What is XLM: Understanding Cross-Lingual Models in Natural Language Processing

Stellar's Positioning and Significance

In 2014, Jed McCaleb, one of the former founders of Ripple, launched Stellar (XLM) to address issues such as financial inequality and inefficient cross-border payments.

As a decentralized gateway for transmitting digital and fiat currencies, Stellar plays a crucial role in the payment and financial inclusion sectors.

As of 2025, Stellar has become a top 20 cryptocurrency by market capitalization, with over 9.7 million holders and an active developer community. This article will analyze its technical architecture, market performance, and future potential.

Origin and Development History

Background

Stellar was created by Jed McCaleb in 2014 to solve issues related to financial inequality and inefficient cross-border payments.

It emerged during the blockchain technology boom, aiming to change the status quo by providing fast, stable, and extremely low-cost transfers of digital assets among banks, payment institutions, and individuals.

Stellar's launch brought new possibilities for the global financial system and underserved populations.

Key Milestones

- 2014: Mainnet launch, achieving high network throughput and low-cost transactions.

- 2015: Stellar reached its all-time low price of $0.00047612.

- 2018: Stellar hit its all-time high price of $0.875563, demonstrating significant market recognition.

- 2025: Ecosystem expansion, with numerous projects issuing new assets on the Stellar network due to its strong network throughput and low-cost characteristics.

With support from the Stellar Development Foundation, Stellar continues to optimize its technology, security, and real-world applications.

How Does Stellar Work?

Decentralized Control

Stellar operates on a decentralized network of computers (nodes) spread across the globe, free from control by banks or governments.These nodes collaborate to verify transactions, ensuring system transparency and attack resistance, granting users greater autonomy and enhancing network resilience.

Blockchain Core

Stellar's blockchain is a public, immutable digital ledger that records every transaction.

Transactions are grouped into blocks and linked through cryptographic hashes, forming a secure chain.

Anyone can view the records, establishing trust without intermediaries.

Stellar's unique consensus mechanism further enhances its performance and efficiency.

Ensuring Fairness

Stellar employs the Stellar Consensus Protocol (SCP) to validate transactions and prevent fraudulent activities like double-spending.

Participants maintain network security through running nodes and validating transactions, receiving XLM rewards for their efforts.

Its innovation includes high transaction throughput and energy efficiency compared to traditional proof-of-work systems.

Secure Transactions

Stellar uses public-private key encryption to protect transactions:

- Private keys (like secret passwords) are used to sign transactions

- Public keys (like account numbers) are used to verify ownership

This mechanism ensures fund security while maintaining pseudonymous transactions.

Additionally, Stellar supports multi-signature accounts and time-bound transactions for enhanced security and flexibility.

Stellar (XLM) Market Performance

Circulation Overview

As of September 11, 2025, Stellar's circulating supply is 31,776,614,276.0198 XLM, with a total supply of 50,001,786,892 XLM. This represents a circulating ratio of approximately 63.55% of the total supply.

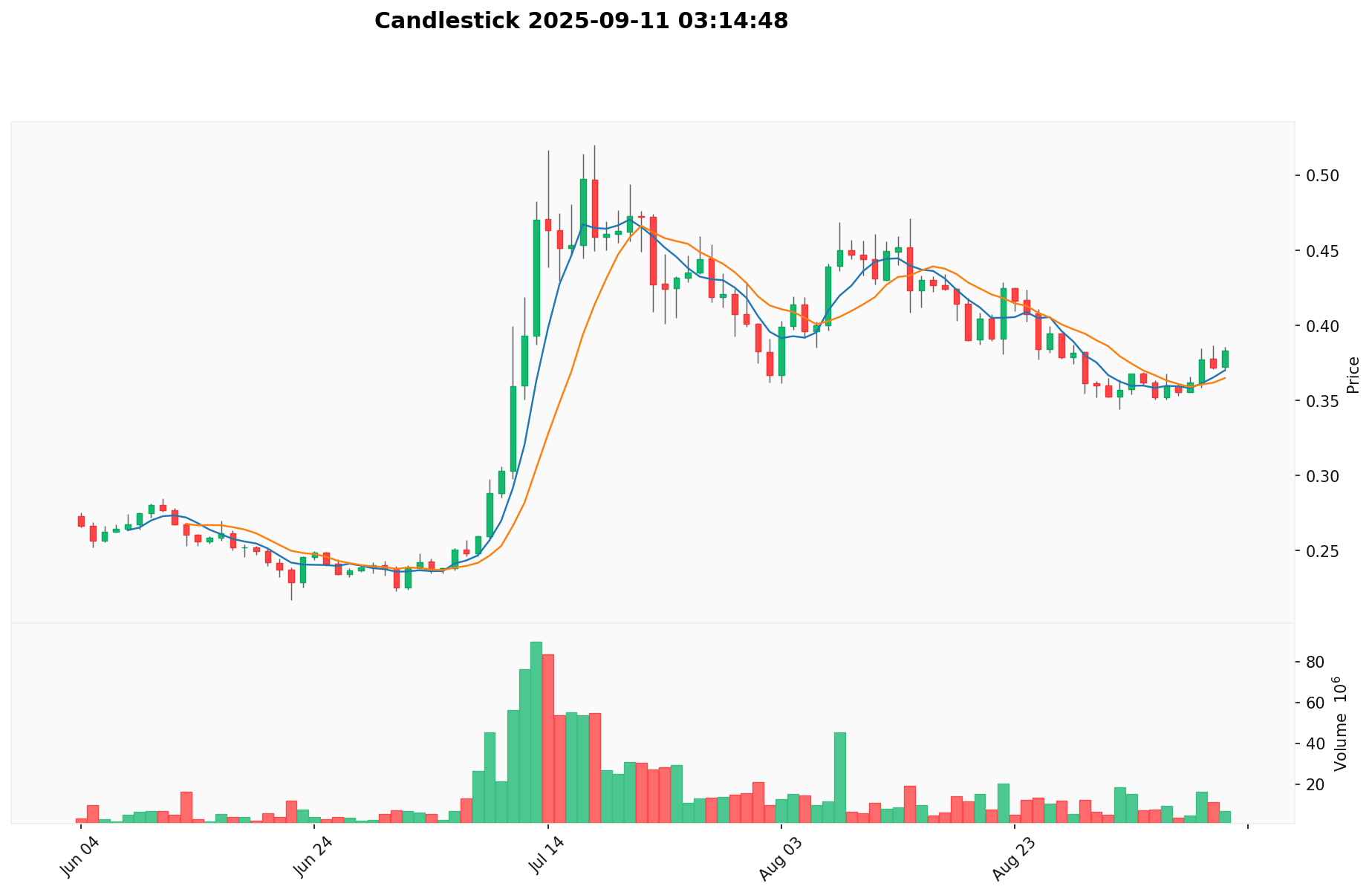

Price Fluctuations

Stellar reached its all-time high of $0.875563 on January 3, 2018, likely driven by the overall cryptocurrency bull market at that time.

Its lowest price was $0.00047612, recorded on March 5, 2015, possibly due to early market uncertainties and limited adoption.These fluctuations reflect market sentiments, adoption trends, and external factors affecting the cryptocurrency space.

Click to view the current XLM market price

On-chain Metrics

- Daily Transaction Volume: 2,846,024.5989524 XLM (indicating network activity)

- Active Addresses: 9,775,338 (reflecting user engagement)

Stellar Ecosystem Applications and Partnerships

Core Use Cases

Stellar's ecosystem supports various applications:

- Cross-border Payments: Facilitating fast and low-cost international transactions.

- Asset Tokenization: Enabling the creation and issuance of digital assets on the Stellar network.

Strategic Collaborations

Stellar has established partnerships with financial institutions and technology companies to enhance its capabilities and market influence. These partnerships provide a solid foundation for Stellar's ecosystem expansion.

Controversies and Challenges

Stellar faces the following challenges:

- Scalability: Addressing network capacity as adoption grows.

- Regulatory Uncertainty: Navigating the evolving regulatory landscape for cryptocurrencies.

- Competition: Contending with other blockchain platforms offering similar solutions.

These issues have sparked discussions within the community and market, driving Stellar's continuous innovation.

Stellar Community and Social Media Atmosphere

Fan Enthusiasm

Stellar's community is vibrant, with significant daily transaction volumes and growing wallet addresses. On X, posts and hashtags related to Stellar often trend, with high monthly engagement rates. Factors such as network upgrades and partnerships have ignited community enthusiasm.

Social Media Sentiment

Sentiment on X shows a mix of opinions:- Supporters praise Stellar's fast transactions and low fees, viewing it as a potential future of global payments.

- Critics focus on issues such as centralization concerns and competition from other blockchain platforms.

Recent trends indicate generally positive sentiment, especially during market upswings.

Hot Topics

X users actively discuss Stellar's role in remittances, its potential in CBDCs, and its environmental sustainability compared to other cryptocurrencies.

More Information Sources on Stellar

- Official Website: Visit Stellar's official website for features, use cases, and latest updates.

- Whitepaper: Stellar's whitepaper details its technical architecture, goals, and vision.

- X Updates: On X, Stellar uses @stellarorg, with posts covering technical upgrades, community events, and partnership news, generating significant engagement.

Stellar's Future Roadmap

- Ongoing: Continued focus on improving scalability and network efficiency.

- Ecosystem Goals: Expanding support for diverse financial applications and services.

- Long-term Vision: Becoming a global standard for digital financial infrastructure.

How to Participate in Stellar?

- Purchase Channels: Buy XLM on Gate

- Storage Solutions: Use secure wallets recommended by the Stellar Foundation

- Participate in Governance: Engage in community decisions through official Stellar channels

- Build on the Ecosystem: Visit Stellar's developer documentation to create applications or contribute code

SummaryStellar is redefining digital currency through blockchain technology, offering transparency, security, and efficient payments. Its active community, rich resources, and strong market performance set it apart in the cryptocurrency space. Despite facing challenges like regulatory uncertainties and technological hurdles, Stellar's innovative spirit and clear roadmap position it as a key player in the future of decentralized technology. Whether you're a newcomer or an experienced participant, Stellar is worth watching and engaging with.

FAQ

What does XLM coin do?

XLM coin facilitates fast, low-cost international payments on the Stellar network. It's used to pay transaction fees, enable currency exchanges, and serve as an account reserve.

Is XLM a good investment?

XLM shows promise for long-term growth, with experts projecting it could reach $10 by 2030. Its rising price trend suggests potential for good returns in the future.

Can XLM reach $100?

While possible, it's highly unlikely. XLM's market cap and supply make a $100 price extremely challenging in the foreseeable future.

How is XLM different from XRP?

XLM is decentralized, focusing on individual and small business financial services. XRP is centralized, mainly used for interbank transactions. XLM operates on Stellar's blockchain, while XRP is part of Ripple's payment protocol.

Share

Content