Gate Research: $441 Million in Liquidations Across the Market in the Past 24 Hours | Polymarket On-Chain Activity Surges

Summary

- Bitcoin has weakened after a brief rebound from last week’s liquidation-driven sell-off, falling 9.13% over the past week on increasing volume.

- Stablecoin inflows reached $74 billion, providing liquidity support amid the market downturn.

- JustLend DAO’s total value locked (TVL) surpassed $7.82 billion.

- Polymarket’s on-chain activity surged 192% in the past 30 days, with 56,000 daily active wallets.

- Aave’s RLUSD stablecoin supply reached a new all-time high of 448 million tokens.

- Over the past 24 hours, total market liquidations amounted to $441 million, including $290 million in long positions and $151 million in short positions.

Market Overview

Market Commentary

- BTC – After last week’s sharp liquidation, Bitcoin initially rebounded but has since continued to weaken, dropping 9.13% over the past week on rising volume. Technically, BTC shows a bearish bias, having fallen below the 5-day, 10-day, and 30-day moving averages, with the MACD forming a death cross. In the short term, market sentiment remains cautious as traders await new macro catalysts or inflows to confirm direction. Failure to reclaim the $111,000 level could lead to an extended consolidation phase, with the next support near $109,000. Overall, the market shows growing divergence between bulls and bears, though trading activity remains solid. Should any major bullish news emerge, a rapid trend reversal is possible. Some analysts note that if BTC can hold above $111,000, it would demonstrate resilience amid rising geopolitical and macroeconomic uncertainty. Meanwhile, increasing expectations for U.S. Fed rate cuts later this year could act as a key driver for a potential BTC rebound.

- ETH – Ethereum has dropped 8.52% over the past week, breaking below its 30-day moving average and consolidating near the 5-day and 10-day averages. The MACD, which briefly showed a bullish crossover, has turned bearish again, indicating weakening upward momentum. The price has fallen below the critical $4,000 level, ending its previous recovery trend, and is now approaching the next support near $3,750. The RSI stands at 43.5, slightly below the neutral 50 mark, suggesting ETH is not yet oversold. Still, with the price remaining below the $4,200–$4,300 resistance zone, the recent rebound appears more like an early structural correction than a confirmed bullish continuation.

- Altcoins – Major altcoins have broadly declined this week, with the Altcoin Season Index at 29, reflecting bearish sentiment and rising risk aversion across the market.

- Stablecoins – The total stablecoin market capitalization now stands at $306.3 billion. Following one of the sharpest crypto sell-offs in recent months, issuers such as Tether and Circle continue minting new stablecoins to inject liquidity and stabilize markets.

- Gas Fees –Ethereum network gas fees have sharply declined from an average of 15.9 Gwei on October 10 to 0.17 Gwei as of October 16, reflecting reduced on-chain activity following recent volatility.

Trending Tokens

This week, major altcoins generally experienced a broad-based decline, reflecting a bearish overall market sentiment and rising risk aversion among investors. According to CoinGecko data, the AI Framework and AI Applications sectors performed notably well, both recording over 48% gains in the past seven days. Below is an overview of representative tokens within these sectors and an analysis of the factors driving their recent growth.

DEGO – Dego Finance( +18.97% | Market Cap: $25.38M)

According to Gate market data, DEGO is currently trading at $1.20, up 18.97% over the past 24 hours. Dego Finance is a cross-chain NFT + DeFi protocol and infrastructure project that serves as an open NFT ecosystem, allowing anyone to create, mine, auction, and trade NFTs. The protocol also provides cross-chain infrastructure to help blockchain projects expand their user base, distribute tokens, and build NFT-powered applications.

According to Dego’s official X account, the project is incubating BOT3 AI, an initiative aimed at advancing AI-driven Web3 social experiences. Additionally, Dego has partnered with BOT3 AI and DeFusion AI to launch multiple campaigns and giveaways to strengthen its Web3 community presence. Since October 11, DEGO has surged 78%, breaking through key resistance levels with strong momentum and rising volume—indicating clear buyer dominance. If upward momentum continues, DEGO may test the $1.60–$1.70 range, though traders should watch for potential short-term pullbacks near $1.45 due to profit-taking.

YGG – Yield Guild Games (+12.72% | Market Cap: $102M)

According to Gate data, YGG is currently priced at $0.16, with a 12.72% gain in the past 24 hours. Yield Guild Games is a decentralized autonomous organization (DAO) that leverages blockchain technology to provide global players with access to Play-to-Earn (P2E) games. YGG not only invests in game-related NFTs but also enables players to participate in virtual world economies, earning income through gameplay.

The recent surge in YGG’s momentum stems from a major centralized exchange (CEX) announcement that it will list YGG on October 15, triggering renewed market interest and higher trading activity in the blockchain gaming sector. CEX support is expected to enhance liquidity and attract mainstream investors and gamers, potentially fueling further growth in the broader P2E ecosystem.

BLESS – Bless (+503.87% | Market Cap: $354M)

According to Gate data, BLESS is trading at $0.19, soaring 503.87% in the last 24 hours. Bless is a decentralized edge computing network providing on-demand CPU and GPU power for AI, machine learning, and advanced data tools near end users.

BLESS’s rally was driven by three major catalysts:

- Technical breakout: The token formed a double-bottom pattern at $0.0234, observed on October 1 and 10—one of the most bullish formations in technical analysis.

- CEX Alpha Competition: A trading event with $2 million in rewards attracted significant participation and liquidity.

Roadmap update: Developers recently unveiled new milestones, including GPU-ready node deployment and fiat on-ramp integration, signaling strong ecosystem expansion potential.

These combined technical and fundamental catalysts have driven BLESS’s impressive performance, making it a standout project within the AI and blockchain gaming narratives.

Focus of the Week

Stablecoin Inflows of $74 Billion Sustain Crypto Liquidity Amid Market Turmoil

Matrixport noted that during the recent sharp correction in the crypto market, stablecoins played a crucial role as “liquidity buffers,” helping to maintain overall market stability. Despite the steep declines in major assets such as Bitcoin and Ethereum, stablecoins — particularly USDT and USDC — have attracted massive capital inflows. Reports indicate that Tether issued approximately $42 billion in new USDT, while Circle added around $32 billion in new USDC, together contributing roughly $74 billion in net new stablecoin supply. This influx of liquidity has injected fresh momentum into the crypto ecosystem and strengthened the market’s ability to absorb shocks during periods of volatility.

These inflows reflect investors’ growing preference for safe-haven digital assets amid heightened uncertainty. Stablecoins have evolved into a foundational asset class within the crypto market, now boasting a combined market capitalization exceeding $300 billion. U.S. Treasury Secretary Bessent recently projected that the stablecoin market could eventually reach a $1 trillion scale, underscoring its expanding role in portfolio stability, capital access, and liquidity flows. This trend highlights the accelerating maturity and institutionalization of the digital asset space.

JustLend DAO TVL Surpasses $7.82 Billion

The TRON-based lending protocol JustLend DAO announced that its total value locked (TVL) has exceeded $7.82 billion, with more than 477,000 users and cumulative grant distributions surpassing $129 million.

As TRON’s leading decentralized lending platform, JustLend DAO has become a core DeFi infrastructure within the ecosystem, driving rapid growth in stablecoin lending and liquidity mining activities. The sustained rise in TVL reflects increasing user confidence and asset security, signaling steady expansion across the TRON DeFi landscape. Going forward, JustLend DAO plans to optimize on-chain governance and risk management mechanisms to further enhance borrowing efficiency and yield performance for global users — reinforcing TRON’s position as a major player in the global decentralized finance arena.

Stablecoin Infrastructure Firm OwlTing to List on Nasdaq

Taiwan-based stablecoin infrastructure company OwlTing is set to list on the Nasdaq Global Market this Thursday, marking its debut as one of the first Asia-based blockchain companies to list directly on a major U.S. exchange. The company’s Class A common stock (ticker: OWLS) is expected to begin trading on October 16.

OwlTing’s flagship product, OwlPay, is a payment infrastructure platform supporting both stablecoin and fiat transactions, designed to offer seamless cross-border payment solutions for global enterprises. In 2024, the company reported $7.6 million in revenue (up ~18% year-over-year) and processed $218 million in total payments (up ~62%). Although net profit turned negative due to listing-related costs, OwlTing expects profitability to improve with business scaling and operational efficiency.

By listing on Nasdaq and adhering to stringent governance standards, OwlTing aims to enhance its global credibility and attract long-term institutional capital. The move also sets a precedent for other Asian Web3 and blockchain firms seeking to access North American capital markets. Furthermore, OwlTing’s public debut brings stablecoin infrastructure projects into the mainstream investment spotlight, potentially accelerating institutional capital flows into blockchain payments and stablecoin innovation.

Key Market Data Highlights

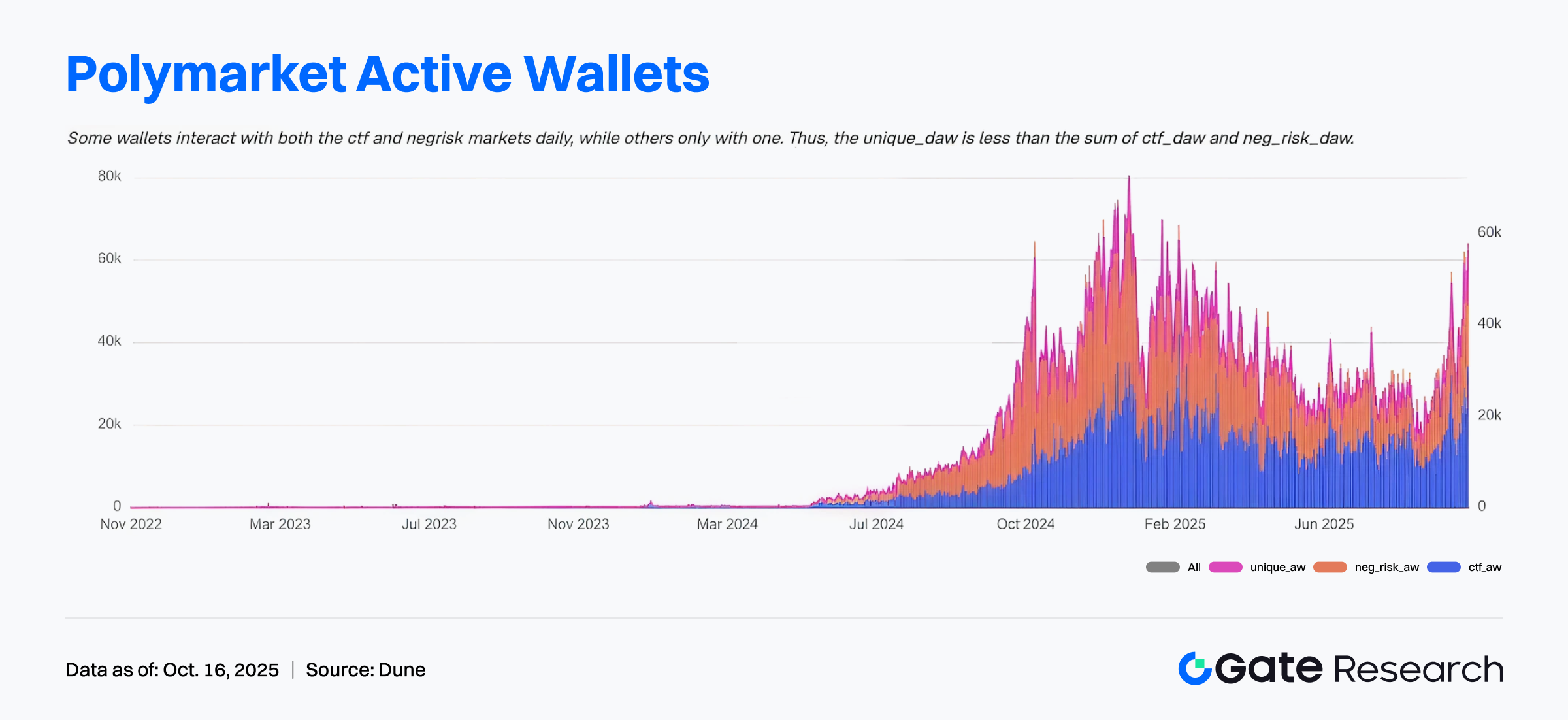

Polymarket’s On-Chain Activity Surges 192%, Daily Active Wallets Reach 56,000

The decentralized prediction market Polymarket has seen a remarkable surge in on-chain activity in recent weeks. Data shows that its daily active wallets have surpassed 56,000, marking a 192% increase over the past 30 days, while total trading volume has reached $15.4 billion. As one of the most well-funded crypto projects in recent years, Polymarket is experiencing rapid growth in both ecosystem activity and market attention. The community widely anticipates that a potential airdrop campaign could become one of the next major events in the crypto space.

Polymarket’s explosive growth reflects the mainstream adoption of on-chain prediction markets, combining news, political forecasts, and speculative trading to drive user engagement and media buzz. Against the backdrop of the growing trend toward “financialization of social narratives,” Polymarket has emerged as a leading platform for on-chain trading of real-world events (RWA of sentiment). A future airdrop would likely expand its user base and further establish prediction markets as a new focal point for both capital and narrative-driven trading in the crypto ecosystem.

Stablecoin RLUSD on Aave Reaches Record Supply of 448 Million Tokens

The total supply of RLUSD, Aave’s native yield-bearing stablecoin, has surged to a record high of 448 million tokens. This growth underscores the rising market demand for yield-generating stablecoins within the Aave ecosystem and signals that liquidity is increasingly flowing back into leading DeFi protocols.

The record supply of RLUSD suggests that DeFi liquidity is consolidating around established platforms like Aave. As Aave continues to build a self-sustaining stablecoin yield ecosystem, RLUSD is positioned to become a key driver of both protocol revenue and liquidity growth. This trend also indicates that capital is rotating away from speculative assets toward stablecoins with tangible utility and sustainable yield mechanisms.

$441 Million in Crypto Liquidations in 24 Hours: $290M Longs, $151M Shorts

According to data from Coinglass, a total of $441 million in crypto positions were liquidated over the past 24 hours amid heightened market volatility, triggering large-scale liquidations on both long and short sides. Of that, $290 million came from long positions and $151 million from shorts, suggesting that bullish traders were hit hardest during the recent market correction. Bitcoin and Ethereum accounted for the majority of the liquidations, with BTC long positions liquidated for around $60 million and ETH longs for approximately $78 million.

The intensified volatility highlights ongoing market fragility, with leveraged positions increasingly vulnerable to liquidation. As major cryptocurrencies continue to consolidate near key support levels, long-side leverage remains under pressure. In the short term, the market may enter a high-volatility, low-leverage defensive phase, though if liquidity stabilizes and trading volume recovers, this wave of liquidations could reset positioning and pave the way for a healthier foundation for the next market rebound.

Funding Weekly Recap

According to RootData, between October 10 and October 16, 2025, a total of 12 crypto and related projects announced completed funding rounds or acquisitions, covering multiple sectors including payment networks, stablecoins, AI, and infrastructure. Below are brief highlights of the top three projects by funding size this week:

Better Payment Network

On October 16, Better Payment Network announced a $50 million funding round aimed at accelerating the development of multi-stablecoin payment infrastructure.

Better Payment Network is a programmable payment network that enables fiat-supported stablecoin minting, swapping, and settlement through a unified layer, bridging centralized and decentralized finance. The network uses a dual-track CeDeFi system, supporting real-time stablecoin minting, swapping, and burning, with the goal of shortening cross-border settlement times and reducing costs.

Inference

On October 15, Inference closed an $11.8 million seed round, led by Multicoin Capital and a16z CSX.

Inference is a decentralized distributed GPU inference network built on Solana, designed to provide high-performance computing for large language models (LLMs). Its core platform, Inference.net, connects global data centers and offers fast, scalable, token-based API services for models including DeepSeek V3 and Llama 3.3, creating an efficient on-chain AI inference infrastructure.

Crown

On October 14, Crown announced an $8.1 million seed round, led by Framework Ventures.

Crown is a stablecoin issuer aiming to provide institutional investors with access to Brazil’s high-yield fixed-income market by issuing BRLV, a stablecoin backed by Brazilian government bonds. This stablecoin is designed to lower entry barriers for foreign investors, overcoming bureaucratic hurdles, complex taxation, and currency exchange challenges.

Next Week to Watch

Token Unlocks

According to Tokenomist, the next seven days (October 17–23, 2025) will see significant token unlocks in the market. The top three are:

- ZRO: $47.3 million worth of tokens to be unlocked, representing 23.1% of circulating supply.

- FTN: $40.4 million worth of tokens to be unlocked, representing 4.6% of circulating supply.

- ARB: $30.35 million worth of tokens to be unlocked, representing 1.7% of circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Gate, https://www.gate.com/crypto-market-data

- Coingecoko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Yahoo Finance, https://finance.yahoo.com/news/stablecoin-startups-raise-record-amounts-073231510.html

- X, https://x.com/DeFi_JUST/status/1978353898953007110

- Crypto.news, https://crypto.news/matrixport-stablecoins-hold-up-crypto-liquidity-amidst-market-crash/

- DeFiLlama, https://defillama.com/stablecoins

- TradingView, https://www.tradingview.com/news/coindar:b5d9dad4a094b:0-yield-guild-games-to-be-listed-on-upbit/

- X, https://x.com/dego_finance

- Dune, https://dune.com/filarm/polymarket-activity

- X, https://x.com/SentoraHQ/status/1978380845590126903

- Coinglass, https://www.coinglass.com/zh/LiquidationData

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?

12 Best Sites to Hunt Crypto Airdrops in 2025