2025 AI Price Prediction: How Machine Learning Will Revolutionize Market Forecasting and Investment Strategies

Introduction: Market Position and Investment Value of AI

Sleepless AI (AI) is an innovative Web3+AI virtual companion game that utilizes AIGC and Large Language Models to create rich story-based gameplay and organically evolving character interactions. Since its launch in January 2025, the project has been developing multiple games including HIM, a virtual boyfriend Otome game featuring unique on-chain SBT characters. As of December 23, 2025, Sleepless AI has achieved a market capitalization of $4.82 million with a circulating supply of 130 million tokens, currently trading at $0.03707 per token. This pioneering asset, recognized for its integration of AI technology with gaming entertainment, is playing an increasingly important role in the emerging intersection of artificial intelligence and blockchain-based gaming experiences.

This article will provide a comprehensive analysis of Sleepless AI's price trends and market dynamics, combining historical price performance, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price insights and practical investment strategies for investors seeking exposure to AI-driven gaming innovations.

I. AI Price History Review and Current Market Status

AI Historical Price Evolution Trajectory

-

March 2024: AI reached its all-time high (ATH) of $2.3781, marking the peak of market enthusiasm for the Sleepless AI virtual companion gaming platform.

-

2024-2025: Following the ATH, AI entered a prolonged downtrend, experiencing significant depreciation throughout the period.

-

October 2025: AI touched its all-time low (ATL) of $0.02665, representing a severe correction from peak valuations and indicating capitulation in the market cycle.

AI Current Market Status

As of December 23, 2025, Sleepless AI (AI) is trading at $0.03707, reflecting the token's recovery from its October 2025 low point. The 24-hour trading volume stands at $15,525.86, with the token experiencing a -4.31% decline over the past 24 hours. Over the 7-day period, AI has depreciated by -2.06%, while the 30-day performance shows a steeper -26.77% decline. The year-to-date performance remains severely negative at -92.45%, indicating substantial long-term losses from earlier valuations.

The fully diluted market capitalization is valued at $37,070,000, with a circulating market cap of $4,819,100 across 130 million circulating tokens out of a total supply of 1 billion tokens. This represents a 13% circulation ratio. The token is listed on 21 exchanges with 54,361 token holders, demonstrating modest ecosystem participation. The market dominance of AI is minimal at 0.0011%, and current market sentiment reflects "Extreme Fear" conditions.

On an intraday basis, AI shows a slight positive movement of +0.03% in the past hour, with a 24-hour trading range between $0.03678 (low) and $0.03894 (high).

Click to view current AI market price

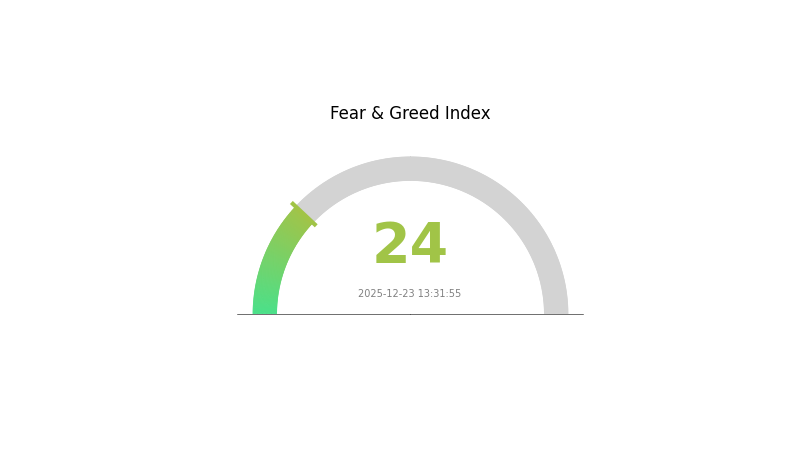

AI Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index dropping to 24. This indicates strong pessimism among investors, as market uncertainty and risk aversion intensify. During such periods, volatility typically increases while investor confidence remains subdued. Long-term believers may view this as a potential opportunity to accumulate assets, while risk-averse investors should maintain cautious positions. Monitor market developments closely and adjust your strategy accordingly on Gate.com.

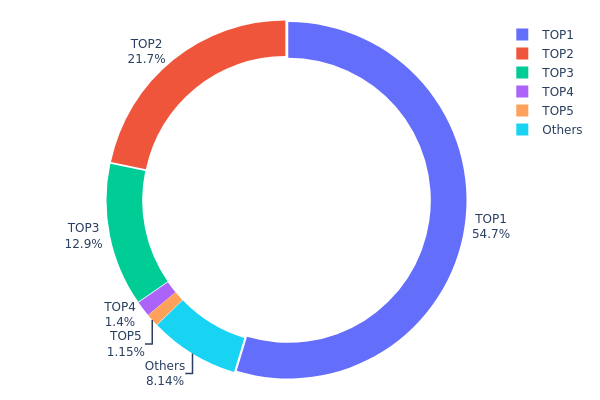

AI Holdings Distribution

The address holdings distribution represents the concentration of AI token ownership across blockchain addresses, serving as a critical metric for assessing the level of decentralization and potential systemic risks within the token ecosystem. This distribution reveals how the total token supply is allocated among the top holders and the broader community, directly impacting market stability and governance dynamics.

The current distribution of AI demonstrates significant concentration risk, with the top three addresses collectively controlling 89.29% of the total supply. The leading address (0x33a0...661c4c) alone accounts for 54.66% of all tokens, representing an exceptionally high concentration level that substantially exceeds healthy decentralization benchmarks. The second-largest holder (0xf977...41acec) maintains 21.70%, while the third holder (0x78d2...689b57) commands 12.93%. This hierarchical structure indicates that decision-making power and potential market influence are heavily concentrated among a limited number of entities, creating notable vulnerabilities in the token's operational framework.

Such extreme concentration poses multifaceted risks to market integrity and price discovery mechanisms. The dominant holders possess substantial capacity to influence market dynamics through large-scale transactions, potentially exerting downward or upward pressure on AI's valuation. The remaining addresses, collectively representing 11.87% of supply, lack sufficient concentration to meaningfully counterbalance potential coordinated actions by major stakeholders. This asymmetry raises concerns regarding the sustainability of fair market conditions and the robustness of the decentralized governance model, suggesting that the AI token ecosystem currently exhibits characteristics more aligned with centralized control structures rather than achieving optimal decentralization objectives.

Click to view current AI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x33a0...661c4c | 546687.50K | 54.66% |

| 2 | 0xf977...41acec | 217061.42K | 21.70% |

| 3 | 0x78d2...689b57 | 129375.00K | 12.93% |

| 4 | 0x8894...e2d4e3 | 13983.10K | 1.39% |

| 5 | 0xff4e...ec6cc3 | 11458.33K | 1.14% |

| - | Others | 81434.65K | 8.18% |

Core Factors Influencing AI Future Price Movement

Macroeconomic Environment

-

Monetary Policy Impact: Major central banks are maintaining cautious interest rate policies that directly influence cryptocurrency market trends. The U.S. Federal Reserve's policy uncertainty creates significant volatility—with internal disagreements among officials about rate decisions causing market fluctuations. Rising capital costs in a high interest rate environment pose constraints on AI infrastructure expansion and return on investment.

-

Inflation Hedge Characteristics: AI-related cryptocurrencies possess certain inflation-hedging properties as digital assets, providing some protection against currency debasement in inflationary environments.

-

Geopolitical Factors: Global capital flows are reshaping based on AI investment sentiment. When investor confidence in AI's future is high, capital flows into high-risk, high-return technology assets in the U.S., strengthening the dollar. Conversely, AI growth slowdowns trigger capital flight to safe-haven assets, potentially weakening the dollar.

Supply Chain and Infrastructure Constraints

-

Physical Bottlenecks: The AI infrastructure buildout faces unprecedented physical limitations. Critical equipment manufacturing cycles, construction timelines, and supply chain capacity cannot be indefinitely compressed. Large power transformers are experiencing global shortages—key equipment suppliers like GE Vernova report that major transformers and gas turbines are essentially fully reserved through 2028.

-

Capital Expenditure Pressures: Tech giants and AI startups are accelerating capital spending at record rates. Goldman Sachs estimates OpenAI's capital expenditure alone could reach $75 billion in 2026. However, early-stage companies like OpenAI and Anthropic remain unprofitable, relying on equity sales and debt issuance to maintain expansion pace.

-

Energy and Land Acquisition Challenges: Securing sufficient electricity, high-bandwidth fiber access, and regulatory approvals for data center construction presents ongoing obstacles. Many projects remain in planning stages, with developers facing challenges in land acquisition, permitting processes, and power grid integration.

Macro Investment Dynamics

-

Capital Flow Intensity: In Q1 2025, AI-related M&A activity recorded 381 transactions, representing 21% year-over-year growth, with total transaction value reaching $21.6 billion. Barclays Global M&A leadership anticipates potential transaction flow exceeding $100 billion in early 2026, indicating substantial capital deployment in the sector.

-

Revenue Generation Requirements: According to JPMorgan Chase's modeling, cumulative global AI infrastructure investment is projected to reach $5 trillion by 2030. To achieve reasonable returns, AI products and services must generate $650 billion in annual new revenue—far exceeding Apple's current annual revenue and significantly surpassing OpenAI's current $20 billion annual revenue.

-

AI Cloud Services Growth Trajectory: Raymond James provides optimistic projections showing AI cloud services revenue could grow nearly nine-fold over the next five years, providing potential revenue sources through advertising, enterprise services, and industry-specific high-value applications.

III. 2025-2030 AI Price Forecast

2025 Outlook

- Conservative Forecast: $0.02003 - $0.04489

- Base Case Forecast: $0.0371

- Bullish Forecast: $0.04489 (requires sustained positive sentiment and institutional adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery, characterized by institutional accumulation and ecosystem expansion

- Price Range Forecasts:

- 2026: $0.03526 - $0.05862 (10% upside potential)

- 2027: $0.04732 - $0.0533 (34% upside potential)

- 2028: $0.03918 - $0.05774 (39% upside potential)

- Key Catalysts: Increased adoption of AI-driven infrastructure, regulatory clarity, enterprise partnerships, and network utility expansion

2029-2030 Long-term Outlook

- Base Case Scenario: $0.03381 - $0.08299 (assumes moderate adoption acceleration and sustained market interest)

- Bullish Scenario: $0.06148 - $0.08299 (assumes breakthrough in AI integration, major institutional inflows, and ecosystem maturation)

- Transformative Scenario: $0.08299+ (requires paradigm shift in AI token utility, mass adoption, and integration with emerging Web3 infrastructure)

- 2025-12-23: AI token currently establishing foundational support levels before anticipated recovery trajectory through 2030

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04489 | 0.0371 | 0.02003 | 0 |

| 2026 | 0.05862 | 0.041 | 0.03526 | 10 |

| 2027 | 0.0533 | 0.04981 | 0.04732 | 34 |

| 2028 | 0.05774 | 0.05155 | 0.03918 | 39 |

| 2029 | 0.06831 | 0.05465 | 0.02787 | 47 |

| 2030 | 0.08299 | 0.06148 | 0.03381 | 65 |

Sleepless AI (AI) Investment Strategy and Risk Management Report

IV. AI Professional Investment Strategy and Risk Management

AI Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in AI-driven gaming and Web3 virtual companion ecosystems who can tolerate high volatility

- Operation Recommendations:

- Accumulate during market downturns, particularly when prices drop below key support levels

- Hold for minimum 12-24 months to capture potential upside as the project develops its game titles and user base

- Reinvest any earnings from gameplay or community rewards back into the position

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour range ($0.03678-$0.03894) and historical support at $0.02665

- Moving Averages: Track 7-day and 30-day trends to identify momentum shifts

- Wave Operation Key Points:

- Enter positions during oversold conditions (when 24h volume is exceptionally high with downward pressure)

- Exit partial positions on 5-10% rallies to secure profits given the -92.45% one-year decline

AI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of portfolio maximum

- Active Investors: 5-8% of portfolio allocation

- Professional Investors: 10-15% of specialized gaming/metaverse allocation

(2) Risk Hedging Solutions

- Position Sizing: Never allocate more than you can afford to lose completely; given current market cap volatility, limit single positions accordingly

- Dollar-Cost Averaging: Spread purchases over 3-6 months rather than lump sum investment to reduce timing risk

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 wallet for active trading and frequent transactions with built-in security features

- Cold Storage Option: Transfer holdings to hardware storage solutions for long-term holdings exceeding 12 months

- Security Precautions: Enable two-factor authentication, never share private keys, verify contract addresses on official channels (https://www.sleeplessai.net/home), and regularly audit wallet permissions

V. AI Potential Risks and Challenges

AI Market Risk

- Extreme Volatility: The token has declined 92.45% over one year and 26.77% over the past month, indicating significant downside pressure and potential further depreciation

- Low Trading Liquidity: 24-hour volume of only $15,525.86 suggests limited exit opportunities during market stress

- Concentration Risk: With 130 million of 1 billion tokens in circulation (13%), significant dilution risk exists if locked tokens unlock or are released

AI Regulatory Risk

- Gaming Industry Scrutiny: Regulatory bodies globally are increasing oversight of gaming mechanics, particularly those involving virtual relationships and microtransactions

- Jurisdiction Uncertainty: Different countries may classify virtual companion games differently, potentially restricting market access

- Blockchain Compliance: Evolution of cryptocurrency regulations could impact token utility and trading capabilities

AI Technology Risk

- Project Execution Risk: The project is still in development phase with limited proven user adoption; delays in game releases could negatively impact token value

- Smart Contract Vulnerability: While using BSC standard BEP20 protocol, undiscovered vulnerabilities could pose security risks

- User Adoption Uncertainty: Success depends on achieving critical mass in the niche virtual companion gaming space, which is not guaranteed

VI. Conclusion and Action Recommendations

AI Investment Value Assessment

Sleepless AI represents a speculative investment in an emerging niche at the intersection of AI gaming and Web3. The project's innovative approach to story-driven AI companions with on-chain SBT characters offers unique value proposition. However, the 92.45% one-year decline, limited trading volume, and early-stage development status present substantial risks. The token's current price of $0.03707 reflects significant market skepticism about near-term execution and adoption. Investment consideration should be limited to risk capital only, with realistic expectations for both substantial upside and potential total loss scenarios.

AI Investment Recommendations

✅ Beginners: Start with micro-allocations (0.1-0.5% of portfolio) only if deeply interested in AI gaming; use only disposable capital and educate yourself on the project's roadmap and team ✅ Experienced Investors: Consider 2-5% allocation within a diversified gaming/metaverse portfolio; employ technical analysis to time entries and maintain strict stop-losses ✅ Institutional Investors: Conduct comprehensive due diligence on the team, smart contract audits, and user engagement metrics before any allocation; structure as venture-stage investment with appropriate risk premium

AI Trading Participation Methods

- Exchange Trading: Purchase AI tokens directly on Gate.com, which provides reliable market data, trading pairs, and withdrawal options

- Token Monitoring: Track price movements, trading volume, and project announcements through the official website (https://www.sleeplessai.net/home) and Twitter (@SleeplessAI_Lab)

- Game Participation: Monitor the project's game releases (particularly HIM) for gameplay rewards and potential future token utility expansion

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. Consult with professional financial advisors before investing. Never invest more than you can afford to lose completely.

FAQ

How much will AI be worth in 2030?

By 2030, AI's market value is projected to reach $25 trillion or more, driven by growth across major artificial intelligence sectors and applications. However, exact valuations remain speculative and subject to market developments.

Can Fetch AI reach $10?

Yes, Fetch AI can potentially reach $10 if bullish momentum persists and market conditions remain favorable. Increased adoption, partnerships, and positive sentiment could drive significant price appreciation toward this target level.

What is the target price for AI?

The target price for AI is 14.67 USD, with analyst estimates ranging from 8.00 to 24.00 USD. Based on current market analysis, the 2026 forecast suggests this price level represents significant upside potential for AI token holders.

How much will AI cost in 2025?

AI token prices in 2025 vary based on market demand and adoption. Current estimates suggest AI projects trade between $10-20k in total value, with integration services ranging from $25-49 per hour.

How Does Crypto Competitor Analysis Drive Market Share Changes?

Mira Network Price Prediction and Market Insights

Is Sleepless AI (AI) a good investment?: Analyzing the Long-Term Growth Potential and Risks in the Emerging AI Market

Is Assemble AI (ASM) a Good Investment?: Analyzing Growth Potential and Market Position in the AI Sector

D vs BAT: The Evolution of Tech Giants in the Digital Economy

2025 PHB Price Prediction: Future Outlook and Market Analysis for Phoenix Global Token

Is Hifi Finance (HIFI) a good investment?: A Comprehensive Analysis of Risks, Rewards, and Market Potential for 2024

Is Agoric (BLD) a good investment?: A comprehensive analysis of tokenomics, market potential, and risk factors for 2024

Is Chrono.tech (TIMECHRONO) a good investment?: A Comprehensive Analysis of Features, Performance, and Future Potential

UNCX vs KAVA: Comprehensive Comparison of Two Leading DeFi Protocols and Their Investment Potential

Top Secure Platforms for Buying Cryptocurrencies in 2025