Funds Shorting MicroStrategy Are Targeting Ethereum Treasury Companies

At 1:47 PM UTC on October 8—8:47 AM in New York—Kerrisdale Capital, a renowned short-selling firm, announced publicly on the social platform X (formerly Twitter) that it had shorted shares of BitMine (BMNR), an Ethereum treasury stock. Kerrisdale clarified in its post that its bearish stance is not on Ethereum itself, but on the treasury company model, which it believes can no longer justify BitMine’s stock price premium over net asset value. The firm’s trade wagers on BMNR reverting to parity or even trading at a discount.

This isn’t Kerrisdale Capital’s first attack on crypto-themed equities. In mid-2024, the firm shorted Bitcoin miner Riot and MicroStrategy (now rebranded as Strategy). Both stocks experienced sharp declines upon the news, but this time, BMNR did not immediately decline sharply; its overnight drop was largely in line with broader market moves. Nevertheless, by the close on October 10 (UTC), BMNR had fallen over 10%, closing at USD 52.47 compared to USD 60 on October 8.

Kerrisdale’s short report outlines six critical reasons for shorting BitMine. Unlike previous short plays on Riot and Strategy, which were hedged by going long Bitcoin, Kerrisdale’s outright short on BMNR underscores its deep skepticism about BitMine’s prospects.

From “Flywheel” to “Death Spiral”

Kerrisdale’s bearish case against BitMine centers on six main points:

- Severe Ethereum-per-share dilution: BMNR issued over 240 million shares via ATM offerings in just three months, raising over USD 10 billion—an average of USD 170 million per day—drastically diluting ETH per share;

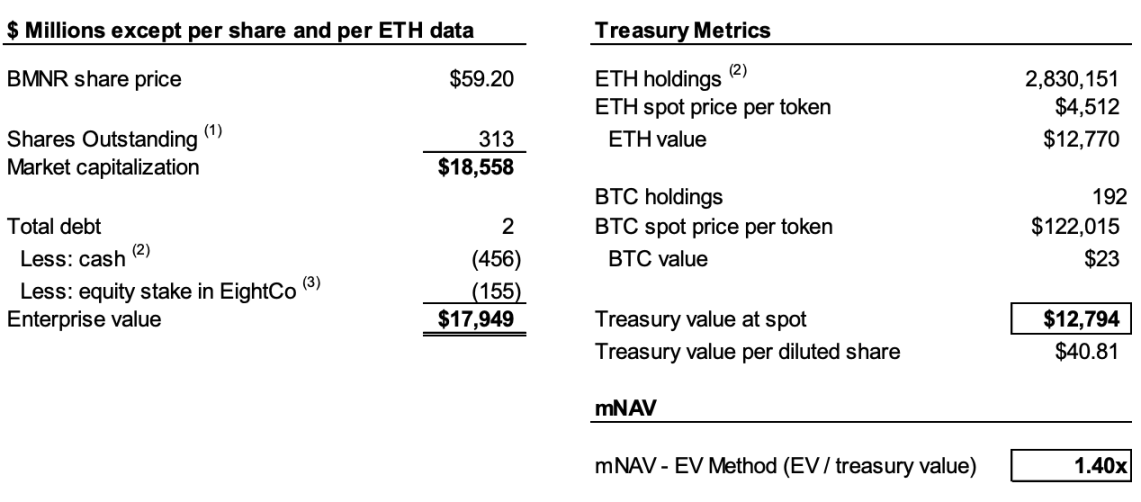

- Persistent mNAV decline: BMNR’s market cap premium to net crypto asset value (mNAV) has dropped from 2.0x in August to 1.4x, with the trend worsening;

- Financial engineering conceals cash-outs: The recent USD 365 million “premium” financing was in fact a deep discount, with attached warrants heavily diluting common equity;

- Opaque disclosures: Since August 25, the company has stopped reporting per-share NAV and total shares outstanding, leaving investors unable to assess ETH per share growth;

- Intensifying competition: 154 U.S. firms are planning to raise nearly USD 100 billion for crypto treasury strategies, and new ETFs will further erode the scarcity premium of DAT structures;

- Strategy model breakdown: The mNAV premium for Strategy (formerly MicroStrategy), the original DAT, has dropped from 2.5x to 1.4x, shaking market confidence in the model.

To grasp the short thesis, it’s critical to understand how DAT companies work. Kerrisdale’s report sums it up: issue shares at a premium to token book value → raise cash → buy more tokens → increase tokens per share → maintain premium → issue more shares, creating a self-reinforcing cycle.

For instance, if Company A holds USD 1 billion in Bitcoin and has 100 million shares outstanding, it can issue new shares above USD 10, because investors expect the company will use proceeds to buy more Bitcoin, boosting the per-share Bitcoin “content” and therefore the stock price, motivating premium purchases. After fundraising, Company A acquires more Bitcoin, raising both per-share content and price. The company can repeat this cycle to drive the stock higher.

But this flywheel requires two key conditions: first, the initial mNAV must trade at a premium, or at least there must be a credible expectation of a future premium; second, the premium and its rate must be sustained. If the premium rate falls to zero or negative, investors will simply buy the underlying crypto assets directly.

Combining the points of severe dilution, persistent mNAV decline, and opaque disclosures explains Kerrisdale’s bearish view. According to its analysis, BitMine had issued over 240 million shares by October 6, pushing total shares to 311.7 million. While BitMine increased its ETH per share from 2.7 ETH per thousand shares to 7 ETH per thousand shares between July and August using the flywheel, Kerrisdale estimates that from August 25 to October 6, BitMine’s ETH holdings rose 65%, but ETH per share increased only 17%.

In short, Kerrisdale argues that dilution means per-share ETH growth is lagging ETH holdings growth. With the mNAV premium dropping from 2x in August to 1.4x, slowing per-share growth and declining premium could trigger a vicious cycle, with both metrics falling together, ultimately resulting in trading at or below net asset value.

While some data is speculative, BitMine’s decision to stop reporting per-share NAV and total shares after August 25 solidifies Kerrisdale’s stance. As the firm said on X: “If per-share earnings had improved, they’d be promoting it loudly.”

“Premium Placement” Is Actually a “Discounted Cash-Out”

On September 22, BitMine announced a securities purchase agreement with an institutional investor, registering 5,217,715 new shares at USD 70 each, plus warrants to purchase up to 10,435,430 shares at USD 87.50. Before fees and expenses, the offering is expected to raise USD 365.24 million.

What would typically be bullish news was seen by Kerrisdale as financial engineering for a discounted cash-out.

The report notes the USD 70 offering price was about 14% above the closing price of USD 61.29, but each share came with two warrants (USD 87.5 strike, 1.5 years). Using Black-Scholes (volatility 100%, rate 4%) and a 40% liquidity discount, each warrant is valued at USD 14.

The Black-Scholes model, established by Fischer Black and Myron Scholes in 1973 (Nobel Prize), calculates the fair value of options exercisable at expiry, based on market parameters. Kerrisdale set volatility at 100% and the risk-free rate at 4%, valuing each warrant in BitMine’s offering at USD 14.

After stripping out the value of two USD 14 warrants per share, BitMine’s net proceeds are just USD 220 million, meaning the effective issue price is only USD 42 per share—about 31% below the closing price. Kerrisdale contends that while investors may not lose on the deal, when a DAT must raise capital at a real discount, it undermines a crucial flywheel condition and signals fatigue in BitMine’s business model.

DATs Have Lost Their Scarcity Premium

The report highlights that when MicroStrategy launched its Bitcoin treasury strategy in 2020, compliant crypto investment vehicles were scarce, making DATs a “leveraged alternative.” Today, over 150 U.S. companies have announced similar strategies, aiming to raise nearly USD 100 billion. With the SEC streamlining ETF approvals, an “ETF tsunami” is likely, and lower-cost, highly liquid Ethereum investment products could quickly capture market share.

Kerrisdale emphasizes that even Strategy’s mNAV premium has dropped from a high of 2.5x to 1.4x, signaling waning confidence in the DAT model. Strategy itself abandoned its pledge to issue new shares only at a 2.5x premium last August. Once market trust and discipline erode, they’re hard to restore. If confidence falters for Strategy, imitators will collapse even faster.

Kerrisdale’s report sums up its position: “We’re not shorting Ethereum—we’re shorting the idea that investors should pay a premium for ETH.” For ETH exposure, simply buy, stake, or invest in an ETF. BMNR’s selling point is “worth more than ETH itself,” but the strategy is lackluster, competition is fierce, disclosures are opaque, per-share ETH growth is slowing, fundraising at a premium is just dilution, and scarcity is gone. In this environment, BMNR’s premium will inevitably keep falling.

Kerrisdale’s Passion for Short-Selling and the Controversial DAT Model

Kerrisdale Capital is one of Wall Street’s most active long/short event-driven hedge funds, famous for aggressive public short reports. In recent years, its focus has been on “overvalued” crypto concepts, quantum tech, and SPACs. From late 2023 to early 2024, Kerrisdale targeted Marathon Digital and Cipher Mining, triggering single-day drops of 5–8%. Beyond crypto, Kerrisdale shorted quantum computing stocks IonQ and D-Wave Quantum, though both rebounded sharply after brief post-report dips.

Founder and CIO Sahm Adrangi began at Deutsche Bank working on high-yield bonds and leveraged loans, later advising on bankruptcies and restructurings at Chanin Capital Partners. He subsequently joined Longacre Management, a USD 2 billion distressed-debt hedge fund, as an analyst.

Adrangi gained prominence by shorting and exposing fraudulent Chinese companies in 2010 and 2011, including China Marine Food Group, China-Biotics, and Lihua International. Targets China Education Alliance and ChinaCast Education Corp were later investigated and sanctioned by the SEC.

While Kerrisdale isn’t exclusively a short fund, its recent focus is on overvalued stocks—DATs are the latest target. As stated earlier, this confident naked short reflects a conviction about fundamental flaws in the model. Kerrisdale’s short track record this year has been mixed, with many targets rebounding after brief drops, but its insights into DATs remain noteworthy.

This year, a wave of U.S. public companies has experimented with Bitcoin, Ethereum, and other altcoin DAT models, with notable investors cheering them on. Yet even Web3 leaders like Vitalik have voiced concerns. In hindsight, those concerns were justified. In a hot, liquid market, DAT stocks can soar, but this bubble-style rally can’t last.

We recognize that DATs can contribute to growth during bullish markets, but when the bubble bursts, the market faces significant risk and volatility.

Statement:

- This article is reprinted from [Foresight News]. Copyright belongs to the original author [Eric, Foresight News]. For any concerns regarding this reprint, please contact the Gate Learn team, and we will address your inquiry promptly.

- Disclaimer: The views and opinions expressed in this article represent the author’s personal perspective and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Except where Gate is explicitly referenced, do not copy, distribute, or plagiarize translated content.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?