Post content & earn content mining yield

placeholder

888GodOfWealth888

#Trading Bot#我正在 Gate uses VIRTUALUSDT contract grid bot, total return since creation -0.12%

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- Comment

- Repost

- Share

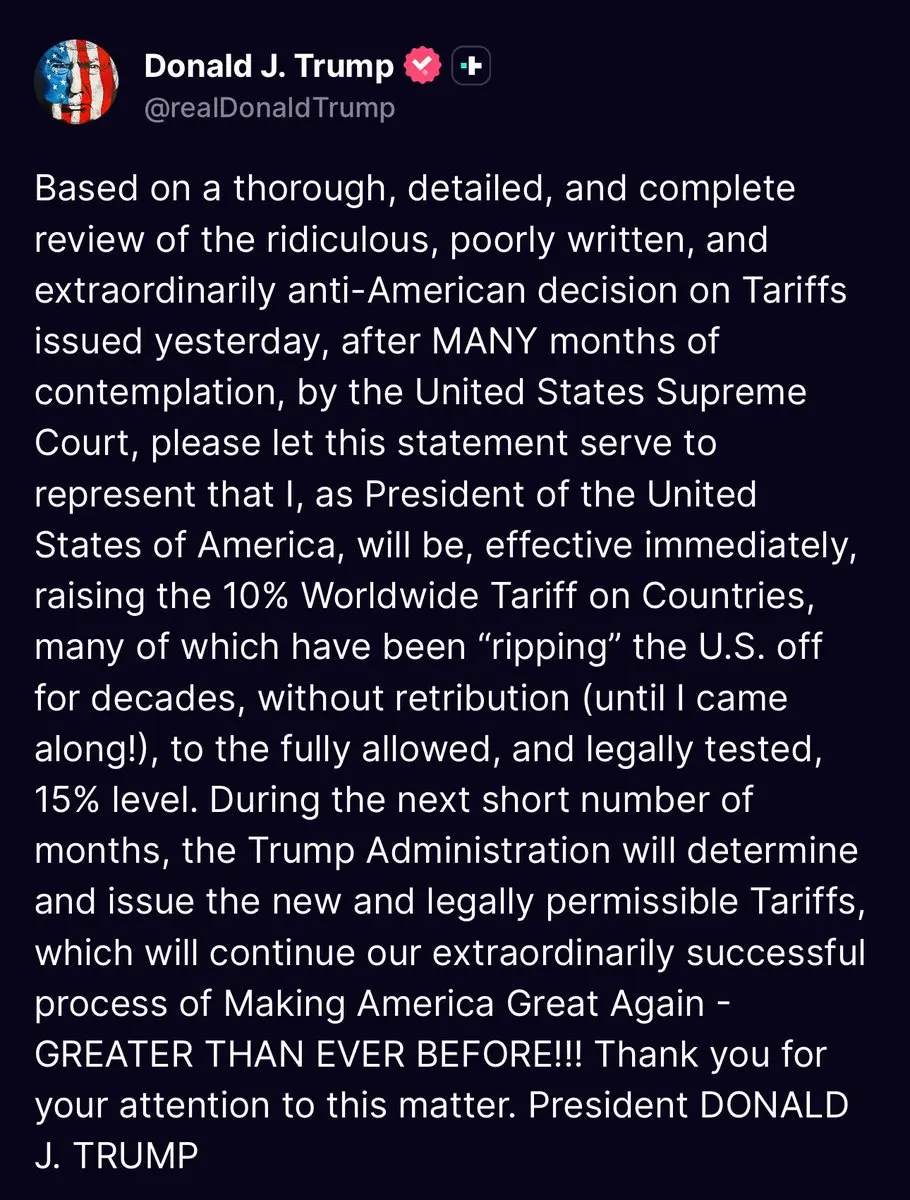

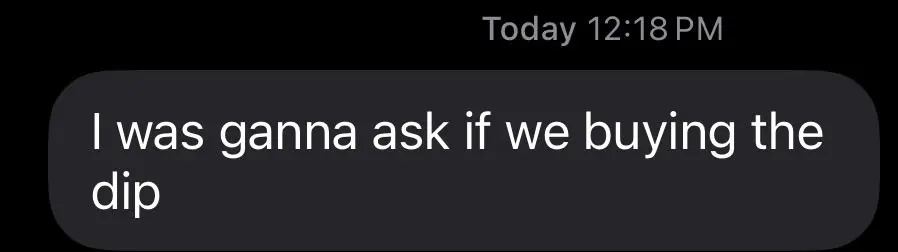

I was about to go to the gym.

Then this hit my phone.

Is it a good enough of an excuse to skip leg day?

Then this hit my phone.

Is it a good enough of an excuse to skip leg day?

- Reward

- 2

- Comment

- Repost

- Share

wallet tracking is so immensely homosexual

like how i buy some shit and get 3 texts dawg i made this wallet 3 days ago

like how i buy some shit and get 3 texts dawg i made this wallet 3 days ago

- Reward

- 1

- Comment

- Repost

- Share

DOGE2MOON

Doge To The Moon

Created By@HangSir

Listing Progress

0.00%

MC:

$2.5K

More Tokens

Another banger 👀

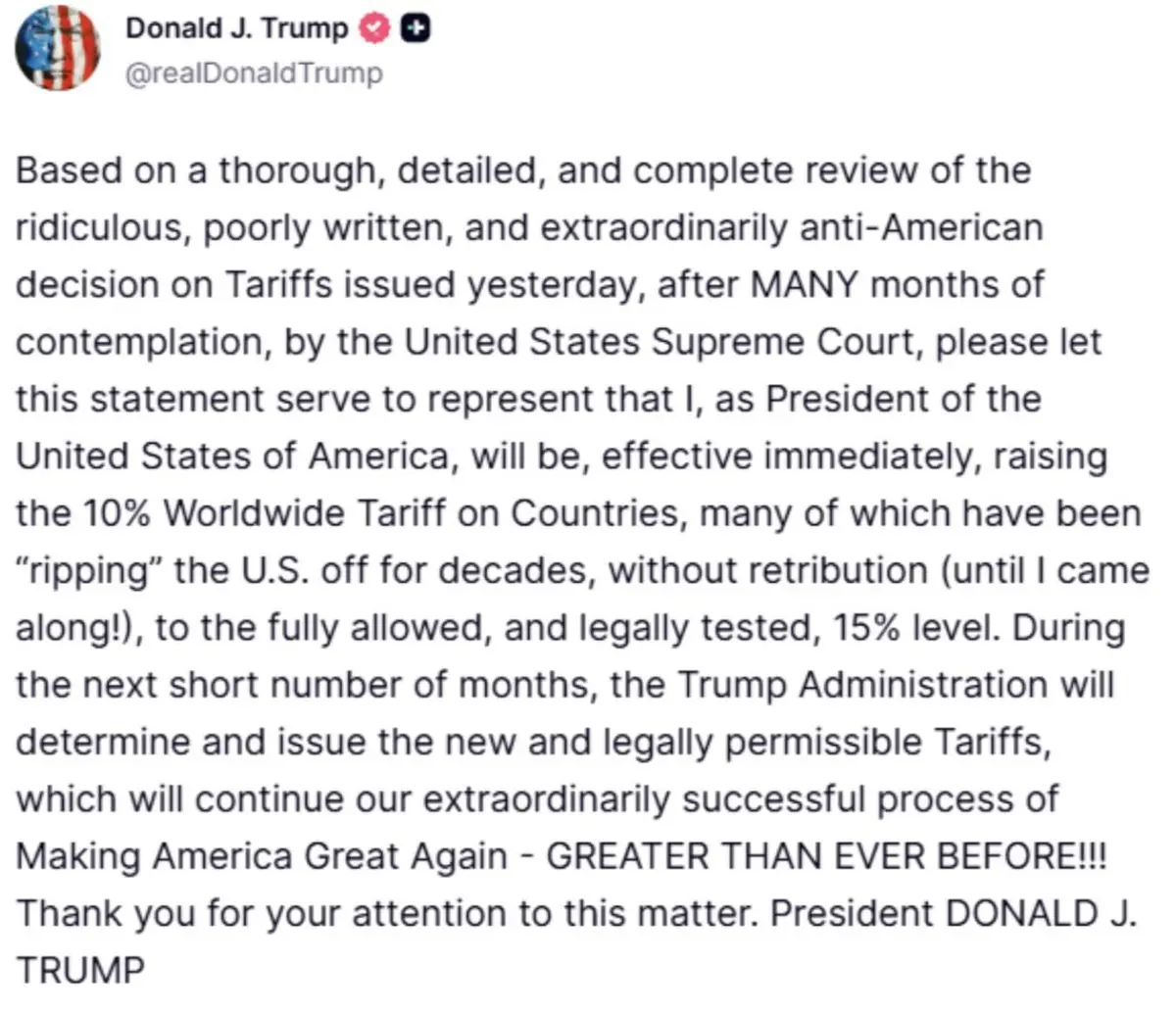

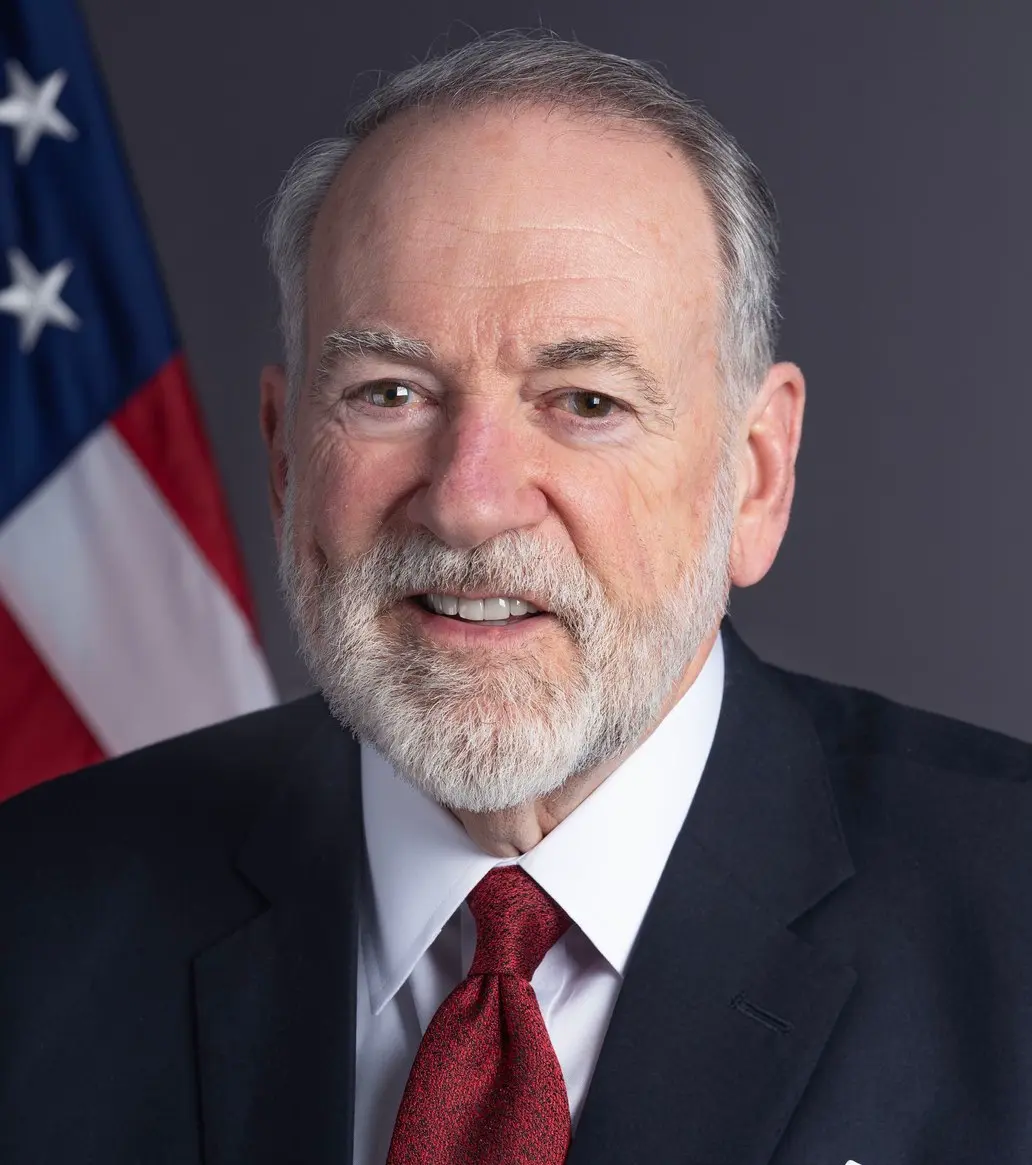

🇺🇸 President Trump raises new global tariff rate from 10% to 15%

🇺🇸 President Trump raises new global tariff rate from 10% to 15%

- Reward

- 2

- Comment

- Repost

- Share

Smart Money Is Accumulating? On-Chain Signals You Must Watch

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVKRVV4JUW

View Original

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

With diligent effort, the body is free of illness; all grievances and harms are met with equal compassion.

View Original

- Reward

- 2

- Comment

- Repost

- Share

#WhiteHouseTalksStablecoinYields WhiteHouseDigitalAssetFramework U.S. Signals Structured Shift Toward Regulated Stablecoin Yields

Policy discussions in The White House are entering a more defined phase as regulators evaluate how yield-generating stablecoins should operate within the U.S. financial system. The objective is no longer whether digital dollars will be integrated, but how they will be supervised without disrupting innovation. Officials are assessing classification standards to determine whether yield-bearing stablecoins resemble bank deposit products or regulated investment instrume

Policy discussions in The White House are entering a more defined phase as regulators evaluate how yield-generating stablecoins should operate within the U.S. financial system. The objective is no longer whether digital dollars will be integrated, but how they will be supervised without disrupting innovation. Officials are assessing classification standards to determine whether yield-bearing stablecoins resemble bank deposit products or regulated investment instrume

- Reward

- 1

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVZMAVTFCQ

View Original

- Reward

- like

- Comment

- Repost

- Share

PHL

Phalestine

Created By@Sofuolu

Listing Progress

0.00%

MC:

$0.1

More Tokens

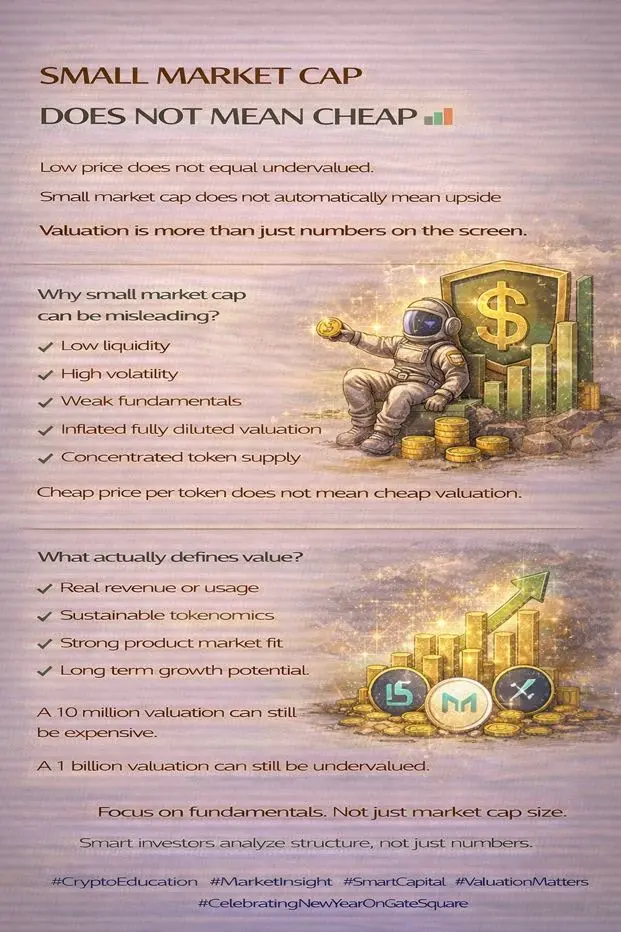

SMALL MARKET CAP DOES NOT MEAN CHEAP 📊

Low price does not equal undervalued.

Small market cap does not automatically mean upside.

Valuation is more than just numbers on the screen.

⸻

Why small market cap can be misleading?

• Low liquidity

• High volatility

• Weak fundamentals

• Inflated fully diluted valuation

• Concentrated token supply

Cheap price per token does not mean cheap valuation.

⸻

What actually defines value?

• Real revenue or usage

• Sustainable tokenomics

• Strong product market fit

• Long term growth potential

A 10 million valuation can still be expensive.

A 1 billion valuation

Low price does not equal undervalued.

Small market cap does not automatically mean upside.

Valuation is more than just numbers on the screen.

⸻

Why small market cap can be misleading?

• Low liquidity

• High volatility

• Weak fundamentals

• Inflated fully diluted valuation

• Concentrated token supply

Cheap price per token does not mean cheap valuation.

⸻

What actually defines value?

• Real revenue or usage

• Sustainable tokenomics

• Strong product market fit

• Long term growth potential

A 10 million valuation can still be expensive.

A 1 billion valuation

TOKEN-0,25%

- Reward

- 2

- Comment

- Repost

- Share

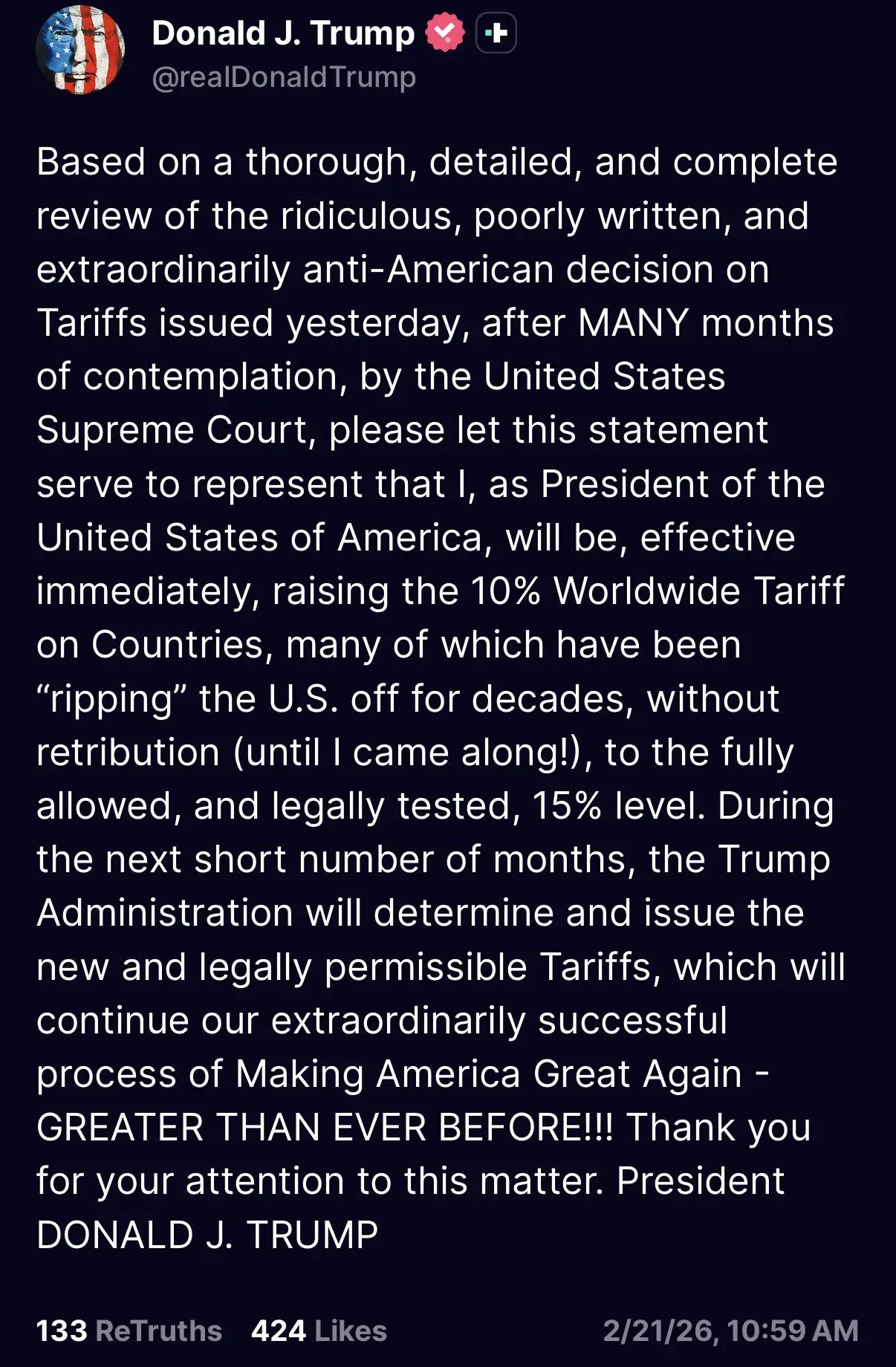

BREAKING: President Trump raises new global tariff rate from 10% to 15%.

Explains the recent flash dump

Explains the recent flash dump

- Reward

- 2

- Comment

- Repost

- Share

JUST IN: Saudi Arabia lashes out at the US ambassador to Israel.

The Kingdom condemned the recent remarks by the American envoy, who suggested that Israel should take control of the entire Middle East.

The Kingdom condemned the recent remarks by the American envoy, who suggested that Israel should take control of the entire Middle East.

- Reward

- like

- Comment

- Repost

- Share

JUST IN: Coinbase ended 2025 holding over 80% of the assets of all US-listed Bitcoin and Ethereum ETFs.

Thanks to this dominant position, the platform processed a peak inflow of $31 billion during the year, demonstrating that most institutional capital prefers its infrastructure to safeguard its digital holdings.

Thanks to this dominant position, the platform processed a peak inflow of $31 billion during the year, demonstrating that most institutional capital prefers its infrastructure to safeguard its digital holdings.

- Reward

- 2

- Comment

- Repost

- Share

Even if we put all our assets into that wallet after this crypto decline, most of it will remain empty... #not an ad

View Original

- Reward

- 3

- Comment

- Repost

- Share

Start the Year of the Horse with a win! Gate Plaza's $50,000 Red Envelope Rain is waiting for you to post and smash https://www.gate.com/campaigns/4044?ref=UwNHBlpW&ref_type=132

View Original

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin briefly spiked to $68,000 — is it still wise to go long?

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More305.54K Popularity

96.83K Popularity

416.89K Popularity

114.33K Popularity

20.76K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:00.00%

- MC:$0.1Holders:10.00%

- MC:$2.5KHolders:10.00%

- MC:$2.54KHolders:20.06%

- MC:$2.5KHolders:10.00%

News

View MoreData: If BTC drops below $65,082, the total long liquidation strength on major CEXs will reach $1.121 billion.

51 m

Data: If ETH drops below $1,890, the total long liquidation strength on major CEXs will reach $749 million.

51 m

Data: Over the past 24 hours, the entire network has liquidated $102 million, with long positions liquidated at $27.504 million and short positions at $74.1143 million.

2 h

Trump: Raise global tariffs from 10% to 15%

3 h

Punch increased by 51.89% after launching Alpha, current price is 0.0386119409101489 USDT

3 h

Pin