2025 TRU Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of TRU

TRU (TrueFi), launched by TrustToken as an unsecured lending DeFi protocol, has established itself as a notable participant in the decentralized finance ecosystem since its inception in 2018. As of December 2025, TRU maintains a market capitalization of approximately $11.69 million, with a circulating supply of around 1.37 billion tokens, currently trading at $0.008532. This innovative DeFi asset is playing an increasingly important role in reshaping the landscape of decentralized lending and borrowing.

This article will provide a comprehensive analysis of TRU's price trends and market dynamics, examining historical performance patterns, market supply and demand factors, and ecosystem developments to deliver professional price forecasts and practical investment strategies for investors considering exposure to this asset.

TRU (Archblock) Market Analysis Report

I. TRU Price History Review and Market Status

TRU Historical Price Evolution

-

2021: TRU reached its all-time high of $1.017 on August 12, 2021, representing the peak of market enthusiasm for the TrueFi protocol launched by TrustToken.

-

2021-2025: Extended bear market period, with the token experiencing a cumulative decline of 90.66% over the one-year period, reflecting broader market downturn and shifting investor sentiment toward DeFi lending protocols.

-

December 19, 2025: TRU reached its all-time low of $0.00789887, marking the lowest valuation point in the token's trading history.

TRU Current Market Status

As of December 21, 2025, TRU is trading at $0.008532, with a 24-hour trading volume of approximately $63,678.75. The token has experienced a -3.76% decline over the past 24 hours, continuing its bearish trend with a -22.08% decrease over the last 7 days and -31.91% over the past 30 days.

The circulating supply stands at 1,370,406,688.35 TRU tokens out of a total supply of 1,385,068,622.20 TRU, representing a circulation ratio of 94.51%. The fully diluted market capitalization is approximately $11.82 million, with a current market cap of $11.69 million. The token maintains a market dominance of 0.00036% in the broader cryptocurrency market.

TRU is listed on 20 exchanges, with an active holder base of 13,022 addresses. The 24-hour price range fluctuated between $0.008504 and $0.008942.

Visit TRU Market Price on Gate.com for real-time updates.

TRU Market Sentiment Indicator

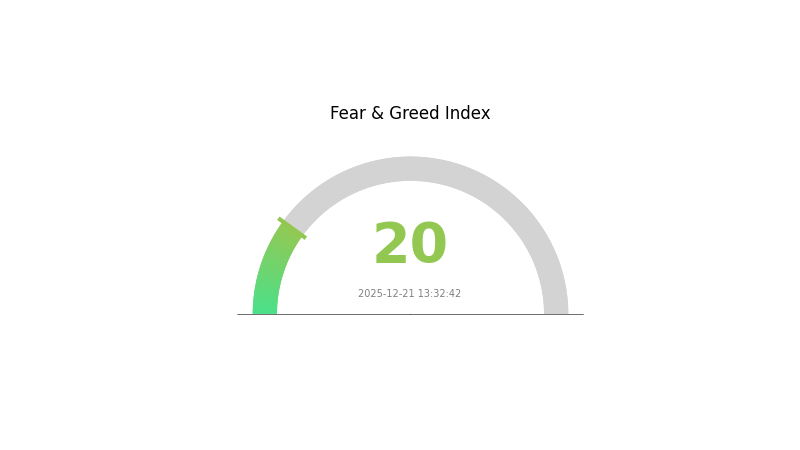

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with the index reaching 20, indicating significant market pessimism and heightened risk aversion among investors. This level typically signals capitulation phases where panic selling dominates. During such periods, experienced traders often identify buying opportunities as prices may have been oversold. However, caution is advised as extreme fear can persist and deepen further. Monitor key support levels and market developments closely. Consider dollar-cost averaging strategies to mitigate timing risk when market sentiment is this depressed. Diversification and risk management remain essential during such volatile conditions.

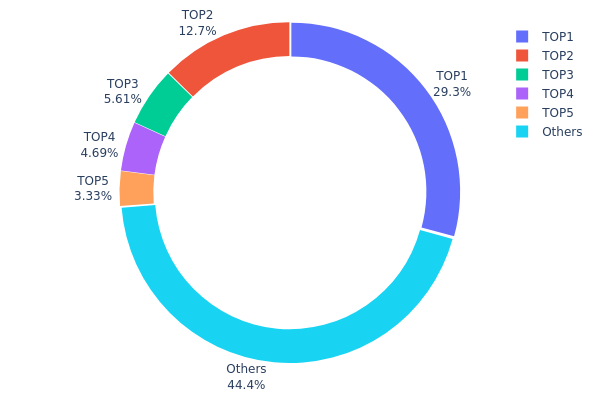

TRU Holdings Distribution

The address holdings distribution chart illustrates how TRU tokens are allocated across different wallet addresses on the blockchain. By analyzing the concentration of tokens among top holders versus the broader holder base, this metric provides critical insights into the decentralization status and potential market manipulation risks of the token ecosystem.

Current data reveals a moderately concentrated distribution pattern for TRU. The top five addresses collectively control approximately 55.54% of circulating tokens, with the largest holder (0xf977...41acec) commanding 29.28% of the total supply. This concentration level suggests meaningful centralization, particularly evident in the dominant position of the leading address. However, the remaining 44.46% distributed among other addresses provides a substantial decentralization component that prevents extreme monopolistic control. The secondary holders demonstrate gradual distribution decline, with holdings decreasing from 12.65% to 3.32%, indicating a relatively balanced tiered structure rather than a cliff-based concentration scenario.

This distribution pattern carries notable implications for market dynamics and stability. The presence of several significant stakeholders with double-digit percentage holdings creates potential vectors for coordinated market movements, particularly during periods of volatility or reallocation events. The substantial portion held by dispersed addresses, however, serves as a stabilizing factor that mitigates extreme price manipulation risks. The current structure suggests TRU operates within acceptable decentralization parameters while maintaining sufficient holder concentration to influence market sentiment and liquidity conditions. Continued monitoring of top holder movement patterns remains essential for assessing whether this distribution evolves toward greater decentralization or gravitates toward increased concentration.

Click to view current TRU holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 405578.50K | 29.28% |

| 2 | 0xa269...d7e7ff | 175340.40K | 12.65% |

| 3 | 0xa1a7...7badcc | 77757.21K | 5.61% |

| 4 | 0x5a52...70efcb | 64940.65K | 4.68% |

| 5 | 0x2369...8ee424 | 46072.56K | 3.32% |

| - | Others | 615379.30K | 44.46% |

II. Core Factors Affecting TRU Future Price

Supply Mechanism

- Maximum Supply Cap: TRU has a maximum issuance limit set through code, establishing a fixed upper bound for total token supply.

- Circulating Supply Dynamics: The amount of TRU in circulation is influenced by both team release schedules and market factors, creating a dynamic supply environment that impacts price discovery.

- Market Impact: Changes in circulating supply relative to maximum supply can significantly influence token scarcity perception and investment demand.

Institutional and Whale Dynamics

- Market Sentiment: TRU's price trajectory is affected by investor sentiment and market psychology, with institutional positioning potentially amplifying price movements in both directions.

- DeFi Market Correlation: As a decentralized finance token, TRU's adoption and value proposition are closely tied to broader DeFi ecosystem development and user acceptance trends.

III. 2025-2030 TRU Price Forecast

2025 Outlook

- Conservative Forecast: $0.00639 - $0.00852

- Neutral Forecast: $0.00852 (average price expectation)

- Optimistic Forecast: $0.01252 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with increasing adoption metrics and protocol improvements

- Price Range Forecast:

- 2026: $0.00852 - $0.01378

- 2027: $0.01106 - $0.01774

- Key Catalysts: Enhanced tokenomics implementation, expanded partnership networks, increased institutional interest, and demonstrated utility growth within the TRU ecosystem

2028-2030 Long-term Outlook

- Base Case: $0.01225 - $0.01659 by 2028 (assumes steady market conditions and moderate adoption acceleration)

- Optimistic Scenario: $0.01387 - $0.01971 by 2029 (assumes strong ecosystem expansion and favorable macroeconomic conditions)

- Transformational Scenario: $0.01419 - $0.02483 by 2030 (requires breakthrough adoption rates, major strategic partnerships, or significant protocol innovations that establish TRU as a critical infrastructure component in the blockchain ecosystem)

- December 21, 2025: TRU trading at $0.00852 (current market positioning reference point)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01252 | 0.00852 | 0.00639 | 0 |

| 2026 | 0.01378 | 0.01052 | 0.00852 | 23 |

| 2027 | 0.01774 | 0.01215 | 0.01106 | 42 |

| 2028 | 0.01659 | 0.01494 | 0.01225 | 75 |

| 2029 | 0.01971 | 0.01576 | 0.01387 | 84 |

| 2030 | 0.02483 | 0.01774 | 0.01419 | 107 |

TRU Professional Investment Strategy and Risk Management Report

I. Executive Summary

TRU (Archblock) is an unsecured lending DeFi protocol launched by TrustToken. As of December 21, 2025, TRU trades at $0.008532 with a market capitalization of approximately $11.69 million and a 24-hour trading volume of $63,678.75. The token has experienced significant depreciation, declining 90.66% over the past year, reflecting broader market challenges in the DeFi lending sector.

IV. TRU Professional Investment Strategy and Risk Management

TRU Investment Methodology

(1) Long-term Hold Strategy

-

Target Investors: DeFi protocol believers with high risk tolerance and extended investment horizons (3+ years)

-

Operational Recommendations:

- Accumulate during market downturns when sentiment is extremely negative

- Establish dollar-cost averaging (DCA) over 6-12 months to reduce timing risk

- Maintain positions through protocol development milestones and governance updates

- Store assets securely using Gate.com Web3 Wallet for active protocol participation

(2) Active Trading Strategy

-

Technical Analysis Approach:

- Volatility Analysis: Monitor the 24-hour price range ($0.008504-$0.008942) for swing trading opportunities

- Volume Trends: Track 24-hour volume patterns against historical averages for entry/exit signals

-

Trading Execution Points:

- Entry on support breaks below $0.00850 with volume confirmation

- Exit on resistance near $0.0095 with profit-taking discipline

- Implement strict stop-loss orders at 15-20% below entry positions

TRU Risk Management Framework

(1) Asset Allocation Principles

-

Conservative Investors: 0-1% of total portfolio

- Suitable only for diversified portfolios with substantial capital reserves

- Maintain as speculative allocation rather than core holding

-

Active Investors: 1-3% of total portfolio

- Position sizing based on individual risk tolerance

- Integrate into broader DeFi sector exposure

-

Professional Investors: 2-5% of total portfolio

- Considered within dedicated DeFi or high-risk alternative allocation

- Subject to institutional risk governance frameworks

(2) Risk Hedging Solutions

-

Portfolio Diversification: Balance TRU exposure with established DeFi tokens and stablecoins to reduce single-asset concentration risk

-

Position Sizing: Implement strict position limits to prevent catastrophic losses during extreme market dislocations

(3) Secure Storage Solutions

-

Hot Wallet Strategy: Gate.com Web3 Wallet for active trading and protocol interactions

- Enables seamless participation in TrueFi governance

- Supports efficient transaction execution on Ethereum network

- Provides user-controlled private key management

-

Cold Storage Approach: For long-term positions exceeding 6 months, consider transferring to hardware-secured solutions with enhanced isolation

-

Security Considerations:

- Enable multi-signature authentication on wallet addresses holding significant TRU quantities

- Verify smart contract interactions on Etherscan before token transfers

- Maintain updated backup records of private keys in secure offline locations

- Monitor wallet activity regularly for unauthorized access attempts

V. Potential Risks and Challenges for TRU

Market Risks

-

Extreme Price Volatility: TRU has declined 90.66% year-over-year, demonstrating severe downside exposure and liquidity constraints during market stress events

-

Low Trading Liquidity: With only $63,678.75 in 24-hour volume and 20 exchange listings, large position entries/exits risk significant slippage and price impact

-

Concentrated Token Distribution: 13,022 token holders suggest potential concentration risk among early investors and core team members, creating sell pressure scenarios

Regulatory Risks

-

DeFi Protocol Uncertainty: Unsecured lending protocols face evolving regulatory scrutiny regarding classification as securities or unregistered financial products

-

Stablecoin Compliance: TrustToken's associated stablecoin products operate under regulatory frameworks that may impact TRU token ecosystem development

-

Jurisdiction-Specific Restrictions: Certain markets may restrict DeFi protocol participation, limiting market expansion opportunities

Technical Risks

-

Smart Contract Vulnerabilities: Unsecured lending protocols carry inherent smart contract risks including code exploits and unforeseen protocol failures

-

Governance Concentration: Protocol decision-making may remain concentrated among early stakeholders, limiting decentralization benefits

-

Adoption Risk: Protocol relevance depends on maintaining active user base and competitive advantages against alternative lending platforms

VI. Conclusion and Action Recommendations

TRU Investment Value Assessment

TRU presents a speculative investment opportunity within the DeFi lending sector, characterized by significant downside risks and limited near-term catalysts. The 90.66% annual decline reflects both sector-wide challenges and potential protocol-specific headwinds. Investment viability depends primarily on TrustToken's ability to establish meaningful lending volume, achieve regulatory clarity, and maintain technical security. Current valuations suggest limited near-term upside, with substantial execution risk remaining.

TRU Investment Recommendations

✅ Beginners: Treat TRU as a speculative satellite position (0.5-1% allocation) only after establishing diversified core holdings in established cryptocurrencies and DeFi protocols. Utilize Gate.com for secure trading access.

✅ Experienced Investors: Consider 1-3% allocation within dedicated DeFi sector exposure, implementing strict stop-loss discipline at 20% below entry prices. Monitor protocol governance developments and technical security updates closely.

✅ Institutional Investors: Evaluate TRU within broader alternative asset allocation frameworks, subject to institutional risk governance and compliance requirements. Establish custody solutions appropriate for institutional holdings.

TRU Trading Participation Methods

-

Spot Trading on Gate.com: Execute direct TRU/USDT trades with transparent order books and competitive fee structures

-

Gate.com Web3 Wallet Integration: Participate in TrueFi protocol governance and staking mechanisms directly from secured wallet interfaces

-

Dollar-Cost Averaging: Implement systematic purchasing schedules to reduce timing risk during extended downtrends

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on individual risk tolerance and should consult professional financial advisors. Never invest capital you cannot afford to lose completely.

FAQ

Is TRU a good investment?

TRU shows strong momentum indicators with a B Momentum Score, making it attractive for momentum investors. Its solid cash flow growth and favorable price-to-cash-flow ratio suggest good potential for growth-oriented investors. Overall, TRU could be a suitable investment choice depending on your investment strategy.

What is TRU (TrueUSD) and how does it work?

TrueUSD (TUSD) is a USD-backed stablecoin verified through daily third-party audits, ensuring 1:1 value stability. It operates across multiple blockchains for seamless transfers and transparency.

What factors could affect TRU price in the future?

TRU price could be influenced by institutional adoption of decentralized finance, overall cryptocurrency market trends, trading volume growth, and increased demand for TrueFi's lending protocols and services.

What are the risks of investing in TRU?

TRU faces market volatility risks, economic downturns, and competitive pressures from other credit reporting agencies. Regulatory changes in the credit reporting industry could impact operations. High valuation multiples also present downside risk.

2025 EULPrice Prediction: Market Analysis and Future Trends for Euler Finance Token in the DeFi Ecosystem

2025 EDGEPrice Prediction: Analysis of Growth Potential and Market Factors Influencing the Future Value

2025 BENQI Price Prediction: Analyzing Market Trends and Future Valuation for the DeFi Protocol

2025 ASTER Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

2025 OMG Price Prediction: Analyzing Market Trends and Future Potential of the Token in a Maturing Crypto Ecosystem

2025 MORPHO Price Prediction: Analyzing Market Trends and Growth Potential for the DeFi Token

2025 BZZ Price Prediction: Expert Analysis and Market Outlook for Swarm's Native Token

2025 BMEX Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 MSQ Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 GEAR Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Cross-Chain Trading Simplified: Discover Hyperswap's Latest Launch & Airdrop Essentials