Slavyna

No content yet

Slavyna

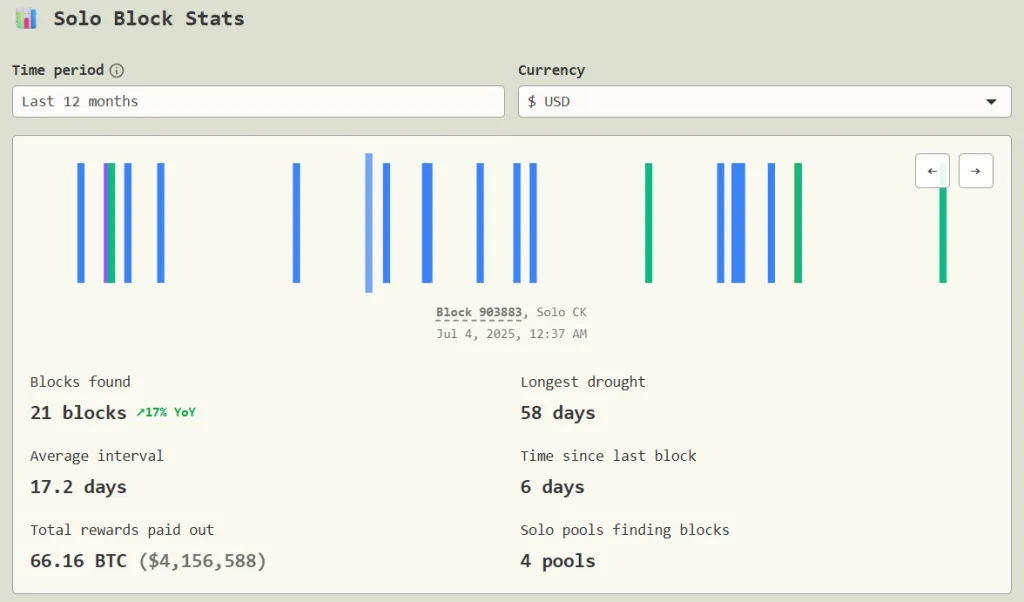

Investments totaling $75 brought a solo miner 3.125 BTC

On February 24, a solo miner mined block #938 092 on the first cryptocurrency network. For this, he received a reward of 3.125 BTC (approximately $196 650 at the current exchange rate).

forklog logoEn

forklog logo

News

Long Reads

Cryptoarium

Podcasts

Artificial Intelligence

Monthly Digest

Cryptocurrency Prices

Special Projects

Mining

#Биткоин#Mining

Investments totaling $75 brought a solo miner 3.125 BTC

02/24/2026 Elena Vasileva

On February 24, a solo miner mined a block on the first cryptocurrency network. For this, he received a rewa

On February 24, a solo miner mined block #938 092 on the first cryptocurrency network. For this, he received a reward of 3.125 BTC (approximately $196 650 at the current exchange rate).

forklog logoEn

forklog logo

News

Long Reads

Cryptoarium

Podcasts

Artificial Intelligence

Monthly Digest

Cryptocurrency Prices

Special Projects

Mining

#Биткоин#Mining

Investments totaling $75 brought a solo miner 3.125 BTC

02/24/2026 Elena Vasileva

On February 24, a solo miner mined a block on the first cryptocurrency network. For this, he received a rewa

BTC-2.85%

- Reward

- 2

- 1

- Repost

- Share

SilencerYz :

:

https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=BVFDV1BZImpinj (PI) expects a target price of $155 amid short-term pressure due to channel correction

On February 6, UBS lowered the target price for Impinj, Inc. (NASDAQ:PI) from $190 to $155 while maintaining a neutral rating. The company noted that the forecast for the first quarter is significantly below consensus expectations, due to prolonged inventory sell-through in the channel and product obsolescence, especially among major clients like UPS. UBS indicated that although estimates have been reduced, more sustainable catalysts may depend on broader adoption in the food vertical and a clearer

View OriginalOn February 6, UBS lowered the target price for Impinj, Inc. (NASDAQ:PI) from $190 to $155 while maintaining a neutral rating. The company noted that the forecast for the first quarter is significantly below consensus expectations, due to prolonged inventory sell-through in the channel and product obsolescence, especially among major clients like UPS. UBS indicated that although estimates have been reduced, more sustainable catalysts may depend on broader adoption in the food vertical and a clearer

- Reward

- like

- Comment

- Repost

- Share

South Korean man poisoned business partner after losing $800 000 on bitcoin crash

The prosecution believes the man poisoned his partner amid losses from crypto investments.

He mixed the forbidden insecticide methomyl into coffee, and the victim spent three days in a coma.

The case became part of a series of crimes linked to cryptocurrency investments.

The Seoul Eastern District Prosecutor's Office indicted a 39-year-old man for attempted murder and violation of pesticide control laws. This occurred due to a conflict over bitcoin investments, according to CD.

According to the investigation, the

View OriginalThe prosecution believes the man poisoned his partner amid losses from crypto investments.

He mixed the forbidden insecticide methomyl into coffee, and the victim spent three days in a coma.

The case became part of a series of crimes linked to cryptocurrency investments.

The Seoul Eastern District Prosecutor's Office indicted a 39-year-old man for attempted murder and violation of pesticide control laws. This occurred due to a conflict over bitcoin investments, according to CD.

According to the investigation, the

- Reward

- like

- Comment

- Repost

- Share

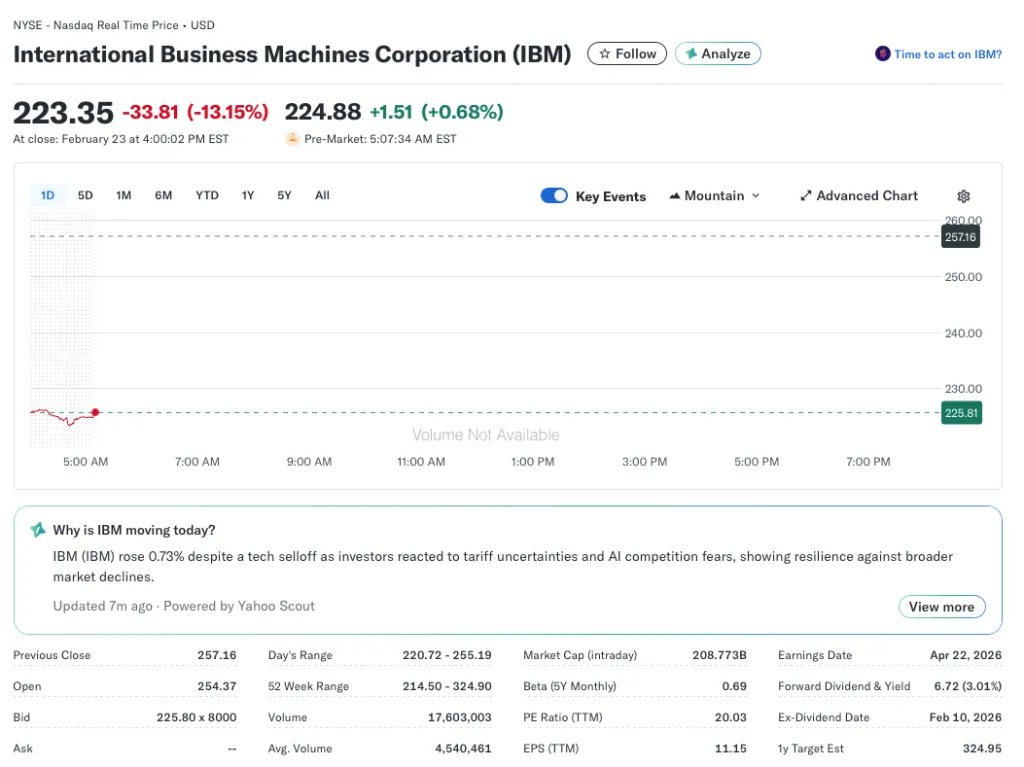

Citrini Research report, in which analysts warned of an economic collapse due to artificial intelligence, partially triggered the sell-off of stocks in the software and payment services sectors.

Global Intelligence Crisis has garnered 24.4 million views on X alone at the time of writing. The document states that AI agents can significantly increase corporate profits and make human labor unnecessary. Such a situation could trigger a recession.

The report describes a bleak scenario for June 2028:

the S&P 500 index drops 38% from its all-time high;

unemployment exceeds 10%;

the private lending ma

View OriginalGlobal Intelligence Crisis has garnered 24.4 million views on X alone at the time of writing. The document states that AI agents can significantly increase corporate profits and make human labor unnecessary. Such a situation could trigger a recession.

The report describes a bleak scenario for June 2028:

the S&P 500 index drops 38% from its all-time high;

unemployment exceeds 10%;

the private lending ma

- Reward

- like

- Comment

- Repost

- Share

Unknown reason why Satoshi Nakamoto created Bitcoin

In 2008, while the world was quietly burning from a financial collapse, banks were receiving aid, ordinary people were losing their homes, savings, and trust. Behind screens and forums, one anonymous mind was watching carefully.

That mind was Satoshi Nakamoto.

Satoshi was not seeking fame. In fact, Satoshi would have disappeared forever. What motivated him to create Bitcoin was something deeper: a broken system.

A system that let people down

In 2008, governments printed money out of thin air. Banks took reckless risks, collapsed the economy,

View OriginalIn 2008, while the world was quietly burning from a financial collapse, banks were receiving aid, ordinary people were losing their homes, savings, and trust. Behind screens and forums, one anonymous mind was watching carefully.

That mind was Satoshi Nakamoto.

Satoshi was not seeking fame. In fact, Satoshi would have disappeared forever. What motivated him to create Bitcoin was something deeper: a broken system.

A system that let people down

In 2008, governments printed money out of thin air. Banks took reckless risks, collapsed the economy,

- Reward

- 1

- 1

- Repost

- Share

Topinvest :

:

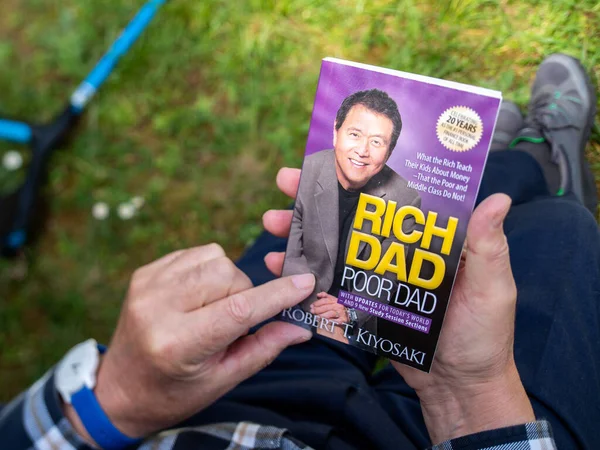

Hold tight 💪Kiyosaki Predicts the "Largest Stock Market Crash in History" Again

Author of "Rich Dad Poor Dad" Robert Kiyosaki advises to buy BTC, ETH, gold, and silver in advance of the upcoming crash. He wrote about this on X. The author reminded that as early as 2013, in another book, "Rich Dad's Prophecy," he wrote about an impending massive crash and urged investing in cryptocurrencies. Now, Kiyosaki claims, an economic crisis has become inevitable.

According to him, those who "heed the advice of the book and prepare in advance" will easily survive the crash. These people, Kiyosaki assures, will be ab

View OriginalAuthor of "Rich Dad Poor Dad" Robert Kiyosaki advises to buy BTC, ETH, gold, and silver in advance of the upcoming crash. He wrote about this on X. The author reminded that as early as 2013, in another book, "Rich Dad's Prophecy," he wrote about an impending massive crash and urged investing in cryptocurrencies. Now, Kiyosaki claims, an economic crisis has become inevitable.

According to him, those who "heed the advice of the book and prepare in advance" will easily survive the crash. These people, Kiyosaki assures, will be ab

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin Promised to Drop to $38 000 and Compared to Benjamin Button

Bitcoin could plummet to $38 000, according to analysts at Stifel. They compared the cryptocurrency to the character from F. Scott Fitzgerald's novel "The Curious Case of Benjamin Button." To support their forecast, analysts created a chart marking the lowest points of all major Bitcoin crashes since 2010. At Stifel, they calculated that: in 2011, the first cryptocurrency lost 93% of its value; in 2015 — 84%; in 2018 — 83%; in 2022 — 76%. If a line is drawn through these lowest market dip points, it will trend upward and ind

Bitcoin could plummet to $38 000, according to analysts at Stifel. They compared the cryptocurrency to the character from F. Scott Fitzgerald's novel "The Curious Case of Benjamin Button." To support their forecast, analysts created a chart marking the lowest points of all major Bitcoin crashes since 2010. At Stifel, they calculated that: in 2011, the first cryptocurrency lost 93% of its value; in 2015 — 84%; in 2018 — 83%; in 2022 — 76%. If a line is drawn through these lowest market dip points, it will trend upward and ind

BTC-2.85%

- Reward

- 1

- Comment

- Repost

- Share

Donald Trump Talks About Secret Deal Between Altcoins and $1 Trillion Company!

Donald Trump stated that he was unaware of a $500 million deal between a member of the Abu Dhabi royal family and the cryptocurrency project World Liberty Financial (WLFI).

U.S. President Donald Trump and his cryptocurrency project World Liberty Financial continue to be in the spotlight.

Recently, Trump and World Liberty Financial (WLFI) made headlines with allegations of a secret deal with a company owned by an Abu Dhabi sheikh that manages $1 trillion.

It has now been revealed that over the weekend, a major deal w

Donald Trump stated that he was unaware of a $500 million deal between a member of the Abu Dhabi royal family and the cryptocurrency project World Liberty Financial (WLFI).

U.S. President Donald Trump and his cryptocurrency project World Liberty Financial continue to be in the spotlight.

Recently, Trump and World Liberty Financial (WLFI) made headlines with allegations of a secret deal with a company owned by an Abu Dhabi sheikh that manages $1 trillion.

It has now been revealed that over the weekend, a major deal w

WLFI-1.46%

- Reward

- like

- 1

- Repost

- Share

GateUser-b93014a8 :

:

Hold on tight, we're about to take off 🛫Vitalik Buterin Sells Multiple Tokens at Once

Ethereum co-founder Vitalik Buterin sold off WOOLLY, IZZY, CHIB, and OP tokens that were sent to his public address some time ago. The tokens were exchanged for 9.4 ETH, worth approximately $29 400, according to Arkham Intelligence analysts. The transactions were carried out through decentralized services and bridges such as LiFi Diamond, Socket Getaway, Across Protocol, and Bungee. Buterin exchanged 7,528 OP tokens for ETH via Bungee. Then, the Ethereum co-founder swapped 4.508 million DEGEN tokens and 23.988 million CHIB tokens for ETH through So

View OriginalEthereum co-founder Vitalik Buterin sold off WOOLLY, IZZY, CHIB, and OP tokens that were sent to his public address some time ago. The tokens were exchanged for 9.4 ETH, worth approximately $29 400, according to Arkham Intelligence analysts. The transactions were carried out through decentralized services and bridges such as LiFi Diamond, Socket Getaway, Across Protocol, and Bungee. Buterin exchanged 7,528 OP tokens for ETH via Bungee. Then, the Ethereum co-founder swapped 4.508 million DEGEN tokens and 23.988 million CHIB tokens for ETH through So

- Reward

- 3

- 3

- Repost

- Share

GarikBY :

:

Earned and removedView More

Gas on Ethereum will become a tradable asset with the launch of the GWEI token

The total supply will be 10 billion coins, of which 10% will go to the community. The remaining assets will be distributed as follows:

31% — to the ecosystem;

27% — to investors;

22% — to the team;

8% — to the foundation;

2% — to advisors.

According to developers, Ethereum remains the leading settlement layer in the crypto industry, but the current mechanism for allocating space in blocks cannot keep up with application demands. The result is transaction delays and sharp spikes in fees.

To address this issue, the ET

The total supply will be 10 billion coins, of which 10% will go to the community. The remaining assets will be distributed as follows:

31% — to the ecosystem;

27% — to investors;

22% — to the team;

8% — to the foundation;

2% — to advisors.

According to developers, Ethereum remains the leading settlement layer in the crypto industry, but the current mechanism for allocating space in blocks cannot keep up with application demands. The result is transaction delays and sharp spikes in fees.

To address this issue, the ET

ETH-5.05%

- Reward

- 2

- 1

- Repost

- Share

Abdullah_Adan :

:

well done keep it up🚨Whales are exiting their long positions in Bitcoin.

Major investors have started closing their long positions in BTC,

a behavior that has historically preceded strong bullish market surges.

If this scenario repeats, some analysts see it opening the way for Bitcoin to reach the $135,000 level.

Major investors have started closing their long positions in BTC,

a behavior that has historically preceded strong bullish market surges.

If this scenario repeats, some analysts see it opening the way for Bitcoin to reach the $135,000 level.

BTC-2.85%

- Reward

- 1

- Comment

- Repost

- Share

Unexpected statement by Elon Musk about the DOGE coin!

Global cryptocurrency markets are once again on edge! Recently, Musk made a statement that literally stirred up all Dogecoin holders around the world!

Musk, whose influence in the crypto space has long become legendary, has once again spoken in favor of DOGE, calling the inflationary model of Dogecoin a "feature, not a flaw," and emphasizing that this particular structure of creating new coins makes DOGE convenient for everyday payments and future use.

This statement came amid ongoing discussions about the role of DOGE in the future of the

Global cryptocurrency markets are once again on edge! Recently, Musk made a statement that literally stirred up all Dogecoin holders around the world!

Musk, whose influence in the crypto space has long become legendary, has once again spoken in favor of DOGE, calling the inflationary model of Dogecoin a "feature, not a flaw," and emphasizing that this particular structure of creating new coins makes DOGE convenient for everyday payments and future use.

This statement came amid ongoing discussions about the role of DOGE in the future of the

DOGE-4.2%

- Reward

- 20

- 14

- Repost

- Share

Ndahsar :

:

Buy to Generate 💎View More

Traders Expect Bitcoin to Rise to $100 000 in January

Investors anticipate a rise in Bitcoin in the first month of the year.

The open interest on Deribit indicates demand for options with a strike price of $100 000.

Wintermute stated that the market no longer incorporates a negative scenario.

Traders are once again betting on a bullish move for Bitcoin and expect the asset to reach $100 000 already in January 2026. Bloomberg reports this, citing data from the derivatives exchange Deribit.

The statement says that the highest open interest in the options market is for contracts with

View OriginalInvestors anticipate a rise in Bitcoin in the first month of the year.

The open interest on Deribit indicates demand for options with a strike price of $100 000.

Wintermute stated that the market no longer incorporates a negative scenario.

Traders are once again betting on a bullish move for Bitcoin and expect the asset to reach $100 000 already in January 2026. Bloomberg reports this, citing data from the derivatives exchange Deribit.

The statement says that the highest open interest in the options market is for contracts with

- Reward

- 3

- 2

- Repost

- Share

EagleEye :

:

Thanks for sharing this informationView More

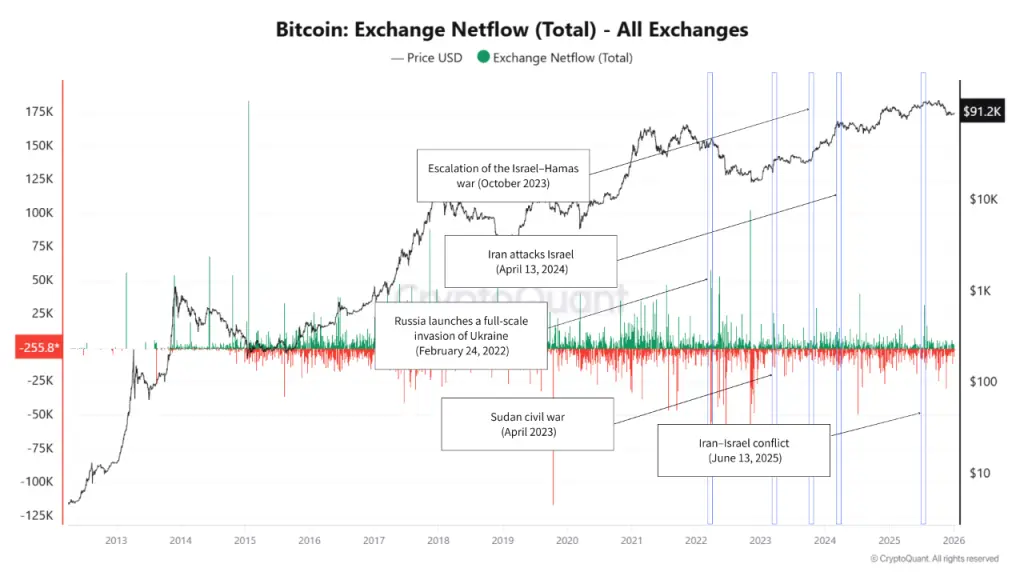

Conflict between the USA and Venezuela: Why is Bitcoin so calm?

In the geopolitical arena at the very beginning of 2026, new risks have emerged – the conflict between the USA and Venezuela has escalated. While global financial experts and economists are on edge, crypto traders remain calm. Analysts say that there were no signs of panic in the Bitcoin market this weekend.

The world's first crypto asset is currently holding just below the $90 000 mark. Experts also remember that sharp changes on the global stage have always previously reflected on high-risk assets. The current situation makes o

In the geopolitical arena at the very beginning of 2026, new risks have emerged – the conflict between the USA and Venezuela has escalated. While global financial experts and economists are on edge, crypto traders remain calm. Analysts say that there were no signs of panic in the Bitcoin market this weekend.

The world's first crypto asset is currently holding just below the $90 000 mark. Experts also remember that sharp changes on the global stage have always previously reflected on high-risk assets. The current situation makes o

BTC-2.85%

- Reward

- 21

- 11

- Repost

- Share

EagleEye :

:

Thanks for sharing this informationView More

The most promising cryptocurrencies of 2026. Who could have predicted the surge of anonymous cryptocurrencies in 2025? Yet, they skyrocketed. It’s clear that prediction accuracy cannot be 100%. But let’s try to name the most promising coins for the upcoming 2026. The difficulty of forecasting First of all, it should be noted: any predictions are purely probabilistic, and no one knows for sure what events might influence the crypto market over the next 12 months. By December 2025, Bitcoin’s price had decreased relative to January’s values, losing about 6.34%, dragging many altcoins down with it

View Original

- Reward

- 47

- 21

- Repost

- Share

EagleEye :

:

Thanks for sharing this informationView More

The Reserve Bank of India Calls on All Countries to Abandon Stablecoins

The Reserve Bank of India (RBI) has declared stablecoins high-risk assets and urged other countries to focus not on creating conditions for the development of stablecoins but on launching central bank digital currencies (CBDC).

Although stablecoins play an important role in the crypto industry, and their significance increased after the enactment of the US stablecoin regulation law, tokens pegged to fiat currencies do not meet the fundamental characteristics of money and could weaken the influence of central banks, fears R

The Reserve Bank of India (RBI) has declared stablecoins high-risk assets and urged other countries to focus not on creating conditions for the development of stablecoins but on launching central bank digital currencies (CBDC).

Although stablecoins play an important role in the crypto industry, and their significance increased after the enactment of the US stablecoin regulation law, tokens pegged to fiat currencies do not meet the fundamental characteristics of money and could weaken the influence of central banks, fears R

ARC-2.46%

- Reward

- 17

- 5

- Repost

- Share

GateUser-3ab50b7e :

:

So if it great news for crypto View More

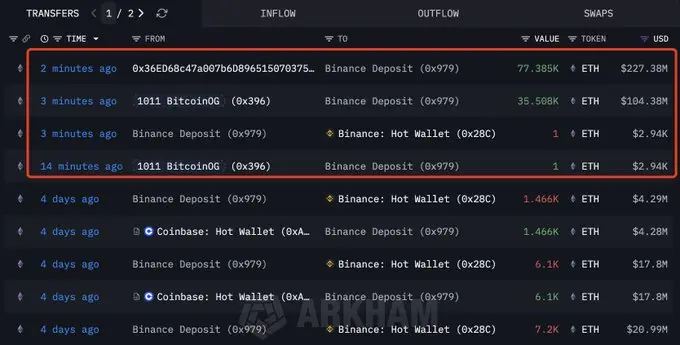

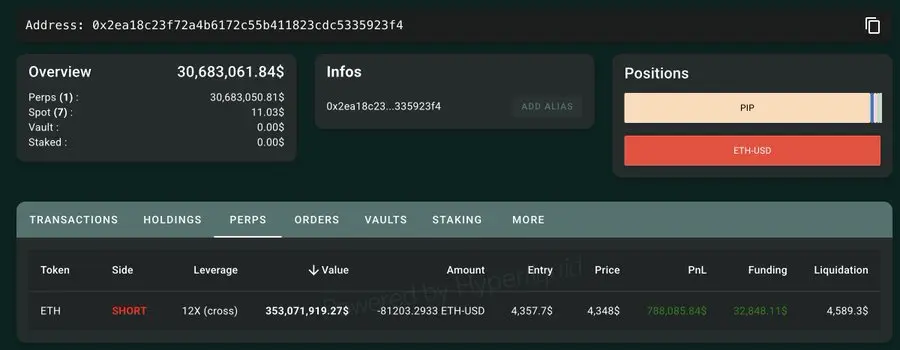

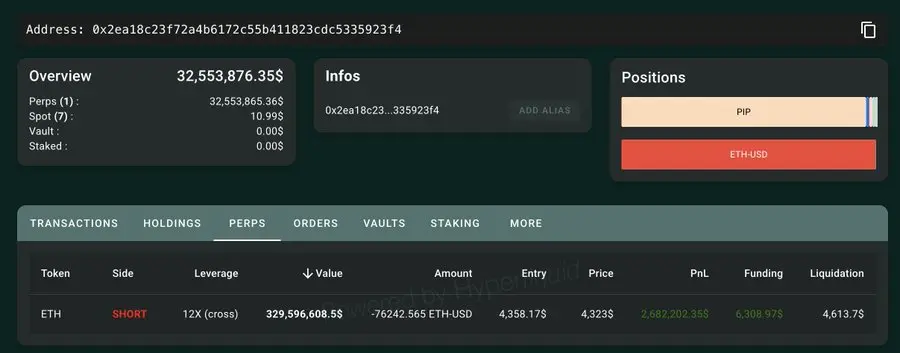

Crypto whales maintain positions amid market fluctuations

Large crypto whales are maintaining their positions despite market volatility, with significant activity observed among key players. "BTC OG Insider Whale" has not rebalanced their portfolio, holding a long position in ETH with an unrealized loss of $9.88 million at an average price of $3,147. The total size of the account's position is approximately $786 million, including long positions in BTC and SOL, all with unrealized losses. Meanwhile, "Shanzhai Air Force Front" has increased its short positions in LIT, now totaling $9.35 million

View OriginalLarge crypto whales are maintaining their positions despite market volatility, with significant activity observed among key players. "BTC OG Insider Whale" has not rebalanced their portfolio, holding a long position in ETH with an unrealized loss of $9.88 million at an average price of $3,147. The total size of the account's position is approximately $786 million, including long positions in BTC and SOL, all with unrealized losses. Meanwhile, "Shanzhai Air Force Front" has increased its short positions in LIT, now totaling $9.35 million

- Reward

- 27

- 11

- 1

- Share

Sanam_Chowdhury :

:

wow nice post😃😃View More

Forecast for Toncoin (TON) in 2026: A Prolonged Pause

There are few cryptocurrencies on the market that are closely watched by members of the Russian crypto community, and TON is a prime example of such a coin. Perhaps its popularity among Russian investors stems from the fact that the project traces its roots back to the developments of the well-known Russian figure Pavel Durov.

Kirill Pissov, Head of Product Development at FG Finam, provided a forecast for TON in 2026 at the request of BeInCrypto. Here are the prospects he sees for the cryptocurrency.

I’ve been following TON since 2022 and h

There are few cryptocurrencies on the market that are closely watched by members of the Russian crypto community, and TON is a prime example of such a coin. Perhaps its popularity among Russian investors stems from the fact that the project traces its roots back to the developments of the well-known Russian figure Pavel Durov.

Kirill Pissov, Head of Product Development at FG Finam, provided a forecast for TON in 2026 at the request of BeInCrypto. Here are the prospects he sees for the cryptocurrency.

I’ve been following TON since 2022 and h

TON0.71%

- Reward

- 37

- 9

- 1

- Share

Harry_F :

:

HODL Tight 💪View More

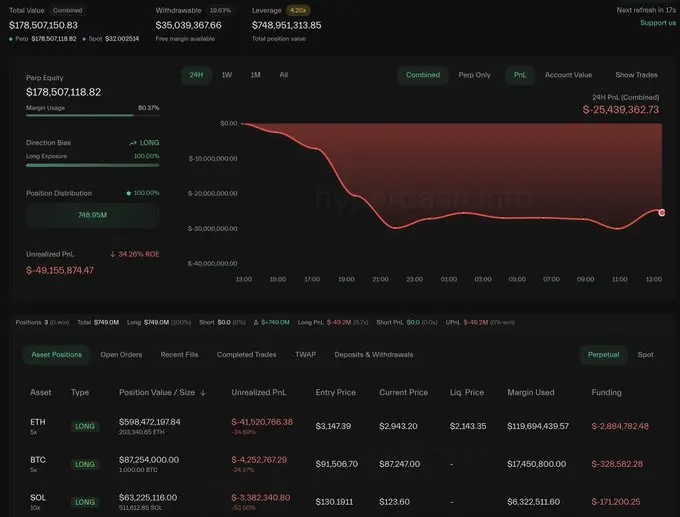

Kit bets $748 million on the rise of Bitcoin, Ethereum, and Solana

An investor with assets totaling $11 billion has opened long positions on the three leading cryptocurrencies, according to Lookonchain. In October, this player accurately predicted a market crash.

/

/

ForkLog

Kit bets $748 million on the rise of Bitcoin, Ethereum, and Solana

Dec 30, 2025, 17:00 GMT+2 Reading time: 2 minutes

ETHUSDT

+2.33%

BTCUSDT

+0.48%

An investor with assets totaling $11 billion has opened long positions on the three leading cryptocurrencies, according to Lookonchain. In October, this player accurately pr

View OriginalAn investor with assets totaling $11 billion has opened long positions on the three leading cryptocurrencies, according to Lookonchain. In October, this player accurately predicted a market crash.

/

/

ForkLog

Kit bets $748 million on the rise of Bitcoin, Ethereum, and Solana

Dec 30, 2025, 17:00 GMT+2 Reading time: 2 minutes

ETHUSDT

+2.33%

BTCUSDT

+0.48%

An investor with assets totaling $11 billion has opened long positions on the three leading cryptocurrencies, according to Lookonchain. In October, this player accurately pr

- Reward

- 18

- 33

- 1

- Share

GateUser-dd8bbbbc :

:

Buy To Earn 💎View More

🎯 THE PERFECT ENTRY

Imbalance + Fibonacci = entry like Smart Money

Want to enter the market simply, logically, and without guessing?

This method is so straightforward that even a school student can handle it 📚

And it’s used by — big players 🧠

🔍 Determine the trend

Look at the higher timeframe:

➡️ Uptrend — go long

➡️ Downtrend — go short

❗ Do not trade against the trend

⚡ Step 1. Find the imbalance (FVG)

Imbalance — is a place where the price moved too quickly.

On the chart — a gap between three candles.

👉 Here, the market was inefficient, and the price often retraces.

📊 Step 2. Fibonacc

View OriginalImbalance + Fibonacci = entry like Smart Money

Want to enter the market simply, logically, and without guessing?

This method is so straightforward that even a school student can handle it 📚

And it’s used by — big players 🧠

🔍 Determine the trend

Look at the higher timeframe:

➡️ Uptrend — go long

➡️ Downtrend — go short

❗ Do not trade against the trend

⚡ Step 1. Find the imbalance (FVG)

Imbalance — is a place where the price moved too quickly.

On the chart — a gap between three candles.

👉 Here, the market was inefficient, and the price often retraces.

📊 Step 2. Fibonacc

- Reward

- 1

- 2

- Repost

- Share