Gate Research: The New Crypto Order Under a Tariff Storm — Structural Shifts and Opportunities in Stablecoins, RWA, and DeFi

4/18/2025, 6:45:09 AM

Download the Full Report (PDF)

This article explores how reciprocal tariff policies affect global financial markets through macroeconomic transmission mechanisms. It further analyzes their impact on the ecosystems of stablecoins, real-world assets (RWAs), and decentralized finance (DeFi), examining both the underlying mechanisms and the potential risks and opportunities involved.Abstract

- Global Market Turbulence and Broad Crypto Decline: Following the release of the “Reciprocal Tariff” policy in April 2025, global financial markets experienced intense volatility. On April 7, the cryptocurrency market suffered a significant downturn, with Bitcoin briefly dropping to around $74,600, and the total crypto market capitalization shrinking by 7% in a single day.

- Strong Reaction from Traditional Markets: After the tariff policy was enacted, U.S. stock markets lost $5.9 trillion in market capitalization over two trading days. The Volatility Index (VIX) surged 50.9% in a single day, and gold prices hit a historical high of $3,167.70 per ounce.

- On-Chain Stablecoin Activity Surges: Between January 20 and April 9, 2025, the total market capitalization of stablecoins grew by 11.13%, reaching $233.5 billion. On April 7, on-chain stablecoin transaction volume reached a two-month high of $72 billion, and daily active addresses exceeded 300,000—reflecting strong demand.

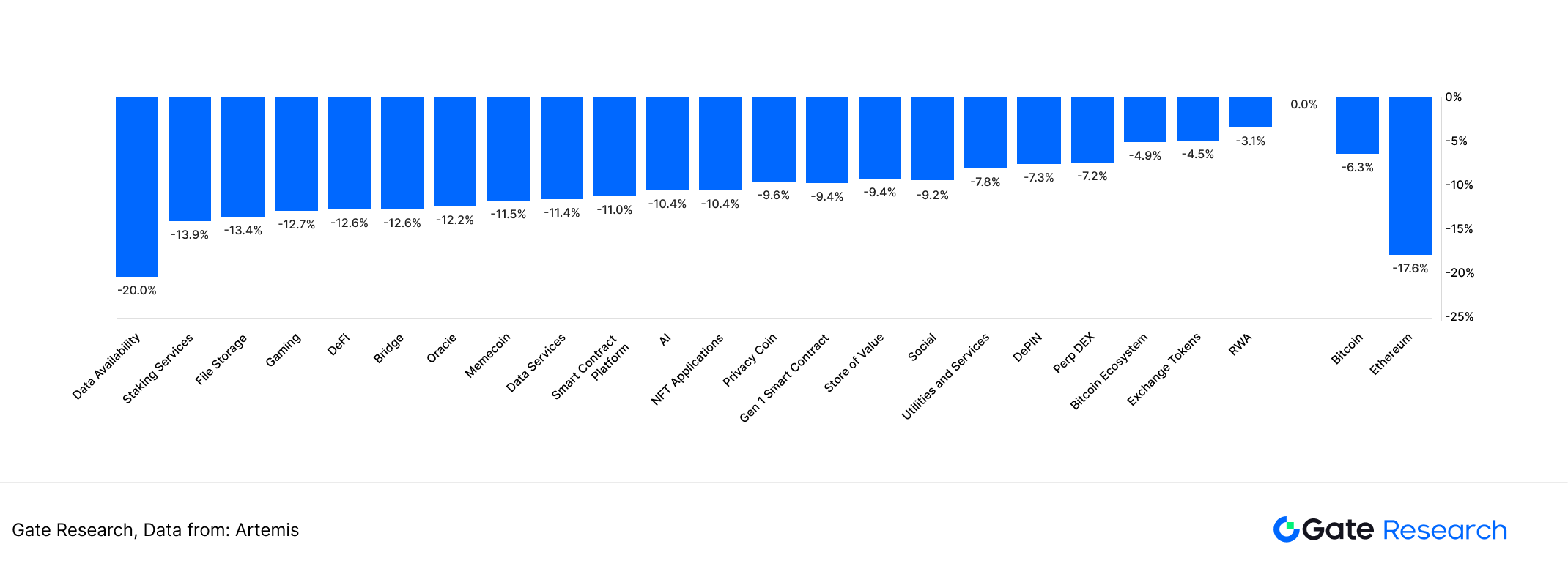

- RWA Shows Resilience and Rapid Growth: Within a week of the tariff rollout, the RWA sector dropped only 3.1%, much lower than other crypto sectors (which saw declines exceeding 10%), indicating its robustness. The total RWA market cap surpassed $32 billion, and trading volume surged 99% within five days of the tariff’s implementation.

- Tokenized Gold Trading Volume Soars: In the seven days leading up to April 11, weekly trading volume of tokenized gold exceeded $1 billion—the highest since March 2023. Since the tariff announcement, PAXG trading volume has soared over 900%, XAUT is up more than 300%, and KAU has skyrocketed by 83,000

- DeFi TVL Declines and Liquidation Risk Intensifies: Impacted by the broader market downturn, the DeFi sector’s total value locked (TVL) dropped 35.34% from January 20 to April 9, 2025, falling to $135.2 billion. In the week following the tariff implementation, TVL fell 13.88%. On-chain liquidation risks have significantly increased, with AAVE V3 recording $94.39 million in collateral token liquidations on April 6 and 7.

- Crypto Market Opportunities Amid Tariff Storm: Stablecoins and RWA show strong potential for hedging and cross-border settlement. DeFi is exploring algorithm-driven tariff arbitrage models using dynamic collateralization ratios, geographic arbitrage, and regulatory hedging to navigate new financial strategies under trade barriers.

(Click below to access the full report)

Gate Research

Gate Research is a comprehensive blockchain and crypto research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Click the Link to learn more

Author: Ember、Addie

Translator: Piper

Reviewer(s): Edward、Wayne、Evelyn

Translation Reviewer(s): Ashley、Joyce

* The information is not intended to be and does not constitute financial advice or any other recommendation of any sort offered or endorsed by Gate.

* This article may not be reproduced, transmitted or copied without referencing Gate. Contravention is an infringement of Copyright Act and may be subject to legal action.

Related Articles

Intermediate

Gate Research: Analysis of the Tariff Policy and Its Impact on the Bitcoin Mining Industry

This report focuses on three key segments—mining rig manufacturing, self-operated mining farms, and cloud mining. It provides a comprehensive review of global mining landscape shifts by analyzing supply chains, cost structures, geopolitical transitions, and stock performance. The report also evaluates how policy shocks feed back into Bitcoin’s medium- to long-term price structure.

4/17/2025, 3:28:03 AM

Beginner

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Yala inherits the security and decentralization of Bitcoin while using a modular protocol framework with the $YU stablecoin as a medium of exchange and store of value. It seamlessly connects Bitcoin with major ecosystems, allowing Bitcoin holders to earn yield from various DeFi protocols.

11/29/2024, 10:10:11 AM

Intermediate

Sui: How are users leveraging its speed, security, & scalability?

Sui is a PoS L1 blockchain with a novel architecture whose object-centric model enables parallelization of transactions through verifier level scaling. In this research paper the unique features of the Sui blockchain will be introduced, the economic prospects of SUI tokens will be presented, and it will be explained how investors can learn about which dApps are driving the use of the chain through the Sui application campaign.

8/13/2025, 7:33:39 AM

Intermediate

Dive into Hyperliquid

Hyperliquid's vision is to develop an on-chain open financial system. At the core of this ecosystem is Hyperliquid L1, where every interaction, whether an order, cancellation, or settlement, is executed on-chain. Hyperliquid excels in product and marketing and has no external investors. With the launch of its second season points program, more and more people are becoming enthusiastic about on-chain trading. Hyperliquid has expanded from a trading product to building its own ecosystem.

6/19/2024, 6:39:42 AM

Beginner

What is Stablecoin?

A stablecoin is a cryptocurrency with a stable price, which is often pegged to a legal tender in the real world. Take USDT, currently the most commonly used stablecoin, for example, USDT is pegged to the US dollar, with 1 USDT = 1 USD.

12/16/2022, 9:13:56 AM

Beginner

What Is a Yield Aggregator?

Yield Aggregators are protocols that automate the process of yield farming which allows crypto investors to earn passive income via smart contracts.

1/27/2023, 2:55:12 PM