2025 CAM Price Prediction: Expert Analysis and Market Forecast for Cameroon Mining Token

Introduction: Market Position and Investment Value of CAM

Camino Network (CAM) stands as the first Layer 1 blockchain specifically designed for the $11 trillion travel industry, representing a pioneering integration of blockchain technology with real-world enterprise applications. Since its launch in January 2025, CAM has gained significant traction as a transformative solution for travel industry pain points. As of December 23, 2025, CAM maintains a market capitalization of approximately $5.33 million with a circulating supply of approximately 318.95 million tokens, trading at around $0.01672 per token. This innovative asset, recognized as a "travel industry blockchain infrastructure," is playing an increasingly critical role in revolutionizing travel bookings, loyalty programs, and interconnected travel supplier ecosystems.

The network operates with backing from over 100 established travel companies and $10 million in funding support, with 200+ brands currently building decentralized applications and Web3 travel products on its platform. Major industry players like the Lufthansa Group are already integrated into the ecosystem, validating Camino's enterprise adoption potential.

This report will provide a comprehensive analysis of CAM's price trajectory through 2030, synthesizing historical performance patterns, market supply and demand dynamics, ecosystem development milestones, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to blockchain-based travel infrastructure solutions.

I. CAM Price History Review and Market Status

CAM Historical Price Evolution Trajectory

- January 2025: CAM reached its all-time high of $0.19806 on January 29, 2025, marking a peak period for the token following its launch.

- October 2025: CAM dropped to its all-time low of $0.01298 on October 28, 2025, representing a significant decline from peak levels.

- December 2025: CAM is currently trading at $0.01672, reflecting a year-to-date decline of -78.40% from its launch price of $0.12.

CAM Current Market Position

As of December 23, 2025, CAM is trading at $0.01672 with a 24-hour trading volume of approximately $56,008.35. The token exhibits minor downward pressure in the short term, with a -0.11% decline over the last 24 hours and a -0.06% decrease in the past hour. However, CAM has shown modest recovery momentum over the past week with a +0.42% gain over 7 days.

The token maintains a total market capitalization of $16.72 million with a fully diluted valuation matching this figure, indicating that approximately 31.89% of the total 1 billion token supply is currently in circulation (318.95 million CAM). The market capitalization positions CAM at rank 1489 in the broader cryptocurrency market, representing a 0.00052% market dominance.

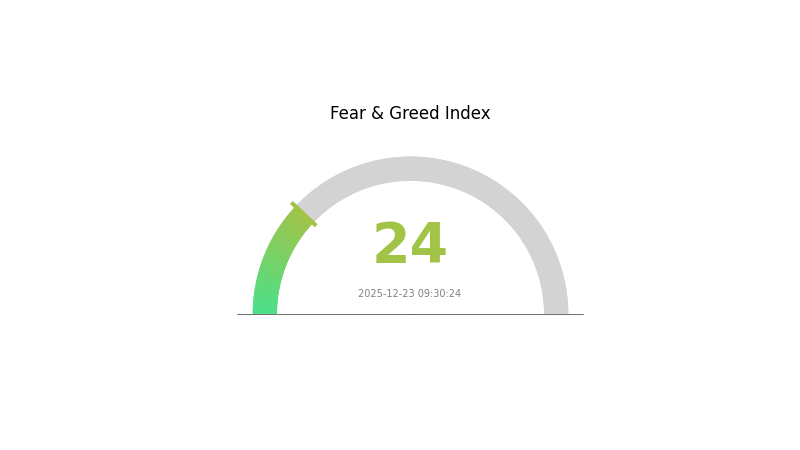

Current market sentiment reflects "Extreme Fear" conditions in the broader cryptocurrency landscape, which may be influencing CAM's trading dynamics and liquidity patterns.

Click to view current CAM market price

CAM Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear with a CAM index reading of just 24. This sentiment reflects significant market anxiety and heightened risk aversion among investors. Such extreme fear levels historically present contrarian opportunities for long-term investors, as panic selling often creates favorable entry points. However, traders should remain cautious and employ proper risk management strategies. Market conditions remain volatile, and it is advisable to conduct thorough research before making investment decisions. Monitor key support levels and market catalysts closely during periods of extreme fear.

CAM Holdings Distribution

Unable to generate analysis at this time. The provided data table appears to be empty or incomplete—no specific address holdings, quantities, or percentage information has been supplied for CAM token distribution analysis.

To proceed with a comprehensive holdings distribution analysis, please provide:

- Specific wallet addresses or entity identifiers

- Holding quantities (in CAM tokens)

- Percentage allocation of total supply

- Wallet classification (exchange wallets, institutional holders, retail addresses, etc.)

Once complete data is furnished, the analysis will evaluate:

- Concentration metrics and centralization risk assessment

- Distribution patterns across holder categories

- Market structure implications and price volatility potential

- On-chain stability indicators and decentralization characteristics

For current CAM holdings data, visit CAM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing CAM's Future Price

Supply Mechanism

- Total Supply Cap: CAM has a total supply of 1 billion tokens, which determines the price and investment value trajectory. As of October 2025, the circulating supply is approximately 318,948,843 CAM tokens.

- Scarcity Impact: The fixed supply ceiling creates inherent scarcity that influences long-term price dynamics and investor confidence in the asset's valuation potential.

Macroeconomic Environment

- Market Adoption Impact: CAM's price movement is significantly influenced by broader market sentiment and cryptocurrency adoption cycles. The asset demonstrated substantial volatility, declining from a historical high of $0.19806 on January 29, 2025, to a low of $0.02062 on October 5, 2025, reflecting market-wide pressures and shifts in investor risk appetite.

Technology Development and Ecosystem Building

- Tourism Industry Integration: CAM serves as "All Travel on One Chain," positioning itself as a comprehensive blockchain-based travel solution. The ecosystem's development in the tourism sector represents a differentiation factor that could drive future adoption and price appreciation as travel industry integration deepens.

- Ecosystem Expansion: The Camino Network's ongoing development of travel-related applications and partnerships within the tourism industry infrastructure supports long-term growth potential and market positioning.

III. 2025-2030 CAM Price Forecast

2025 Outlook

- Conservative Forecast: $0.01153 - $0.01671

- Neutral Forecast: $0.01671

- Optimistic Forecast: $0.02105 (requires sustained market interest and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with increasing adoption momentum

- Price Range Forecast:

- 2026: $0.01492 - $0.0202 (12% upside potential)

- 2027: $0.01368 - $0.02169 (16% upside potential)

- 2028: $0.01423 - $0.02515 (23% upside potential)

- Key Catalysts: Enhanced utility integration, increased institutional participation, improving market sentiment, and technological upgrades within the CAM ecosystem

2029-2030 Long-term Outlook

- Base Case: $0.01373 - $0.02472 (36% growth potential by 2029, with equilibrium price around $0.02289)

- Optimistic Case: $0.01976 - $0.02975 (42% growth potential by 2030, assuming accelerated adoption and broader market expansion)

- Transformational Case: $0.03000+ (contingent on breakthrough developments, regulatory clarity, major partnership announcements, and significant mainstream adoption)

- December 23, 2025: CAM consolidating near mid-range levels, positioning for potential multi-year appreciation trajectory

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02105 | 0.01671 | 0.01153 | 0 |

| 2026 | 0.0202 | 0.01888 | 0.01492 | 12 |

| 2027 | 0.02169 | 0.01954 | 0.01368 | 16 |

| 2028 | 0.02515 | 0.02062 | 0.01423 | 23 |

| 2029 | 0.02472 | 0.02289 | 0.01373 | 36 |

| 2030 | 0.02975 | 0.0238 | 0.01976 | 42 |

Camino Network (CAM) Professional Investment Analysis Report

IV. CAM Professional Investment Strategy and Risk Management

CAM Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Patient capital allocators, institutional investors, and those believing in blockchain integration of travel industry

- Operation Suggestions:

- Accumulate during periods of market weakness when CAM trades below $0.015 to build core positions

- Hold through protocol developments and ecosystem expansion milestones with travel partners

- Reinvest any dividends or airdrops to compound long-term returns

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor key price levels at $0.016 (current support), $0.019, and $0.025 (resistance zones)

- Volume Analysis: Track 24-hour volume patterns; significant moves typically occur when daily volume exceeds $100,000

- Wave Operation Key Points:

- Take advantage of the observed -0.11% 24-hour volatility by establishing positions during short-term pullbacks

- Monitor the positive 7-day trend (+0.42%) for confirmation of medium-term momentum

- Set strict exit rules when price approaches resistance levels or volume diverges from price action

CAM Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio maximum

- Active Investors: 3-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio with hedging instruments

(2) Risk Mitigation Strategies

- Portfolio Diversification: Balance CAM holdings with established cryptocurrencies and traditional assets to reduce concentration risk

- Dollar-Cost Averaging (DCA): Deploy capital systematically over time rather than lump-sum investments to reduce timing risk

(3) Secure Storage Solutions

- Hot Wallet Method: Gate Web3 Wallet for active trading and frequent transactions

- Cold Storage Approach: Transfer long-term holdings to secure offline storage for protection against exchange compromises

- Security Precautions: Enable two-factor authentication, use hardware security keys, never share private keys, and regularly verify wallet addresses before transactions

V. CAM Potential Risks and Challenges

CAM Market Risk

- High Volatility: CAM has experienced significant price fluctuations, with a 78.40% decline over the past year, indicating substantial market risk and potential for further downside

- Limited Liquidity: Daily trading volume of $56,008 is relatively low for a $16.72M market cap project, making large trades potentially difficult to execute

- Price Discovery Challenge: The 31.89% circulation ratio means most tokens remain unlocked, creating future selling pressure as tokens vest

CAM Regulatory Risk

- Travel Industry Compliance: Integration with major travel operators like Lufthansa Group requires adherence to complex financial and tourism regulations across multiple jurisdictions

- Payment Settlement Regulation: The network's focus on payment processing and settlement exposes it to stringent banking and money services regulations globally

- KYC/AML Requirements: Expansion of B2B and B2C travel products necessitates robust know-your-customer and anti-money-laundering compliance frameworks

CAM Technology Risk

- Blockchain Scalability: As a Layer 1 solution handling travel transactions, the network must prove it can scale to millions of daily transactions without network congestion

- Ecosystem Development: Dependence on 200+ brands building dApps creates concentration risk; failure of key partners could significantly impact network utility

- Technical Vulnerabilities: All blockchain systems carry inherent smart contract risks, security audit weaknesses, and potential for critical bugs affecting fund security

VI. Conclusion and Action Recommendations

CAM Investment Value Assessment

Camino Network presents an interesting investment thesis centered on blockchain's application within the $11 trillion travel industry. The project has distinguished partnerships with over 100 established travel companies and major brands like Lufthansa, positioning it as a genuine attempt to solve real industry pain points. However, investors must acknowledge the significant challenges: the project's 78.40% year-over-year decline suggests market skepticism, low trading liquidity creates execution risks, and the regulatory complexity of travel industry integration remains unproven at scale. The current price of $0.01672 offers a lower entry point than the all-time high of $0.19806, but this reflects market pricing of substantial execution and adoption risks.

CAM Investment Recommendations

✅ Beginners: Start with a small test position (0.5-1% of portfolio) through Gate.com to understand the project mechanics. Use dollar-cost averaging with quarterly purchases to reduce timing risk. Focus on understanding the travel industry integration story before committing additional capital.

✅ Experienced Investors: Consider building a 2-5% position through a combination of spot purchases at support levels and selective accumulation during market weakness. Implement stop-loss orders at $0.015 to protect downside while monitoring ecosystem developments with the 200+ partner brands.

✅ Institutional Investors: Evaluate 5-10% allocations for long-term venture-stage exposure, focusing on the protocol's ability to achieve mainstream adoption among travel suppliers. Require quarterly reporting on active transaction volumes, new partnership agreements, and mainnet usage metrics before scaling commitments.

CAM Trading Participation Methods

- Spot Trading on Gate.com: Purchase and hold CAM tokens directly with real-time price discovery

- Trading Pairs: Access CAM/USDT pairs on Gate.com for fiat conversion and exit strategies

- Gate Web3 Wallet Integration: Maintain holdings in secure self-custody while maintaining trading access through Gate.com's ecosystem

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the prediction for Canaan in 2025?

Analysts predict Canaan's average price target for 2025 is $4.30, with forecasts ranging from $2.50 to $8.00. Expected revenue is projected around $4.37 trillion, showing strong market growth potential.

What factors influence CAM price movements?

CAM price movements are driven by market demand, trading volume, sensor technology advancements, brand reputation, and broader crypto market sentiment. Regulatory news and adoption developments also significantly impact price volatility.

What is the current market cap and price of CAM?

The current price of Camino Network (CAM) is $0.016621 USD, with a market cap of $5.41 million. The 24-hour trading volume stands at $48,513.11 USD as of December 23, 2025.

Is CAM a good investment based on technical analysis?

Based on technical analysis, CAM shows positive trends and is considered a good investment for long-term growth. Current indicators suggest strong momentum and potential value appreciation in the market.

MASA vs GRT: Comparing Two Leading Web3 Infrastructure Solutions for Decentralized Applications

How Does DOT Compare to Its Competitors in Performance, Market Cap, and User Base?

SAFE vs CHZ: Comparing Two Innovative Blockchain Projects in the Sports and Entertainment Industry

Is Tezos Domains (TED) a good investment?: Exploring the potential and risks of this blockchain-based domain name system

Is EtherMail (EMT) a good investment?: Analyzing the potential of this blockchain-based email solution

Is Andromeda (ANDR) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Pixelmon (MONPRO) a good investment?: A comprehensive analysis of the blockchain gaming token's potential returns and market viability

Is Chain Games (CHAIN) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Outlook

Is Enosys Global (HLN) a good investment?: A comprehensive analysis of the company's financial performance, market position, and growth prospects

TET vs DOT: Understanding the Key Differences Between Two Essential Testing Methodologies

XDB vs BAT: Comprehensive Comparison of Distributed Database Solutions and Traditional Big Tech Infrastructure