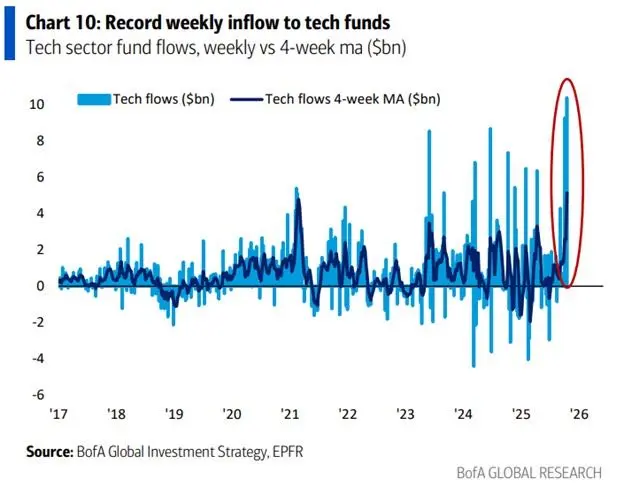

Let's talk about last night's CPI data: 1. The alignment of data has relieved the market; this time, all four sub-items were below expectations, especially the CPI and core CPI month-on-month, which were lower than the August values. This has not only boosted the market's expectations for a rate cut in December but has also partly alleviated concerns about inflation getting out of control again due to the general increase in tariffs in August. Moreover, after meeting expectations for the previous two months, it has started to fall below expectations again, which is a good signal.

2

View Original2