# BitcoinFallsBehindGold

1.71K

xxx40xxx

Why the “Safe Haven” Narrative Is Being Repriced

In an environment of rising global uncertainty, markets are sending a clear signal:

capital is prioritizing stability over growth.

While gold and silver continue to print new highs, Bitcoin is lagging both in price action and investor confidence.

📊 Crypto Fear & Greed Index: 20 — Extreme Fear

This level reflects a market driven more by defensive positioning than risk-taking.

🔍 Key Market Signals

Bitcoin price: ~88,150 USDT

BTC YTD performance: -6.25%

Gold: +65–70% over the past year

Volatility: Elevated across BTC & ETH

Capital flow: Risk-off

In an environment of rising global uncertainty, markets are sending a clear signal:

capital is prioritizing stability over growth.

While gold and silver continue to print new highs, Bitcoin is lagging both in price action and investor confidence.

📊 Crypto Fear & Greed Index: 20 — Extreme Fear

This level reflects a market driven more by defensive positioning than risk-taking.

🔍 Key Market Signals

Bitcoin price: ~88,150 USDT

BTC YTD performance: -6.25%

Gold: +65–70% over the past year

Volatility: Elevated across BTC & ETH

Capital flow: Risk-off

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 7

- 10

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

#BitcoinFallsBehindGold

Today's market chatter around **#BitcoinFallsBehindGold** is heating up, but the narrative feels a bit too defeatist for my taste. The original take paints it as gold decisively winning while Bitcoin sits on the sidelines—almost like a temporary funeral for "digital gold." I see it differently: this isn't Bitcoin losing; it's a classic cyclical pause in a much longer game where Bitcoin's upside asymmetry still dwarfs gold's steady grind. Here's my fully rewritten take in English, with my own commentary woven in.

### Bitcoin Isn't Falling Behind Gold—It's Just Playing a

Today's market chatter around **#BitcoinFallsBehindGold** is heating up, but the narrative feels a bit too defeatist for my taste. The original take paints it as gold decisively winning while Bitcoin sits on the sidelines—almost like a temporary funeral for "digital gold." I see it differently: this isn't Bitcoin losing; it's a classic cyclical pause in a much longer game where Bitcoin's upside asymmetry still dwarfs gold's steady grind. Here's my fully rewritten take in English, with my own commentary woven in.

### Bitcoin Isn't Falling Behind Gold—It's Just Playing a

BTC-0,85%

- Reward

- 5

- 11

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

The Traditional Victor of the Digital Age

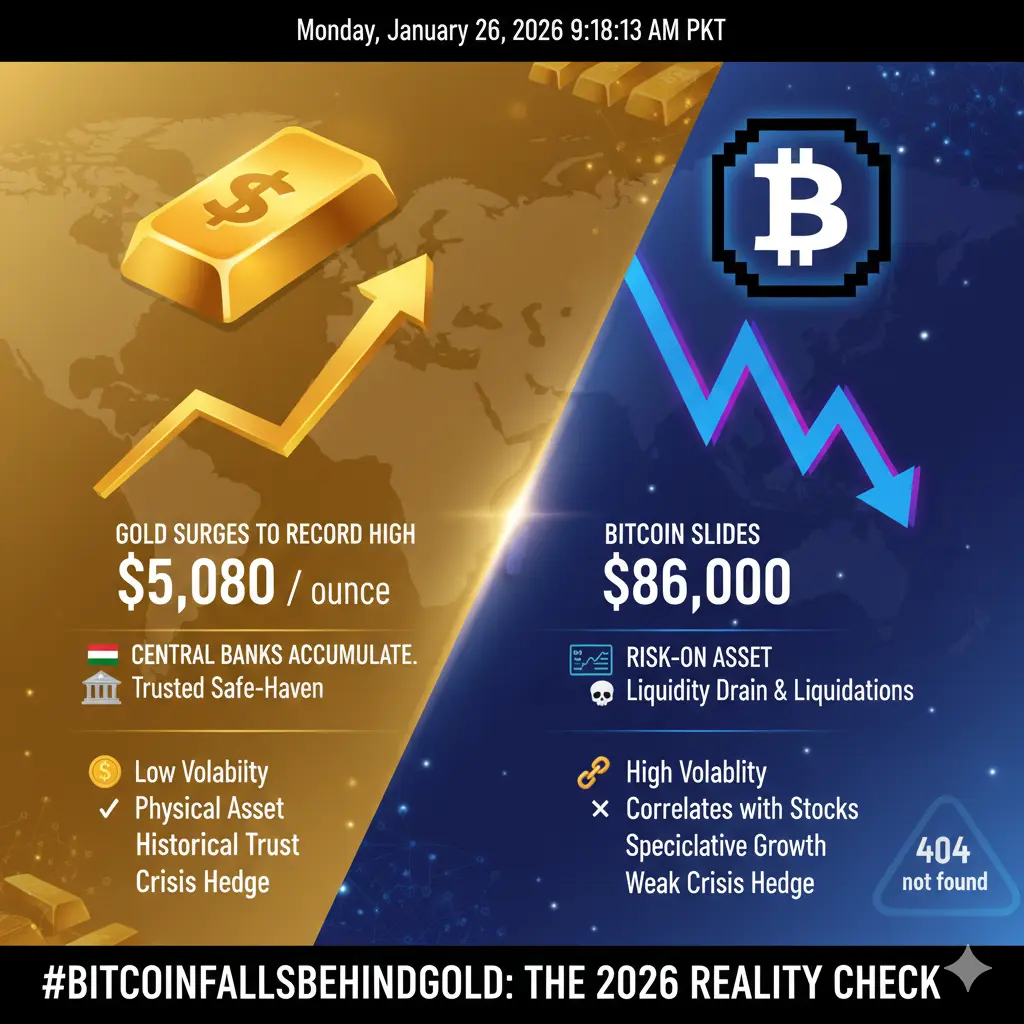

As of January 2026, the gap between "digital gold" and "physical gold" in global financial markets has widened more than ever before. While Bitcoin struggles to break through the psychological barrier of $100,000, traditional gold continues to shatter records, proving itself as the true sovereign of the stage.

The year 2026 began as a "reality check" for the financial world. While there has been talk for years about Bitcoin claiming its crown as digital gold, data from January presents a starkly different picture. Gold (XAU)

The Traditional Victor of the Digital Age

As of January 2026, the gap between "digital gold" and "physical gold" in global financial markets has widened more than ever before. While Bitcoin struggles to break through the psychological barrier of $100,000, traditional gold continues to shatter records, proving itself as the true sovereign of the stage.

The year 2026 began as a "reality check" for the financial world. While there has been talk for years about Bitcoin claiming its crown as digital gold, data from January presents a starkly different picture. Gold (XAU)

BTC-0,85%

- Reward

- 8

- 13

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#BitcoinFallsBehindGold

Bitcoin’s Gold Ratio Down 55% Is This a Dip-Buying Opportunity or a Warning Signal?

Bitcoin has recently fallen behind gold in terms of relative strength, with the BTC-to-gold ratio down approximately 55% from its peak. Additionally, BTC has slipped below its 200-week moving average, a long-term technical benchmark that has historically acted as a strong support level during major corrections. These movements have left investors and traders asking: Is this the ideal moment to accumulate, or is the downside risk still too high?

Bitcoin’s recent underperformance relativ

Bitcoin’s Gold Ratio Down 55% Is This a Dip-Buying Opportunity or a Warning Signal?

Bitcoin has recently fallen behind gold in terms of relative strength, with the BTC-to-gold ratio down approximately 55% from its peak. Additionally, BTC has slipped below its 200-week moving average, a long-term technical benchmark that has historically acted as a strong support level during major corrections. These movements have left investors and traders asking: Is this the ideal moment to accumulate, or is the downside risk still too high?

Bitcoin’s recent underperformance relativ

- Reward

- 11

- 14

- Repost

- Share

Luna_Star :

:

DYOR 🤓View More

#BitcoinFallsBehindGold

Today’s market conversation is increasingly shaped by a quiet but meaningful comparison: Bitcoin, often called “digital gold,” is currently falling behind actual gold in terms of performance and investor preference. While Bitcoin remains a dominant force in the crypto ecosystem, gold has taken the lead as capital seeks stability over speculation. This shift doesn’t signal the end of Bitcoin’s relevance, but it does highlight how market priorities change when uncertainty rises.

Gold’s recent strength reflects a classic flight-to-safety move. As macro pressures persist r

Today’s market conversation is increasingly shaped by a quiet but meaningful comparison: Bitcoin, often called “digital gold,” is currently falling behind actual gold in terms of performance and investor preference. While Bitcoin remains a dominant force in the crypto ecosystem, gold has taken the lead as capital seeks stability over speculation. This shift doesn’t signal the end of Bitcoin’s relevance, but it does highlight how market priorities change when uncertainty rises.

Gold’s recent strength reflects a classic flight-to-safety move. As macro pressures persist r

BTC-0,85%

- Reward

- 3

- 4

- Repost

- Share

ybaser :

:

thanks for information sent every day ☺️View More

#BitcoinFallsBehindGold

BTC vs Gold ratio down 55% and now below the 200W MA — that’s a serious shift in relative strength.

Capital is hiding in metals while Bitcoin cools off.

For me, this is not panic — this is a rotation signal.

I’m slowly accumulating BTC on weakness while keeping gold exposure as hedge on Gate TradFi.

When the ratio reverses, BTC usually moves fast.

Are you buying this dip or waiting for confirmation?

BTC vs Gold ratio down 55% and now below the 200W MA — that’s a serious shift in relative strength.

Capital is hiding in metals while Bitcoin cools off.

For me, this is not panic — this is a rotation signal.

I’m slowly accumulating BTC on weakness while keeping gold exposure as hedge on Gate TradFi.

When the ratio reverses, BTC usually moves fast.

Are you buying this dip or waiting for confirmation?

BTC-0,85%

- Reward

- 4

- 4

- Repost

- Share

xxx40xxx :

:

Buy To Earn 💎View More

#BitcoinFallsBehindGold

In recent months, Bitcoin’s performance has noticeably lagged behind gold, reigniting a long-standing debate among investors: digital gold versus physical gold. Once hailed as the ultimate hedge against inflation and currency debasement, Bitcoin is now facing tough competition from the timeless appeal of gold, especially in an environment marked by economic uncertainty, high interest rates, and geopolitical tensions.

Gold has surged ahead as investors seek safety. Central banks around the world have been aggressively accumulating gold reserves, signaling a preference fo

In recent months, Bitcoin’s performance has noticeably lagged behind gold, reigniting a long-standing debate among investors: digital gold versus physical gold. Once hailed as the ultimate hedge against inflation and currency debasement, Bitcoin is now facing tough competition from the timeless appeal of gold, especially in an environment marked by economic uncertainty, high interest rates, and geopolitical tensions.

Gold has surged ahead as investors seek safety. Central banks around the world have been aggressively accumulating gold reserves, signaling a preference fo

BTC-0,85%

- Reward

- 6

- 8

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

Bitcoin is underperforming gold as investors reassess risk amid rising global uncertainty. While gold continues to attract strong inflows as a traditional safe-haven asset, Bitcoin’s momentum has slowed, highlighting a divergence between digital assets and hard assets in the current market cycle.

Gold’s strength is being driven by macroeconomic stress, geopolitical risks, expectations of interest rate cuts, and sustained central bank buying. In contrast, Bitcoin—often referred to as “digital gold”—is still viewed by many investors as a risk-on asset, making it more sens

Bitcoin is underperforming gold as investors reassess risk amid rising global uncertainty. While gold continues to attract strong inflows as a traditional safe-haven asset, Bitcoin’s momentum has slowed, highlighting a divergence between digital assets and hard assets in the current market cycle.

Gold’s strength is being driven by macroeconomic stress, geopolitical risks, expectations of interest rate cuts, and sustained central bank buying. In contrast, Bitcoin—often referred to as “digital gold”—is still viewed by many investors as a risk-on asset, making it more sens

BTC-0,85%

- Reward

- 1

- 3

- Repost

- Share

EagleEye :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

#BitcoinFallsBehindGold

A shift is happening—and the markets are taking notice.

As gold continues to push higher, Bitcoin is starting to lag, challenging the long-held narrative of crypto as “digital gold.” In times of real uncertainty, capital is once again gravitating toward what has proven itself over centuries, not cycles.

Gold thrives when trust in currencies weakens, when debt piles up, and when geopolitical risks rise. It doesn’t rely on networks, regulation, or sentiment. It simply is. Central banks are buying it aggressively, institutions are increasing expos

#BitcoinFallsBehindGold

A shift is happening—and the markets are taking notice.

As gold continues to push higher, Bitcoin is starting to lag, challenging the long-held narrative of crypto as “digital gold.” In times of real uncertainty, capital is once again gravitating toward what has proven itself over centuries, not cycles.

Gold thrives when trust in currencies weakens, when debt piles up, and when geopolitical risks rise. It doesn’t rely on networks, regulation, or sentiment. It simply is. Central banks are buying it aggressively, institutions are increasing expos

BTC-0,85%

- Reward

- like

- Comment

- Repost

- Share

#BitcoinFallsBehindGold

As of early 2026, Bitcoin has been trading roughly in the $85,000–$95,000 range, showing weak momentum and sideways to downward price action compared with recent months. Bitcoin bulls are struggling to break above key resistance levels and the market sentiment remains cautious.

Gold (XAU)

Gold has surged to record highs, surpassing $5,000 per ounce for the first time amid rising geopolitical tensions and macroeconomic uncertainty. This level reflects both strong investor demand and central bank purchasing.

Why Bitcoin Is Lagging Behind Gold in 2026

1. Bitcoin’s Role

As of early 2026, Bitcoin has been trading roughly in the $85,000–$95,000 range, showing weak momentum and sideways to downward price action compared with recent months. Bitcoin bulls are struggling to break above key resistance levels and the market sentiment remains cautious.

Gold (XAU)

Gold has surged to record highs, surpassing $5,000 per ounce for the first time amid rising geopolitical tensions and macroeconomic uncertainty. This level reflects both strong investor demand and central bank purchasing.

Why Bitcoin Is Lagging Behind Gold in 2026

1. Bitcoin’s Role

- Reward

- 23

- 22

- Repost

- Share

xxx40xxx :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

3.76K Popularity

86.44K Popularity

59.62K Popularity

16.04K Popularity

34.7K Popularity

29.58K Popularity

21.2K Popularity

94.58K Popularity

60.68K Popularity

30.9K Popularity

21.16K Popularity

14.71K Popularity

268.04K Popularity

31.26K Popularity

187.53K Popularity

News

View MoreCoinShares: Digital asset investment products saw a net outflow of $1.73 billion last week

16 m

Alpha Token Launch: AMELIA is now live

17 m

Yili Hua: Will buy the dip and hold more ETH with various strategies

21 m

Today's Cryptocurrency News (January 26) | Japan plans to open crypto ETFs in 2028; Cathie Wood increases holdings in crypto stocks

25 m

PYUSD is now live on the Stable network

31 m

Pin