US Dollar Stablecoin Bill: The Prelude to On-Chain Hegemony

The currency has not been reconstructed, it has only been put on the chain; Web3 has not gained freedom, it has only changed regulators.

Written by: Sanqing

🇺🇸 Stablecoin Legislation Breakthrough: GENIUS Bill Passed Senate Procedural Vote

[Washington, May 19, 2025] - The U.S. Senate on Monday night passed a procedural vote on the “U.S. Stablecoin National Innovation Act” (GENIUS Act) with 66 votes in favor and 32 against, clearing the biggest hurdle for the final passage of the bill. This legislation establishes a comprehensive federal regulatory framework for the issuance, reserve, redemption, compliance, and consumer protection of stablecoins in the United States.

The bill originally faced political resistance due to its involvement with the cryptocurrency business interests of former President Trump’s family and failed to enter the voting process in early May. After revisions to the terms, new provisions were added to restrict foreign issuers and prohibit large tech companies from dominating the issuance of stablecoins. Some moderate lawmakers shifted their support, allowing the bill to overcome the procedural hurdle of 60 votes in the Senate. A final vote in the Senate is expected this week, after which it will be sent to the House of Representatives for review.

Bill Overview: Under the Guise of “Stability”, Actual Regulation

The GENIUS Act clearly defines stablecoins as “digital assets redeemable at a fixed amount for payment and settlement purposes,” excluding central bank digital currencies and forms such as bank deposits.

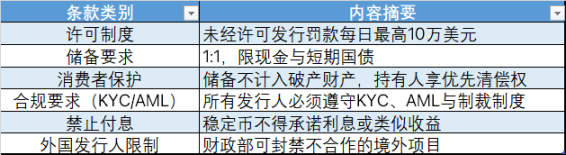

Overview of Core Provisions of the GENIUS Act

After the bill is passed, compliant stablecoin issuers like Circle (USDC) and PayPal (PYUSD) will benefit, while entities like Tether (USDT) and most DeFi structured stablecoin projects (such as RAI, USDe) may face a legitimacy crisis in the US market.

Background Deepening: The Certainty Moment of On-Chain Dollar

Structurally, the GENIUS Act is not a tolerance for stablecoins, but rather an institutional confirmation of U.S. dollar sovereignty in the blockchain space, representing an American-style expansion of digital currency. By legalizing compliant stablecoins, it extends the dollar’s issuance rights into the Web3 ecosystem: although the on-chain settlement unit is issued by Circle, it essentially functions as an “on-chain dollar clearing bank.”

This means:

- The US dollar has become the pricing benchmark for all on-chain assets, with dominance continuing to be held by the Federal Reserve system;

- Compliant stablecoins will gain clearing privileges, while other algorithmic stablecoins and structured financial tokens will be marginalized or exit the U.S. market;

- Web3 is losing its potential as an “independent value system” and is gradually being integrated into the digital extension of dollar hegemony.

The GENIUS Act is gradually transforming blockchain from a “currency-neutral platform” into a “settlement appendage of the US dollar.”

The Deep Impact of Web3 and Decentralized Finance

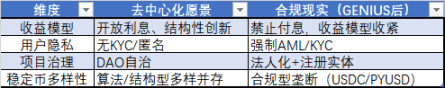

Decentralized Vision vs Compliance Reality

1. DeFi Yield Assets are Marginalized:

The prohibition of “interest payments” means that structural stablecoins are difficult to sustain. Designs like sDAI and USDe are restricted and may face securitization risks, which erodes the core business logic of DeFi.

2. KYC Compliance Forces Centralization of DApps:

The compliance of stablecoins will force DApps to introduce AML/KYC mechanisms, which contradicts the original intention of decentralized design, and DAOs may have to legally establish representative entities.

3. The stablecoin market is highly centralized:

Stablecoins like USDC and PYUSD, which have a “passport” from US regulators, will absorb market liquidity, leading to a sharp increase in project costs and higher innovation thresholds.

4. On-chain collaborative units struggle to form a closed-loop economy:

Projects like PAYFi that attempt to build structurally non-pegged value units will struggle to gain mainstream user trust due to the lack of fiat currency exit, and the closed-loop economy faces a credit bottleneck.

5. The “Financial Resistance Laboratory” is being incorporated into the “Digital Dollar Interface”:

The GENIUS Act represents that Web3 is no longer seen as a threat to the old order, but rather is forced to become a submodule of its infrastructure. This is hegemony, not being subverted, but rather being “protocolized and extended.”

Conclusion: From Gray Area Currency to Permissive Finance, Is Compromise the Next Step for Web3?

The GENIUS Act is a milestone in stablecoin legislation and a chain-based confirmation of “the US Dollar as the global value anchor.” In the short term, it enhances compliance clarity and opens the green light for institutional entry; in the long term, it builds a firewall for the value system, making Web3 increasingly resemble TradFi, while becoming less like the world it was originally meant to replace.

If Bitcoin once dreamed of breaking the monopoly of sovereign currencies, then the GENIUS Act declares:

The currency has not been reconstructed, it has only been put on the chain; Web3 has not gained freedom, it has only changed regulators.