The issue coin platform has rolled up, but have you made any money?

Over the past year, the Launchpad market, a meme coin issuance platform on the Solana chain, has experienced explosive growth and quickly developed a highly competitive landscape. Pump.fun was the first platform to rise and was seen as the catalyst for Solana’s “on-chain casino” boom. The platform allows any user to issue tokens without thresholds, adopts binding curve pricing, and creates a fair issuance model with no pre-sale and no team shares.

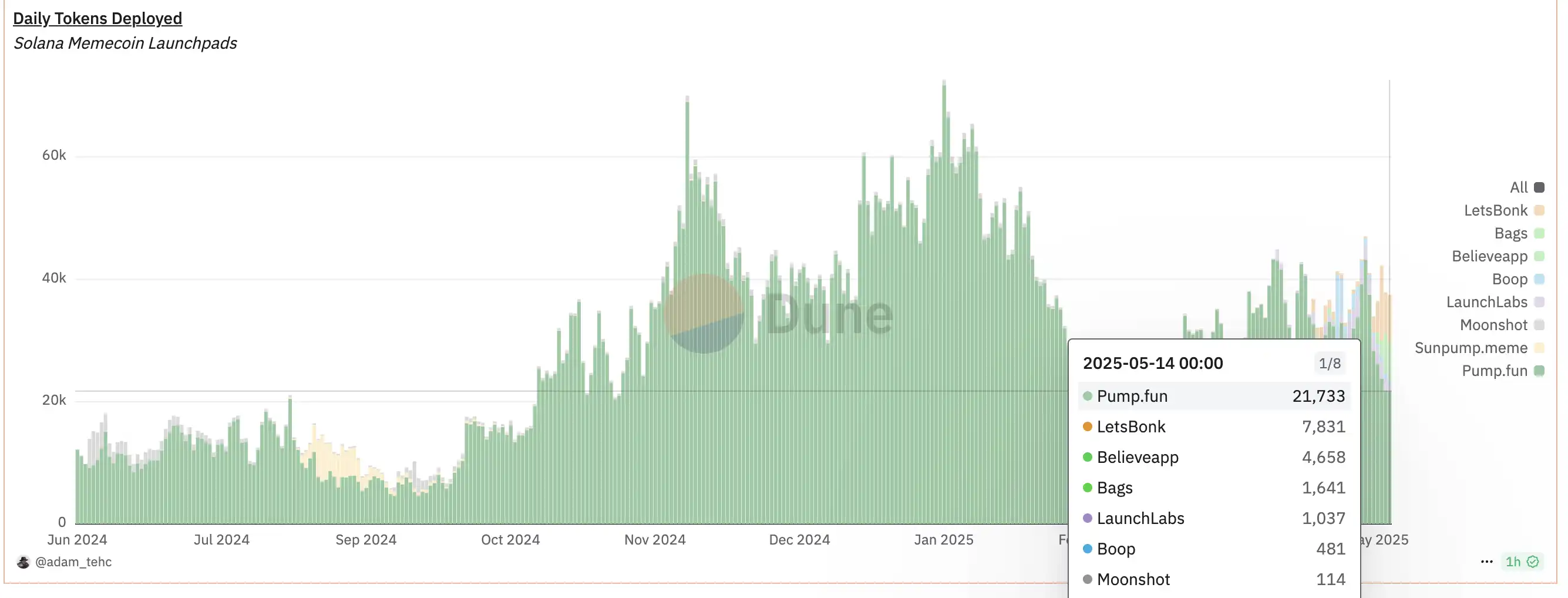

With the advantages of low-cost and high-speed transactions on Solana, Pump.fun ignited a meme coin frenzy in 2024. In just 13 months, users on the platform issued over 8 million Tokens, and at its peak on October 24, 2024, the daily output exceeded 36,000 Tokens, with an average of 25 new Tokens born every minute. This unprecedented scale of Token creation allowed Pump.fun to dominate the market, also leading to Solana being referred to as the largest “casino” on-chain. However, the success of Pump.fun also brought concerns. On one hand, a large number of low-quality projects emerged, with a graduation rate of less than 1%, and the vast majority of Tokens were short-lived. On the other hand, while the platform was highly profitable, users generally suffered losses, with statistics showing that nearly 90% of users lost their principal or made less than $100 in meme coin trading, while the platform raked in about $98 million in just 6 months.

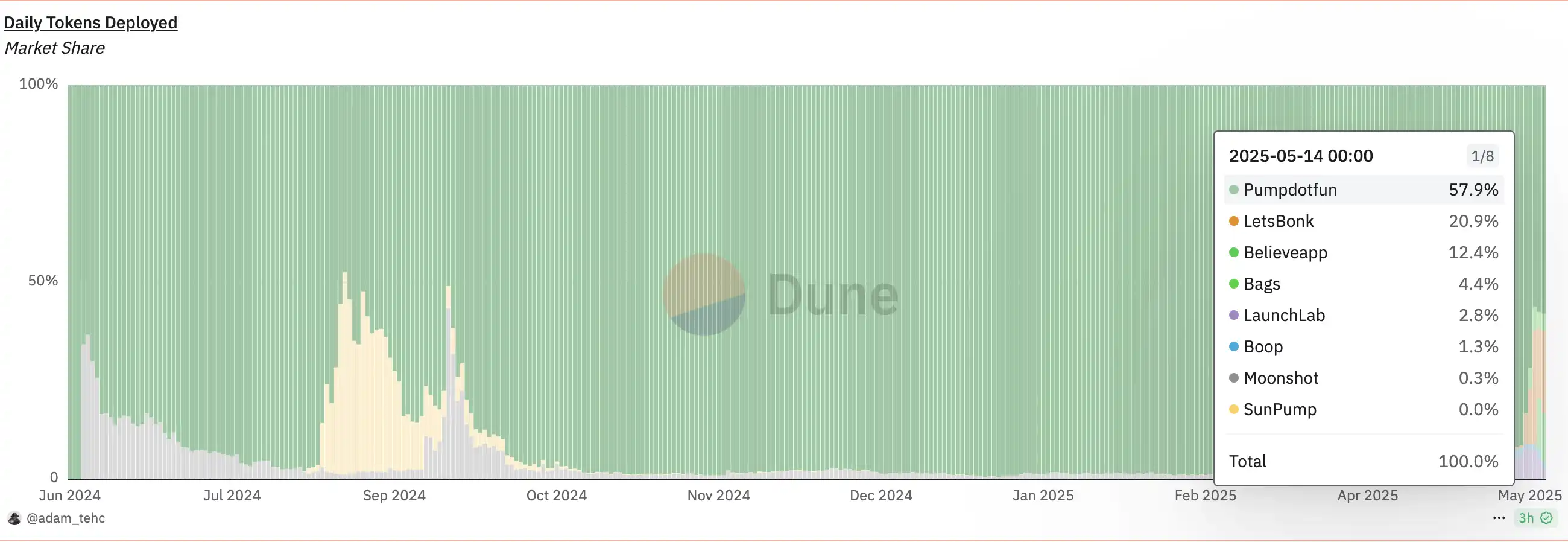

By the end of 2024, Pump.fun had accumulated more than $223 million in official revenue (approximately 1.15 million SOL) and continued to monetize the resulting SOL. In just one and a half years, the platform fee account sold about 3.403 million SOL (about $629 million), making it the second largest source of selling pressure after Solana’s early investors FTX/Alameda. Such a large outflow of funds has raised concerns in the community about the sustainability and ecological impact of the platform. Faced with the dominance of Pump.fun, market participants moved quickly, and the entire Meme Launchpad track entered a fierce competition. In the Solana ecosystem, Raydium, a veteran decentralized trading platform, launched LaunchLab to compete with Pump.fun; Popular meme coin BONK opens LetsBonk.fun launchpad; Jupiter, an on-chain aggregator, is also trying to launch a similar service.

Daily Token deployment situation, data from @adam_tehc’s DUNE

Pump.fun’s Challenge

Pump.fun As a pioneer of the one-click launch platform for meme coins, it has established a basic operating model. Users only need to fill in basic information such as token name and symbol, and can automatically deploy token contracts and establish transaction pools without programming skills, which greatly reduces the threshold for coin issuance. The platform uses a variety of binding curve pricing models to balance the initial price and market demand, and the issued tokens can be traded immediately in the platform’s AMM pool without the need to inject liquidity in advance.

The platform innovatively introduces an LP share destruction mechanism. When a new coin reaches a specific market value threshold, it will automatically inject part of the liquidity into the Raydium trading pool and destroy the corresponding LP Tokens, ensuring that the project team cannot withdraw liquidity and escape, thereby enhancing liquidity security.

With the experience of “no-code token issuance and instant trading”, Pump.fun quickly became popular in 2024, giving rise to a large number of creative meme Tokens, including many hundredfold and even thousandfold coins, attracting numerous speculators. The platform became one of the most profitable on-chain applications in 2024 by extracting transaction fees.

However, with the development, the problems of Pump.fun gradually became apparent: among the more than 8 million issued Tokens, less than 1% successfully “graduated” into external liquidity pools; user earnings are severely polarized, forming a zero-sum game; the platform monetizes transaction fees and continues to sell SOL, creating selling pressure on the Solana network; the completely anonymous and unreviewed model, while in line with the spirit of crypto, brings regulatory and trust risks. As a result, Pump.fun’s growth rate slowed down in early 2025, with daily trading volume dropping from a peak of $544 million in January to $270 million in February, a nearly 50% decline.

The graduation rate of Pumpfun’s Token has been consistently declining on a weekly basis.

Wheel Battle of LaunchPad - LaunchLab, Boop, Believe

LaunchLab’s on-chain Degen strategy

Raydium LaunchLab is one of the most direct competitors of Pump.fun in the Solana ecosystem. Raydium itself is an important AMM protocol on Solana, and it benefited early on from Pump.fun’s contribution of 41% of Swap fee revenue. However, with Pump.fun branching out to launch PumpSwap, Raydium’s traffic and trading volume have been significantly impacted.

In March 2025, Raydium released LaunchLab, seen as a direct counterattack to Pump.fun. The overall mechanism of the platform is highly similar to that of Pump.fun, both of which support one-click coin issuance and curve pricing, but the details have been optimized.

Support multivariate pricing curves, allowing project parties to choose linear, logarithmic or exponential models according to token positioning; Set a lower transaction fee of just 1% and less than 2% of Pump.fun, with no additional migration fees; The graduation threshold has also been lowered, and only 85 SOLs (about $11,000) need to be raised to transfer to the Raydium AMM pool; At the same time, a creator sharing mechanism is introduced, and the founders of graduation tokens can continue to receive 10% of the handling fee profit; The platform has also strengthened ecological integration, including innovative designs such as fee repurchase of platform coin RAY, support for LP lock-up, and the introduction of pricing diversity.

On the day the news was released, RAY coin rose by 14%, and the market has high hopes for Raydium LaunchLab. Although the official statement claims that LaunchLab is “providing alternative options,” it has actually successfully attracted some projects to shift, weakening the dominance of Pump.fun.

In addition, multiple platforms such as LetsBonk.fun launched in collaboration with the BONK community, as well as Meteora, Boop, and Genesis Launches, are also striving to break through and drive the entire Launchpad market into a phase of full competition.

The daily active users of LaunchLab are rising rapidly.

A New Approach to Believe, Creative Narrative Productization Concept Strategy

As the Meme Launchpad track becomes increasingly crowded, the “rebirth” of the Believe project has attracted widespread attention in the industry.

As the Meme Launchpad sector becomes increasingly crowded, the rebirth of the Believe project has attracted widespread attention in the industry. Founded by Australian entrepreneur Ben Pasternak, Believe is the successor to the social Token platform Clout. Ben has created several blockbuster applications and successfully monetized them, but Clout quickly faded due to its over-reliance on celebrity effect. At the end of April 2025, Ben returned to the market with the upgraded platform Believe, shifting the concept from “Believe in Someone” to “Believe in Something,” emphasizing the belief in the value of creativity and ideas, marking the platform’s strategic transformation from social asset trading to a creative incubation factory.

Commenting on the change, Ben said, “It’s a shift from Influence to Trust. We’re no longer hyping celebrities, we’re looking for projects that make sense.”

Believe adopts a unique product mechanism and uses social platforms as the entrance to coin issuance to achieve a seamless connection between Web2 and Web3. Users only need to @LaunchACoin on Platform X and attach the name of the token, and the system will automatically create the token using Meteora’s union curve, without having to log in to a DApp or fill out a form. This interactive model of “discussing and issuing coins” allows any valuable idea to be instantly converted into tokens, greatly reducing the barrier to participation. The platform has also set up a “B point” mechanism, when the token fee income reaches a critical value, the founder can withdraw funds to support the project, if it does not meet the standard, it will be regarded as a market veto. Although point B is not a hard numerical threshold, the logic behind it is similar to the Kickstarter-style crowdfunding mechanism, “transaction heat is market voting”

Imran Khan, the founding partner of Alliance DAO, once commented that “the founder or Scout tags @LaunchACoin, and a Token is born. The market values it based on the importance of the problem this idea aims to solve.” In short, market enthusiasm determines the fate of a project.

In terms of revenue structure, Believe has also implemented a series of innovative designs. A 2% transaction fee is charged for each transaction, and unlike other LaunchPads, its Token still has a trading tax of 2% for both buying and selling within the contract after launch, but its distribution structure is highly incentive-oriented: 1% is allocated to the Token creator (founder), 0.1% is rewarded to Scouts (the users who first discovered or promoted the Token), and the remaining 0.9% goes to platform operations. This mechanism not only provides immediate income assurance for creators but also integrates “Token discoverers” into the revenue-sharing system for the first time, greatly motivating the community to actively discover and spread quality ideas.

Since its launch, Believe has recorded a total transaction volume of 1.8 billion dollars, bringing 9.5 million dollars in direct income to creators, of which 4.7 million dollars belongs to the trading of Believe Token.

According to the BelieveScan dashboard data, the transaction fee revenue of Believe in the past 24 hours is approximately 10 million.

While opening up the issuance of coins, Believe also tries to manage the order of the platform to a certain extent to avoid becoming a place where shitcoins are flooded.

In terms of creator incentives, Believe’s mechanism is to share with the issuer, returning 1% directly to creators for each transaction; there are no reserved holdings or Token ratio controls, allowing founders to freely define distributions; a Scout incentive mechanism is established to promote decentralized content discovery; the platform actively displays transaction volumes, creator income, and other data to enhance transparency. The involvement of some Web2 entrepreneurs has also strengthened Believe’s Meta quality, with RizzGPT developer Alex Leiman and well-known hacker Ruben Norte having issued personal Tokens on the platform, with project market values once reaching several million dollars, pushing Believe’s image from a purely Meme playground towards a “creative value testing ground.”

This narrative logic is particularly evident in the LaunchCoin event. The token originated from PASTERNAK, which was issued by Ben personally, and was later renamed LaunchCoin when it was launched on the platform, giving it functional significance. On the day of its launch, LaunchCoin skyrocketed 200 times, with a market value exceeding 200 million dollars, sparking intense discussions within the community.

Some users see it as a sign that the platform has officially entered the governance Token phase; others question whether Ben is using his founder status for arbitrage. Ultimately, Ben sold off most of his holdings in batches, making a profit of about 1.3 million dollars. The fate of LaunchCoin has sparked heated discussions in the community around the core theme of “trust.” Whether supporters or skeptics, this turmoil has successfully brought the Believe brand positioning back to the discussion center and validated the attention on its main value direction.

Trust narratives emphasize the value behind creativity, no longer simply encouraging foolhardy operations, but attracting more rational Builders and entrepreneurs. The interest bundling mechanism allows creators, Scouts, and the platform to have profit mechanisms, binding participants’ interests on an economic level and continuously incentivizing high-quality content. Under this mechanism, although many Web2 talents have emerged with tokens launched alongside products.

However, the real feedback from the current community participation is that after the Token is launched, most of the chips are obtained by bots, and due to the high tax at the beginning, there are fewer sell orders. High-quality projects can quickly reach a market value of over 5-10 million USD, and then the trading tax decreases, leading to bots with a large number of chips to sell off massively. As a result, many Tokens have risen to hundreds or even tens of millions in market value, but their sustainability is not very good. Some people in the community believe that this is good for entrepreneurs, Scouts, and the platform, but these costs are all borne by retail investors.

Ben hopes to seek a dynamic balance between “empowering real value projects” and “curbing blind speculative bubbles” through Believe. Although there is still controversy over whether it can truly sustain in the long run, at the current stage, Believe has successfully established a differentiated label in the Meme Launchpad battle with its innovative mechanisms, topical events, and explosive data.

Comparison of Key Differences Among Leading Platforms

After experiencing the rapid rise of Pump.fun and the subsequent imitation by various platforms, the current Meme Launchpad market has formed multiple leading camps. Below is a horizontal comparison of Pump.fun, Raydium LaunchLab, Boop, and Believe across key dimensions.

Issuance Method and Threshold

Pump.fun, LaunchLab, and SunPump all use a DApp page style one-click token issuance, where users need to log in and fill out the relevant token information to complete the deployment process. Believe, on the other hand, completely breaks out of the DApp paradigm by triggering token issuance through Twitter social links, without the need to enter the platform page.

From the perspective of thresholds, Boop, Pump.fun, and LaunchLab have almost no requirements for issuers; any user can issue a coin at any time. Believe appears to have no threshold, but in reality, it has formed a kind of “natural selection” through social networks, where those who follow entrepreneurs like Ben and Alex become the first creators and participants.

Regarding the “graduation threshold”, Pump.fun was initially set to a market value of $69,000; LaunchLab was initially set at 85 SOL (approximately $11,000), but can set a minimum launch mode of 30 SOL, which has a lower threshold; while Believe does not set a fixed threshold, judging whether the idea is accepted by the market based on the trading fee income from the “B point”.

Fee Structure and Distribution Mechanism

Pump.fun charges a 2% transaction fee, initially all of which goes to the platform, and starting from May 2025, 50% will be returned to creators; LaunchLab has a transaction fee rate of 1%, of which 25% is used to repurchase the platform coin RAY, and founders can additionally apply for up to 10%; Believe charges a 2% transaction fee embedded in the Token contract, of which 1% goes to creators, 0.1% to Scout, and 0.9% is retained by the platform. From the data, Believe offers the highest revenue share to creators among all platforms, while also pioneering the Scout profit-sharing incentive, allowing discoverers to continue benefiting.

Community Participation and Governance

Pump.fun follows extreme liberalism, with no censorship or governance mechanism. The community relies on spontaneous organization for hot topic dissemination, but this also makes it susceptible to manipulation by whales, resulting in retail investors “losing more and winning less.”

With its AMM background, Raydium LaunchLab binds DeFi community resources and circulates the ecosystem through platform token incentives. Boop relied on Dingaling’s previous influence in the community.

Believe attempts to incorporate community consensus decision-making elements in governance. Through token-based governance, Snapshot voting, and other methods, discussions are held on whether the Token will subsequently enter DEX liquidity pools and whether to support promotion, forming a preliminary framework of “governance upon issuance.” If it matures in the future, its user community engagement is expected to far exceed that of current mainstream platforms.

Creator Economy Model

In terms of creator incentives, Believe and LaunchLab are the most attractive. Believe has built a flywheel effect of issuance → attracting new users → re-issuance, based on a 1% handling fee returned upon Token issuance, combined with the Scout reward mechanism.

LaunchLab retains creators through low barriers, high flexibility, and RAY buyback mechanisms, while Pump.fun has lost some appeal in the new environment due to a lack of early incentive mechanisms.

Market Outlook of LaunchPad

As the Meme Launchpad market transitions from a period of explosive growth to maturity, several key trends are emerging, providing reference directions for platform competition and industry evolution.

The data frenzy subsides, and refined competition begins

On-chain data shows that the frenzy of meme coin issuance is receding. Taking Pump.fun as an example, its daily trading volume and daily token issuance have clearly declined since early 2025, making it difficult to replicate the “get rich overnight” myth on a large scale.

This means that the phase of barbaric growth is about to end, and competition among platforms will shift to refined operations. Whoever can continuously create blockbuster products, improve creator profitability, and enhance user transaction experience will be able to take the initiative before the next wave of enthusiasm. The data from Pump.fun users voting with their feet (a halving in transaction volume) also indicates that if the platform cannot improve the profit and loss structure and emotional experience of participants, even first-mover advantages will gradually be eroded.

The business model shifts from ‘harvesting’ to ‘win-win’

Pump.fun’s early profit model was simple and straightforward: the platform collected fees, and users had a very low win rate in the game, creating a one-sided structure of “platform wins, users lose.” In contrast, new platforms represented by Believe and LaunchLab generally adopt a model that benefits creators and communities for growth.

For example, Believe directly returns 1% of the transaction fees to the founders, encouraging creators to continuously produce content; LaunchLab builds a more endogenous growth ecological closed loop through transaction fee sharing and RAY buybacks. Future Launchpads will emphasize a win-win situation for the platform, creators, and users, forming a true “content incentive network.”

Pump.fun recently launched a creator profit-sharing mechanism, which can also be seen as this new model putting pressure on old players.

Multi-chain patterns become the norm, with various ecosystems mining their own Meme soil

As the competition for Solana platforms (Pump.fun, LaunchLab, and BONK) heats up, other public chains are also stepping up their deployment of their own Meme Launchpads: Tron’s SunPump, Solana’s Boop, Base’s Genesis Launches, and even projects with ICP and Avalanche ecosystems have begun to test the waters.

Essentially, the Meme issuance platform has become a powerful tool for public chains to compete for active users. Meme coin, due to its low entry barrier and strong topical attributes, is naturally suitable for building on-chain traffic.

In the future, major public chains may give rise to one or two leading Meme Launchpads, which will be deeply integrated with wallets, social platforms, and NFT tools, becoming important indicators of ecological activity and user loyalty.

Community culture and narrative building will become the platform’s moat

The core of Meme is not in technology, but in narrative. The platform itself is no exception:

Pump.fun started with “extreme freedom and absolute openness,” but has thus fallen into issues of rampant manipulators and poor-quality projects;

Raydium emphasizes “fair issuance, technical optimization” to shape the “Avenger” image and attract native users back.

Boop will feed back its personal brand “Dingaling” and the ecosystem of $Boop, focusing on the value recovery of the core Token;

Believe takes the “trust and value” route, attempting to attract the Builder community, using creativity as the source of Memes.

In the future, community culture will directly determine the type of user groups that the platform attracts: whether they are more Degen (pure speculation), KOL (influencer-driven), Builder (value-oriented), or general users (primarily for entertainment). The platform’s differentiated positioning will no longer be limited to product mechanisms but will extend to emotional consensus and cultural atmosphere.

From the perspective of daily Token deployment ratio, Pumpfun’s market share has shifted from a significant monopoly to 57%.

From Meme to ICM, a new startup incubation path emerges

Although 99% of the current meme coins are still short-term speculation, some projects have begun to try to “move from meme to product”. Some founders use fees to build an initial capital pool, start to build a team, and develop prototypes; Some platforms, such as Believe, encourage founders to cash out Roadmap through the mechanism of “releasing start-up capital after reaching point B”;

The community has started long-term observation and governance on certain Tokens, such as LaunchCoin, which possesses experimental value in governance, profit distribution, and functional expansion. If a small number of Meme projects are successfully incubated into actual products through the Launchpad in the future, their “symbolic” nature will have a profound impact on the entire industry: it will prove that the Launchpad can not only incubate speculative coins but also nurture the goals of Web3 projects. At that time, the Launchpad will no longer be a “issuance tool,” but rather a “project cold-start infrastructure.”

Summary

Meme Launchpad is standing at the tipping point of transitioning from explosive growth to refined operations. The monopoly of Pump.fun has been broken, and platforms like Raydium LaunchLab and Believe are entering the market through differentiated strategies, gradually capturing shares of users and creators.

The future winners of the industry may not necessarily be the ones with the lowest transaction fees, but those who can build content flywheels, community consensus, and platform trust mechanisms. Believe is currently establishing its differentiated moat through social distribution models, Scout incentive mechanisms, and governance exploration, demonstrating strong iteration and growth potential. Of course, this is still a marathon-style competition. The platforms that can truly stand out must achieve a balance across multiple dimensions of “cultural identity, creator win-win, ecological governance, and safety compliance.”

As Ben Pasternak said, “We are not just building a platform; we want to give every good idea a monetization possibility.” This might be the most credible direction for the next phase of Meme Launchpad.

Original link