What is PENDLE: A Comprehensive Guide to the DeFi Yield Trading Protocol

Pendle's Positioning and Significance

In 2021, Pendle was introduced as a protocol for tokenized future yield trading on AMM systems. It aims to solve the challenge of efficient yield management and trading in the DeFi space.

As a pioneering yield trading protocol, Pendle plays a crucial role in the DeFi sector, particularly in yield optimization and management.

As of 2025, Pendle has become a significant player in the DeFi yield market, with a market cap of over $826 million and an active community of yield traders and liquidity providers.

Origins and Development History

Background

Pendle was created in 2021 to address the complexities of yield trading and management in the rapidly evolving DeFi ecosystem. It emerged during a period of explosive growth in DeFi applications, aiming to provide users with more efficient ways to manage and trade future yields.

Pendle's launch brought new possibilities for yield farmers, traders, and liquidity providers in the DeFi space.

Key Milestones

- 2021: Pendle launched, introducing tokenized yield trading.

- 2023: Total supply reached 251 million PENDLE, with a circulating supply of about 140 million.

- 2025: Market cap surpassed $826 million, ranking 121st among cryptocurrencies.

Supported by its community and development team, Pendle continues to optimize its technology, security, and real-world applications in yield trading.

How Does Pendle Work?

Decentralized Control

Pendle operates on a decentralized network of computers (nodes) worldwide, free from control by traditional financial institutions or governments. These nodes collaborate to validate transactions, ensuring system transparency and attack resistance.

Blockchain Core

Pendle's blockchain is a public, immutable digital ledger that records all transactions. Transactions are grouped into blocks and linked through cryptographic hashes, forming a secure chain. Anyone can view the records, establishing trust without intermediaries.

Ensuring Fairness

Pendle uses a consensus mechanism to validate transactions and prevent fraudulent activities. Participants maintain network security through activities such as providing liquidity or staking PENDLE tokens, and are rewarded with PENDLE tokens.

Secure Transactions

Pendle uses public-private key encryption to protect transactions:

- Private keys (like secret passwords) are used to sign transactions

- Public keys (like account numbers) are used to verify ownership

This mechanism ensures fund security while maintaining transaction privacy. Additionally, Pendle implements smart contract audits and other security measures to protect user assets.

PENDLE Market Performance

Circulation Overview

As of September 16, 2025, PENDLE has a circulating supply of 168,630,142.7085997 tokens, with a total supply of 281,527,448.4585314 tokens.

New tokens enter the market through a weekly emission schedule, which affects its supply and demand dynamics.

Price Fluctuations

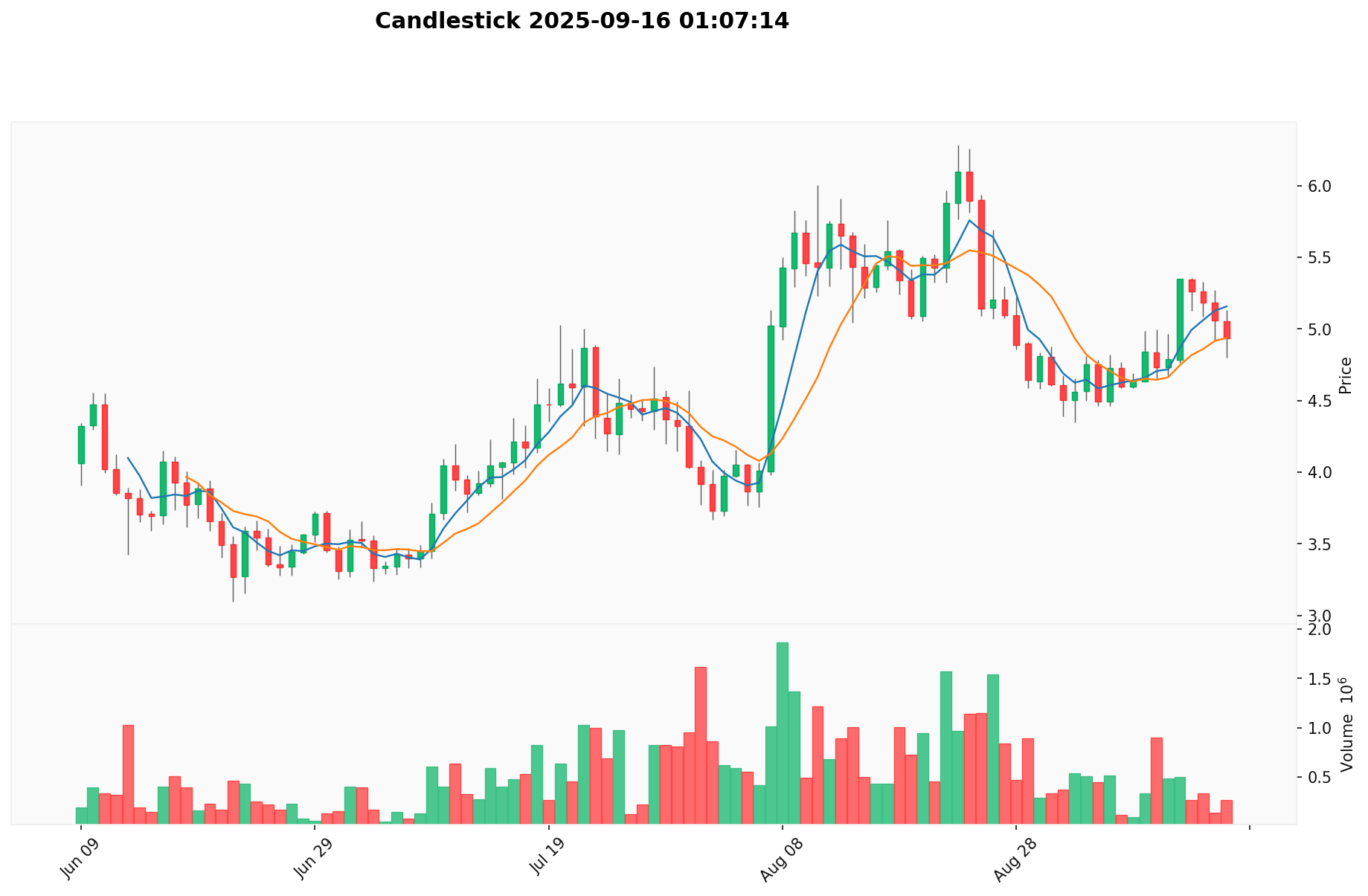

PENDLE reached its all-time high of $7.5 on April 11, 2024.

Its lowest price was $0.03377729, recorded on November 15, 2022.

These fluctuations reflect market sentiment, adoption trends, and external factors.

Click to view the current PENDLE market price

On-Chain Metrics

- Daily Transaction Volume: $1,277,884.44388 (indicating network activity)

- Active Addresses: 64,473 (reflecting user engagement)

Pendle Ecosystem Applications and Partnerships

Core Use Cases

Pendle's ecosystem supports various applications:

- DeFi: Pendle Protocol, providing tokenized future yield trading on AMM systems.

- Yield Management: Pendle v2 AMM, enabling users to earn fixed or flexible yields.

Strategic Partnerships

Pendle has established collaborations with various DeFi protocols and yield-generating platforms, enhancing its technological capabilities and market influence. These partnerships provide a solid foundation for Pendle's ecosystem expansion.

Controversies and Challenges

Pendle faces the following challenges:

- Technical Challenges: Maintaining capital efficiency in yield trading

- Regulatory Risks: Potential scrutiny of DeFi protocols and yield products

- Competitive Pressure: Emergence of other yield optimization platforms

These issues have sparked discussions within the community and market, driving continuous innovation for Pendle.

Pendle Community and Social Media Atmosphere

Fan Enthusiasm

Pendle's community is vibrant, with 64,473 holders as of the latest data.

On X platform, related posts and hashtags (such as #Pendle) frequently trend, reflecting community engagement.

Price movements and new feature releases ignite community enthusiasm.

Social Media Sentiment

Sentiment on X presents a mixed picture:

- Supporters praise Pendle's innovative yield trading mechanisms and capital efficiency.

- Critics focus on potential risks associated with yield farming and complex DeFi strategies.

Recent trends show generally positive sentiment amidst market fluctuations.

Hot Topics

X users actively discuss Pendle's yield optimization strategies, tokenomics, and DeFi integration, showcasing both its transformative potential and the challenges in DeFi adoption.

More Information Sources for Pendle

- Official Website: Visit Pendle's official website for features, use cases, and latest updates.

- Whitepaper: Pendle's whitepaper details its technical architecture, goals, and vision.

- X Updates: On X platform, Pendle uses @pendle_fi, actively sharing technical upgrades, community events, and partnership news.

Pendle's Future Roadmap

- Ongoing Development: Continue to enhance the Pendle v2 AMM and yield tokenization mechanisms

- Ecosystem Goals: Expand partnerships with more yield-generating protocols and DeFi platforms

- Long-term Vision: Become a leading protocol for yield trading and management in the DeFi space

How to Participate in Pendle?

- Purchase Channels: Buy PENDLE on Gate.com

- Storage Solutions: Use secure Web3 wallets for storing PENDLE tokens

- Participate in Governance: Engage in community decisions through vePENDLE staking

- Build the Ecosystem: Visit Pendle's GitHub repository to contribute code or develop integrations

Summary

Pendle is redefining yield trading in DeFi, offering innovative tokenized future yield trading and efficient yield management. Its active community, rich resources, and strong market performance make it stand out in the cryptocurrency field. Despite facing challenges in DeFi complexity and market volatility, Pendle's innovative spirit and clear roadmap position it as an important player in the future of decentralized finance. Whether you're a newcomer or an experienced player, Pendle is worth watching and participating in.

FAQ

What is the meaning of Pendle?

Pendle refers to a pendent object, like an earring or pendulum. It's also linked to Pendle Hill in Lancashire, England.

What is Elon Musk's crypto coin?

Elon Musk doesn't have his own crypto coin. He's known for influencing Bitcoin and Dogecoin, with Dogecoin being his most notable mention.

How does Pendle work?

Pendle tokenizes future yields, allowing users to trade them separately from underlying assets. This enables fixed returns and unlocks liquidity in DeFi, similar to zero-coupon bonds in traditional finance.

What are pendles used for?

Pendles are used for yield trading, liquidity provision, and governance in the Pendle ecosystem. They enable users to trade future yield, provide liquidity to earn rewards, and participate in protocol decisions.

Share

Content