EagleEye

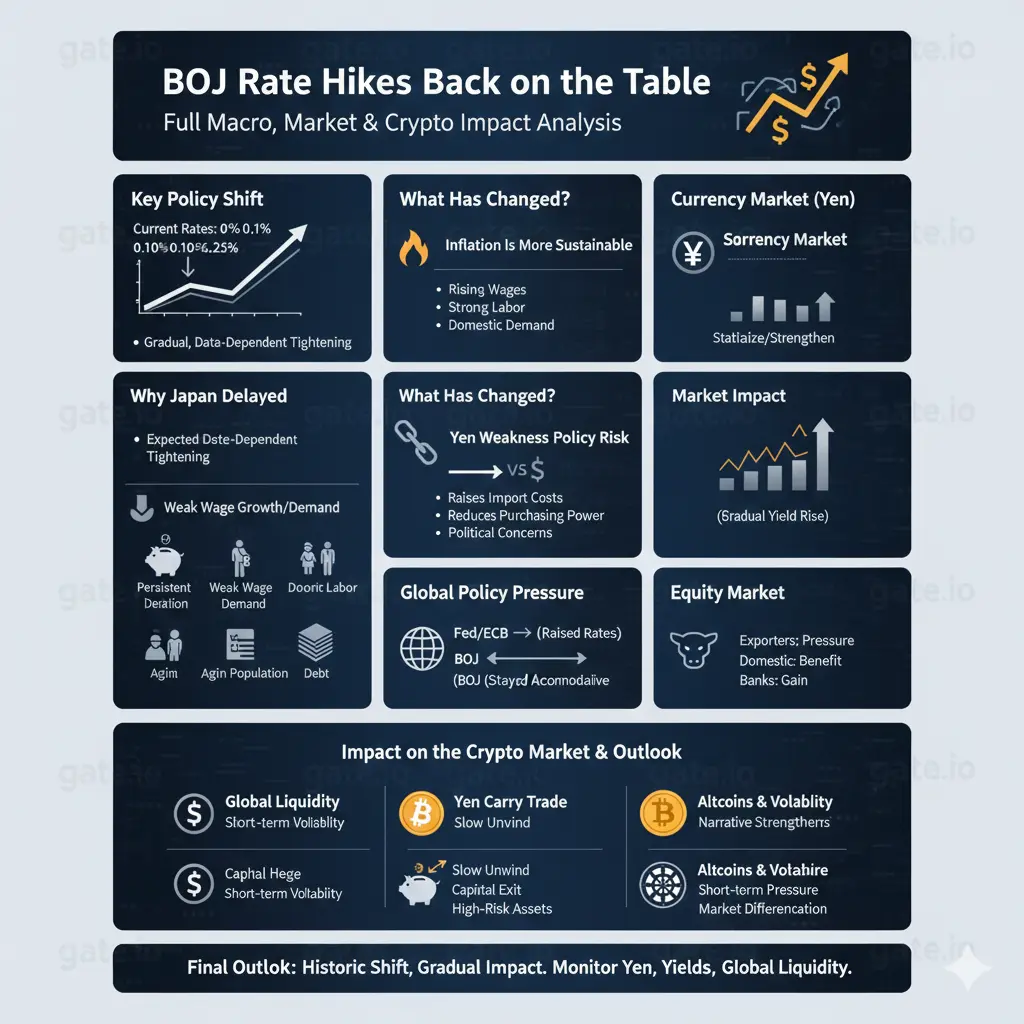

BOJ Rate Hikes, Yen Liquidity, and Crypto Risk Allocation: A Deep Dive

The Bank of Japan (BOJ) has long been a central pillar of global liquidity dynamics due to its decades-long ultra-loose monetary policy. Near-zero and negative rates, along with yield curve control, have created a unique environment where the yen has functioned as the go-to funding currency for leveraged global carry trades. Investors have borrowed yen at minimal cost to deploy capital into higher-yielding markets, including equities, commodities, and increasingly, crypto. In this sense, the BOJ’s policies have indirectly f

The Bank of Japan (BOJ) has long been a central pillar of global liquidity dynamics due to its decades-long ultra-loose monetary policy. Near-zero and negative rates, along with yield curve control, have created a unique environment where the yen has functioned as the go-to funding currency for leveraged global carry trades. Investors have borrowed yen at minimal cost to deploy capital into higher-yielding markets, including equities, commodities, and increasingly, crypto. In this sense, the BOJ’s policies have indirectly f