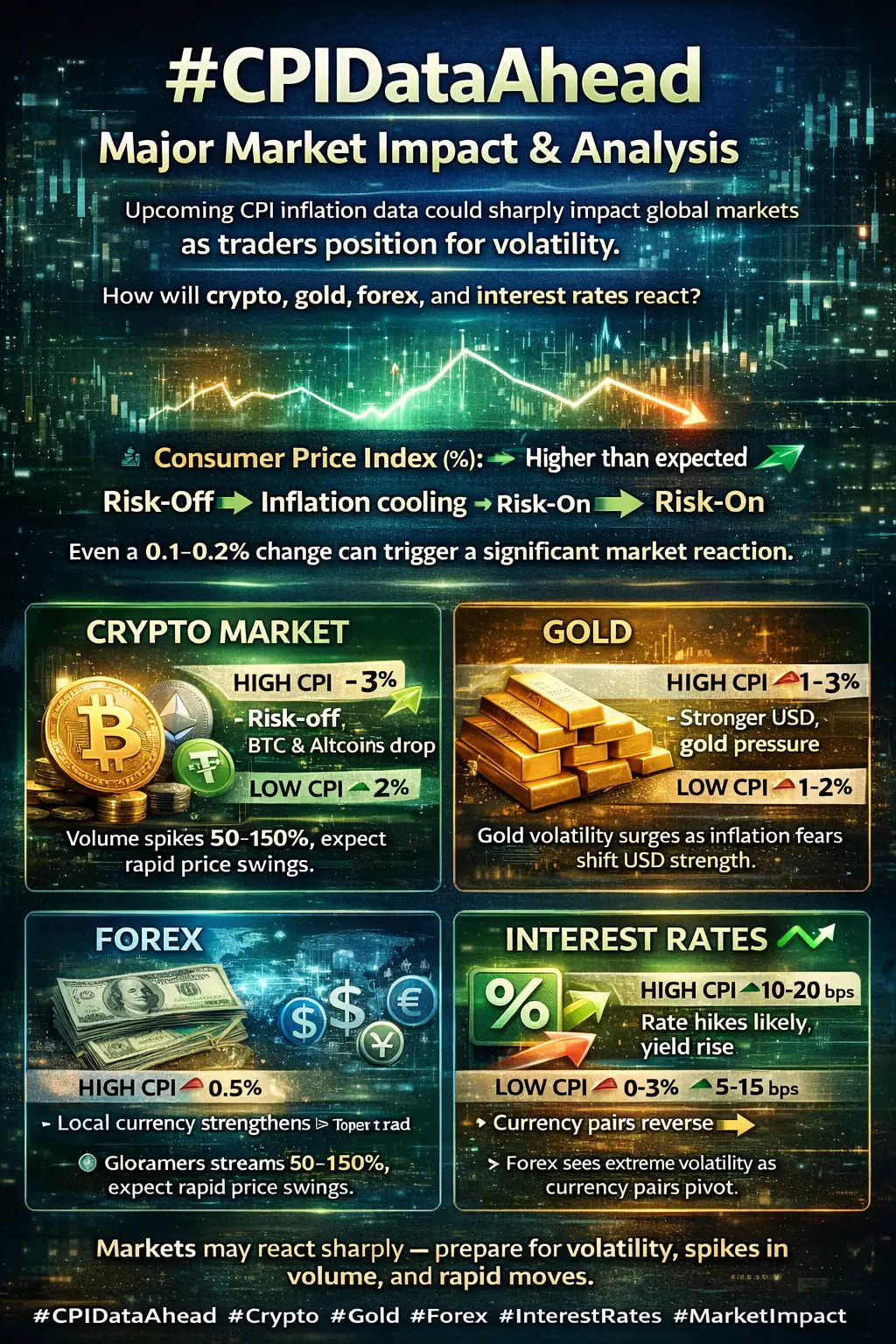

#CPIDataAhead

#CPIDataAhead

The Consumer Price Index (CPI) inflation data is about to be released, and global markets are preparing for a potentially volatile reaction. CPI measures the percentage change in prices of a basket of goods and services over a period and is considered one of the most critical economic indicators.

This data is closely watched because it affects not only central bank decisions but also risk sentiment, asset allocation, and market momentum across crypto, gold, forex, and interest rates.

🔍 Understanding CPI

CPI is published as a percentage, showing how much inflation

#CPIDataAhead

The Consumer Price Index (CPI) inflation data is about to be released, and global markets are preparing for a potentially volatile reaction. CPI measures the percentage change in prices of a basket of goods and services over a period and is considered one of the most critical economic indicators.

This data is closely watched because it affects not only central bank decisions but also risk sentiment, asset allocation, and market momentum across crypto, gold, forex, and interest rates.

🔍 Understanding CPI

CPI is published as a percentage, showing how much inflation

- Reward

- 25

- 26

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Buy To Earn 💎View More

#BitcoinDropsBelowKeyPriceLevel 📉 Bitcoin Drops Below a Key Price Level — What the Future May Hold 📉

Bitcoin slipping below a critical price zone has once again caught the market’s attention. While short-term sentiment may feel uncertain, history shows that key breakdowns often precede major structural shifts in the crypto market 🔍

Rather than panic, long-term participants are closely watching what this move could mean for the next phase of Bitcoin’s journey.

🔮 Future Outlook Scenarios:

Healthy Reset: Temporary weakness can flush out overleveraged positions and build a stronger base 🧱

Acc

Bitcoin slipping below a critical price zone has once again caught the market’s attention. While short-term sentiment may feel uncertain, history shows that key breakdowns often precede major structural shifts in the crypto market 🔍

Rather than panic, long-term participants are closely watching what this move could mean for the next phase of Bitcoin’s journey.

🔮 Future Outlook Scenarios:

Healthy Reset: Temporary weakness can flush out overleveraged positions and build a stronger base 🧱

Acc

BTC-0,01%

- Reward

- 3

- Comment

- Repost

- Share

Solana Short Liquidation Frenzy – $9.48K Wiped Out as SOL Surges Past $201!

In a high-stakes market shake-up, a $9,488.8 short position on Solana ($SOL ) was liquidated at $201.89, highlighting the intense battle between bulls and bears. This major liquidation event underscores Solana’s volatile nature, as traders navigate its rapid price movements. As one of the fastest-growing blockchain ecosystems, SOL continues to be a top contender in the crypto space, with its high-performance technology driving both adoption and speculation.

📈 What Led to This Massive Liquidation?

As SOL defied bearish

In a high-stakes market shake-up, a $9,488.8 short position on Solana ($SOL ) was liquidated at $201.89, highlighting the intense battle between bulls and bears. This major liquidation event underscores Solana’s volatile nature, as traders navigate its rapid price movements. As one of the fastest-growing blockchain ecosystems, SOL continues to be a top contender in the crypto space, with its high-performance technology driving both adoption and speculation.

📈 What Led to This Massive Liquidation?

As SOL defied bearish

- Reward

- 3

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

46.39K Popularity

28.63K Popularity

14.03K Popularity

61.84K Popularity

345.16K Popularity

9.69K Popularity

8.89K Popularity

17.78K Popularity

109.47K Popularity

22.26K Popularity

200.64K Popularity

19.02K Popularity

6.83K Popularity

15.21K Popularity

171.17K Popularity

News

View MoreResearcher warns: Don't expect institutions to push Bitcoin to $150,000

1 m

Trump and Rutte finalize "permanent" Greenland framework agreement, Europe urgently responds to sovereignty and tariff risks

2 m

Institutional funds may find it difficult to push Bitcoin to $150,000, researchers warn of a risk of falling back to $60,000

5 m

Whale starting with 0x9311 opens a new 20x leveraged BTC long position, with a position size of $11.24 million

6 m

Bitcoin experiences intense volatility triggering $625 million in liquidation, with both long and short positions being wiped out simultaneously.

7 m

Pin