NIZA vs GMX: The Battle for Dominance in Next-Generation DeFi Trading Protocols

Introduction: NIZA vs GMX Investment Comparison

In the cryptocurrency market, the comparison between NIZA and GMX has always been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in the crypto asset space.

Niza Global (NIZA): Since its launch, it has gained market recognition for its focus on powering a secure, transparent, and user-friendly ecosystem.

GMX (GMX): Introduced as a decentralized and sustainable exchange, it has been recognized for its utility and governance token features.

This article will comprehensively analyze the investment value comparison between NIZA and GMX, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most concerning to investors:

"Which is the better buy right now?" Here is the report based on the provided template and information:

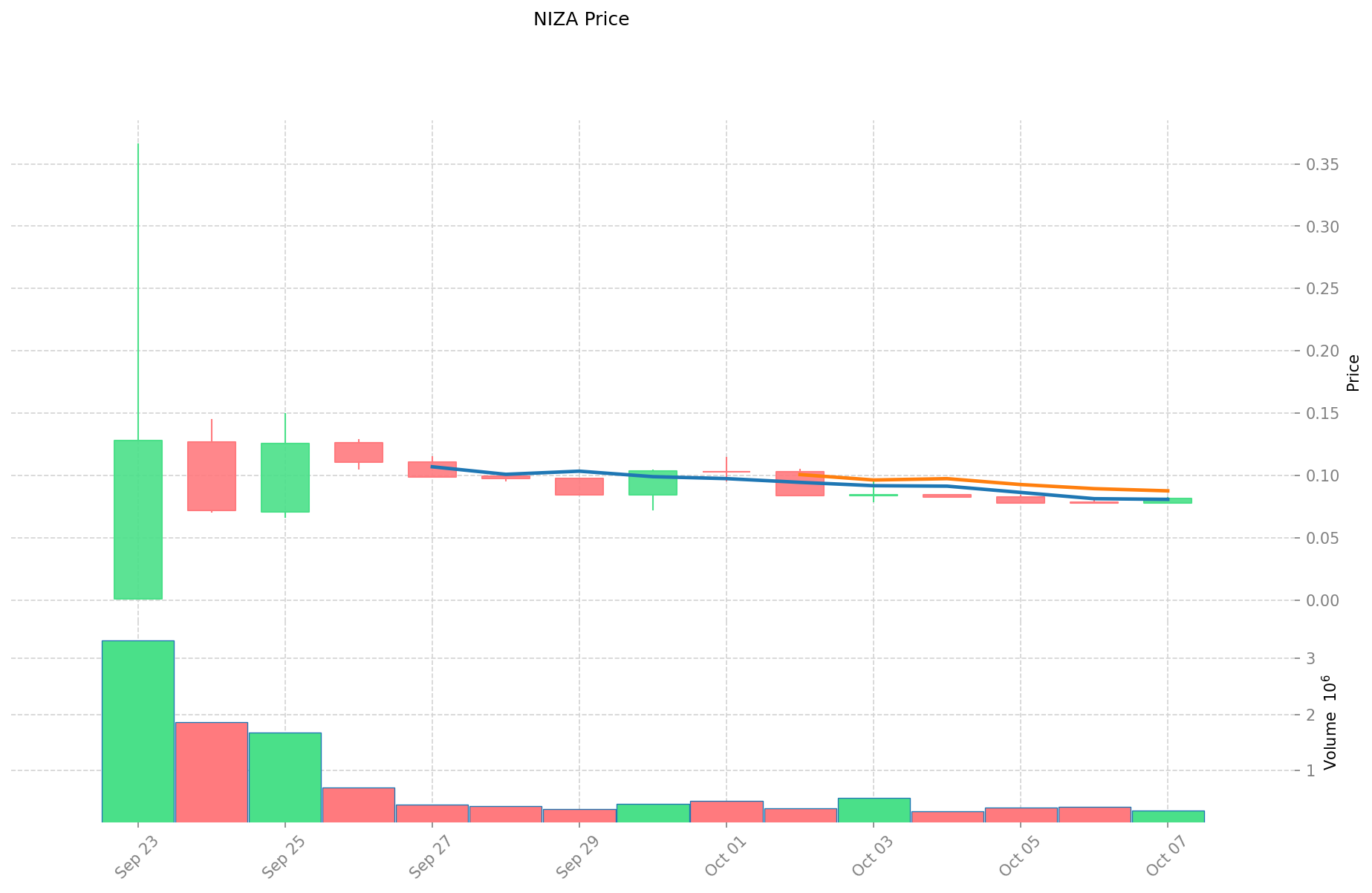

I. Price History Comparison and Current Market Status

NIZA (Coin A) and GMX (Coin B) Historical Price Trends

- 2025: NIZA reached its all-time high of $0.366666 on September 23, 2025.

- 2025: GMX dropped to its all-time low of $9.61 on April 7, 2025.

- Comparative analysis: In the current market cycle, NIZA has fallen from its high of $0.366666 to $0.081302, while GMX has risen from its low of $9.61 to $14.32.

Current Market Situation (2025-10-08)

- NIZA current price: $0.081302

- GMX current price: $14.32

- 24-hour trading volume: NIZA $23,628.51 vs GMX $236,716.46

- Market Sentiment Index (Fear & Greed Index): 70 (Greed)

Click to view real-time prices:

- Check NIZA current price Market Price

- Check GMX current price Market Price

II. Key Factors Affecting NIZA vs GMX Investment Value

Supply Mechanism Comparison (Tokenomics)

- GMX: Innovative contract trading platform with strong performance during bear markets, showing counter-trend growth of 100%

- NIZA: Protocol-to-Protocol model with performance-linked token distribution that prioritizes allocations to builders, modules, and partners

- 📌 Historical Pattern: GMX's innovative approach to combining spot DEX with contract DEX created a sustainable value proposition even during market downturns.

Institutional Adoption and Market Applications

- Institutional Holdings: GMX has demonstrated ability to attract whales and market makers through token incentives to provide liquidity

- Enterprise Adoption: GMX has contributed significant user volume and transaction numbers to Arbitrum in its early stages

- Regulatory Stance: Not explicitly mentioned in available information

Technical Development and Ecosystem Building

- GMX Technical Upgrades: GMX V2 Delta Neutral Pool allows liquidity to be used for LP provision on GMX V2 while also hedging against market movements, creating delta-neutral positions

- NIZA Technical Development: Focuses on an efficient protocol model with performance-linked mechanisms that differs from traditional blockchain approaches

- Ecosystem Comparison: GMX has established itself as a flagship project within its ecosystem, demonstrating the importance of having strong anchor projects for long-term sustainability

Macroeconomic Factors and Market Cycles

- Inflation Performance: Not explicitly detailed in available information

- Monetary Policy Impact: Not explicitly detailed in available information

- Geopolitical Factors: Not explicitly detailed in available information

III. 2025-2030 Price Prediction: NIZA vs GMX

Short-term Prediction (2025)

- NIZA: Conservative $0.079 - $0.081 | Optimistic $0.081 - $0.104

- GMX: Conservative $13.78 - $14.35 | Optimistic $14.35 - $19.23

Mid-term Prediction (2027)

- NIZA may enter a growth phase, with an estimated price range of $0.097 - $0.115

- GMX may enter a bullish market, with an estimated price range of $14.13 - $23.87

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- NIZA: Base scenario $0.139 - $0.155 | Optimistic scenario $0.155 - $0.183

- GMX: Base scenario $19.63 - $25.83 | Optimistic scenario $25.83 - $33.32

Disclaimer: The above predictions are based on historical data and market trends. Cryptocurrency markets are highly volatile and subject to change. This information should not be considered as financial advice. Always conduct your own research before making investment decisions.

NIZA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10404992 | 0.081289 | 0.07885033 | 0 |

| 2026 | 0.129737244 | 0.09266946 | 0.0713554842 | 13 |

| 2027 | 0.11453945256 | 0.111203352 | 0.09674691624 | 36 |

| 2028 | 0.1377031107816 | 0.11287140228 | 0.0835248376872 | 38 |

| 2029 | 0.184172267100276 | 0.1252872565308 | 0.065149373396016 | 54 |

| 2030 | 0.182581118942334 | 0.154729761815538 | 0.139256785633984 | 90 |

GMX:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 19.229 | 14.35 | 13.776 | 0 |

| 2026 | 23.001615 | 16.7895 | 9.40212 | 17 |

| 2027 | 23.874669 | 19.8955575 | 14.125845825 | 38 |

| 2028 | 27.7940938275 | 21.88511325 | 14.88187701 | 52 |

| 2029 | 26.82677182185 | 24.83960353875 | 14.90376212325 | 73 |

| 2030 | 33.324812107587 | 25.8331876803 | 19.633222637028 | 80 |

IV. Investment Strategy Comparison: NIZA vs GMX

Long-term vs Short-term Investment Strategies

- NIZA: Suitable for investors focused on ecosystem potential and protocol-to-protocol models

- GMX: Suitable for investors seeking innovative DEX platforms with strong performance in bear markets

Risk Management and Asset Allocation

- Conservative investors: NIZA: 30% vs GMX: 70%

- Aggressive investors: NIZA: 60% vs GMX: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- NIZA: Volatility due to newer project status and market sentiment shifts

- GMX: Exposure to broader DeFi market trends and potential liquidity fluctuations

Technical Risks

- NIZA: Scalability, network stability

- GMX: Smart contract vulnerabilities, potential issues with V2 upgrades

Regulatory Risks

- Global regulatory policies may impact both projects differently, with DeFi platforms like GMX potentially facing more scrutiny

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- NIZA advantages: Performance-linked token distribution, focus on building efficient protocol model

- GMX advantages: Proven track record in bear markets, innovative DEX approach combining spot and contract trading

✅ Investment Advice:

- New investors: Consider a balanced approach, leaning towards GMX for its established presence

- Experienced investors: Explore NIZA for potential growth, while maintaining a position in GMX

- Institutional investors: Evaluate GMX for its liquidity provision incentives and consider NIZA for long-term ecosystem potential

⚠️ Risk Warning: The cryptocurrency market is highly volatile, and this article does not constitute investment advice. None

VII. FAQ

Q1: What are the key differences between NIZA and GMX? A: NIZA focuses on a protocol-to-protocol model with performance-linked token distribution, while GMX is an innovative DEX platform combining spot and contract trading. GMX has shown strong performance in bear markets, while NIZA is positioning itself as an efficient protocol model.

Q2: Which coin has performed better in recent market conditions? A: GMX has shown better recent performance, rising from its all-time low of $9.61 to $14.32, while NIZA has fallen from its all-time high of $0.366666 to $0.081302 in the current market cycle.

Q3: How do the supply mechanisms of NIZA and GMX differ? A: NIZA uses a performance-linked token distribution that prioritizes allocations to builders, modules, and partners. GMX employs an innovative approach that has allowed for sustainable value creation even during market downturns.

Q4: What are the long-term price predictions for NIZA and GMX? A: By 2030, NIZA is predicted to reach $0.139 - $0.183, while GMX is expected to reach $19.63 - $33.32 in optimistic scenarios. However, these predictions are subject to market volatility and should not be considered financial advice.

Q5: How do institutional investors view NIZA and GMX? A: GMX has demonstrated an ability to attract whales and market makers through token incentives for liquidity provision. NIZA's institutional adoption is less clear from the available information, but its protocol model may be of interest for long-term ecosystem potential.

Q6: What are the main risks associated with investing in NIZA and GMX? A: Both face market risks due to cryptocurrency volatility. NIZA may have additional risks due to its newer status, while GMX could face regulatory scrutiny as a DeFi platform. Technical risks include scalability for NIZA and potential smart contract vulnerabilities for GMX.

Q7: How should different types of investors approach NIZA and GMX? A: New investors might consider a balanced approach, leaning towards GMX for its established presence. Experienced investors could explore NIZA for potential growth while maintaining a position in GMX. Institutional investors may evaluate GMX for its liquidity incentives and consider NIZA for long-term ecosystem potential.

Share

Content