XRP Price Prediction: XRP Falls Into Extreme Buy Zone Potential Rebound

Short-Term XRP Investors Face Significant Losses

On-chain analytics firm Santiment’s latest report reveals that short-term XRP investors have recently faced substantial losses. This downturn, however, may also create opportunities for a market rebound. Santiment analyzes the profit and loss status of XRP holders using the 30-day MVRV ratio, which compares market capitalization to realized capitalization. A ratio below 1 signals that most investors are under water.

XRP Hits Extreme Buy Zone

The report states that XRP’s 30-day MVRV ratio has dropped to about 0.898, indicating that investors who purchased XRP in the past month have, on average, lost more than 10%. This places XRP within Santiment’s defined extreme buy zone. Historically, assets in this zone often see short-term rebounds.

Price Action and Market Response

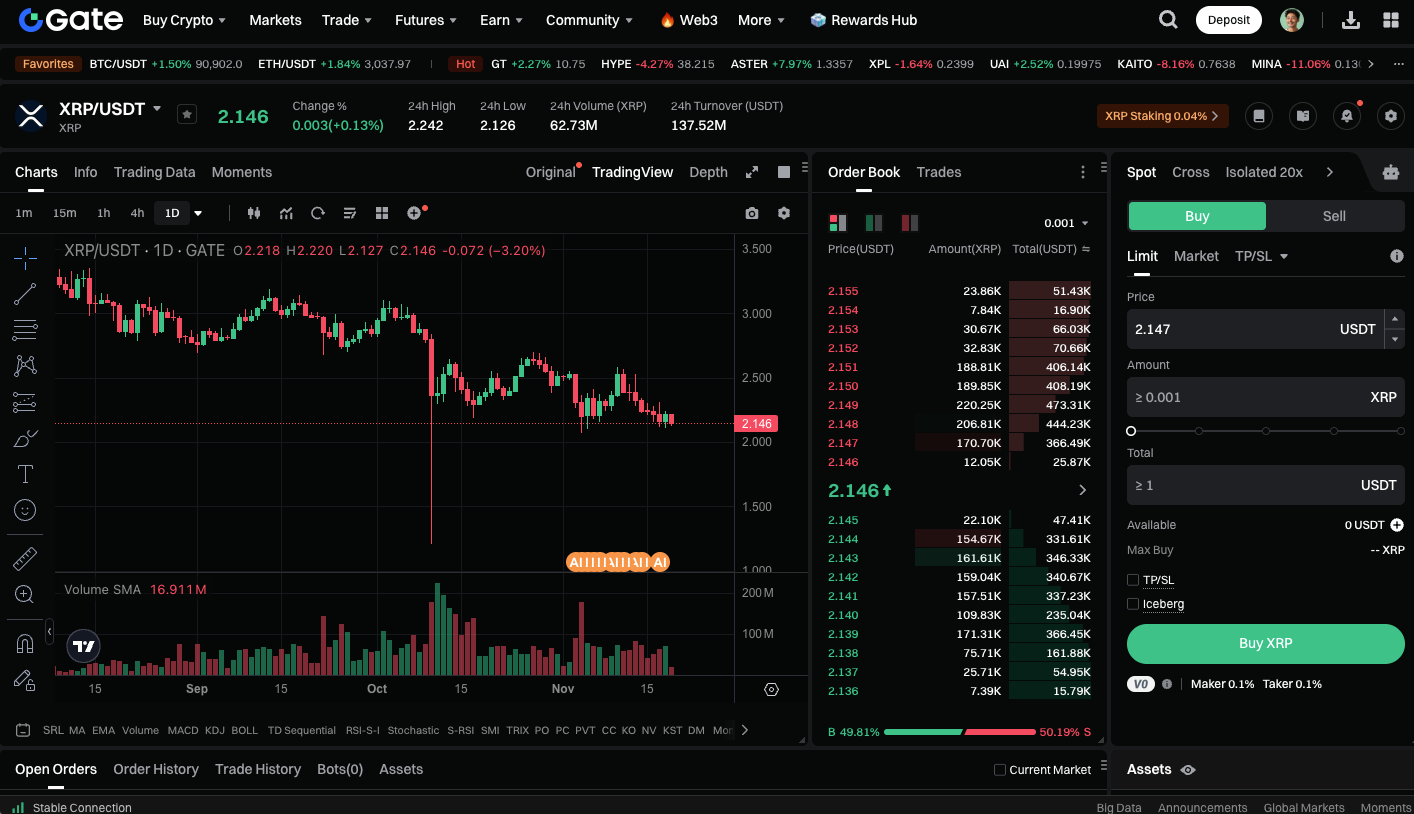

XRP is currently trading at approximately $2.14, with a decline of over 11% in the past week. Santiment notes that when peer average trading returns reach extreme negative territory, the likelihood of a sharp recovery rises considerably. This suggests XRP could see support or a rebound in the near term.

XRP spot trading is available here: https://www.gate.com/trade/XRP_USDT

Summary

XRP is currently at the lower end of its short-term adjustment phase. While investors remain in loss positions, there is potential for upside movement. The market’s next direction will depend on whether buying momentum can drive a price recovery. Further corrections may follow if buying momentum is insufficient. For those monitoring the market, this is a crucial time to watch for rebound signals.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

What is N2: An AI-Driven Layer 2 Solution