Pacifica Trading Guide: How New Users Can Capture Early Rewards with 10 Million Weekly Points

The growth of perpetual DEXs continues to accelerate. After Hyperliquid took the lead in capturing market share, a new generation of decentralized exchanges emerged. This year, Aster, backed by CZ and with equity held by Yzi Labs, launched and began a trading competition. During certain periods, its trading volume surpassed that of Hyperliquid. Another notable project is Pacifica, founded in January by three co-founders, including former FTX COO Constance Wang. The project progressed rapidly, launching its testnet two months after inception and officially starting its mainnet on June 10.

Pacifica currently has 30,000 active users, with a seven-day trading volume reaching $5.9 billion. Although Pacifica has developed quickly, its trading volume still trails the current leaders, Lighter and Hyperliquid, indicating significant potential for growth. Since October 30, the platform’s regular points distribution has increased twenty-fold, and the current total supply exceeds 135 million points. For Pacifica, which has yet to issue a token, this points program is particularly attractive to users.

This article provides a step-by-step guide to registering and trading on Pacifica. The points campaign began less than six months ago and remains in its early stage. Those interested in participating in the points program should continue reading for more information.

Pacifica Registration Guide

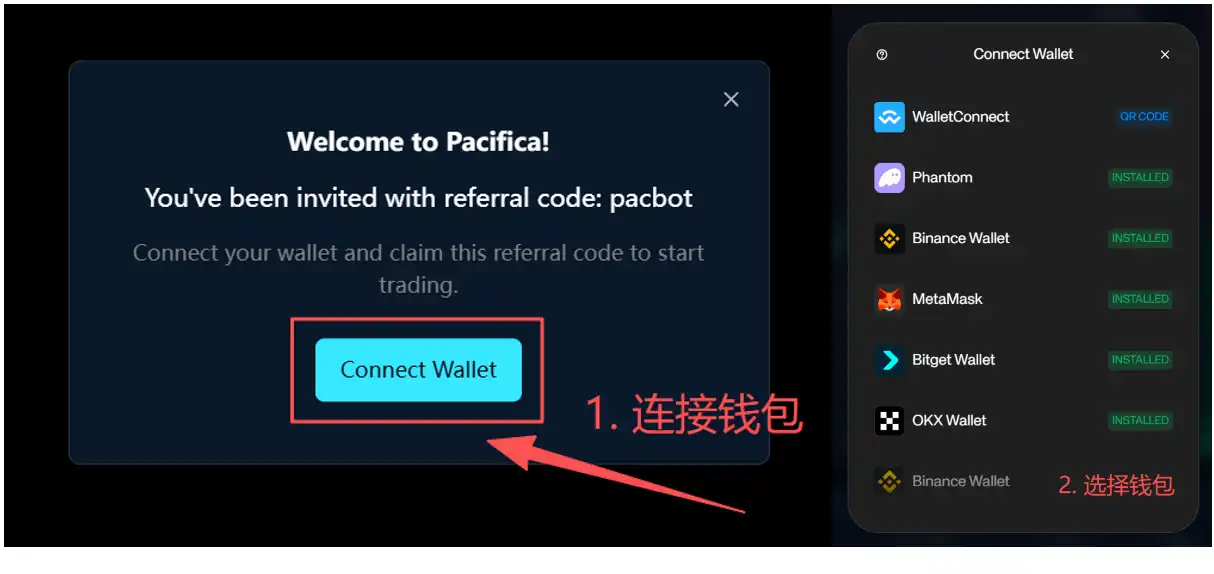

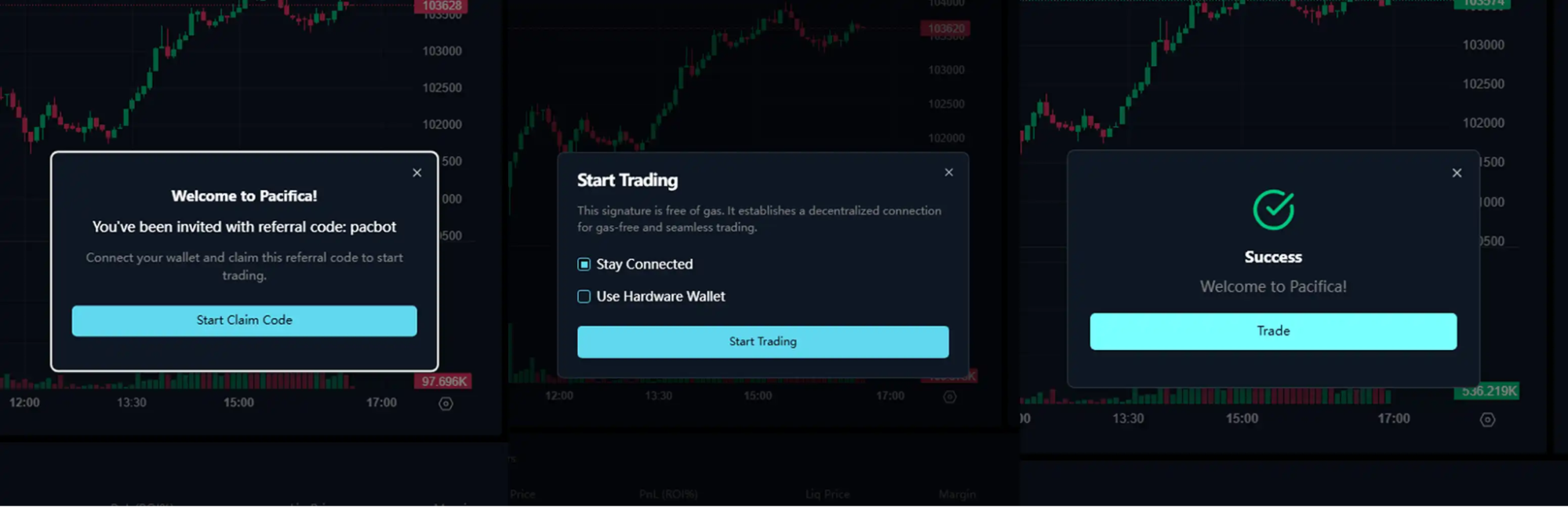

1. Visit the Pacifica official website to register and connect your wallet

Pacifica Official Website: https://app.pacifica.fi/

After linking your wallet, you will see 2–3 confirmation prompts. Follow the instructions to complete each confirmation.

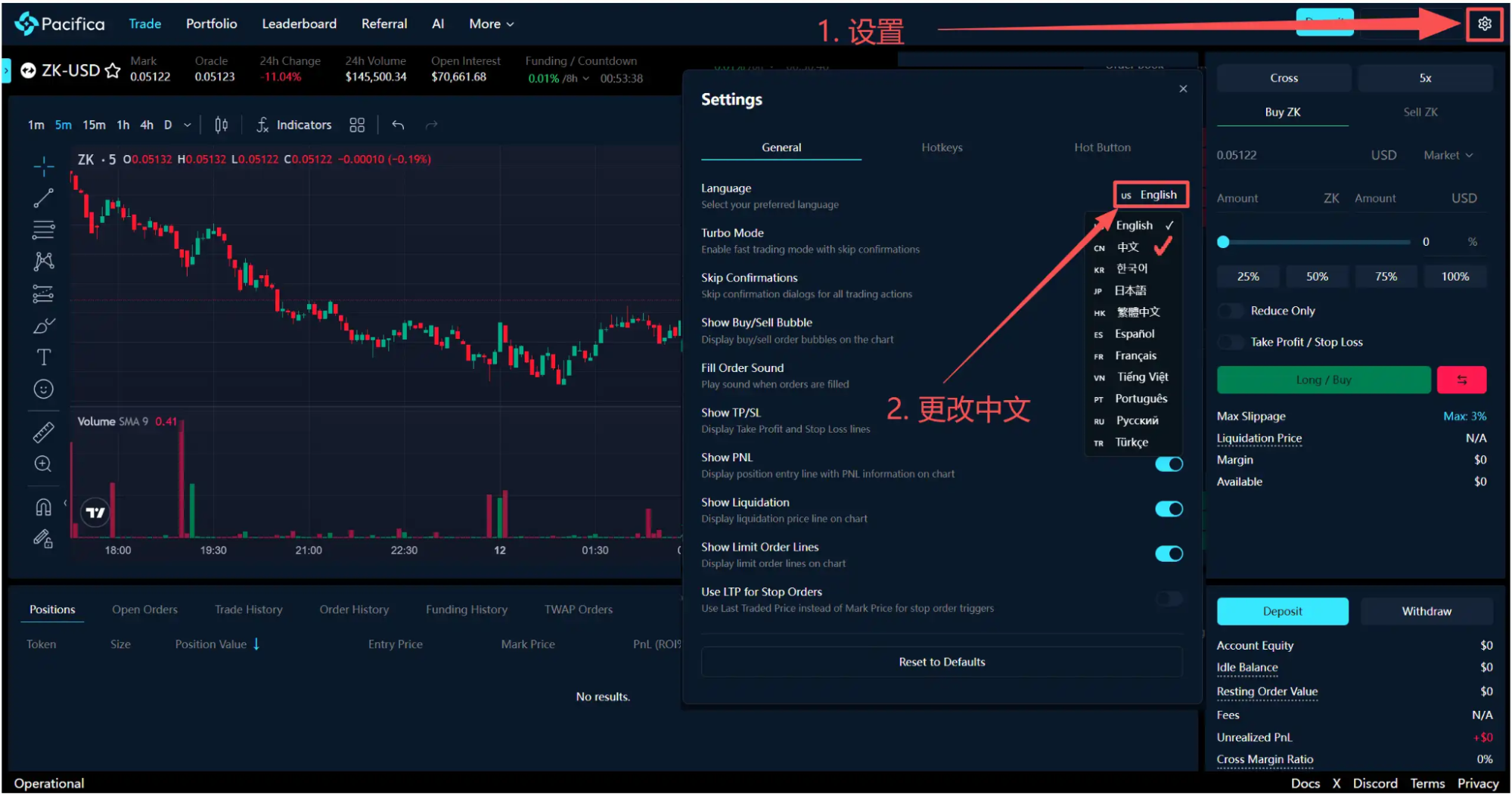

2. Set your language preference

The website supports multiple languages. If you prefer Chinese, select “中文” or “繁体中文.” If you prefer English, you may retain the default setting.

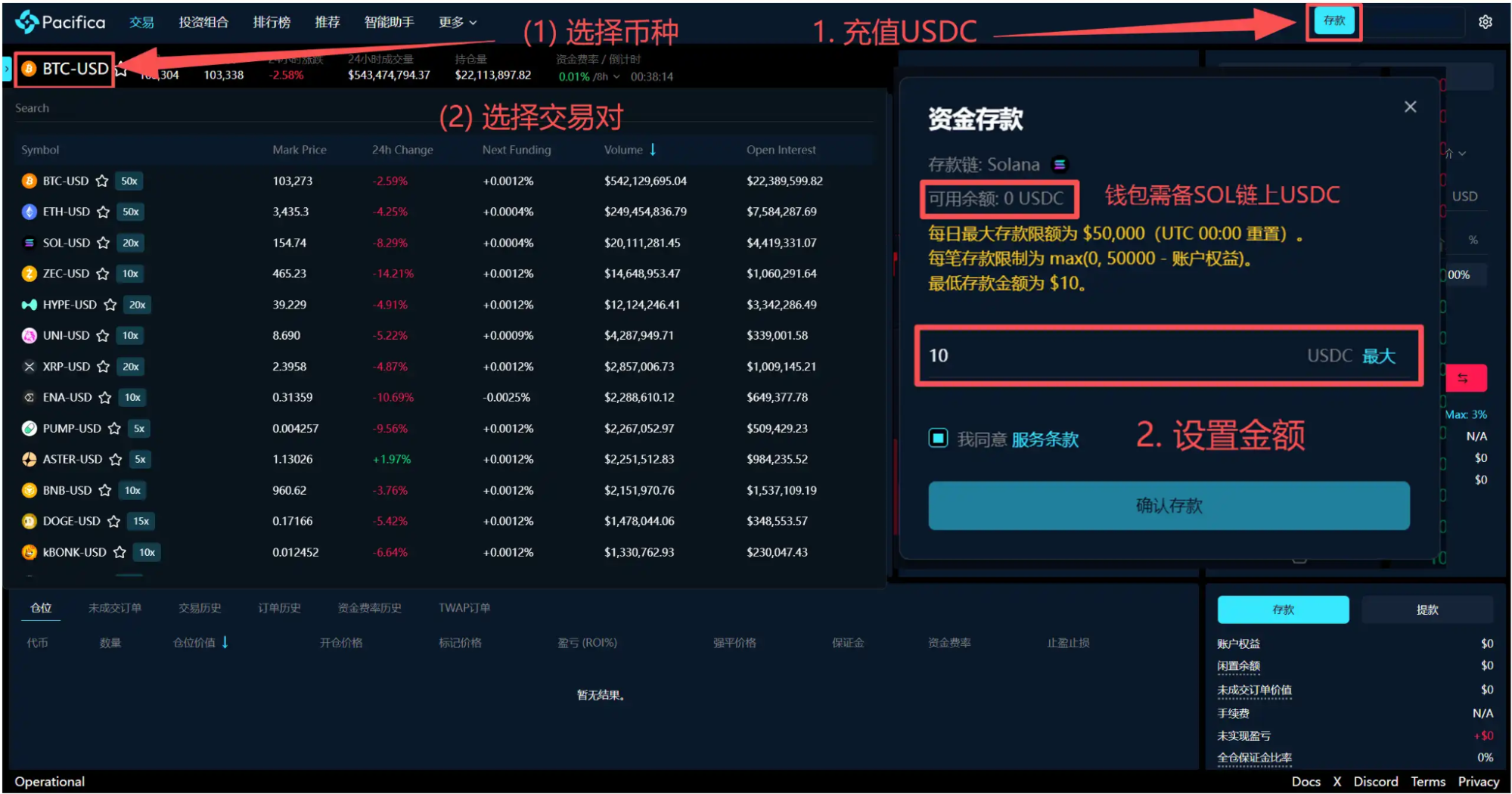

3. Deposit USDC and select your desired trading pair

Pacifica operates on Solana, so select USDC on the Solana network when depositing. Always double-check your wallet address before making an on-chain transfer.

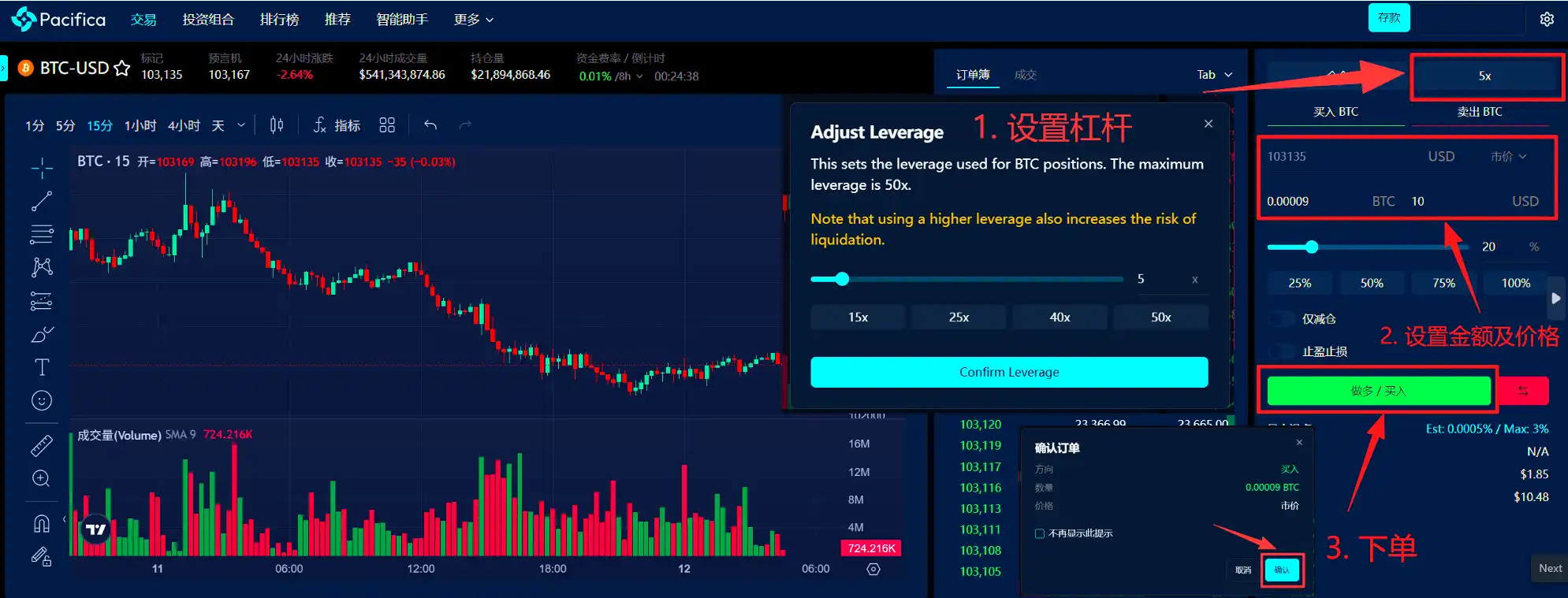

4. Make your first trade (using BTC as an example)

After depositing, select your preferred trading pair from the upper left menu. Pacifica supports most major tokens and is continually adding new ones.

For the example shown:

- Set your leverage (beginners should use low leverage and avoid excessive risk).

- Select position direction: Long/Short.

- Enter the order size and select the order type (market order).

- Enter the token amount.

- Click “Confirm” to place your order.

5. To close a position or set a limit order to close your position after trading, refer to the example below.

Pacifica Points Rules

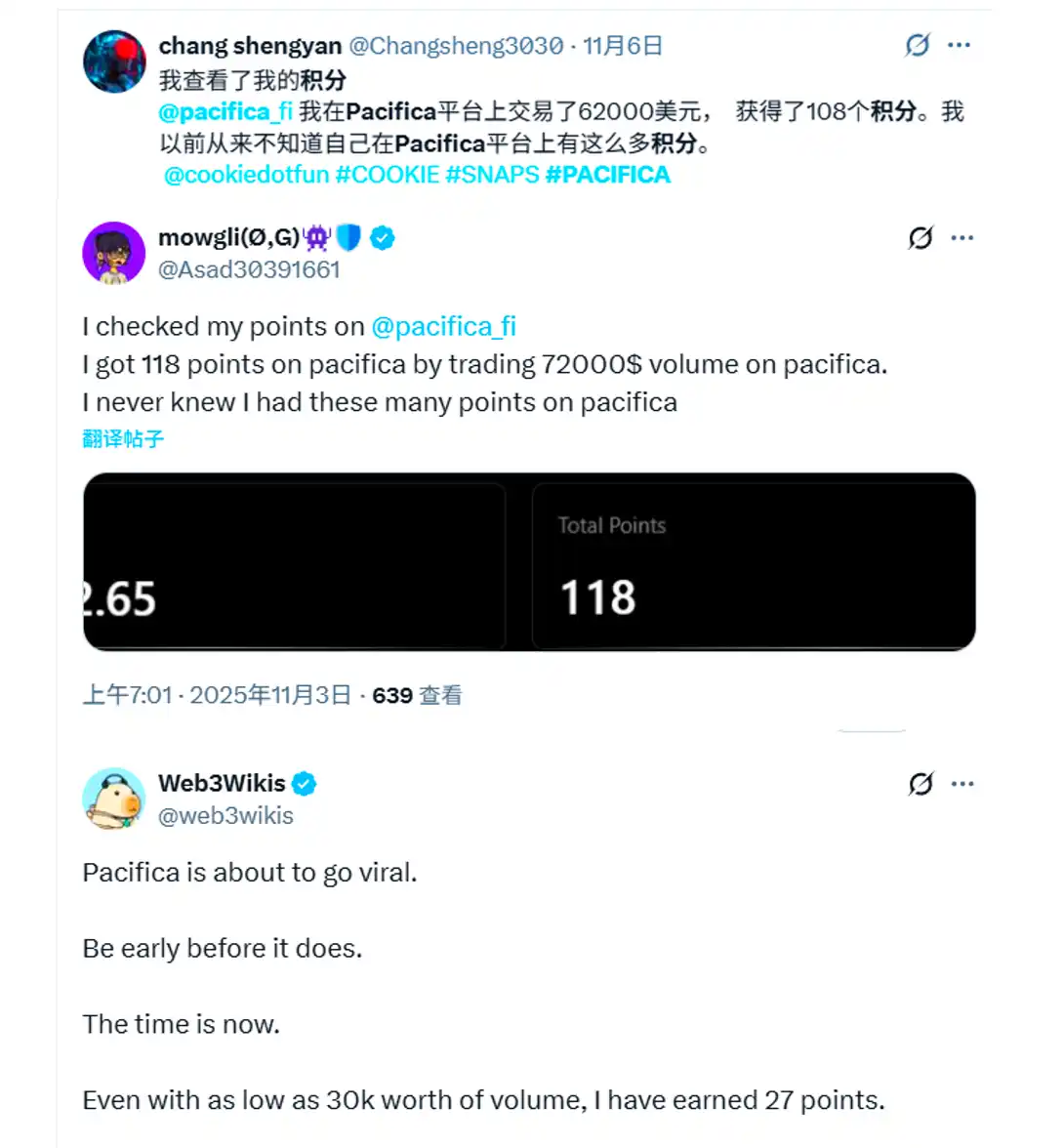

Pacifica’s points program began on September 4, 2025. Every Thursday at 00:00 UTC, the platform takes a snapshot and distributes points to eligible active users within 24 hours. The exact distribution formula has not been disclosed, but allocation is primarily based on total platform trading volume. Each week, 10,000,000 points are distributed to active traders (previously 500,000, increased twenty-fold on October 30), with allocation based on the week’s total user count and trading volume, so the number of points earned may vary.

According to data from traders since November, for every $600–$1,000 in trading volume, roughly 1 point is earned. To minimize costs, consider trading tokens with lower volatility and lower funding rates.

How Valuable Are Points?

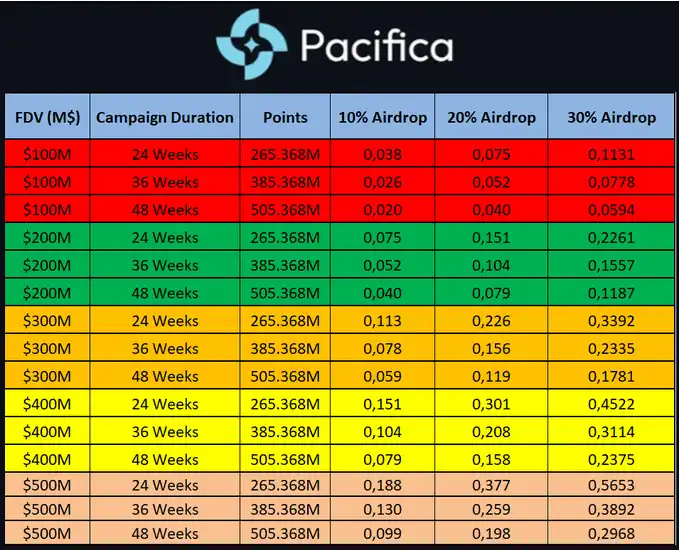

Any link between Pacifica points and token value is based on industry precedent and community speculation; no official rules have been provided. Nonetheless, historical patterns and community consensus often associate points with potential token value. Under this assumption, the community uses a widely circulated formula: Point price = (Project FDV × Token Airdrop Ratio) / Total Points Issued in the Program.

This formula depends on several key factors: an estimate of the project’s FDV, an assumption about the token airdrop’s share of total supply, and a projection for the total duration of points issuance (often assumed to be 24, 36, or 48 months). The table below presents different point price scenarios based on these variables for reference:

As a final note, this guide aims to help users earn more points. Derivatives trading carries risks and may be habit-forming; exercise caution.

Statement:

- This article is republished from [BlockBeats], with copyright held by the original author [Xinshou Ai Jilu]. If you have concerns about this republication, please contact the Gate Learn team, who will handle the matter promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed are those of the author only and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article without attribution to Gate.

Related Articles

Top 10 NFT Data Platforms Overview

7 Analysis Tools for Understanding NFTs

What Is Technical Analysis?

What is Tronscan and How Can You Use it in 2025?

Top 20 Crypto Airdrops in 2025