From Balancer to Berachain: When the Chain Hits the Pause Button

The DeFi sector has once again found itself in the spotlight.

On November 3 (UTC), several projects leveraging the Balancer V2 architecture were hit by a sophisticated attack, with cumulative losses exceeding $120 million. The breach affected the Ethereum mainnet, Arbitrum, Sonic, Berachain, and other chains, making it one of the most impactful security incidents in the industry since the Euler Finance and Curve Finance exploits.

BlockSec’s preliminary analysis described this as a “high-complexity price manipulation exploit.” Attackers manipulated the BPT (Balancer Pool Token) price calculation, exploiting invariant rounding errors to induce price distortion and repeatedly arbitrage within a single batch swap.

For instance, the Arbitrum attack unfolded in three phases:

- The attacker first swapped BPT for the underlying asset, precisely adjusting the cbETH balance to the rounding threshold (around 9 units), setting up a loss of calculation precision for subsequent steps;

- Next, they exchanged a specific amount (=8 units) between wstETH and cbETH. Downward rounding during scaling slightly reduced the calculated Δx, causing Δy to be underestimated and the stable pool invariant D to decrease, which depressed the theoretical BPT price;

- Finally, the attacker reversed the swap, converting the underlying asset back to BPT and pocketing profits from the artificially lowered price.

In essence, this was a precision exploit targeting the intersection of mathematics and code.

Balancer confirmed the exploitation of its V2 Composable Stable Pools. The team is collaborating with leading security researchers on a full investigation and has committed to publishing a comprehensive post-mortem. All affected pools with pause capability have been urgently frozen and initiated recovery procedures. The vulnerability is limited to V2 Composable Stable Pools and does not impact Balancer V3 or other pool types.

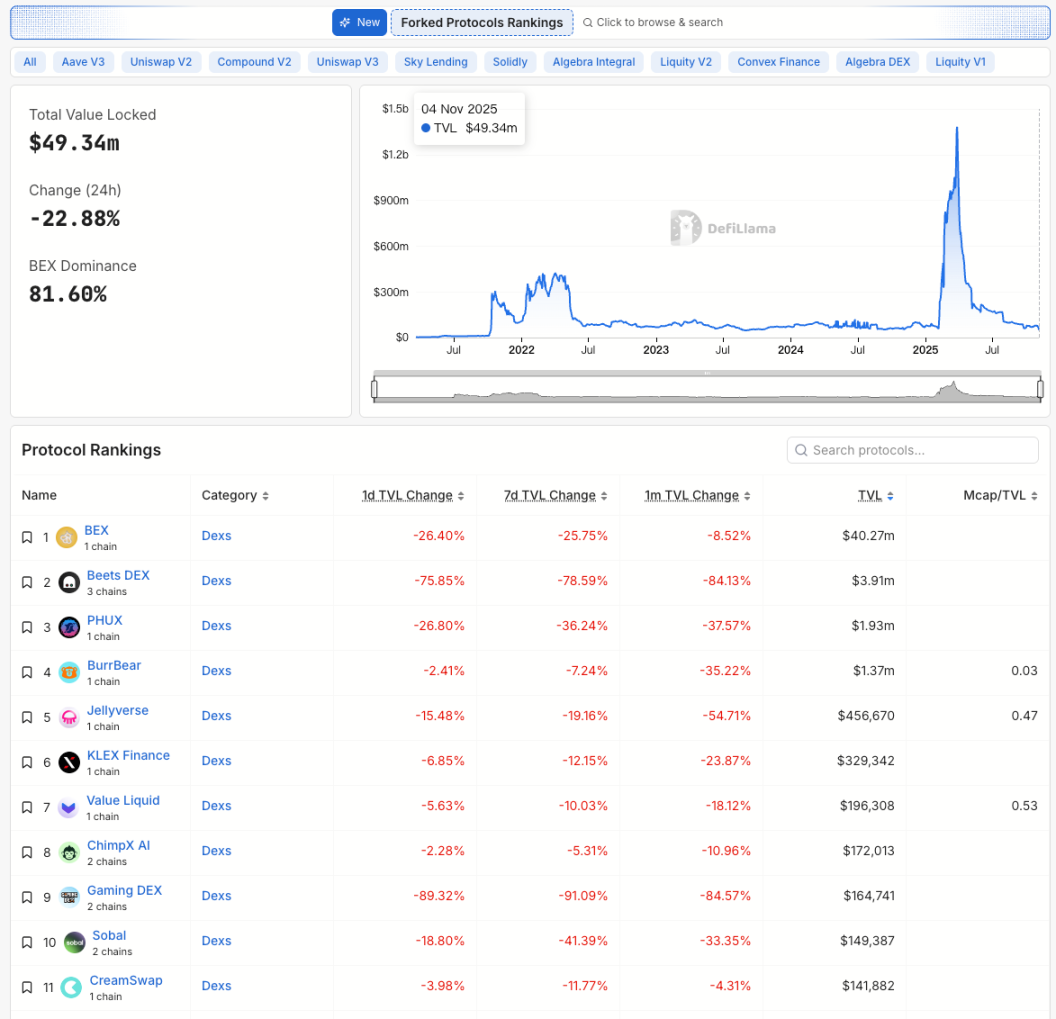

After the Balancer V2 exploit, projects forking its architecture experienced major shakeups. According to DeFiLlama, as of November 4 (UTC), the aggregate value locked in related projects fell to roughly $49.34 million—a 22.88% drop in one day. BEX, Berachain’s native DEX, saw TVL plunge 26.4% to $40.27 million, still representing 81.6% of the ecosystem. Yet, chain outages and frozen liquidity continued to drive capital outflows. Beets DEX suffered even more, with TVL collapsing 75.85% in 24 hours and nearly 79% over the past week.

Other DEXs built on Balancer’s architecture also saw panic withdrawals: PHUX fell 26.8% in a day, Jellyverse dropped 15.5%, and Gaming DEX crashed 89.3%, with liquidity nearly depleted. Even medium and small platforms not directly affected—including KLEX Finance, Value Liquid, and Sobal—generally saw 5%–20% outflows.

Chain Reaction: Berachain Executes Emergency Hard Fork

The vulnerability in Balancer V2 rapidly triggered a broader chain reaction.

Berachain, a new public blockchain built with the Cosmos SDK, was attacked within hours as BEX also used Balancer V2 contracts. Upon discovering anomalies, the foundation quickly announced a full chain halt.

Attackers compromised assets in BEX’s USDe Tripool and other liquidity pools, with losses totaling around $12 million. Attackers exploited the same logic flaw as Balancer, using multiple smart contract interactions to siphon funds. Since some affected assets were non-native tokens, the team had to execute a hard fork for block rollback and restoration for tracking and recovery.

Several Berachain ecosystem protocols—including Ethena, Relay, and HONEY—also took defensive measures:

- Prohibited USDe cross-chain transfers;

- Suspended lending market deposits;

- Halted HONEY minting and redemption;

- Notified centralized exchanges to block suspicious addresses.

Berachain Foundation stated that the network suspension was planned and that operations would soon resume. The Balancer exploit mainly affected the Ethena/Honey pools via complex smart contract transactions. Because non-native assets (not just BERA) were impacted, block rollback and restoration required more than a simple hard fork, so the network was paused pending a comprehensive solution.

On November 4 (UTC), Berachain Foundation reported that the hard fork binaries had been distributed and some validator nodes upgraded. Before relaunching and generating new blocks, they aim to ensure key infrastructure partners (like liquidation oracles) have updated their RPC endpoints. These are the main hurdles to resuming on-chain activity. Once core RPC services are in place, the team will coordinate with cross-chain bridges, CEX partners, and custodians to resume operations.

Meanwhile, a Berachain MEV bot operator reached out to the foundation after the chain halt, claiming to have “white-hat” extracted funds and sent an on-chain message, offering to pre-sign transactions to return the funds once the chain is live again.

Security Versus Decentralization?

“We know this is controversial, but when roughly $12 million in user assets are at risk, protecting users is the only choice,” said Berachain co-founder Smokey The Bera, responding to concerns about centralization.

He acknowledged that Berachain hasn’t reached Ethereum-level decentralization, and that validator coordination functions more like a “crisis command center” than an automated consensus network. In fact, on-chain nodes were halted within an hour of the exploit, demonstrating centralized efficiency but also revealing the governance structure’s concentration.

The community response was sharply divided.

Supporters argued that the team demonstrated its commitment to user safety—a form of “pragmatic decentralization.” Critics countered that it violated the “Code is Law” principle and undermined on-chain irreversibility.

On-chain investigator ZachXBT commented, “When user funds are in imminent danger, it’s a difficult but correct decision.”

But some developers were blunt: “If a blockchain can be manually paused at any time, how is it different from traditional finance?”

The Shadow of the DAO Hack Reappears

This crisis has reminded many veterans of the 2016 Ethereum DAO hack, when Ethereum rolled back transactions via a hard fork to recover $50 million in stolen funds—splitting the community into Ethereum (ETH) and Ethereum Classic (ETC).

Nine years later, a similar dilemma has emerged.

This time, the subject is a nascent public chain without deep decentralization or global-scale consensus.

Berachain’s intervention may have limited losses, but it reignites the debate over whether blockchains can truly be autonomous.

In some ways, this episode is a mirror for DeFi: Security, efficiency, and decentralization—a perfect equilibrium has never truly been achieved.

When hackers can steal tens of millions in seconds, idealism often gives way to reality.

Balancer’s team is working with top security researchers, plans to publish a post-mortem, and cautions users to beware of scam messages from imposters.

Berachain is expected to gradually restore block production and transaction functionality after the hard fork.

However, restoring user trust is much more difficult than fixing code. For any new public chain, a network halt may provide a short-term solution but could have long-term consequences—users may doubt the chain’s decentralization, and developers may have concerns about the chain’s immutability.

DeFi may be redefining decentralization—not as absolute laissez-faire, but as the minimum consensus reached in times of crisis.

Statement:

- This article is reprinted from [Foresight News] and copyright belongs to the original author [ChandlerZ, Foresight News]. For any concerns regarding this reprint, please contact the Gate Learn team for prompt handling according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are exclusively those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is explicitly cited, copying, distributing, or plagiarizing translated articles is prohibited.

Related Articles

False Chrome Extension Stealing Analysis

Analysis of the Sonne Finance Attack

What is a Crypto Card and How Does it Work? (2025)

Introduction to the Aleo Privacy Blockchain

Understanding the Babylon Protocol: The Hanging Gardens of Bitcoin