User_any

Hello everyone,

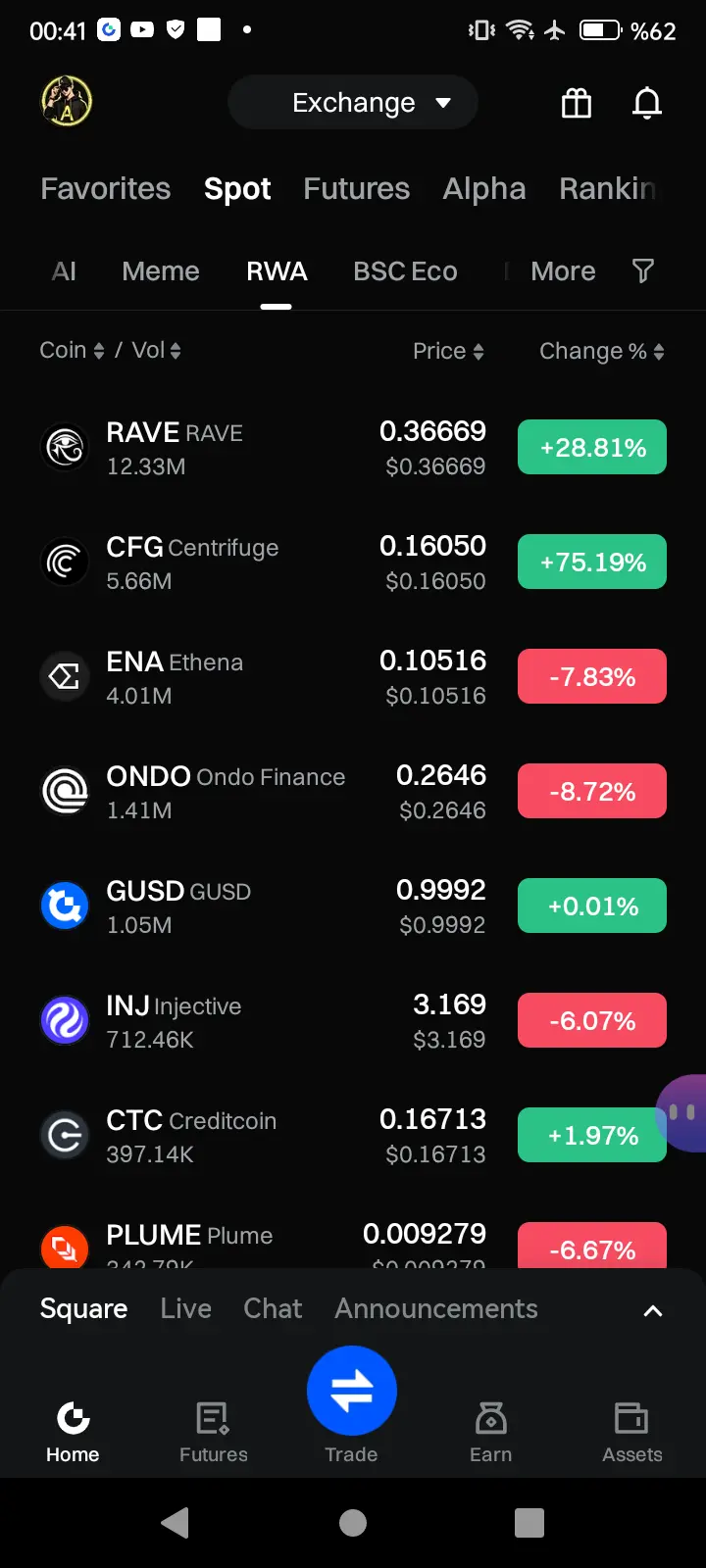

We are in the midst of a rapid transition from the traditional, classic understanding of cryptocurrencies to an integration into a new system. As Gate users, we are part of this tremendous change. Along with ETFs, RWAs have become the favorites of investors and portfolios. Billions of dollars in funds are moving away from the classic investment logic, and with the acceleration of tokenization, interest in RWAs is increasing day by day.

By 2025, everything has changed. We are witnessing a rapid transition from classic investment instruments and understanding to a completely new

We are in the midst of a rapid transition from the traditional, classic understanding of cryptocurrencies to an integration into a new system. As Gate users, we are part of this tremendous change. Along with ETFs, RWAs have become the favorites of investors and portfolios. Billions of dollars in funds are moving away from the classic investment logic, and with the acceleration of tokenization, interest in RWAs is increasing day by day.

By 2025, everything has changed. We are witnessing a rapid transition from classic investment instruments and understanding to a completely new

- Reward

- 24

- 20

- 5

- Share

SinCity :

:

To The Moon 🌕View More

The Rise of AI in Crypto #DeepDiveCreatorCamp

How Smart Agents Are Changing the Game

Man, the crypto world never sleeps, does it? Lately, everyone's buzzing about how AI is sneaking into everything from payments to trading, and I figured I'd share my take on it. It's February 2026, and with all the regulatory green lights popping up, this AI-crypto mashup feels like it's about to explode. I've been following this for a bit, and honestly, it's got me rethinking my whole strategy – not just hype, but real stuff that's making crypto easier and smarter.

Let's start with the basics: AI agents. Thes

How Smart Agents Are Changing the Game

Man, the crypto world never sleeps, does it? Lately, everyone's buzzing about how AI is sneaking into everything from payments to trading, and I figured I'd share my take on it. It's February 2026, and with all the regulatory green lights popping up, this AI-crypto mashup feels like it's about to explode. I've been following this for a bit, and honestly, it's got me rethinking my whole strategy – not just hype, but real stuff that's making crypto easier and smarter.

Let's start with the basics: AI agents. Thes

- Reward

- 7

- 8

- Repost

- Share

SinCity :

:

To The Moon 🌕View More

Due to changes in the work schedule for March, the live broadcasts will be paused for about half a month. Friends, wait for me to come back😄

February is almost over, and I’ve given myself a very good report card this month. In just two weeks, my overall profit exceeded 47.5% of my previous results. That calm and composed me is back! Maintaining profitability in the contract market is difficult. I can't say I'm very skilled, but I have improved compared to my past self. I am very grateful that I have learned self-control!#加密市场反弹

View OriginalFebruary is almost over, and I’ve given myself a very good report card this month. In just two weeks, my overall profit exceeded 47.5% of my previous results. That calm and composed me is back! Maintaining profitability in the contract market is difficult. I can't say I'm very skilled, but I have improved compared to my past self. I am very grateful that I have learned self-control!#加密市场反弹

- Reward

- 7

- 3

- Repost

- Share

MissKitty :

:

Happy New Year 🧨View More

- Reward

- 1

- 2

- Repost

- Share

LirivasiIsATraditionalDance :

:

1000x Vibes 🤑View More

In the unregulated market of the crypto world, retail investors are being completely played out.

POWER93.99%

- Reward

- 4

- 2

- Repost

- Share

AskTheWay888 :

:

It's all the money earned by the investors.View More

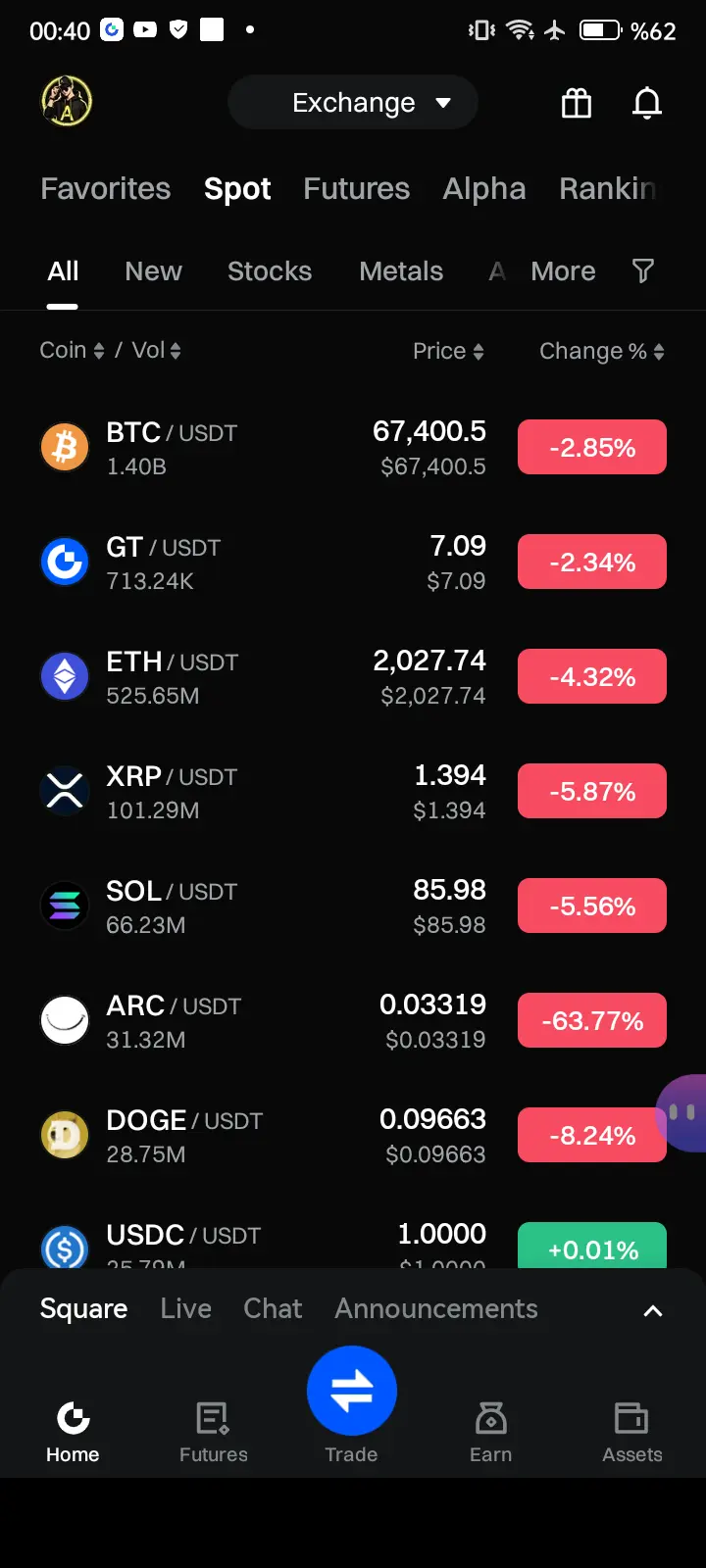

Although this sharp decline in the early morning briefly touched around 66,600, from a technical perspective, this was actually an effective test of a key support level. This level is not only a previous area of high trading volume but also coincides with the daily MA60 moving average. After the price touched this level, it quickly rebounded and formed a long lower shadow, indicating strong buying support below and signaling a waning downward momentum. At the same time, this downward probe effectively cleared excessive leverage funding rates, reducing selling pressure for the subsequent rally.

BTC-1.1%

- Reward

- 2

- 4

- Repost

- Share

WhenTheMountainDoesn'tMove,The :

:

2026 Go Go Go 👊View More

- Reward

- 2

- 1

- Repost

- Share

mkmknjbhvgcf :

:

81 can't be reached, still 18#OORT The hardest part was buying it at the peak back then, being fooled by others to buy at $2 off the market, losing my most funds. Over the past two years, I've become increasingly disappointed with it. I sold all at a high of 0.2. Later, I realized it was dropping further and finally felt hopeless.

OORT6.49%

- Reward

- 2

- 1

- Repost

- Share

CryptoNomad :

:

Don't be afraid, don't regret, don't complain. Go public immediately. Buy on dips.- Reward

- 5

- 1

- Repost

- Share

GateUser-afd1ce43 :

:

What is the new favorite in gold?- Reward

- 1

- 1

- Repost

- Share

GateUser-e606ef35 :

:

0.18Decibel, a perpetual derivatives decentralized exchange incubated by Aptos Labs, officially launched on the mainnet and introduced an official points program. Initially offering perpetual contract trading, Decibel later expanded to spot trading and risk-weighted assets (RWA). After launch, Decibel's trading volume reached $6.4 million, with a total value locked (TVL) of $57 million. Built on Aptos, Decibel supports deposits via Ethereum/Solana's X-chain, and its on-chain CLOB model ensures transparent risk management. The head of the Decibel Foundation emphasized that rewards should be based o

View Original- Reward

- 2

- 1

- Repost

- Share

GateUser-b8637901 :

:

Published Join the event$DOGE Short Selling!!

Double in two weeks, you can short sell when this coin rebounds! It reached a high of 0.3, very weak and unable to return to the top. Market liquidity is very low, and individual traders and institutions are not buying this meme coin that has few applications. Most importantly, many people are buying at levels of 0.2 and 0.3, and when the price rises, it gets pushed down. Recover the market price 🈳 Enter now! 👇👇👇#Gate广场发帖领五万美金红包 $DOGE

Double in two weeks, you can short sell when this coin rebounds! It reached a high of 0.3, very weak and unable to return to the top. Market liquidity is very low, and individual traders and institutions are not buying this meme coin that has few applications. Most importantly, many people are buying at levels of 0.2 and 0.3, and when the price rises, it gets pushed down. Recover the market price 🈳 Enter now! 👇👇👇#Gate广场发帖领五万美金红包 $DOGE

DOGE-4.99%

- Reward

- 3

- 2

- Repost

- Share

WengwasudaliswahaYinyin :

:

Happy New Year 🧨View More

【$POWER Signal】Pullback to Long + 1H Level Strong Consolidation, Waiting for a Second Explosion

$POWER The 1H level has experienced a historic surge and is currently consolidating strongly at high levels. The price is building a platform within the 1.67-1.85 range, with the 1H EMA20 (1.5246) forming a strong dynamic support. Although the 4H level shows a long upper shadow, the overall trend remains a pullback confirmation after a massive breakout, with stable OI and no large-scale profit-taking, indicating clear main force support. The negative fee rate is as high as -0.58%, with potential f

View Original$POWER The 1H level has experienced a historic surge and is currently consolidating strongly at high levels. The price is building a platform within the 1.67-1.85 range, with the 1H EMA20 (1.5246) forming a strong dynamic support. Although the 4H level shows a long upper shadow, the overall trend remains a pullback confirmation after a massive breakout, with stable OI and no large-scale profit-taking, indicating clear main force support. The negative fee rate is as high as -0.58%, with potential f

- Reward

- 3

- 1

- Repost

- Share

ybaser :

:

Buy To Earn 💰️A large trader built an extremely large long bet on ARC perpetual contracts on the decentralized exchange Lighter (open interest reached near $50 million). When the price started dropping, his position was partly liquidated and then fully unwound through the platform’s risk

ARC-51.56%

- Reward

- 4

- 1

- Repost

- Share

GateUser-0e26ae59 :

:

how did you know thatI started back in 2013, and I remember that the total supply of Dogecoin was always listed as 100 billion. So how did it become unlimited now? Was there a secret transition to a new chain? If that's not possible, a new Dogecoin chain could be created with a total supply of 100 billion, and then the current mined amount could be determined. The mined coins would then be burned directly, and Dogecoin holders would be replaced 1:1, so the total supply can be reduced instead of unlimited issuance. #加密市场反弹 #DOGE

DOGE-4.99%

- Reward

- 3

- 1

- Repost

- Share

GateUser-40f776ca :

:

Bullish market at its peak 🐂Late reports indicate that Li Auto is studying Huawei, and the more they learn, the worse their sales become. A case worth pondering is:

Initially, sales commissions were very low. After studying Huawei, new Huawei executives significantly increased incentives.

Subsequently, it was discovered that to secure high returns, some Li Auto top sellers would secretly split a 3000 yuan commission with customers, while other salespeople earning only 1500 yuan in commission were forced to follow suit to survive.

Some salespeople no longer focus on how to introduce the product but instead look forward to

View OriginalInitially, sales commissions were very low. After studying Huawei, new Huawei executives significantly increased incentives.

Subsequently, it was discovered that to secure high returns, some Li Auto top sellers would secretly split a 3000 yuan commission with customers, while other salespeople earning only 1500 yuan in commission were forced to follow suit to survive.

Some salespeople no longer focus on how to introduce the product but instead look forward to

- Reward

- 3

- 1

- Repost

- Share

HighAmbition :

:

very informative post- Reward

- like

- Comment

- Repost

- Share

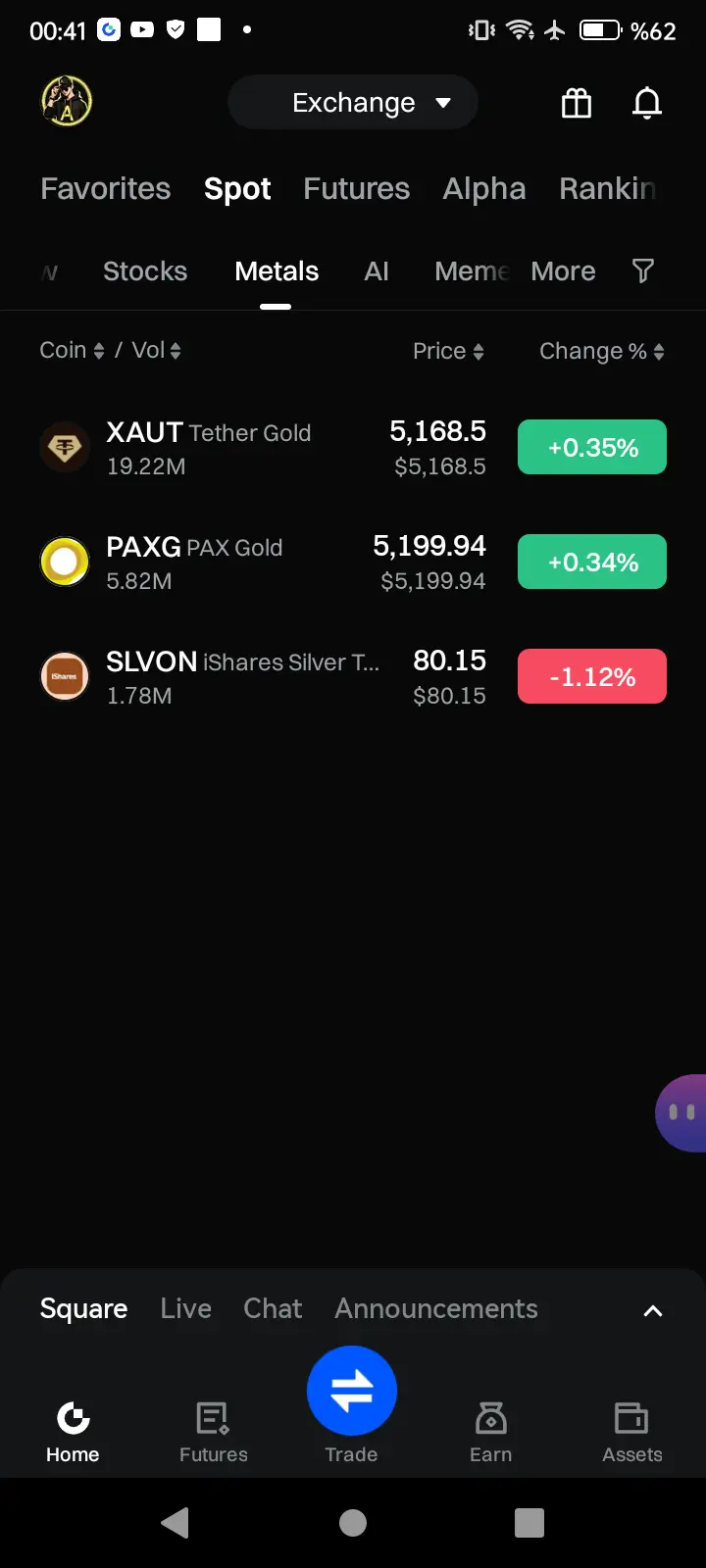

February 27, 2026 Spot Gold Morning Analysis

Yesterday, spot gold initially retreated then surged, showing overall strong volatility. The lowest was around $5131, and the highest reached $5205, closing above $5180, with the bulls in control.

The Fed's rate cut expectations remain, the US dollar is relatively weak, and gold is naturally favored; global central banks and major institutions continue to buy gold, providing support for the price; geopolitical tensions have minor fluctuations, also encouraging funds to seek gold as a safe haven. Today, focus on the USD trend and news from the Europe

Yesterday, spot gold initially retreated then surged, showing overall strong volatility. The lowest was around $5131, and the highest reached $5205, closing above $5180, with the bulls in control.

The Fed's rate cut expectations remain, the US dollar is relatively weak, and gold is naturally favored; global central banks and major institutions continue to buy gold, providing support for the price; geopolitical tensions have minor fluctuations, also encouraging funds to seek gold as a safe haven. Today, focus on the USD trend and news from the Europe

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Testimony by Vice Chair for Supervision Bowman on supervision and regulation

Chairman Scott, Ranking Member Warren, and Members of the Committee, thank you for the opportunity to testify on the Federal Reserve's supervisory and regulatory activities.

My testimony today will focus on two areas. First, the

- Reward

- like

- Comment

- Repost

- Share

Load More

Trending Topics

View More289.79K Popularity

22.13K Popularity

35.37K Popularity

11.75K Popularity

451.01K Popularity

Pin