Gate Research: Oracle Sector Deep Dive: Ecosystem Expansion, Economic Value Capture, and the Financial Bridge

11/7/2025, 9:13:47 AM

Download the Full Report (PDF)

This report highlights that as of October 2025, the global oracle sector’s Total Value Secured (TVS) has surpassed $102.1 billion, with a total market capitalization of $14.1 billion. The market remains dominated by Chainlink, while competition is shifting from technical scalability toward economic model sustainability and cross-chain capability. The report notes that oracle growth has entered a “multiplier effect” phase, with momentum shifting from DeFi-native demand to Real World Assets (RWA), which are emerging as the core driver of institutional adoption. Meanwhile, cross-chain communication (CCIP), prediction markets, and AI-integrated oracles are expected to shape the next growth curve. On the economic front, the sector is transitioning from a “pay-per-call” model to a “service staking” paradigm, signaling a return to fundamentals-based valuation logic. The report estimates LINK’s long-term fair value range at $26–35, with potential upside to $40–45 upon the implementation of the Smart Value Recovery (SKey Takeaways

- Oracles are the critical infrastructure that connects blockchain with the real world. They securely and transparently bring off-chain data onto the blockchain, enabling smart contracts to perceive and interact with real-world conditions. As such, oracles have become the “trust engine” and “data settlement layer” of the Web3 ecosystem.

- Explosive Market Growth: Oracles have evolved from serving as price input layers for DeFi protocols to becoming the foundational trust layer of the entire Web3 ecosystem. As of October 2025, the oracle sector’s TVS has surpassed $102.1 billion, with an overall market capitalization exceeding $14.1 billion and annual data call volumes in the hundreds of billions—cementing oracles as a core pillar of the on-chain data economy.

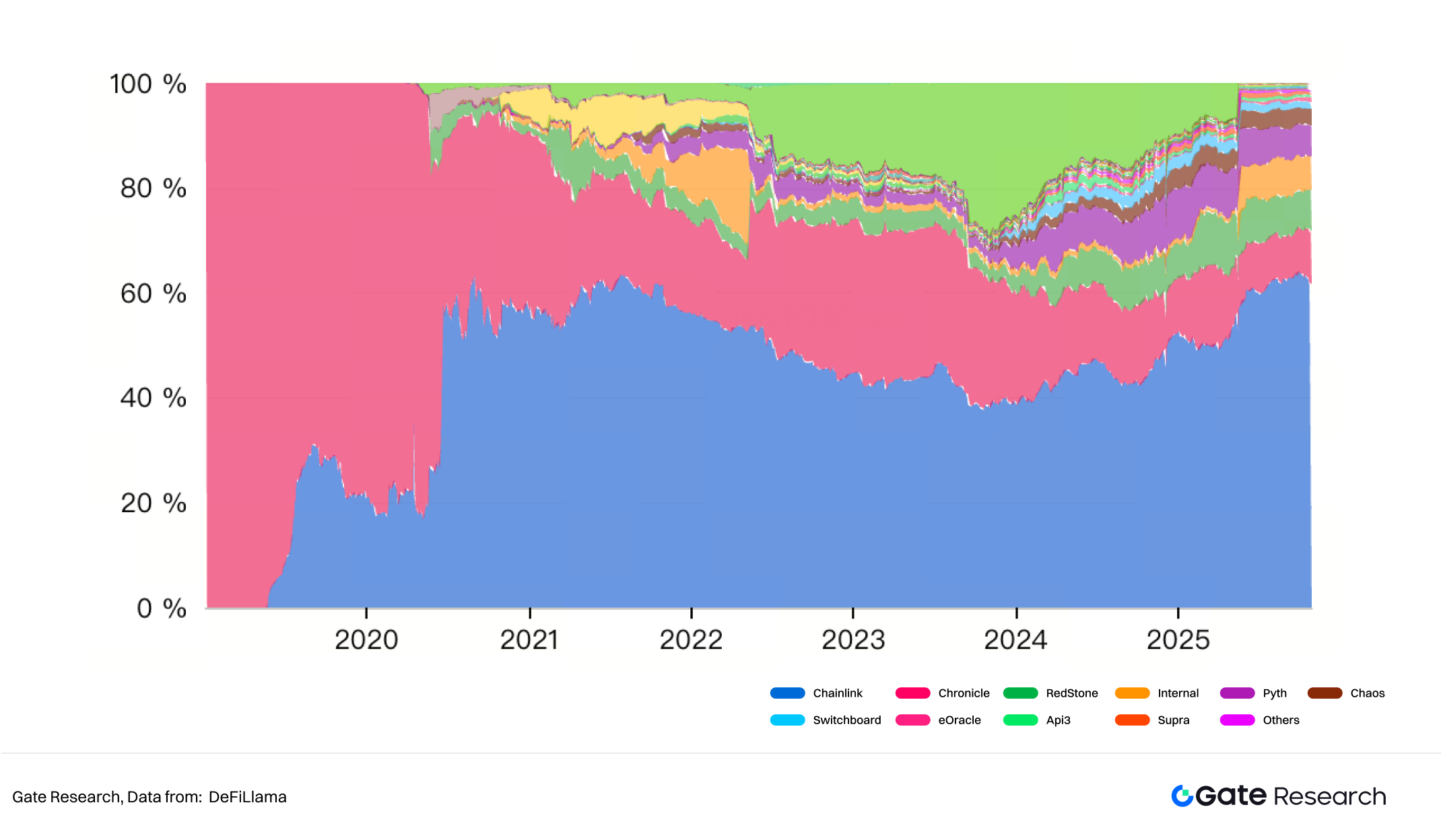

- Oligopolistic Structure and Shifting Competitive Focus: The market has consolidated into an oligopoly dominated by Chainlink, which accounts for over 87% of market capitalization and 61.58% of TVS. Competition is shifting from pure data-feed efficiency toward service quality, sustainable economic models, and cross-chain communication capabilities. Meanwhile, emerging networks such as Pyth Network and RedStone are rapidly gaining ground in low-latency and high-frequency data delivery scenarios, carving out differentiated market advantages.

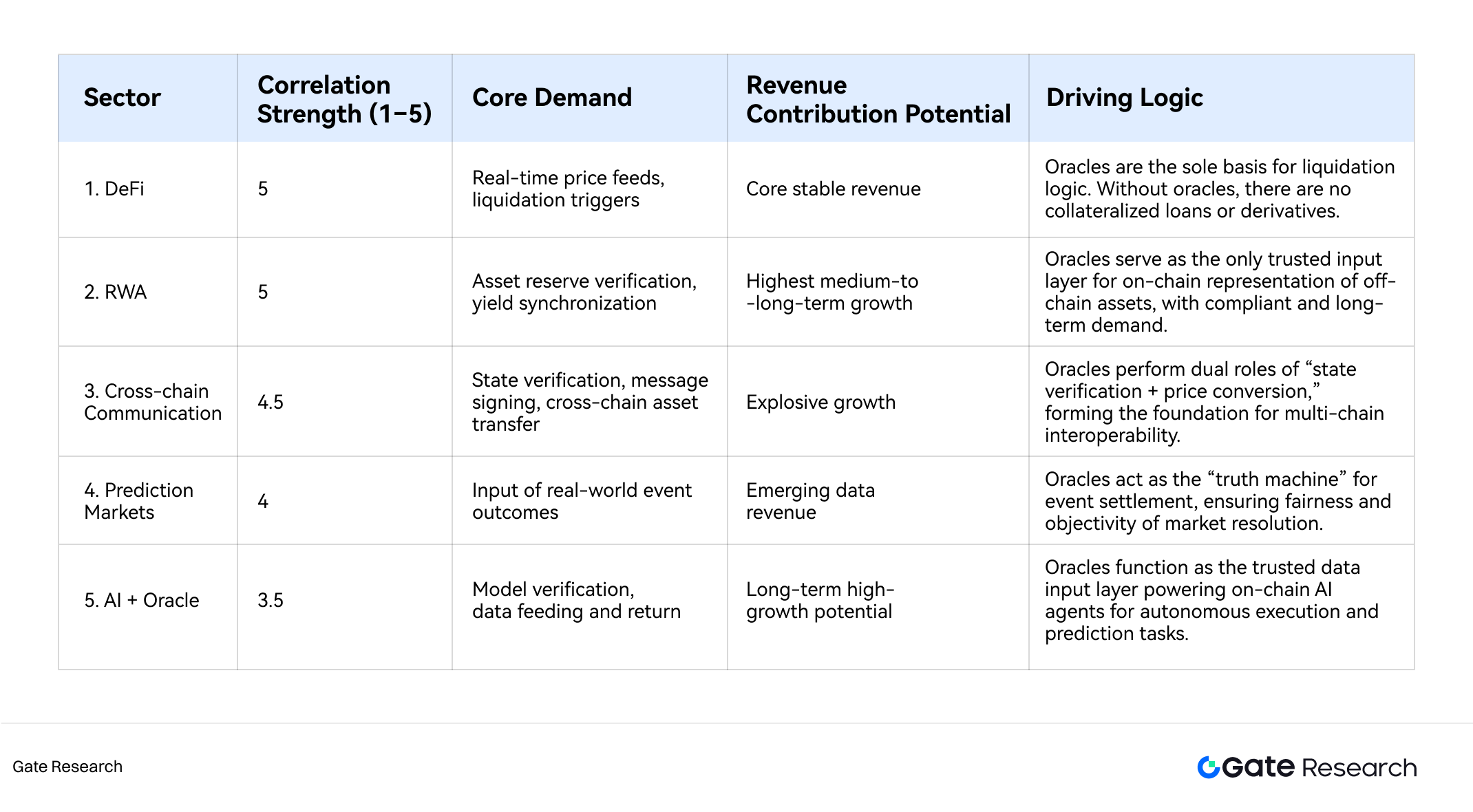

- DeFi, RWA, and Institutional Adoption as Core Growth Drivers: Oracle growth has entered a “multiplier effect” phase. DeFi ( TVL ≈ $168.3 B) remains the native battlefield; RWA (real-world assets exceeding $35 billion) is becoming the strongest engine for institutional expansion; and cross-chain communication (CCIP), prediction markets, and AI + Oracle integrations are forming the second wave of growth momentum.

- Value Capture Model Transformation — From Call Volume to Service-Staking Economics: The industry is transitioning from a call-volume-driven revenue model to an economic loop centered on node staking, security budgets, and service fees. This shift enables oracle tokens to gain long-term, sustainable value support while establishing their macro-financial role as the decentralized trust layer.

- Valuation Anchors for the Future: The long-term valuation of oracle tokens (e.g., LINK) is increasingly anchored to protocol revenue, TVS growth quality, and staking participation. The valuation logic has shifted from narrative-driven speculation toward fundamental metrics such as MCap/TVS. Current estimates suggest LINK’s fair long-term value lies between $26–35, while the introduction of the SVR mechanism could amplify overall valuation by 1.2–1.5x, implying a potential price range of $40–45.

- Macro-Financial Integration and the Birth of the “Information Interest Rate”: Oracles are becoming the critical nexus between TradFi and on-chain finance. By synchronizing real-time macroeconomic data—such as bond yields, FX rates, and interest curves—and partnering with institutions like SWIFT and Visa via CCIP settlement, oracles are accelerating the digitalization of real-world finance. This evolution also gives rise to a novel concept of yield derived from trusted data flows—the Information Interest Rate.

Gate Research is a comprehensive blockchain and crypto research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

Author: Ember

Reviewer(s): Shirley, Akane

* The information is not intended to be and does not constitute financial advice or any other recommendation of any sort offered or endorsed by Gate.

* This article may not be reproduced, transmitted or copied without referencing Gate. Contravention is an infringement of Copyright Act and may be subject to legal action.

Related Articles

Beginner

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

This article explores the development trends, applications, and prospects of cross-chain bridges.

12/27/2023, 7:44:05 AM

Advanced

Solana Need L2s And Appchains?

Solana faces both opportunities and challenges in its development. Recently, severe network congestion has led to a high transaction failure rate and increased fees. Consequently, some have suggested using Layer 2 and appchain technologies to address this issue. This article explores the feasibility of this strategy.

6/24/2024, 1:39:17 AM

Intermediate

Sui: How are users leveraging its speed, security, & scalability?

Sui is a PoS L1 blockchain with a novel architecture whose object-centric model enables parallelization of transactions through verifier level scaling. In this research paper the unique features of the Sui blockchain will be introduced, the economic prospects of SUI tokens will be presented, and it will be explained how investors can learn about which dApps are driving the use of the chain through the Sui application campaign.

8/13/2025, 7:33:39 AM

Advanced

Navigating the Zero Knowledge Landscape

This article introduces the technical principles, framework, and applications of Zero-Knowledge (ZK) technology, covering aspects from privacy, identity (ID), decentralized exchanges (DEX), to oracles.

1/4/2024, 4:01:13 PM

Beginner

What is Tronscan and How Can You Use it in 2025?

Tronscan is a blockchain explorer that goes beyond the basics, offering wallet management, token tracking, smart contract insights, and governance participation. By 2025, it has evolved with enhanced security features, expanded analytics, cross-chain integration, and improved mobile experience. The platform now includes advanced biometric authentication, real-time transaction monitoring, and a comprehensive DeFi dashboard. Developers benefit from AI-powered smart contract analysis and improved testing environments, while users enjoy a unified multi-chain portfolio view and gesture-based navigation on mobile devices.

5/22/2025, 3:13:17 AM

Intermediate

What Is Ethereum 2.0? Understanding The Merge

A change in one of the top cryptocurrencies that might impact the whole ecosystem

1/18/2023, 2:25:24 PM