Gate Ventures Research Insights: The Rise of Long-Tail Assets and How On-Chain Liquidity Could Disrupt CEX

TL;DR

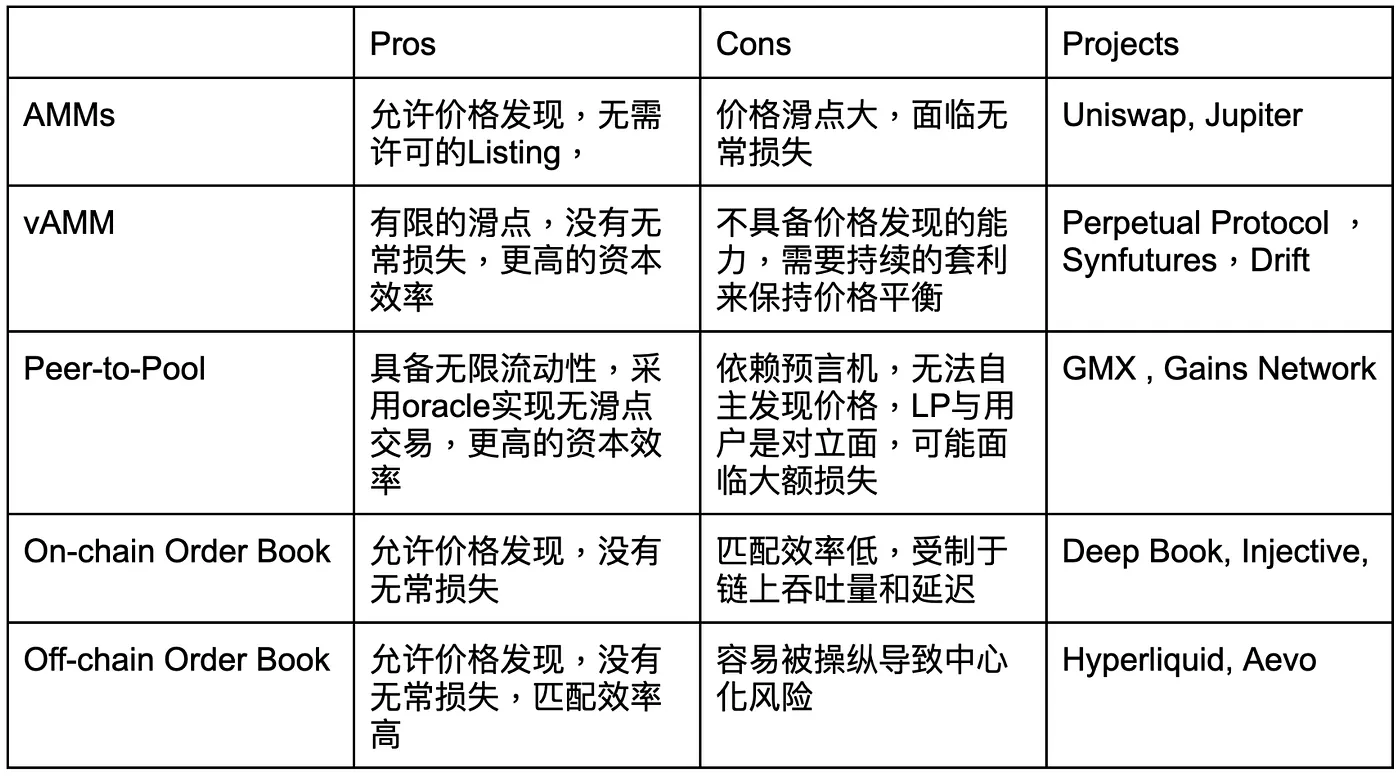

In this article, we explore how on-chain liquidity, driven by technological innovation, is gradually reshaping the competitive landscape between decentralized exchanges (DEXs) and centralized exchanges (CEXs). From the evolution of AMMs to vAMMs, Peer-to-Pool, and finally on-chain Order Books, these mechanisms address core challenges such as slippage, impermanent loss, and price discovery, while delivering a better trading experience for users.

We emphasize that deep liquidity is the key factor determining whether CEXs can remain competitive against DEXs. The success of $Trump once again demonstrates the increasing abundance of on-chain liquidity, powered by a growing diversity of liquidity providers. We analyze the modularization and specialization trends in LP vaults, an innovation that is enhancing liquidity support for both long-tail and mainstream assets. By examining successful cases such as Hyperliquid and Elixir, we show how on-chain liquidity has become a critical driver of DeFi’s growth and may ultimately disrupt CEX dominance in the trading market.

Introduction

Exchanges have long been the cornerstone of capital markets, but centralized exchanges (CEXs) have always faced heavy criticism. First, their operations run counter to blockchain’s core values of decentralization and transparency. Second, issues such as excessive listing fees, projects being exploited through token dumping, and the misappropriation of user assets are all too common. In the past, due to underdeveloped on-chain infrastructure, users needed an efficient, convenient, and low-cost trading platform—making CEXs the go-to choice. However, as on-chain infrastructure matures—with key components like automated market makers (AMMs), oracles, high-performance blockchains, cross-chain bridges, and security audits improving—trading activity on CEXs will gradually migrate back on-chain.

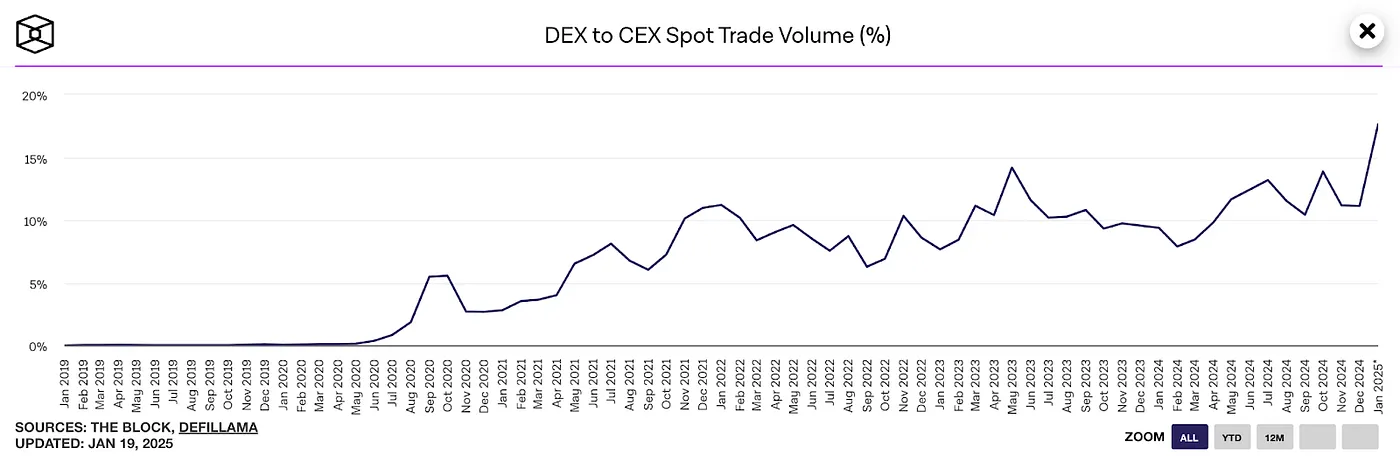

DEX to CEX Spot Trading Volume, source: The block

As shown in the chart above, the spot trading volume ratio of DEX to CEX reached a historic high of 20% in January 2025.

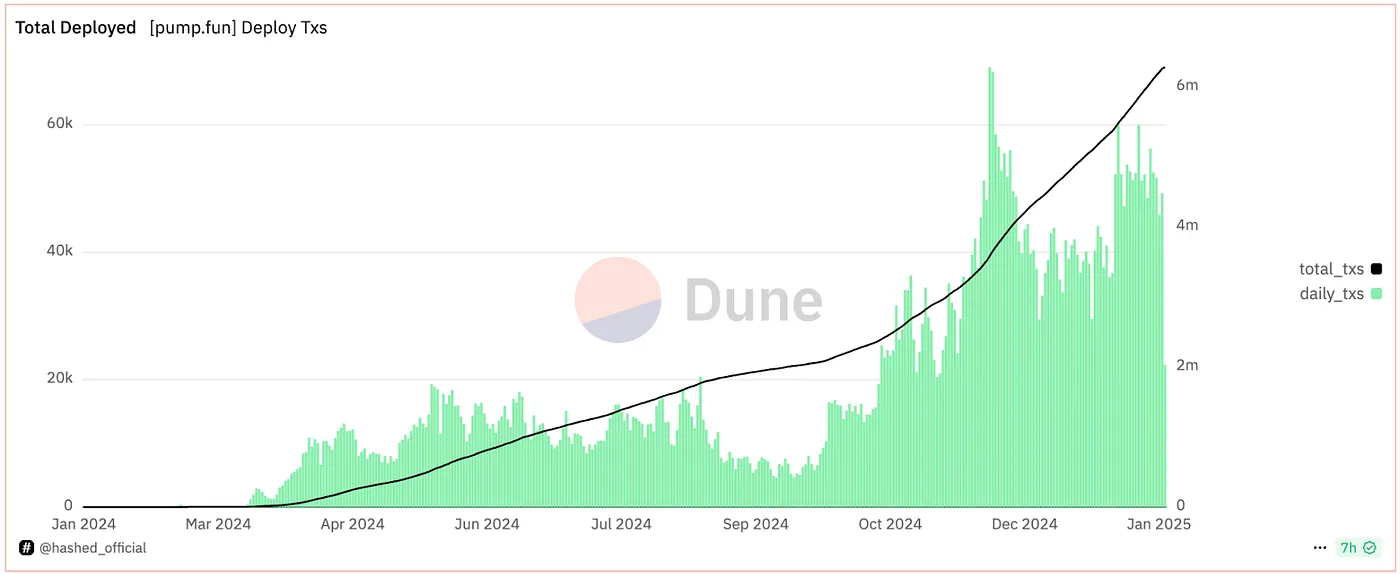

Pump.fun token issuance statistics, source: Hashed

Taking Pump.fun as an example, the daily number of token launches on its on-chain launchpad has repeatedly hit new highs. If Hyperliquid’s achievement of reaching a $10 billion FDV through on-chain launches can be considered a successful trial, then the more iconic event was the successful issuance of the Trump token on-chain. Within 24 hours, Trump reached a $70 billion FDV with on-chain liquidity exceeding $700 million—all of which happened entirely on-chain. More importantly, its token price was far less influenced by centralized exchanges, which were unable to manipulate prices by acquiring free tokens.

In response, the founder of Bybit remarked:

“The future of Web3 and decentralized trading has already arrived. In 2025, we will focus on building an on-chain version of Bybit, enhance the user experience of the Bybit Web3 self-custody wallet, and further strengthen our on-chain infrastructure.”

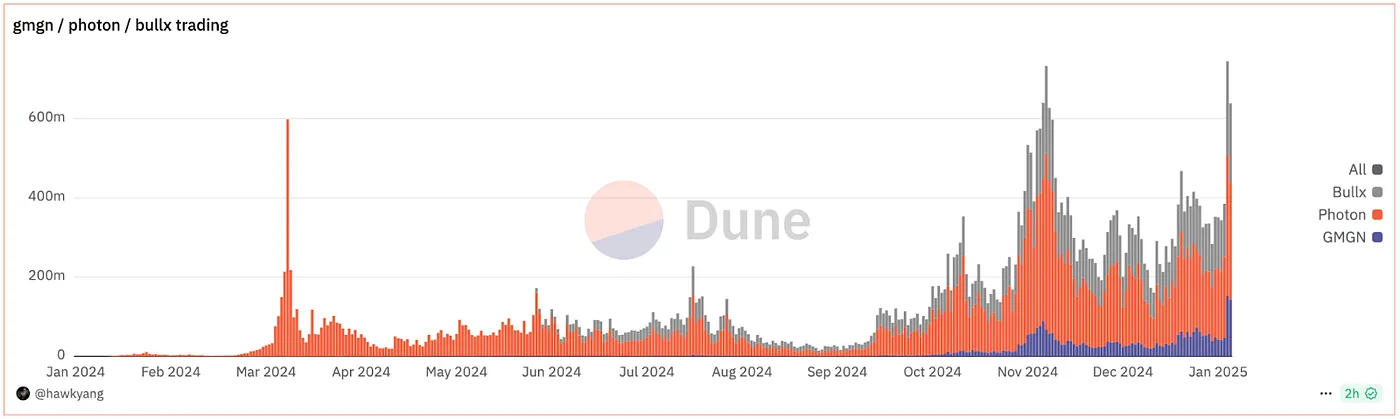

On-chain Trading Bot statistics

At the same time, on-chain trading tools have been rapidly growing. Platforms such as DEXX, GMGN, Photon, and BullX—all on-chain, cross-platform trading tools—have captured notable market share thanks to features like one-click trading and comprehensive on-chain analytics. During the $Trump trading frenzy, these tools absorbed part of the trading flow, with transaction volumes hitting record highs. Beneficiaries of this surge included GMGN, which quickly expanded its market share, while Moonshot even climbed to the top of the U.S. App Store download chart, attracting 200,000 new users in a single day.

Essentially, these tools are front-end applications that build user-friendly liquidity aggregation interfaces while also providing Anti-MEV protection and on-chain analytics—features that are not a focus of centralized exchanges. This is precisely why DEXs are able to capture the majority of trading flow. In an era where on-chain asset issuance is becoming increasingly popular, such tools simplify complex on-chain trading processes and directly solve user pain points. Whoever controls the traffic gateway will be well-positioned to become the next on-chain “Binance.”

LP Vault Mechanism: The Core of DEX Liquidity

Behind these front-end tools lies a massive supply of liquidity. The success of $Trump further highlighted liquidity’s central role in the on-chain ecosystem. If you are building an on-chain DEX, one of the first priorities is to construct your own LP pools while also tapping into existing on-chain liquidity. In short, the depth of liquidity directly determines whether a DEX can compete with CEXs. Without a sufficiently supportive liquidity environment on-chain, $Trump’s success would not have been possible. LP pools, as the primary liquidity solution on-chain, have themselves gone through multiple phases of improvement and innovation.

Liquidity solutions on-chain—from the AMM model that launched the great DeFi era, to vAMMs, peer-to-pool trading, on-chain order books, and even off-chain order book products—have all centered on optimizing liquidity. These approaches continually seek the best balance between liquidity depth, user experience (convenience and security), and cost efficiency.

During the AMM era, asset prices were determined by the formula x * y = k. Since Uniswap V3 introduced concentrated liquidity ranges, LPs have been able to fine-tune the price bands within which their capital is active. This dramatically increased capital efficiency, in some cases by up to 1,000 times. However, this model also brought new challenges, such as large price slippage and impermanent loss exceeding LP fee earnings.

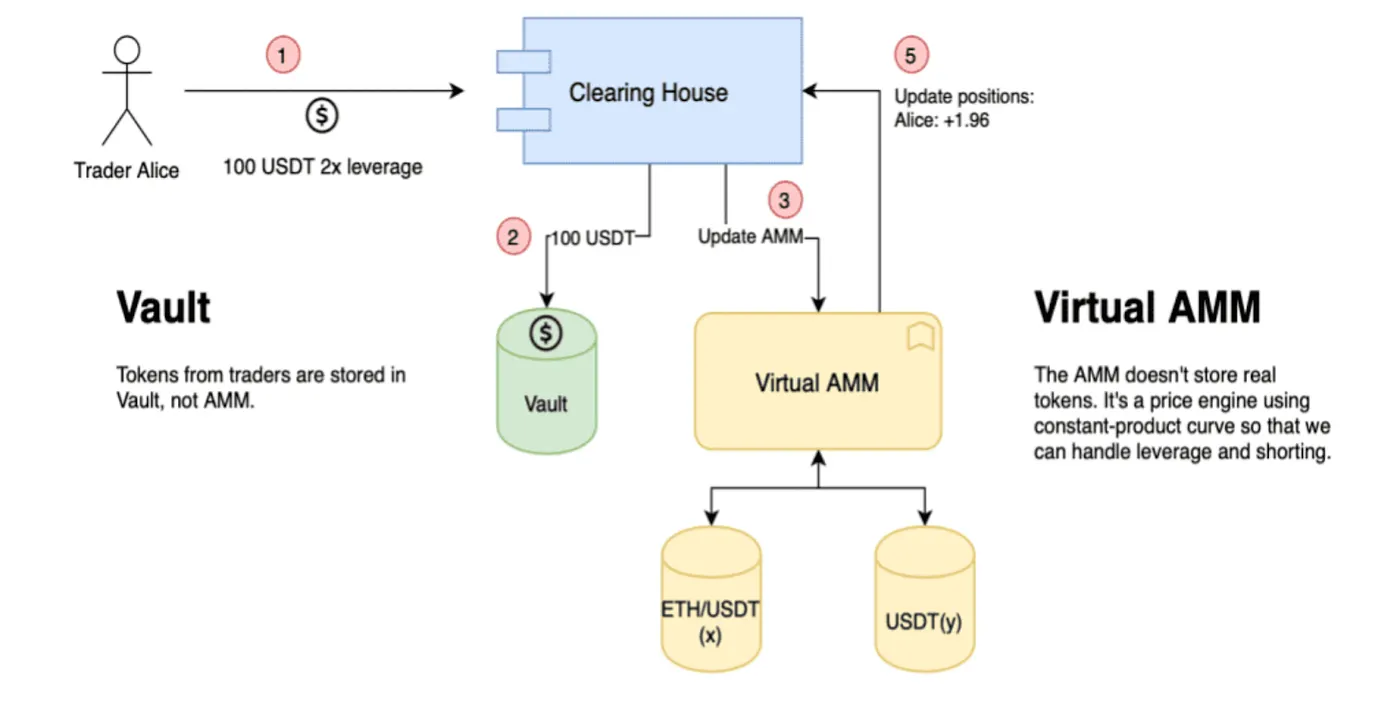

vAMM Mechanism

In 2019, Perpetual Protocol introduced a brand-new liquidity solution — the vAMM (virtual automated market maker). This mechanism simulates market depth through the use of virtual liquidity pools. Users deposit stablecoins such as USDT into a vault pool, while the AMM operates with virtual assets based on the classic x * y = k pricing curve. Under this system, one user’s profit directly corresponds to another user’s loss, effectively resolving the impermanent loss problem inherent in traditional AMMs.

However, since vAMMs do not involve actual asset trading, their pricing relies heavily on oracle updates, lacking the ability to perform real asset price discovery. This means vAMMs can only follow market prices rather than generate them independently, which has become a key factor limiting their scalability. From the perspective of professional market makers, control over price discovery is one of the most critical elements in determining whether a mechanism can achieve widespread adoption. The absence of this capability has become a major bottleneck for vAMM development.

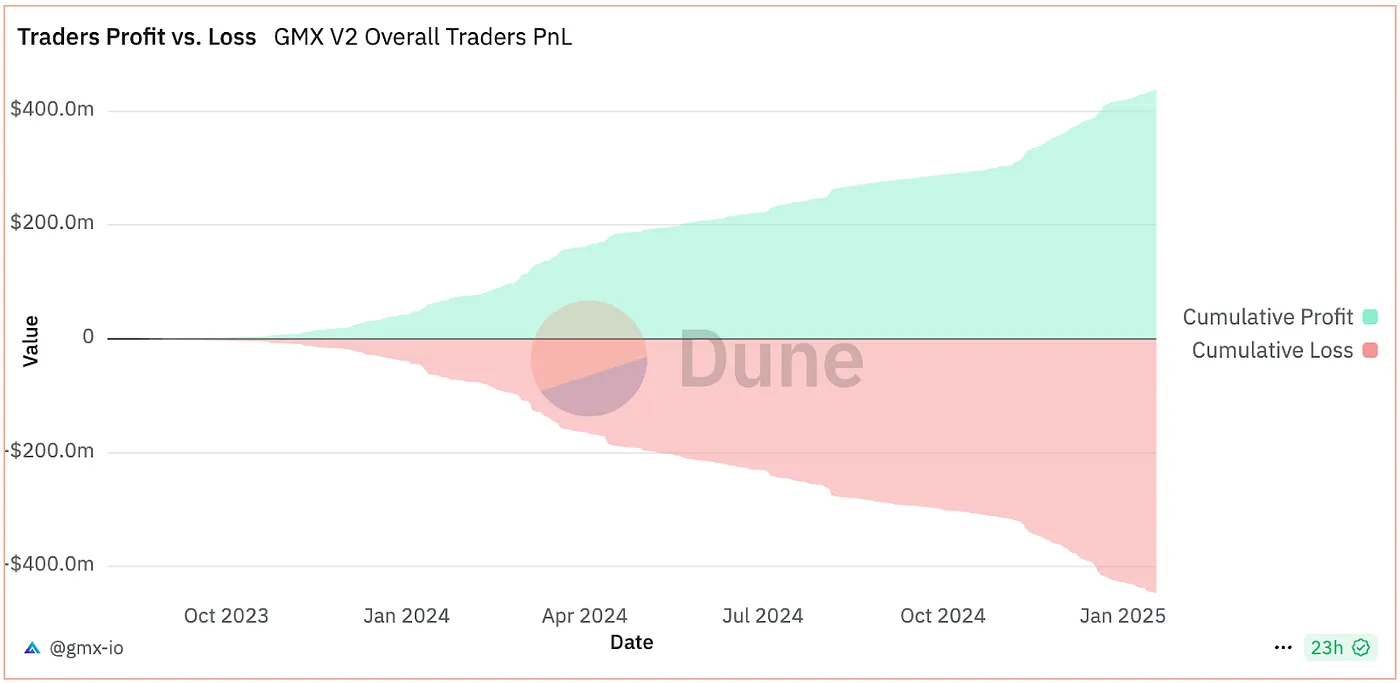

GMX LP Vault Profits

The design of vAMMs is somewhat similar to the P2P model. Later, GMX innovatively introduced the Peer-to-Pool liquidity mechanism, which transfers trading risk to the collective LP holders. In this model, since traders (on average) tend to lose more than they gain, the GMX LP vault—acting as the counterparty to all traders—can still generate returns. However, despite its theoretical advantages of unlimited liquidity and zero-slippage trading, its biggest limitation, much like the vAMM, is the inability to perform independent price discovery. This shortcoming has become a ceiling on its growth, restricting further scalability.

In summary, all three of the above models (AMMs, vAMMs, and P2P) operate in the form of vault pools. AMMs have the ability to independently discover prices, whereas vAMMs and P2P models, while solving the issues of slippage and impermanent loss, can only track price indexes without autonomous pricing. This significantly limits their potential for expansion.

On the other hand, the order book model comes in two variants: on-chain and off-chain. The primary trade-off lies between centralization risk and efficiency. For example, the fully on-chain protocol Injective coordinates liquidity from multiple protocols to deliver the best swap experience. Meanwhile, Hyperliquid relies on off-chain market makers to supply liquidity to its order book, similar to the market-making model of traditional CEXs. While the off-chain approach ensures high liquidity efficiency, it also inherits some of the centralization characteristics.

Gate Ventures

The Trend of LP Vault Diversification and Specialization

Liquidity is one of the key factors determining whether decentralized exchanges (DEXs) can successfully compete with centralized exchanges (CEXs). From AMMs to off-chain order books, different mechanisms have introduced unique innovations in liquidity provision. For example, AMMs provide liquidity through token pair pools; vAMMs introduced single-asset pools (such as USDC); in the Peer-to-Pool model, LP vaults act as counterparties to all traders; on-chain order books aggregate liquidity across multiple token pairs, while off-chain order books rely on high-frequency quantitative market makers as liquidity providers.

It is not only the structure of LP pools that continues to evolve and innovate, but also the composition of liquidity providers is quietly changing. According to research from the Bank for International Settlements (BIS), although LP mechanisms operate in a democratized manner, the emergence of diverse LP formats—such as adjustable-range AMMs and function-specific LP vaults—has pushed liquidity provision toward specialization. Data shows that the majority of liquidity is now supplied by a small group of “sophisticated” LPs with professional expertise and capital advantages, accounting for 65%–85% of the market share. By contrast, retail LPs participate at much lower levels, and their yields are significantly lower than those of professional LPs.

LP Vault in Hyperliquid, souce: Hyperliquid

As shown in the chart above, the average annualized return rate of official LP vaults is 25.81%, but professional HF vaults (high-frequency trading vaults) have even greater potential and broader room for growth. At present, innovations in on-chain liquidity are making significant strides, with DEXs at the very center of this progress.

In addition to Hyperliquid, which has brought off-chain market makers (MMs) on-chain and leveraged high-throughput Layer-1 blockchains to exponentially improve the trading experience, many other innovations based on LP mechanisms are steadily emerging. These advancements not only enhance the depth and efficiency of liquidity but also provide users with richer features and superior experiences, further accelerating the growth of the DEX ecosystem.

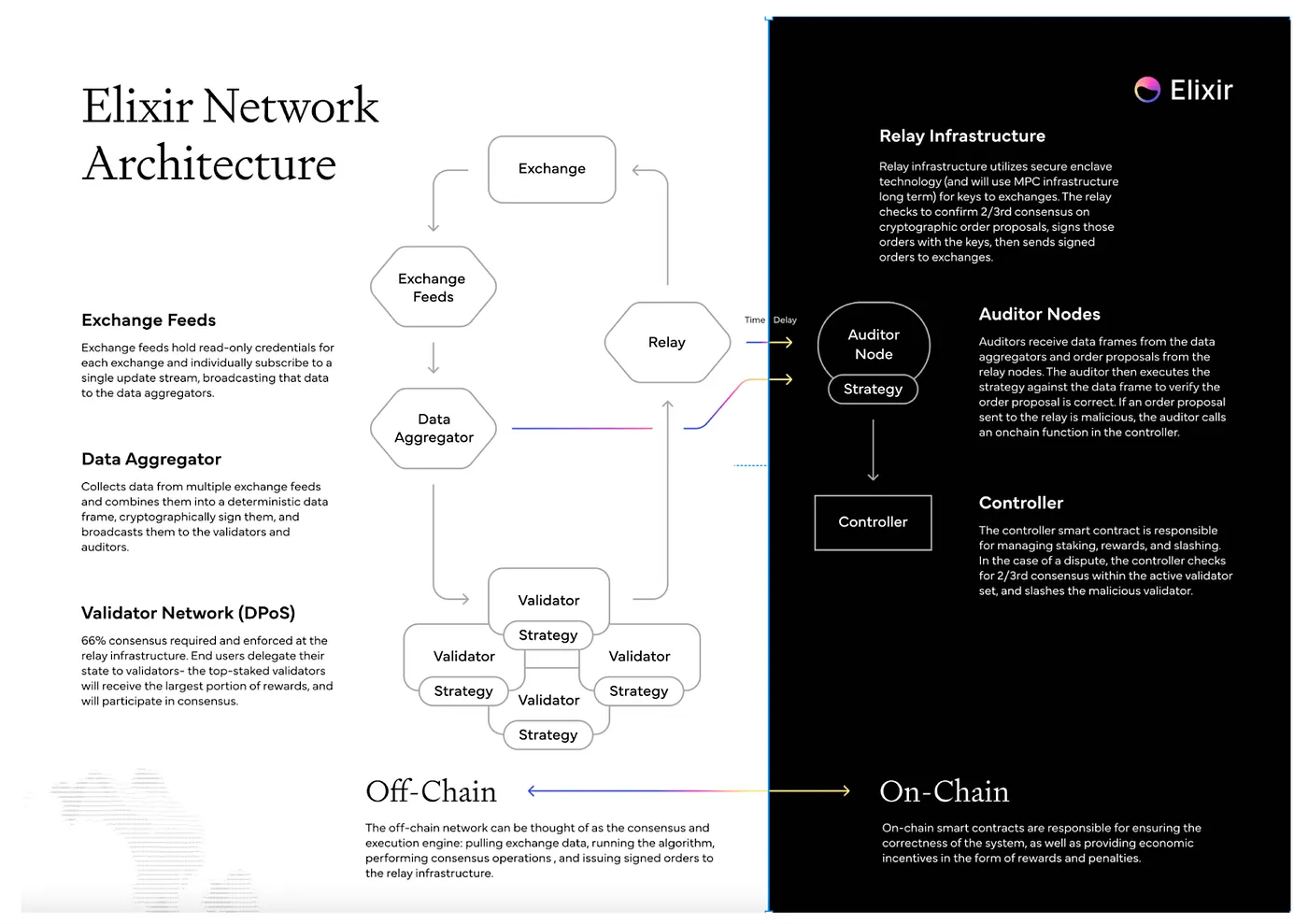

Elixir Workflow, source: Elixir

We have observed that Elixir is driving innovation through its modular LP mechanism. Elixir adopts a customized variant of the Avellaneda-Stoikov algorithm to deploy liquidity within decentralized exchange order books. Using these neutral strategies, Elixir can provide liquidity for long-tail assets across the entire chain. Users can leverage this algorithmic platform to act as more professional LPs, without being confined to a single DEX. Currently, projects such as Injective, dYdX, and Bluefin have already been integrated into its ecosystem.

In Elixir’s off-chain component, the system first retrieves order data from exchanges. After the data aggregator verifies its validity, it is sent to validator nodes. The validator nodes run algorithms to generate orders, while on-chain audit validators are responsible for auditing the signatures of these orders. Finally, the orders are sent to the corresponding exchanges for execution.

Compared with Hyperliquid, Elixir provides a more transparent market-making (MM) model thanks to the presence of on-chain audit validators. However, this transparency also comes with efficiency trade-offs, which remain one of its main challenges. By contrast, Hyperliquid’s LP vault is highly efficient but lacks scalability. Elixir’s modular LP design, on the other hand, is capable of providing liquidity across all order books, showcasing stronger adaptability.

Spicenet Structure, source: Spicenet docs

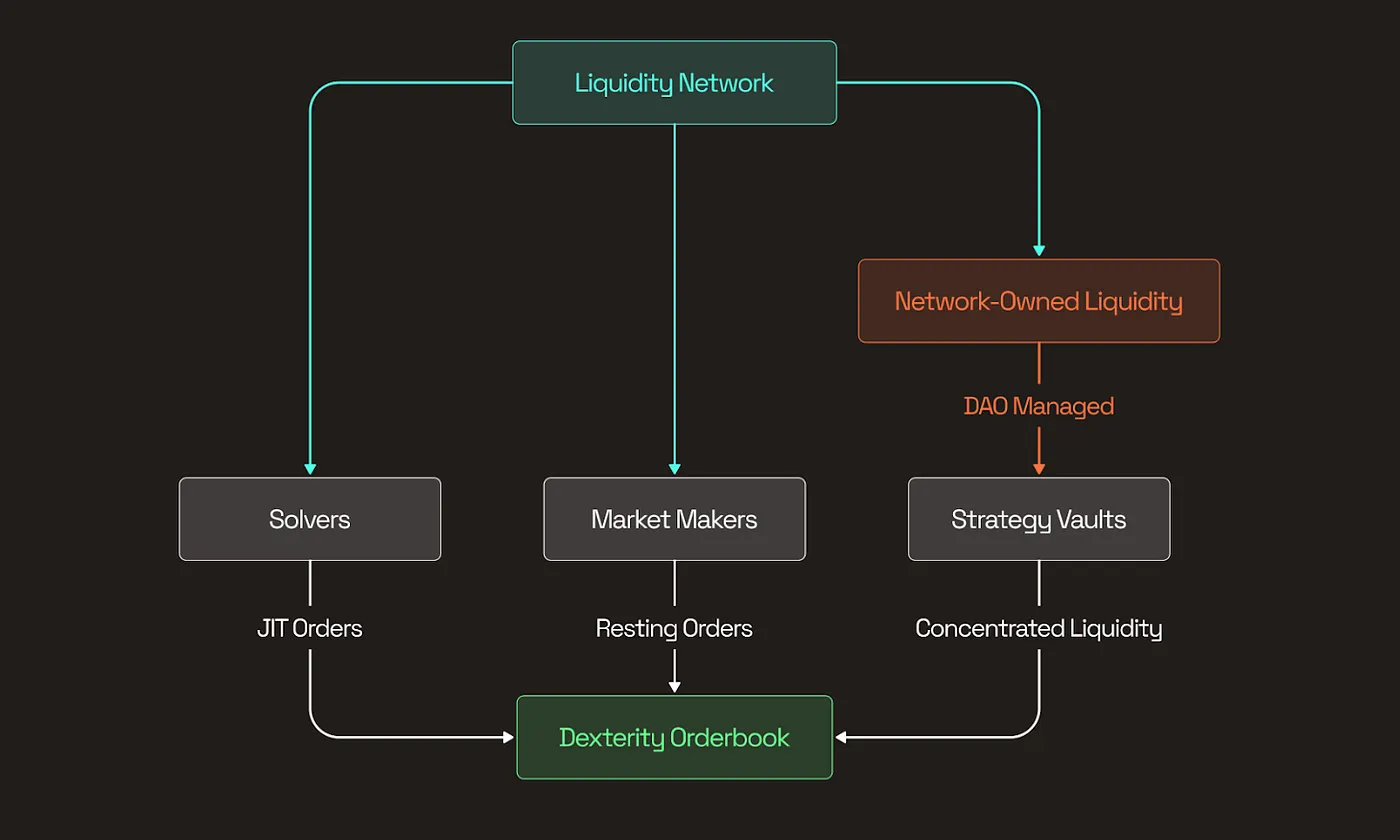

Elixir is a highly innovative project that has been under development since 2021, aiming to provide a novel and generalized solution for on-chain order books. At present, many projects have achieved atomic-level innovation in liquidity architecture. For example, Spicenet and Liquorice have integrated Solvers, market makers (MMs), and Network of Liquidity (NOL) pools to supply global liquidity with low slippage for order books.

NOL (Network of Liquidity) essentially functions as users’ LP vaults. Users and LPs can allocate funds into different strategy vaults based on their own risk preferences and return objectives. These vaults focus on specific areas such as spot trading, futures trading, or cross-order-book liquidity. In this way, they can alleviate LVR (Liquidity Volatility Risk) when market-making incentives are insufficient, ensuring greater stability and efficiency of liquidity.

Liquidity Development Trends

The LP vault is one of the most fundamental and atomic components of on-chain liquidity and is currently undergoing a wave of modular innovation. By integrating across multiple front-end DEXs, LP vaults enable smoother, lower-slippage trading experiences. While the traditional AMM model, with its simplicity and ease of bootstrapping, performs well for initial liquidity provision—especially for meme and other long-tail assets—it is no longer sufficient to meet the higher liquidity standards required for mainstream assets in today’s DeFi era. As trading migrates from CEXs to DEXs, users’ sensitivity to slippage and their demand for high-quality execution in mainstream asset trading has only increased. LP vault innovations are emerging as the key solution to this pain point, with liquidity depth directly determining the outcome of competition between CEXs and DEXs.

The current trend in on-chain liquidity shows that long-tail assets typically rely on AMM LPs for initial liquidity, but as their market capitalization grows, they gradually shift to order book-based trading. For order book DEXs, liquidity compositions are becoming more diverse, including not only AMM LPs but also LP vaults powering off-chain algorithmic market makers (such as Hyperliquid) or innovative on-chain market makers (such as Elixir). In addition, these DEXs integrate third-party traditional market makers through open APIs to further improve liquidity efficiency.

LP vaults are evolving toward professionalization and modularization. These specialized LP vaults not only significantly enhance on-chain liquidity depth but also dominate the share of liquidity provision on-chain. Their innovations provide users with higher-quality trading experiences and offer essential support for the sustained growth of DEXs. Collectively, these advancements are fueling the prosperity of the on-chain ecosystem and narrowing the gap between DEXs and CEXs.

Disclaimer

This content does not constitute an offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decision. Please note that Gate.io and/or Gate Ventures may restrict or prohibit some or all services for users from restricted regions. Please read the applicable user agreement for more details.

About Gate Ventures

Gate Ventures is the venture capital arm of Gate.io, focusing on investments in decentralized infrastructure, ecosystems, and applications that will reshape the world in the Web3 era. Gate Ventures partners with global industry leaders to empower teams and startups with innovative vision and capabilities, redefining how society and finance interact.

Official website: https://www.gate.com/ventures

Thanks for your attention.

Share

Content