XRP Price Prediction: XRP Surges Above $3 With 94% Supply in Profit but Faces 20% Downside Risk

Preface

XRP recently broke above the $3 level during a strong rebound, pushing over 94% of circulating supply into profit—a scenario seen only near the peaks of the 2017 and 2021 bull markets. This data shows the market is in a period of high optimism, but it also introduces potential profit-taking pressure.

Profit Ratios Above 90% Often Signal Market Tops

Glassnode data shows that around 93.92% of XRP’s supply is currently in profit. Historically, whenever the profit percentage surpasses 90%, the market is typically approaching a macro top.

- Early 2018: XRP reached $3.3 before falling by approximately 95%.

- April 2021: When the profit ratio again broke above 90%, XRP topped out near $1.95, then dropped more than 80%.

Although the current high level of unrealized profit demonstrates strong bullish momentum, it also means investors could choose to cash out at any moment.

On-Chain Indicators

Another key metric is NUPL (Net Unrealized Profit/Loss), which is currently in the “belief - denial” range. This resembles the market structure during 2017 and 2021, when XRP reached local highs in this phase and then entered a decline. If NUPL keeps rising toward the “greed” zone, historical trends suggest the market could come under heightened selling pressure.

Technical Patterns

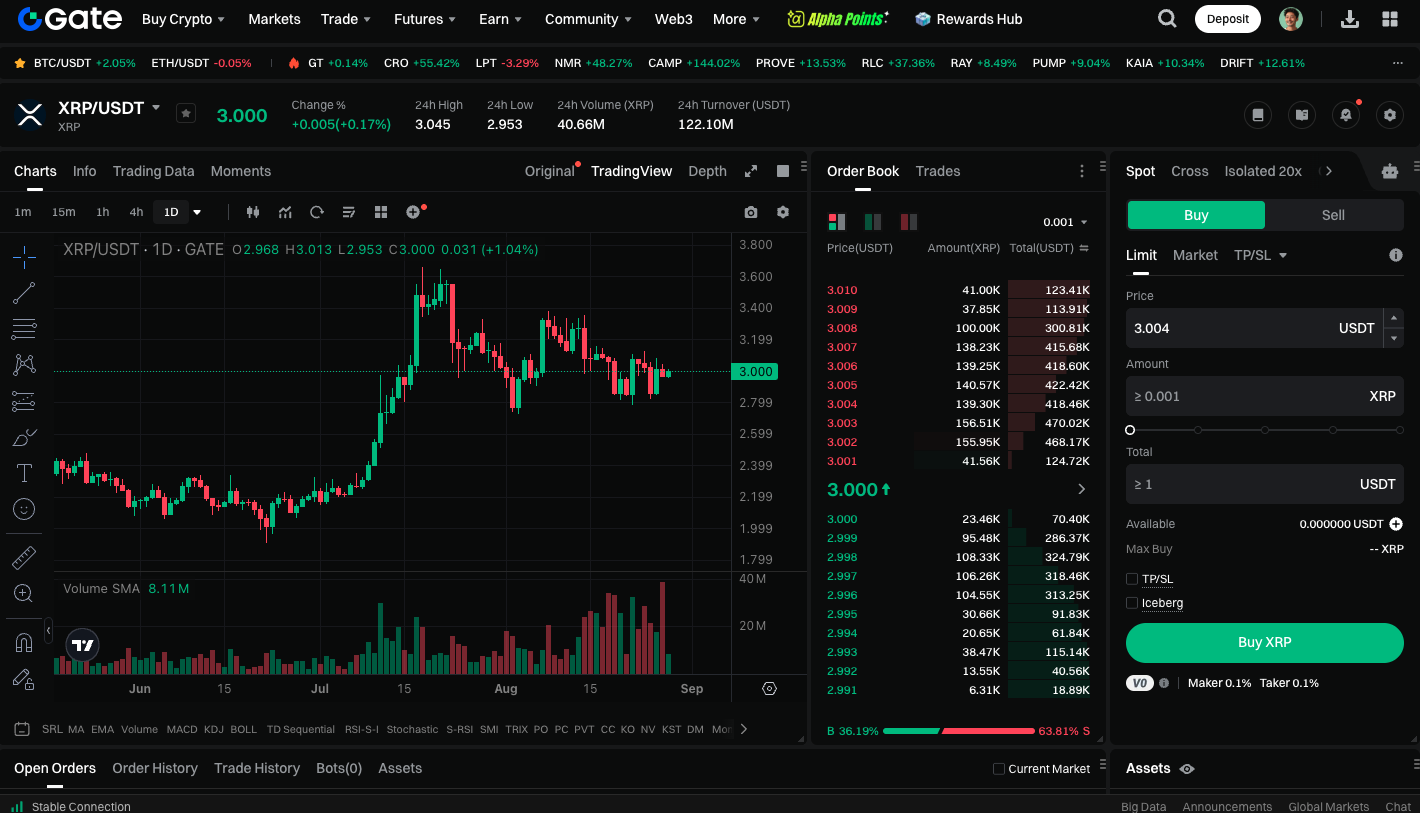

From a technical standpoint, XRP is consolidating around $3.05 and forming a descending triangle—a bearish pattern that signals risk of a downside break. If the price falls below the $3.05 support, it could quickly drop to $2.39, marking about a 23.5% pullback. If, instead, XRP breaks out above the descending trendline, a trend reversal is possible. In this case, market participants may target the $6 level.

XRP spot trading is available at: https://www.gate.com/trade/XRP_USDT

Summary

XRP’s rapid ascent has delivered significant gains for investors, but both historical precedent and technical signals suggest the market may be entering a high-risk phase. In the near term, $3.05 is the critical support—holding above that level could extend the rally, while a breakdown warrants caution regarding a steeper correction. Long-term investors should monitor institutional capital flows. Further inflows may help offset potential selling pressure.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article