$300 Million Raised, CFTC Approved, Kalshi Competing for Prediction Market Dominance

Prediction markets are rapidly emerging as a multi-billion-dollar industry at the intersection of crypto and finance. On October 10 (UTC), Kalshi, a U.S.-regulated prediction market platform, raised over $300 million in funding, raising its valuation to $5 billion. Sequoia Capital and a16z led the round, with existing stakeholders like Paradigm following on with additional investments. Kalshi also plans to enable customers from more than 140 countries to participate in prediction markets on its platform.

Just four months prior, in June, Kalshi’s valuation was $2 billion after a $185 million funding round. Its valuation has now doubled, underscoring investors’ strong confidence in prediction market growth.

Distinguished Team & VC Lineup

Tarek Mansour and Luana Lopes Lara co-founded Kalshi. Mansour is an MIT graduate and a seasoned quantitative trader, previously serving as an executive at the Chicago Mercantile Exchange (CME), with expertise in derivatives pricing and risk management. Lara comes from Brazil’s fintech sector and led emerging market strategies at Morgan Stanley. Together, they focused on the “event contracts” overlooked by traditional finance—betting on future events.

In contrast to Polymarket’s blockchain-native approach, Kalshi built a compliant platform from scratch, securing early regulatory approval from the Commodity Futures Trading Commission (CFTC) and becoming the first fully regulated prediction market in the U.S. Alex Immerman, partner at a16z Growth Fund, described this as a “challenging yet responsible path,” which helped Kalshi stand out amid regulatory turbulence.

Kalshi’s team is its core strength. Beyond its co-founders, Kalshi has brought in Wall Street veterans and top tech talent. CTO Eli Levine, formerly of Google Cloud, led major data infrastructure projects to ensure low latency and high throughput. Sarah Chen, Head of Product, joined from Coinbase and spearheaded the expansion into sports and political markets, integrating complex multi-event contracts.

Significantly, Donald Trump Jr. joined Kalshi’s advisory board in January 2025, contributing political insight and boosting the platform’s election market performance—Kalshi’s presidential win forecasts achieved 85% accuracy in the 2024 U.S. election, outperforming traditional polling. The team now exceeds 150 members, covering quantitative modeling, compliance, and user growth, with average industry experience over 10 years. This “Wall Street + Silicon Valley” hybrid allows Kalshi to lead product innovation, expanding from single event contracts to sports, weather, and economic data markets, with daily active users surpassing 100,000.

Kalshi’s impressive fundraising highlights the strategic value of prediction markets. Sequoia Capital, a Silicon Valley icon with investments in Airbnb and Stripe, led this round, recognizing Kalshi’s regulatory advantage early on. a16z, a crypto-native fund, saw founder Marc Andreessen publicly praise Kalshi for “reinventing event-driven finance.” Paradigm, which led June’s $185 million round, increased its stake this round, with total investment now exceeding $200 million. Other backers include Coinbase Ventures and Bond Capital, led by former a16z partner Mary Meeker and focused on data-driven platforms. Kalshi’s total funding now approaches $591 million across three rounds: a $15 million seed round in 2021 (led by SV Angel), a $50 million Series A in 2023, and the current Series D.

Kalshi’s competitor, Polymarket, was founded in 2020 by Shayne Coplan and operates as a blockchain-native prediction market on Polygon, allowing users to bet directly in USDC. On October 7, 2025 (UTC), Polymarket announced an investment of up to $2 billion from Intercontinental Exchange (ICE), parent of the New York Stock Exchange.

Kalshi vs. Polymarket

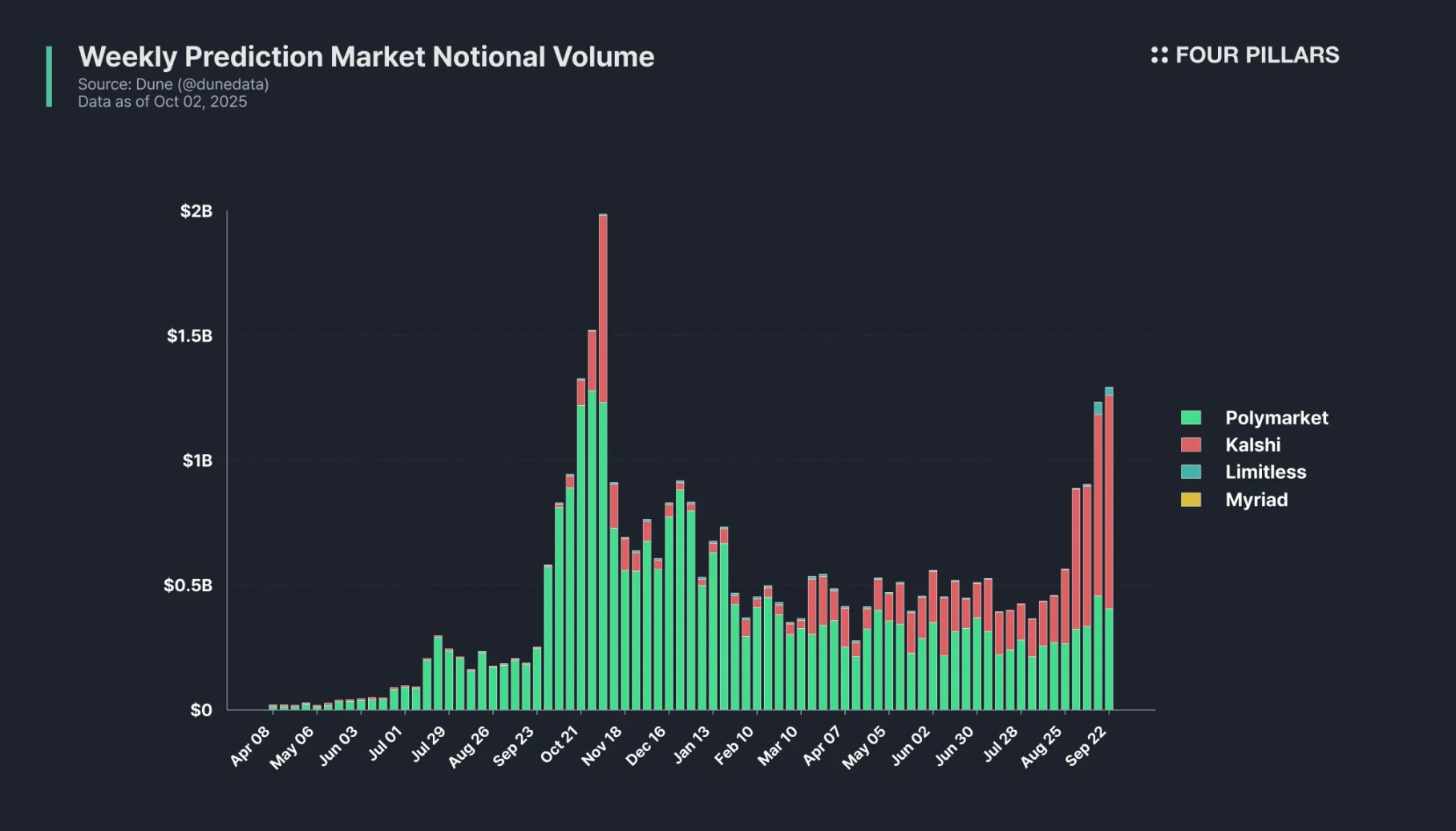

Kalshi’s data-driven results are the backbone of its fundraising. The platform’s liquidity pools maintain an average slippage of less than 0.1%, well below the industry norm. Financially, Kalshi is already profitable, with revenue exceeding $200 million in the first half of 2025, primarily from trading fees between 0.5% and 1%. According to Dune Analytics, Kalshi’s weekly prediction market volume has surged, overtaking Polymarket.

Kalshi outpaces Polymarket across several metrics. On compliance: Kalshi is a CFTC-designated contract market (DCM), so U.S. users do not need a VPN. Polymarket lost U.S. traffic after a 2022 ban and now relies on overseas users; it recently re-entered the U.S. via the QCX LLC acquisition, though its official launch date is still pending.

User experience: Kalshi supports USD deposits and streamlined KYC, catering to institutional clients. Polymarket depends on crypto wallets, offering higher gas fees and volatility. Market coverage: Kalshi dominates the U.S. market with a broader range of sports and economic contracts but has limited international presence. Polymarket focuses on political and crypto events but has low U.S. penetration due to compliance constraints.

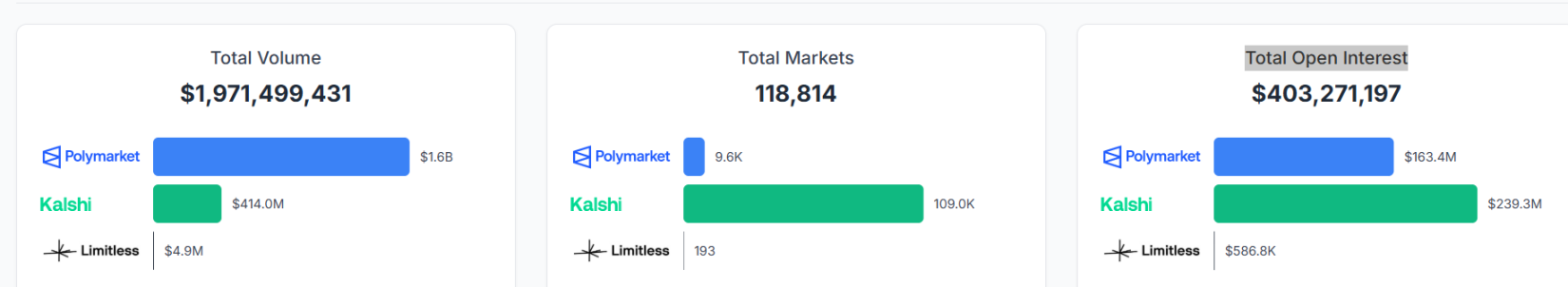

Latest polymarketanalytics data shows Kalshi’s total trading volume at just $400 million, trailing Polymarket, but it leads in both the number of prediction markets and total open interest.

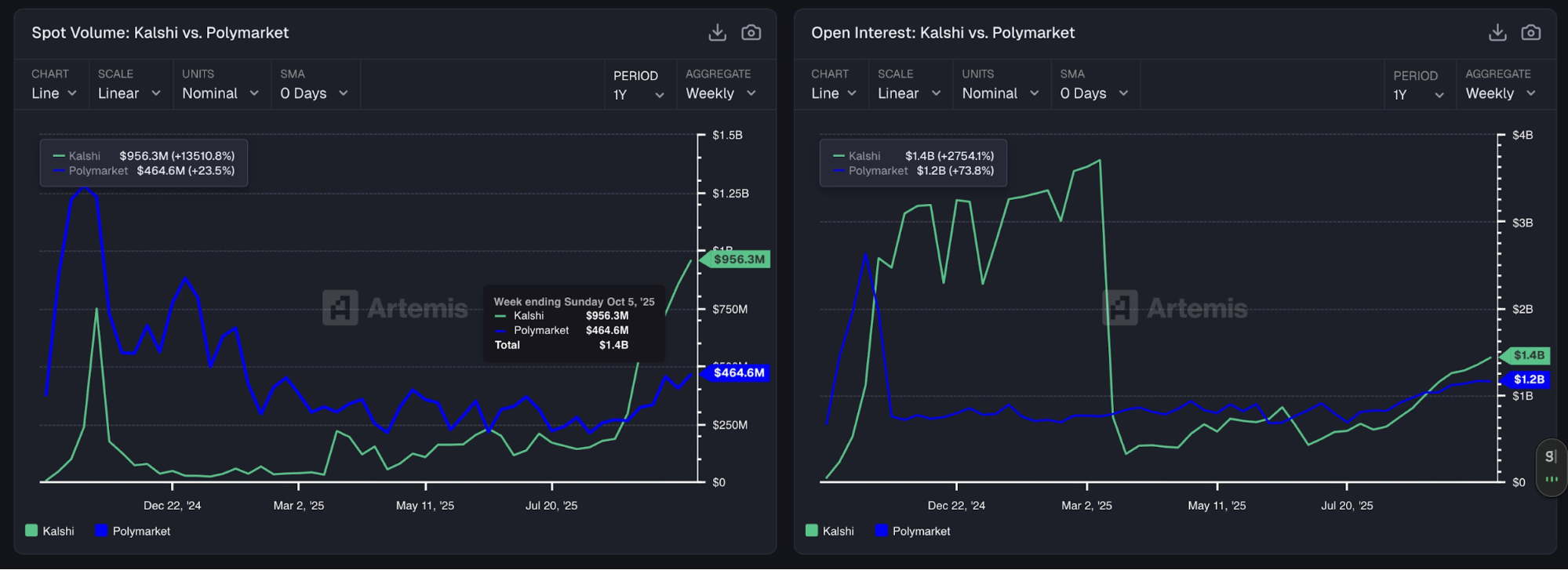

Zooming in on recent growth, Artemis reports Kalshi’s market transaction volume jumped 135-fold over the past year to $956.3 million, while Polymarket reached only $464.6 million.

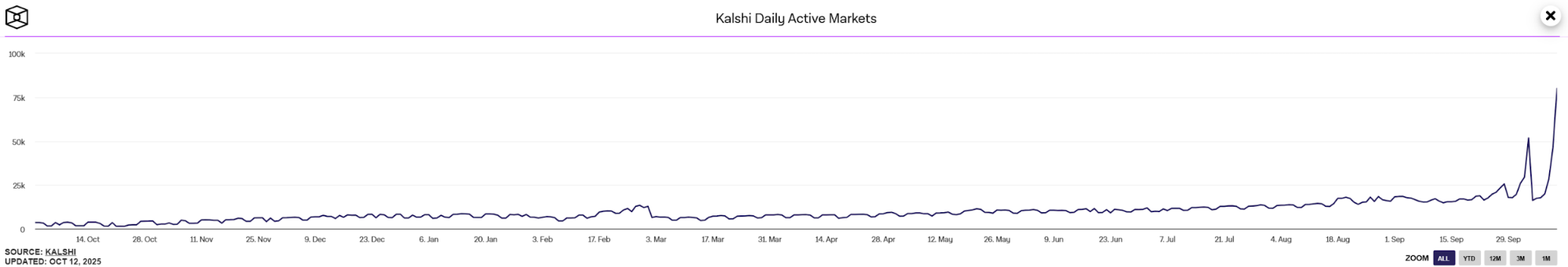

The Block’s latest data shows Kalshi’s daily active prediction markets have hit a record high, surpassing 75,000.

Kalshi notably topped the Apple App Store’s free chart on November 6, 2024 (UTC), overtaking Polymarket. In October, Kalshi’s Head of Crypto, John Wang, stated in a The Block interview at Singapore’s Token2049 conference that Kalshi will be integrated into “every major crypto app and exchange” within the next 12 months.

Polymarket’s founder has hinted at launching the POLY token. This has led to speculation about whether Kalshi will issue its own token. Despite market rumors about possible tokenization, official channels and funding announcements have not mentioned a Kalshi token.

Disclaimer:

- This article is republished from [Foresight News]. Copyright belongs to the original author [1912212.eth, Foresight News]. For any concerns regarding republication, please contact the Gate Learn team, who will address the matter promptly in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team and may not be copied, distributed, or reproduced without proper attribution to Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?