How Beginners Can Start Investing in Cryptocurrency: A Complete Guide

What Is Cryptocurrency

Cryptocurrency is a digital asset built on blockchain technology. Unlike traditional currencies, cryptocurrencies are decentralized, accessible worldwide, and offer transparent transactions. Bitcoin and Ethereum are among the most widely recognized cryptocurrencies. Anyone new to investing should first learn these basics.

Why Beginners Can Invest

While the cryptocurrency market is known for its volatility, getting started is relatively easy. All a beginner needs is a computer or smartphone, a cryptocurrency wallet, and registering with an exchange to begin investing. In addition, with more available educational resources and stronger security on trading platforms, newcomers can now enter the market more easily than ever.

How to Choose the Right Exchange

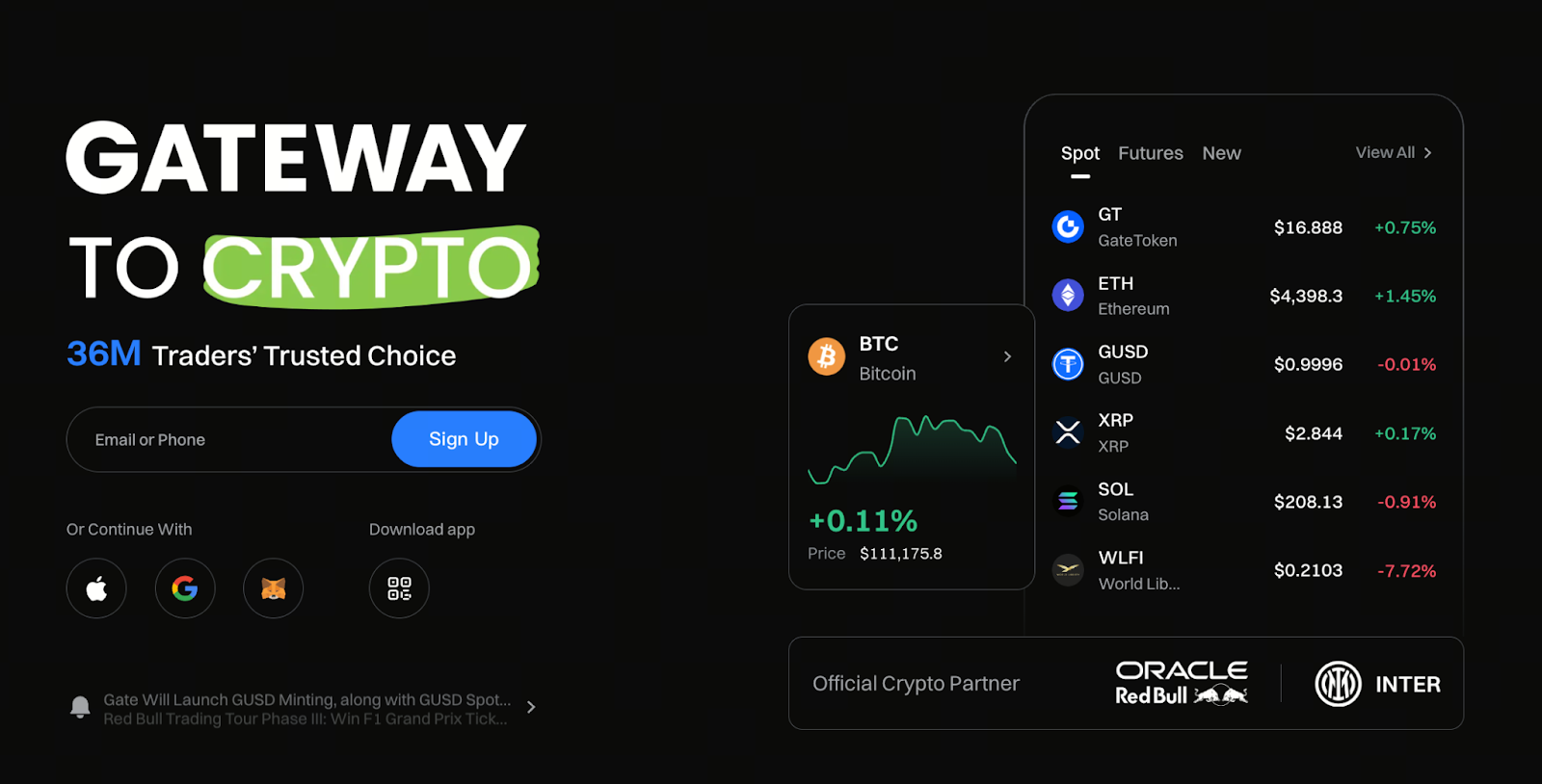

Figure: https://www.gate.com/

When selecting an exchange, consider these key factors:

- Security: Check the exchange’s security certifications, record of past security incidents, and percentage of assets held in cold wallets.

- Trading fees: Fees can vary widely; beginners should look for exchanges that offer the best value for cost.

- User experience: Platforms with a simple interface, mobile support, and multi-language customer service are ideal for newcomers.

- Liquidity: Higher liquidity makes buying and selling easier and decreases the likelihood of significant price slippage.

For beginners, major exchanges like Gate are recommended.

Essential Concepts to Know Before You Invest

- Wallet: A storage solution for cryptocurrencies, which includes both hot wallets and cold wallets.

- Private keys and mnemonic phrases: Critical for safeguarding your assets—these should never be shared.

- Market order versus limit order: These order types influence trading costs and risk exposure.

- Investment horizon: Short-term trading and long-term holding require different investment strategies; beginners should align their investment approach with their personal financial goals.

Beginner Strategies and Risk Management

- Invest small amounts across multiple transactions to reduce risk, rather than investing all your capital at once.

- Set stop-loss levels: Predetermine your stop-loss threshold to prevent impulsive decisions.

- Focus on major coins: Bitcoin and Ethereum are generally less volatile, making them better choices for beginners.

- Stay informed by regularly reading news and participating in community discussions; however, exercise independent judgment rather than blindly following the crowd.

Summary

For beginners, successful cryptocurrency investing hinges on security, ongoing education, and disciplined strategy. Understand the fundamentals, choose the right exchange, learn to use investment tools, and build sound strategies. Newcomers can enter the market step by step and work toward increasing their digital assets.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

What is N2: An AI-Driven Layer 2 Solution

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article