Post content & earn content mining yield

placeholder

GateUser-21d24216

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=CYMZSVIP

View Original

- Reward

- 1

- Comment

- Repost

- Share

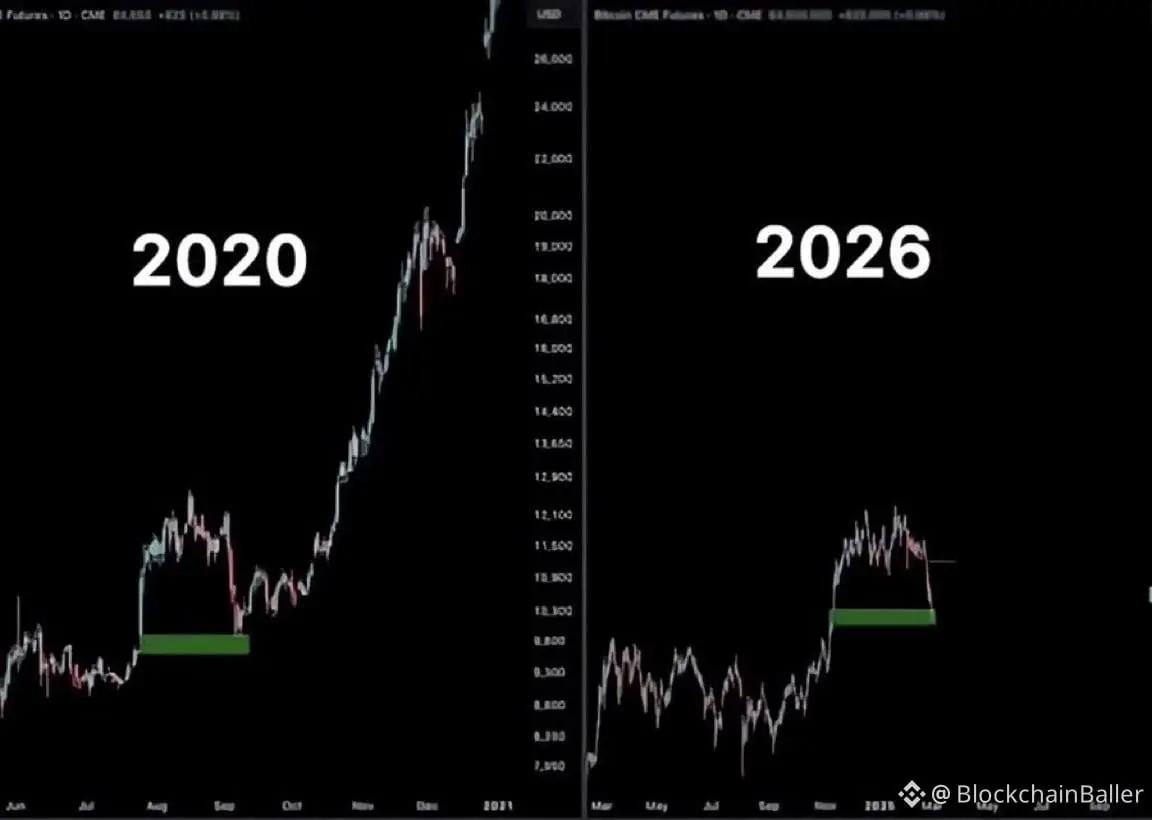

If you’re having a bad day

Just remember someone did that in 2013

Just remember someone did that in 2013

- Reward

- like

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=UgMXU15Z

- Reward

- 5

- 6

- Repost

- Share

Discovery :

:

LFG 🔥View More

PHL

Phalestine

Created By@Sofuolu

Listing Progress

0.00%

MC:

$0.1

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain every day, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVdEBg1b

View Original

- Reward

- like

- Comment

- Repost

- Share

Market Update: Bitcoin Analysis and Key Altcoins

- Reward

- like

- Comment

- Repost

- Share

#WhiteHouseTalksStablecoinYields

#WhiteHouseTalksStablecoinYields

Closed-door meetings held in Washington this week have focused on the legality of the "yield" concept within the crypto asset ecosystem. Hosted by the White House Advisory Council on Digital Assets, these sessions tackled "stablecoin rewards"—the primary hurdle facing major anticipated regulations like the GENIUS Act and the CLARITY Act.

At the core of the crisis lies a deep divergence between the traditional banking sector and crypto platforms. Banks argue that interest-like yields offered on stablecoins will lead to "deposit

#WhiteHouseTalksStablecoinYields

Closed-door meetings held in Washington this week have focused on the legality of the "yield" concept within the crypto asset ecosystem. Hosted by the White House Advisory Council on Digital Assets, these sessions tackled "stablecoin rewards"—the primary hurdle facing major anticipated regulations like the GENIUS Act and the CLARITY Act.

At the core of the crisis lies a deep divergence between the traditional banking sector and crypto platforms. Banks argue that interest-like yields offered on stablecoins will lead to "deposit

- Reward

- 24

- 40

- Repost

- Share

CryptoChampion :

:

To The Moon 🌕View More

We are now 24,000 followers! 🐋🔥

Thank you from the bottom of our hearts for the support, the messages, and for being here day after day.

This is not just a number: it's a community.

We continue building.

On the way to 100,000 🚀

View OriginalThank you from the bottom of our hearts for the support, the messages, and for being here day after day.

This is not just a number: it's a community.

We continue building.

On the way to 100,000 🚀

- Reward

- like

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLUSUA1BAQ

- Reward

- 2

- Comment

- Repost

- Share

I warned you this next leg is you going to be so violent it’s going to feel like you took a straight $PUNCH to the face

- Reward

- like

- Comment

- Repost

- Share

BTC$BTC 4H Update 📊

BTC$BTC is slowly grinding toward the 70K–72K range.

Volume is still relatively low and that’s why the move feels slow and controlled.

No explosive momentum yet, just steady positioning. Liquidity building. Bigger move likely once volume steps

BTC$BTC is slowly grinding toward the 70K–72K range.

Volume is still relatively low and that’s why the move feels slow and controlled.

No explosive momentum yet, just steady positioning. Liquidity building. Bigger move likely once volume steps

BTC0,82%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

The worlds largest gold ETF holds steady, while Bitcoin sees aggressive accumulation by whales — is safe-haven capital preference undergoing a historic shift?

- Reward

- like

- Comment

- Repost

- Share

BTC

Bitcoin Gate

Created By@BNB100

Subscription Progress

0.00%

MC:

$0

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVgRUV0O

View Original

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=BFVNVlkJ

View Original

- Reward

- like

- Comment

- Repost

- Share

Hyy #ALTSEASON WILL MELT FACES 💯

New millionaires will be made in a matter of months, just hold🔥🚀

New millionaires will be made in a matter of months, just hold🔥🚀

- Reward

- like

- Comment

- Repost

- Share

EVERYONE IS A GENIUS IN A BULL MARKET 🐂

When everything goes up, confidence feels like skill.

Green candles create easy conviction.

But rising prices can hide weak strategies.

⸻

Why does everyone look smart in a bull market?

• Most tokens are moving up

• Dips get bought quickly

• Risk management feels unnecessary

• Leverage looks easy

• Profits come fast

Momentum can disguise mistakes.

⸻

What really matters?

• Risk control

• Position sizing

• Emotional discipline

• Long term strategy

• Surviving the next cycle

A real edge is proven in difficult markets.

⸻

Bull markets reward participation.

Be

When everything goes up, confidence feels like skill.

Green candles create easy conviction.

But rising prices can hide weak strategies.

⸻

Why does everyone look smart in a bull market?

• Most tokens are moving up

• Dips get bought quickly

• Risk management feels unnecessary

• Leverage looks easy

• Profits come fast

Momentum can disguise mistakes.

⸻

What really matters?

• Risk control

• Position sizing

• Emotional discipline

• Long term strategy

• Surviving the next cycle

A real edge is proven in difficult markets.

⸻

Bull markets reward participation.

Be

- Reward

- 4

- Comment

- Repost

- Share

Post and Interact to Share $50,000 Red Packets on Gate Square https://www.gate.com/ar/campaigns/4044?ref=VQAQUVSMAQ&ref_type=132

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More312.49K Popularity

97.65K Popularity

416.82K Popularity

115.97K Popularity

21.34K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.5KHolders:10.00%

- MC:$2.5KHolders:10.00%

- MC:$0.1Holders:00.00%

News

View MoreData: In the past 24 hours, the total liquidation across the entire network was $83,637,800,000, with long positions liquidated at $18,636,800,000 and short positions at $65,001,100,000.

1 h

Data: If BTC drops below $65,082, the total long liquidation strength on major CEXs will reach $1.121 billion.

2 h

Data: If ETH drops below $1,890, the total long liquidation strength on major CEXs will reach $749 million.

2 h

Data: Over the past 24 hours, the entire network has liquidated $102 million, with long positions liquidated at $27.504 million and short positions at $74.1143 million.

4 h

Trump: Raise global tariffs from 10% to 15%

4 h

Pin