Gate BTC Staking With 9.99% APY: Let Your Bitcoin Grow Again After the “1011 Crash”

A Night of Turmoil: Bitcoin Plunges 12%, 1.6 Million Traders Liquidated

Image: https://www.gate.com/trade/BTC_USDT

During the early hours of October 11, 2025 (UTC), the crypto market witnessed a significant event. In just 30 minutes, Bitcoin plunged from $117,000 to $102,000—a drop of over 12%. Within 24 hours, liquidation volumes reached $19.1 billion, with more than 1.6 million traders liquidated.

On “1011,” derivatives markets saw widespread declines. Leading altcoins fell sharply: SUI flash-crashed from $3.50 to $0.55, WLD dropped 80%, and even Dogecoin was cut in half. Global capital markets also declined—US stocks, the Hang Seng Index, and A50 all fell.

The Harsh Reality: Not Everyone Walks Away Unscathed

There are no absolute winners in crypto. Even during upward market trends, traders motivated by excessive sentiment and leverage may be forced out of the market. For most rational investors, cycles of surges and crashes are psychological tests.

The “1011” crash reminds us—risk is always present, and rewards always reflect your risk tolerance. To avoid repeated losses due to market swings, reconsider asset allocation: allocate some BTC strategically rather than remaining inactive during periods of volatility.

From Speculation to Stability: BTC Staking as a Safe Haven

Historically, BTC was viewed as an asset held long term but generating no yield. Now, with staking, users can earn steady returns while securely holding BTC.

Compared to short-term speculation, BTC staking offers a more measured approach. When the market is in turmoil and investors panic, those who receive steady yields represent a calm minority.

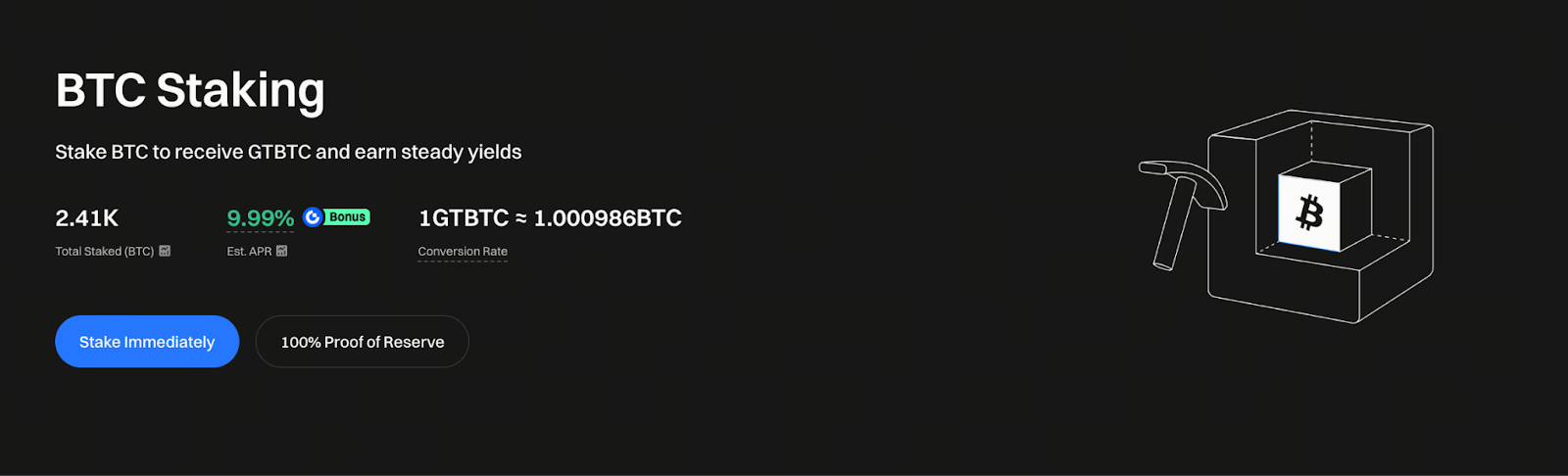

Gate BTC Staking: Secure 9.99% APY for Stable Returns

Image: https://www.gate.com/staking/BTC

In today’s market, Gate offers BTC staking with a current annual yield of 9.99%, providing users with a secure and profitable solution.

Gate is an established crypto exchange. Its robust risk controls and on-chain yield models ensure staking is safe, transparent, and straightforward. Stake BTC on Gate to earn rewards automatically. Flexible redemption and daily compounding are supported.

Key benefits include:

- High APY: Current annual yield is 9.99%

- Asset Security: Protected by Gate’s custody and audit mechanisms

- Flexible Redemption: Unstake any time, maintaining liquidity

- Automatic Compounding: Earnings are reinvested automatically—no manual management required

After major volatility, stable returns become especially valuable.

BTC Yield Generation: Steady Gains After the Storm

The “1011” crash resulted in significant liquidations and market reevaluation. As speculation fades, funds increasingly move toward stable strategies. Gate BTC staking enables BTC to transform from assets stored in cold wallets into yield-generating assets that grow and compound on-chain.

With a 9.99% APY, holders can achieve both stability and growth—even in turbulent markets.

Conclusion

No matter how strong the bull market, not everyone walks away with gains. By respecting the market, managing risk, and keeping assets actively engaged, investors can build momentum for the next cycle.

Access Gate, begin BTC staking, and allow your Bitcoin to earn passively.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution