Stablecoin Summer is coming, which mines should I invest in?

With the crypto market on the upswing, stablecoins are experiencing explosive growth. Innovative projects like Plasma, STBL, and Falcon Finance are drawing investor attention with new mechanisms and attractive yields. The surge of investments following $XPL and $SBTL token airdrops and listings, along with the $FF community sale surpassing Buidlpad’s fundraising record, has emerged as the central narrative for the latter half of 2025. PANews summarizes mining pool strategies for these three projects across major platforms to help readers capture this wave of opportunity.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Data cited may change over time.

Plasma ($XPL): Abundant Mining Pools with Balanced APR and TVL

Plasma is a Layer 1 blockchain built for global stablecoin payments, designed to tackle the speed and cost challenges of large-scale, high-frequency stablecoin transactions. Its standout feature is zero-fee transfers. Plasma is EVM-compatible, enabling Ethereum-based smart contract deployment, and supports custom gas tokens plus a trustless Bitcoin bridge, allowing direct BTC usage in smart contracts.

XPL, Plasma’s project token, held its Token Generation Event (TGE) on September 25 (UTC), and has reached a $2.8 billion market cap. Its stablecoin is USDT0.

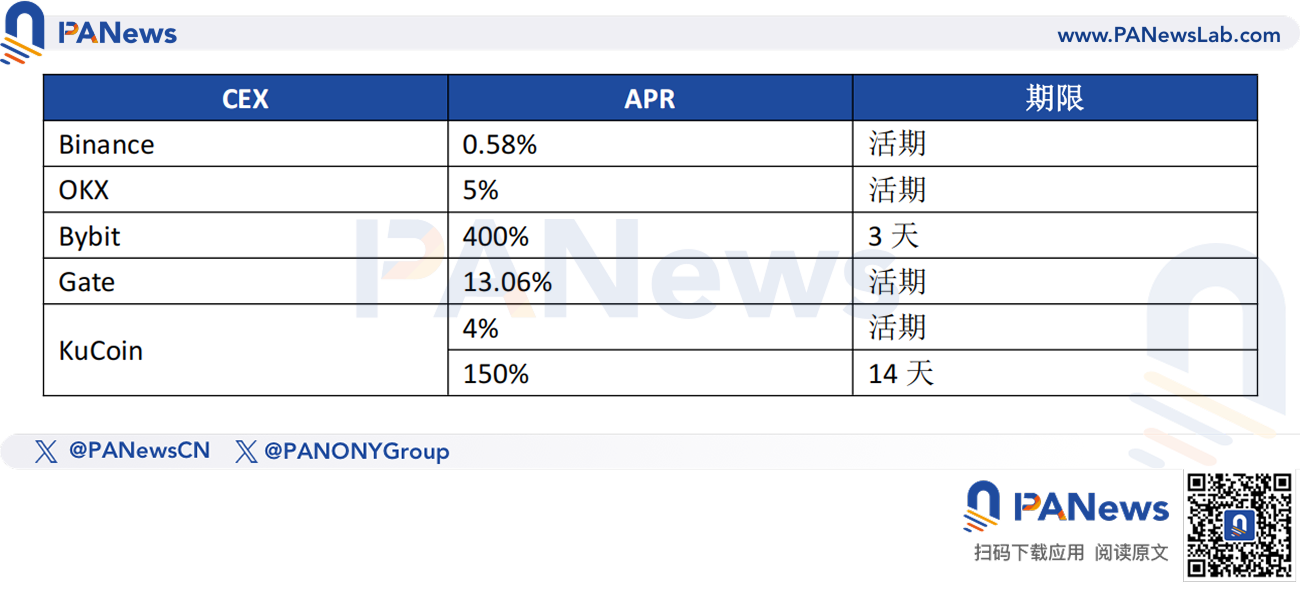

$XPL mining pools are mainly available on five centralized exchanges and PancakeSwap.

On CEXs, mining pools are categorized into flexible and fixed-term products. Gate offers the highest APR among flexible products at 13.06%. Bybit boasts the highest fixed-term APR of 400%, limited to a three-day window. KuCoin provides the most diverse product lineup, featuring two distinct options.

PancakeSwap hosts numerous $XPL pools, though some indicate unverified token status. Most pools exhibit modest TVL and 24-hour volume, but the V3 XPL/USDT pool at 0.01% fee tier stands out with a TVL over $1.7 million, nearly $57 million in daily volume, and a combined APR (mining plus LP fees) of 117.73%.

Nine leading DeFi protocols host twenty-nine pools featuring $USDT0, classified into liquidity provision (LP), borrowing, lending, and deposit pools. Protocols typically pay incentives in $XPL.

LP pools are most prevalent, with 13 spread across Uniswap, Curve, and Balancer. Balancer leads the pack with six pools. The WXPL/USDT0 pool on Balancer offers the highest APR at 134.71%; with trading fees, total APR reaches 211.48% and TVL surpasses $4.5 million. Balancer’s USDai-aUSDT pool holds the highest TVL, over $69 million, with an average APR of 14.24%.

Ten lending pools are available on Aave, Euler, Fluid, and Gearbox. Lending USDT0 or selected tokens earns incentives, with Gearbox providing the top APY at 19% ($WXPL and $GEAR contribute 15.44% and 3.67%, respectively). Aave’s TVL leads at $3.49 billion, though its APY is lower at 8.9%.

All four borrowing pools are on Fluid. Although borrowing UST0 incurs interest, $WXPL token rewards typically exceed these rates, allowing borrowers to realize net positive returns. The USDai-USDT0/USDT0 vault delivers the highest APR at 31.1%—net APR after borrowing costs is 28.34%. The syrupUSDT/USDT0 vault boasts the top TVL at nearly $85 million but the lowest net APR at just 1.15%.

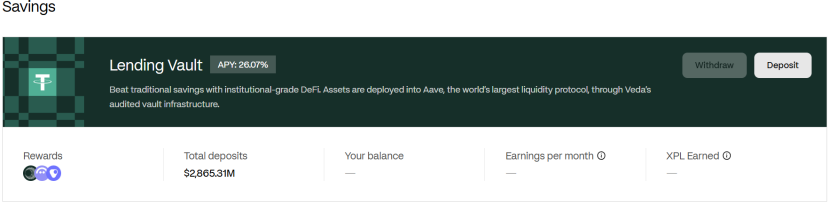

Deposit pools are limited to Veda and Term Finance. Veda, Plasma’s official partner, facilitates asset deployment to Aave. Plasma’s official savings vault APY is 26.07% with $2.86 billion in USDT0 deposits. Term Finance pools total over $38 million. Funds are allocated to yield strategies across K3 Capital, Tulipa Capital, MEV Capital, and Shorewoods. The APY is 24.66%, which includes a base APR of 1.73% for USDT0.

STBL ($SBTL): High APR with Higher Risk and Limited Pool Selection

Developed by a team including Tether’s co-founder, STBL is creating a “Stablecoin 2.0” ecosystem. The protocol features a three-token system with yield stripping: Users depositing yield-generating RWA collateral receive both USST (a USD-pegged stablecoin) and YLD (an NFT representing future yield rights). This enables users to trade or deploy USST in DeFi and earn continued returns from underlying collateral via the YLD NFT. SBTL serves as the protocol governance token.

$STBL began its airdrop on September 16 (UTC), and the market cap now exceeds $200 million.

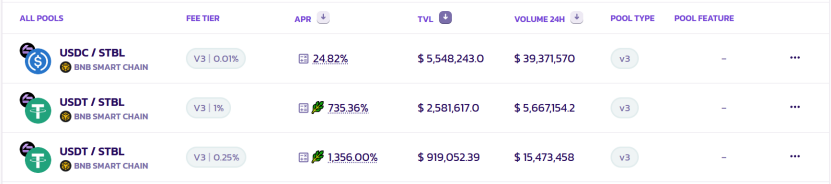

$STBL lacks CEX mining pools, likely due to its BSC deployment; only PancakeSwap hosts its pools. Three pools stand out due to their TVL and daily volume. The V3 USDC/STBL pool at a 0.01% fee tier leads in TVL and volume, exceeding $5.5 million and $39 million, respectively. The USDT/STBL pool at a 0.25% fee tier offers the highest APR—1,356%—but TVL remains below $1 million.

Note: The USST stablecoin has not launched; exercise caution when interacting with related liquidity pools on PancakeSwap.

Falcon Finance ($FF): Mining Rewards Paid in USDf Stablecoin

Falcon Finance is a DeFi platform specializing in transforming collateral assets into synthetic USD liquidity. Its flagship product, USDf, uses an over-collateralization model to maintain a USD peg. Unlike traditional stablecoins, USDf’s collateral includes stablecoins (USDC, USDT) and volatile assets (BTC, ETH). The protocol employs dynamic collateral ratios and delta-neutral strategies to hedge volatility and stabilize USDf.

Falcon Finance’s FF token is not yet issued, but its recent community sale reached $112 million—2,821% of its initial target—surpassing Buidlpad’s fundraising record. The upcoming $FF token will enhance the dual-token model by providing governance and supporting protocol growth, while $USDf delivers stability and yield.

As of now, $USDf’s market cap is $1.89 billion, growing at 111.44% monthly. Four mining pools are available on PancakeSwap and Uniswap, with rewards paid in $USDf.

On PancakeSwap V3, the USDT/USDf pool at a 0.01% fee tier offers the highest APR at 15.59%, but has the lowest TVL at $2 million. Uniswap V3’s USDT/USDf pool at 0.01% fee tier leads in TVL at nearly $37 million, but the APR is just 0.18%.

Plasma provides the widest range of mining options among the three projects. The PancakeSwap V3 USDT/STBL pool at a 0.25% fee tier yields the highest absolute APR, but the low TVL means risk may outweigh returns. Balancer’s WXPL/USDT0 pool combines strong APR and TVL, while Fluid’s USDai-USDT0/USDT0 vault lets borrowers offset interest with token rewards for positive APR.

Statement:

- This article is republished from [PANews] and copyright remains with the original author [J.A.E]. For copyright concerns, please contact the Gate Learn team for resolution.

- Disclaimer: The views and opinions expressed are those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Do not copy, distribute, or plagiarize translated articles without referencing Gate.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.