2025 FST Price Prediction: Expert Analysis and Market Forecast for Fastcoin's Future Value

Introduction: FST's Market Position and Investment Value

FreeStyle Classic Token (FST) represents a cultural asset reborn on-chain, bridging street culture and digital expression through Web3. Launched in 2025, FST has established itself as a community-driven token within the cultural ecosystem space. As of December 2025, FST commands a market capitalization of $39.59 million with a circulating supply of 220 million tokens, currently trading at $0.03959 per token. This asset, positioned as a "cultural symbol in the blockchain era," is playing an increasingly important role in reshaping how communities engage with meme culture and digital ownership.

This article will provide a comprehensive analysis of FST's price trends and market outlook, examining historical price movements, supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for market participants interested in this token's trajectory through 2030.

FreeStyle Classic Token (FST) Market Analysis Report

I. FST Price History Review and Market Status

FST Historical Price Evolution

Based on available data, FreeStyle Classic Token has experienced significant price volatility since its launch on January 24, 2025:

- September 20, 2025: All-time high (ATH) of $0.177, representing peak market enthusiasm for the project

- August 25, 2025: All-time low (ATL) of $0.0252, marking the lowest valuation point in the token's history

- December 22, 2025: Current price of $0.03959, reflecting a -41.011% decline from ATH over the year

FST Current Market Status

As of December 22, 2025, FreeStyle Classic Token is trading at $0.03959 with the following market metrics:

Price Performance:

- 1-hour change: -0.2%

- 24-hour change: -1.15%

- 7-day change: -14.97%

- 30-day change: -18.55%

- Year-to-date change: -41.011%

Market Capitalization and Supply:

- Current market cap: $8,709,800

- Fully diluted valuation (FDV): $39,590,000

- Circulating supply: 220,000,000 FST (22% of total supply)

- Total supply: 1,000,000,000 FST

- Market dominance: 0.0012%

Trading Activity:

- 24-hour trading volume: $12,087.21

- Number of active holders: 11,100

- Number of trading pairs: 5 exchanges

- Market ranking: #1,245 by market capitalization

Technical Specifications:

- Blockchain: BSC (BEP-20 standard)

- Contract address: 0xfa35e2250e376c23955247383dc32c79082e7fcc

- 24-hour price range: $0.03938 - $0.03997

The token currently operates in an environment characterized by extreme market fear (VIX: 25), reflecting broader cryptocurrency market sentiment challenges. The token's relatively low trading volume relative to its market cap indicates limited liquidity, which may contribute to price volatility.

Click to view current FST market price

FST Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the FST index at 25. This exceptionally low reading signals severe market anxiety and pessimistic sentiment among investors. During periods of extreme fear, opportunities often emerge for contrarian traders, as assets may be oversold. However, caution is advised as volatility typically increases during such market conditions. Investors should conduct thorough research before making trading decisions and consider their risk tolerance carefully on Gate.com's market data platform.

FST Holdings Distribution

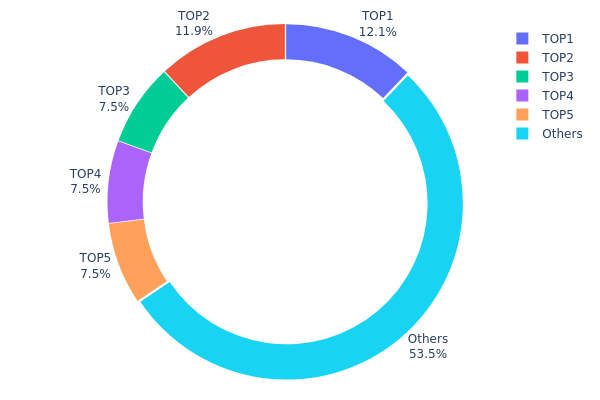

The address holdings distribution chart illustrates the concentration of FST tokens across the blockchain network by tracking the top individual wallet addresses and their respective token quantities. This metric is crucial for assessing the degree of decentralization and identifying potential concentration risks within the token's ecosystem.

Current analysis reveals moderate concentration characteristics in FST's holder landscape. The top five addresses collectively control approximately 46.48% of the total token supply, with the leading address holding 12.07% and the second-largest position accounting for 11.91%. While the remaining 53.52% is distributed across other addresses, the relatively balanced positioning of the top five holders suggests that no single entity exercises dominant control. This distribution pattern indicates that FST maintains a reasonably diversified holder base compared to highly centralized token structures, where top addresses frequently exceed 30-40% individual concentration thresholds.

The current address distribution presents a stabilized market structure with reduced manipulation risks. The fragmentation across multiple significant holders creates natural checks and balances, making coordinated price suppression or sudden liquidation events less likely to destabilize the broader market. The substantial portion held by dispersed holders (53.52%) further reinforces the token's decentralization trend, suggesting organic adoption and community participation. This structure indicates that FST has achieved a favorable balance between institutional participation through the top holders and grassroots distribution, supporting both market liquidity and long-term ecosystem stability.

Click to view current FST Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa5a8...ab05b7 | 120713.66K | 12.07% |

| 2 | 0x7a24...c724bd | 119166.67K | 11.91% |

| 3 | 0xef18...546db3 | 75000.00K | 7.50% |

| 4 | 0x63e7...f7478f | 75000.00K | 7.50% |

| 5 | 0x6eea...83e985 | 75000.00K | 7.50% |

| - | Others | 535119.67K | 53.52% |

II. Core Factors Affecting FST's Future Price

Market Demand and Trading Activity

-

Platform Launch Impact: The launch of FST spot trading on Gate.com represents a significant milestone that directly influences price discovery and market accessibility. As a newly listed token on a major exchange, increased platform visibility and trading volume are expected to support price dynamics.

-

HODLer Airdrop Program: Gate.com's HODLer Airdrop initiative, distributing 150,000 FST tokens to GT holders, enhances user engagement and token distribution. This community-building mechanism can influence holder sentiment and trading activity by expanding the token's user base.

-

Trading Volume Correlation: FST's price trajectory is intrinsically linked to trading volume and platform activity levels on Gate.com. Higher transaction volumes typically correlate with improved price discovery and reduced volatility in spot trading markets.

III. FST Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.02766 - $0.03951

- Neutral Forecast: $0.03951

- Bullish Forecast: $0.04465 (requires sustained market interest and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with progressive price discovery as the project develops its utility and adoption metrics.

- Price Range Forecast:

- 2026: $0.03787 - $0.04923 (6% upside potential)

- 2027: $0.04246 - $0.05844 (15% cumulative gains)

- 2028: $0.04736 - $0.06662 (31% cumulative gains)

- Key Catalysts: Enhanced tokenomics implementation, ecosystem expansion, strategic partnerships, and increased institutional adoption through platforms like Gate.com.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.06344 - $0.10741 (82% cumulative appreciation by 2030, assuming steady fundamental development and market recovery)

- Optimistic Scenario: $0.08485 - $0.10741 (assumes accelerated adoption, successful protocol upgrades, and broader market momentum)

- Transformative Scenario: Above $0.10741 (requires breakthrough utility adoption, significant ecosystem milestones, and favorable macroeconomic conditions)

- 2030-12-22: FST at $0.07209 average (representing established market positioning after sustained growth trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04465 | 0.03951 | 0.02766 | 0 |

| 2026 | 0.04923 | 0.04208 | 0.03787 | 6 |

| 2027 | 0.05844 | 0.04565 | 0.04246 | 15 |

| 2028 | 0.06662 | 0.05205 | 0.04736 | 31 |

| 2029 | 0.08485 | 0.05933 | 0.03323 | 49 |

| 2030 | 0.10741 | 0.07209 | 0.06344 | 82 |

FreeStyle Classic Token (FST) Professional Investment Analysis Report

I. Executive Summary

FreeStyle Classic Token (FST) is a cultural-driven digital asset operating on the BEP-20 standard within the Binance Smart Chain ecosystem. As of December 22, 2025, FST is trading at $0.03959 with a market capitalization of $8.71 million and a fully diluted valuation of $39.59 million. The token represents a community-owned cultural ecosystem bridging street culture, digital expression, and Web3 technology.

Key Metrics Overview

| Metric | Value |

|---|---|

| Current Price | $0.03959 |

| 24H Change | -1.15% |

| Market Cap | $8.71M |

| Fully Diluted Valuation | $39.59M |

| Circulating Supply | 220M FST |

| Total Supply | 1B FST |

| Circulation Ratio | 22% |

| 24H Trading Volume | $12,087.21 |

| Market Rank | #1245 |

| Total Holders | 11,100 |

| Active Exchanges | 5 |

II. FST Market Position & Performance Analysis

Current Market Status

FST is positioned as a community-driven cultural token with a moderate market presence. The token ranks #1245 in overall market capitalization, indicating emerging market status with room for growth potential.

Price Performance Timeline:

- All-Time High (ATH): $0.177 (September 20, 2025)

- All-Time Low (ATL): $0.0252 (August 25, 2025)

- Current Price: $0.03959

- Distance from ATH: -77.6%

- Distance from ATL: +57.1%

Recent Price Trends

| Time Period | Price Change | Absolute Change |

|---|---|---|

| 1 Hour | -0.2% | -$0.000079 |

| 24 Hours | -1.15% | -$0.000461 |

| 7 Days | -14.97% | -$0.00697 |

| 30 Days | -18.55% | -$0.00902 |

| 1 Year | -41.011% | -$0.02752 |

The token exhibits significant downward pressure across all major timeframes, with the steepest declines occurring in longer-term horizons. This suggests potential market consolidation or structural challenges requiring investor evaluation.

Liquidity & Trading Volume

Current 24-hour trading volume of $12,087.21 demonstrates modest liquidity relative to market cap, indicating:

- Moderate liquidity conditions

- Potential slippage on large orders

- Limited market depth for institutional trades

III. FST Project Foundation & Ecosystem

Project Vision & Positioning

FreeStyle Classic transcends traditional entertainment platforms by establishing itself as a cultural icon reimagined through blockchain technology. The project articulates a comprehensive vision:

Core Philosophy:

- Cultural Symbol Reborn On-Chain: FST represents the evolution of street culture into Web3, creating a digital-native cultural movement

- Lifestyle & Movement: Beyond financial utility, the token embodies a lifestyle choice and community-driven movement

- Co-Creator Economy: Every participant transforms from passive consumer to active story co-creator

Ecosystem Components

1. Cultural Integration

- Street culture to global digital stage

- Meme culture and digital expression

- Community ownership mechanics

2. Web3 Native Features

- Decentralized community governance

- Creator economy participation

- Token-gated community access

3. Community Model

- Remix culture and meme creators

- FreeStyle Classic representatives

- Multi-cultural digital creators

Technical Specifications

Blockchain Network: Binance Smart Chain (BSC) Token Standard: BEP-20 Contract Address: 0xfa35e2250e376c23955247383dc32c79082e7fcc Blockchain Explorer: BSC Scan Integration

Supply Structure:

- Total Supply: 1,000,000,000 FST

- Circulating Supply: 220,000,000 FST (22% circulated)

- Remaining Supply: 780,000,000 FST (78% to be released)

The substantial amount of unreleased tokens (78%) presents both opportunity and dilution risk, with future token release mechanics crucial for price dynamics.

IV. FST Professional Investment Strategy & Risk Management

FST Investment Methodology

(1) Long-Term Holding Strategy

Target Investor Profile:

- Community-oriented investors believing in cultural token movements

- Web3 enthusiasts with conviction in creator economy adoption

- Patient capital investors with 18-36 month time horizons

Operational Recommendations:

- Community Participation: Engage actively within FST ecosystem to understand project development, participate in governance discussions, and identify early signals of product expansion

- Dollar-Cost Averaging (DCA): Implement systematic purchasing during market weakness to reduce entry price volatility and build positions gradually

- Secure Storage: Utilize Gate.com Web3 wallet for custodial security with multi-signature capability and regular backup protocols

(2) Active Trading Strategy

Technical Analysis Tools:

- Relative Strength Index (RSI): Monitor RSI 14-period indicator for overbought (>70) and oversold (<30) conditions to time tactical entry and exit points

- Moving Average Convergence Divergence (MACD): Track MACD crossovers and histogram divergence for momentum confirmation and trend reversal signals

- Bollinger Bands: Utilize 20-period Bollinger Bands to identify price extremes and potential mean reversion trading opportunities

Swing Trading Key Points:

- Resistance & Support Identification: Establish technical levels based on previous price structure, particularly around $0.177 (ATH) and $0.0252 (ATL) for profit-taking and stop-loss placement

- Volume Confirmation: Execute trades only when accompanied by above-average volume to confirm institutional participation and reduce false breakout risk

FST Risk Management Framework

(1) Asset Allocation Principles

Conservative Investors: 1-3% portfolio allocation

- Suitable for investors with low risk tolerance

- Focus on position sizing to contain maximum drawdown exposure

- Emphasis on stop-loss discipline

Active Investors: 3-8% portfolio allocation

- Medium risk tolerance with technical market understanding

- Flexible position adjustment based on market conditions

- Regular rebalancing triggers

Professional Investors: 8-15% portfolio allocation

- High risk tolerance with institutional experience

- Multi-position sizing across different entry points

- Hedging strategies for portfolio optimization

(2) Risk Hedging Solutions

- Stablecoin Conversion Hedge: Convert positions to USDT or USDC during significant technical resistance to reduce downside exposure while maintaining optionality

- Diversification Strategy: Maintain FST as percentage of broader crypto portfolio, ensuring no single asset concentration exceeds risk tolerance threshold

(3) Secure Storage Solutions

Hot Wallet Strategy: Gate.com Web3 Wallet for active trading positions requiring frequent transactions and quick liquidity access with industry-standard security protocols

Cold Storage Consideration: For long-term holdings exceeding 12+ months, maintain majority positions in secure self-custody arrangements with backup recovery mechanisms

Security Best Practices:

- Never share private keys or recovery phrases with any third party

- Enable all available multi-factor authentication mechanisms

- Maintain offline backup copies of critical security information

- Regularly audit wallet transaction history for unauthorized activity

- Test recovery procedures periodically to ensure operational readiness

V. FST Potential Risks & Challenges

FST Market Risks

- Extreme Volatility & Drawdown Risk: Token has declined 41% over 12 months and 77.6% from ATH, demonstrating high volatility and significant capital loss potential. Limited trading volume ($12K daily) creates slippage risk and liquidity crises during market stress

- Emerging Asset Class Liquidity Risk: With only 22% of supply in circulation and 78% remaining to be released, substantial token dilution is inevitable. Future token unlocks could trigger price depreciation and create distribution challenges

- Speculative Asset Characteristics: As a culturally-driven token with community-based valuation, FST lacks traditional revenue models or cash flow generation, making intrinsic value assessment extremely difficult

FST Regulatory Risks

- Uncertain Regulatory Classification: Crypto regulatory frameworks globally remain in development stages. Future classification of cultural tokens could impact tax treatment, trading restrictions, or compliance requirements across major jurisdictions

- Platform Risk: Token trading on 5 exchanges creates concentration risk. Exchange delisting, regulatory action, or operational issues could dramatically reduce liquidity and accessibility

- Sanctions & AML Compliance: BSC token operations must maintain compliance with evolving OFAC sanctions lists and anti-money laundering requirements across operating jurisdictions

FST Technology Risks

- Smart Contract Audit Status: Limited information on comprehensive third-party security audits for underlying smart contracts creates potential vulnerability exposure to exploits or design flaws

- BSC Network Dependency: Token functionality depends entirely on Binance Smart Chain infrastructure. Network congestion, security incidents, or governance changes could impact token utility

- Upgrade & Compatibility Risk: Future blockchain upgrades, token migrations, or network forks could introduce technical incompatibilities requiring token holder action

VI. Conclusion & Action Recommendations

FST Investment Value Assessment

FreeStyle Classic Token (FST) represents an experimental approach to cultural tokenization within Web3, bridging street culture and digital community ownership. The project demonstrates clear positioning and active community engagement. However, significant challenges warrant careful consideration:

Strengths:

- Differentiated cultural positioning in emerging creator economy

- Active community with 11,100+ token holders

- Multi-exchange trading capability providing some liquidity

Material Concerns:

- Severe performance deterioration (-41% YoY, -77.6% from ATH) indicating structural challenges

- Minimal daily trading volume ($12K) creates significant liquidity constraints

- 78% of supply unreleased, creating substantial future dilution risk

- Limited project documentation and technical transparency for assessment

Value Proposition: FST's long-term value depends critically on successful community expansion, creator economy adoption, and effective token utility development. Current pricing reflects market skepticism regarding near-term catalysts and fundamental valuation supports.

FST Investment Recommendations

✅ Beginners: Limit position size to 1-2% of portfolio allocation. Prioritize community education and project documentation review before capital deployment. Maintain strict stop-loss discipline at 20-30% below entry price.

✅ Experienced Investors: Implement systematic DCA strategy during price weakness between $0.025-$0.045 range. Develop clear technical entry and exit criteria using RSI and MACD indicators. Size positions according to individual risk tolerance and diversification requirements.

✅ Institutional Investors: Conduct comprehensive smart contract audits and legal compliance review before consideration. Structure positions through professional custodians and establish clear liquidity exit strategies. Consider small pilot allocation (under 5% of crypto holdings) to assess community dynamics and product development trajectory.

FST Trading Participation Methods

- Centralized Exchange Trading: Access FST through Gate.com platform featuring professional-grade trading tools, advanced order types, and institutional-quality liquidity infrastructure

- Direct Wallet Acquisition: Purchase FST through direct wallet integration when launching new market pairs, enabling peer-to-peer transactions and non-custodial ownership

- Community Participation: Engage with FST ecosystem through governance participation, community governance tokens, and creator reward mechanisms to establish deeper ecosystem involvement

Cryptocurrency investment carries extreme risk including total capital loss potential. This report does not constitute investment advice. Investors must make decisions aligned with personal risk tolerance and financial circumstances. Consult qualified financial advisors before significant capital deployment. Never invest capital you cannot afford to lose completely.

FAQ

What is the historical price trend of FST? What were the past price highs and lows?

FST reached its all-time low of 0.0252 USD in August 2025, then surged to an all-time high of 0.177 USD in September 2025. As of October 2025, FST stabilized around 0.1356 USD, showing strong recovery potential.

What are the main factors affecting FST price?

FST price is influenced by market sentiment, trading volume, regulatory policies, overall crypto market conditions, and technical developments. Supply and demand dynamics also play a significant role in price fluctuations.

How to predict FST price? What analysis methods can be referenced?

FST price prediction combines technical and fundamental analysis. Use trend lines, moving averages, and trading volume indicators. Consider market sentiment, project developments, and community consensus ratings for comprehensive forecasting.

What risks exist in FST price predictions? How should I invest rationally?

FST price predictions involve market volatility and regulatory risks. Rational investing requires diversifying your portfolio, monitoring market trends, and avoiding over-reliance on predictions alone for decision-making.

What are the price performance characteristics of FST compared to similar tokens?

FST demonstrates distinct volatility patterns with significant price fluctuations. Currently trading at historical lows, FST shows high-risk characteristics but possesses substantial rebound potential. Its trading volume and market dynamics differ notably from comparable tokens in the ecosystem.

What are professional institutions' predictions for FST's future price?

Professional analysts predict FST will experience steady growth trajectory. Price projections vary by analyst, based on fundamental metrics and market sentiment. Current technical and fundamental indicators suggest positive momentum ahead.

2025 ZTX Price Prediction: Bullish Outlook as Adoption and Technology Advancements Drive Growth

2025 SQR Price Prediction: Analyzing Market Trends and Expert Forecasts for Potential Growth

2025 APRS Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

2025 FST Price Prediction: Expert Analysis and Market Outlook for Fastswap Token

NKN ($NKN) Price Prediction: Can Decentralized Networks Push It to $0.50 in 2025?

WalletConnect Token Analysis: Will WCT's Ecosystem Revolution Power the Next Bull Run?

Explore Aurory (AURY) - Your Ultimate Guide to the Web3 Gaming Experience

Guide to Purchasing Hamster Kombat (HMSTR) in India

Current Value of 1 Hamster Kombat Token (HMSTR) in Indian Rupees

Discover the Reduced Expenses of Launching Your Own Blockchain Node

What is QUICK: A Comprehensive Guide to Understanding the Revolutionary Payment System