Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

TradFi

Gold

Trade global traditional assets with USDT in one place

Options

Hot

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

New

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Affiliate

Enjoy exclusive commissions and earn high returns

Gate Booster

Expand your influence and enjoy massive airdrops

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

Trending Topics

View More50.85K Popularity

47.54K Popularity

18.7K Popularity

44.41K Popularity

253.84K Popularity

Pin

A Complete Collapse! US Stocks – Gold – Silver – Bitcoin All Plunge: How Long Will This “Black Swan” Last?

Friday the 13th

With only four trading days left before the 2026 Lunar New Year, the global financial markets experienced a true “Black Friday.”

The Nasdaq fell nearly 3%, gold and silver – two traditional safe-haven assets – unexpectedly plummeted, and Bitcoin broke through several key support levels with a drop of over 5% in the session. All risky assets were sold off massively, creating a rare “sell everything for cash” scenario. BTC is currently trading around $66,468, down 0.92% in the last 24 hours (updated data).

What happened?

The direct cause stemmed from two simultaneous shocks:

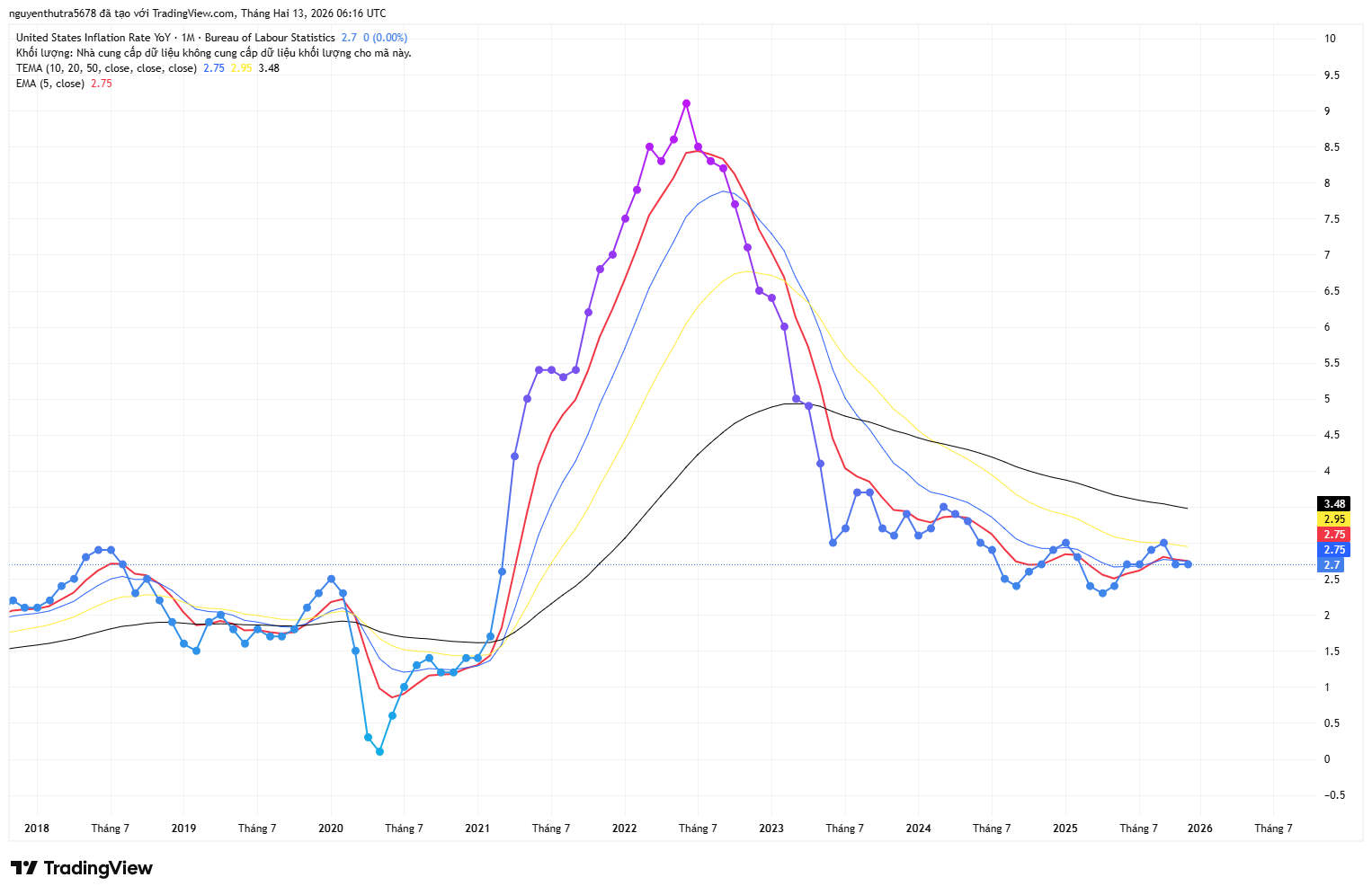

US inflation data (CPI) was better than expected but trended towards a “recovery” (i.e., inflation higher than market expectations).

Fed officials repeatedly sent hawkish signals, causing investors to worry that interest rates would remain high for longer.

The result: the US stock market plummeted, dragging down all risky assets. Gold and silver lost their safe-haven status, and Bitcoin lost its title as “digital gold.” Large institutions rushed to liquidate positions before the long Lunar New Year holiday, resulting in extremely thin buying liquidity and a strong long squeeze (forcing long-term margin investors to sell at a loss).

Signs of a “bottom is near” despite the surface panic

Despite the feeling that the market is “shattered,” deeper data reveals rare positive signals:

On-chain : Within 4 hours of the crash, whales holding 100–1,000 BTC not only didn’t sell but also bought a net 2,300 BTC. This is clear accumulation by “smart money.”

Technical indicators: The daily RSI reached the oversold zone of 25 – a level that accurately predicted strong rallies over the past 6 months.

Options market: Despite retail investors complaining on social media, the volume of call options for the end-of-February (after the Lunar New Year) period surged, and implied volatility (IV) jumped. Large funds are quietly betting on a strong rebound after the holiday.

Trading Guide During This Period

Trader commented:

“BTC is being dragged down by the general trend of the global financial market. This is a short-term bear market. The number one priority is capital preservation, reducing trading frequency, and absolutely avoiding frequent counter-trend trading.” Current reasonable strategy:

Reduce leverage, narrow positions.

Only hold coins with strong fundamentals and where whale capital is accumulating.

Prepare funds to buy dips if on-chain signals and options continue to confirm.

Conclusion: How long will this “black swan” last?

From a data perspective, this is not the beginning of a long-term bear market, but rather a strong liquidity cleanup before the Lunar New Year – typical of years with major Chinese holidays.

Whale accumulation signs + oversold RSI + option money betting on a recovery after the Lunar New Year holiday suggest a high probability this event will end quickly within the next 1-2 weeks, as money flows back in after the holiday.

The market is currently in a “sell out of fear, buy out of reason” phase.

Stay calm, protect your capital, and be ready for a strong recovery after the 2026 Lunar New Year. What are you doing right now: holding, cash, or looking for buying opportunities? Comment below!